Silver or Ethereum?

ByteFolio Issue 188;

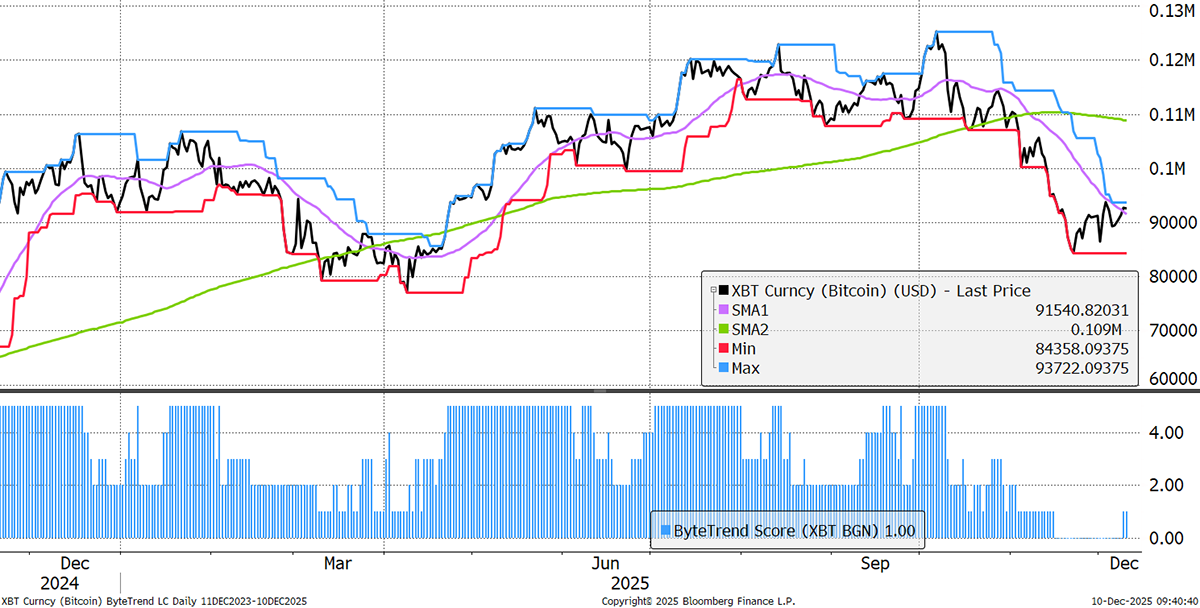

Bitcoin’s ByteTrend Score has increased to a 1 out of 5, as the price has passed above the 30-day moving average. It’s hardly bullish, but I’ll take that over a new low.

Bitcoin

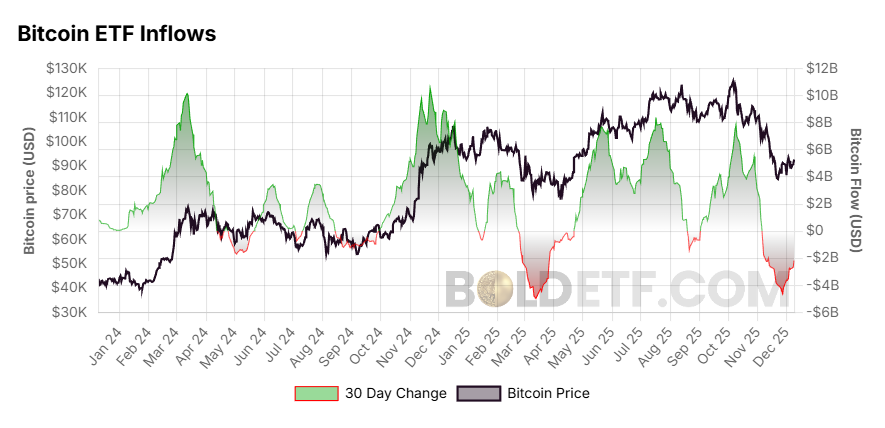

According to the flows, the Bitcoin bear case has softened. We saw Bitcoin ETF outflows begin in August and accelerate in November. At one point, the 30-day change saw $5 billion exit Bitcoin, which has since stabilised.

Bitcoin ETF Inflows

Going back to the early days of Bitcoin, people used to talk about digital gold, and many still do. The idea was that Bitcoin would disrupt gold and eventually replace it. I never bought into that argument and instead believe the two assets are complementary as Bitcoin is risk-ON, and Gold, risk-OFF. More importantly, Bitcoin would become the reserve asset of the virtual world, while Gold remained the reserve asset for the real world. Never should the two meet.

But there was undoubtedly a loser, and that was silver, which was historically Gold’s riskier friend. I plot the silver-to-gold ratio, as opposed to the more common gold-to-silver ratio, which shows silver outperformance over Gold when it is rising, against Bitcoin. In 2011, the surge in Bitcoin coincided with the great silver boom. But since then, and despite some high-level correlation, the price of silver has steadily eroded against Gold, as Bitcoin has gained credibility.

Silver Versus Gold and Bitcoin

Silver touched $50 in 1980, and again in 2011, just as Bitcoin was getting started. Finally, after 55 years, silver has made an all-time high, and that has stirred up the animal spirits, just as Bitcoin is in the doghouse. Little wonder Bitcoin is slack, as the hot money has found a new toy to play with.

Silver All-Time High

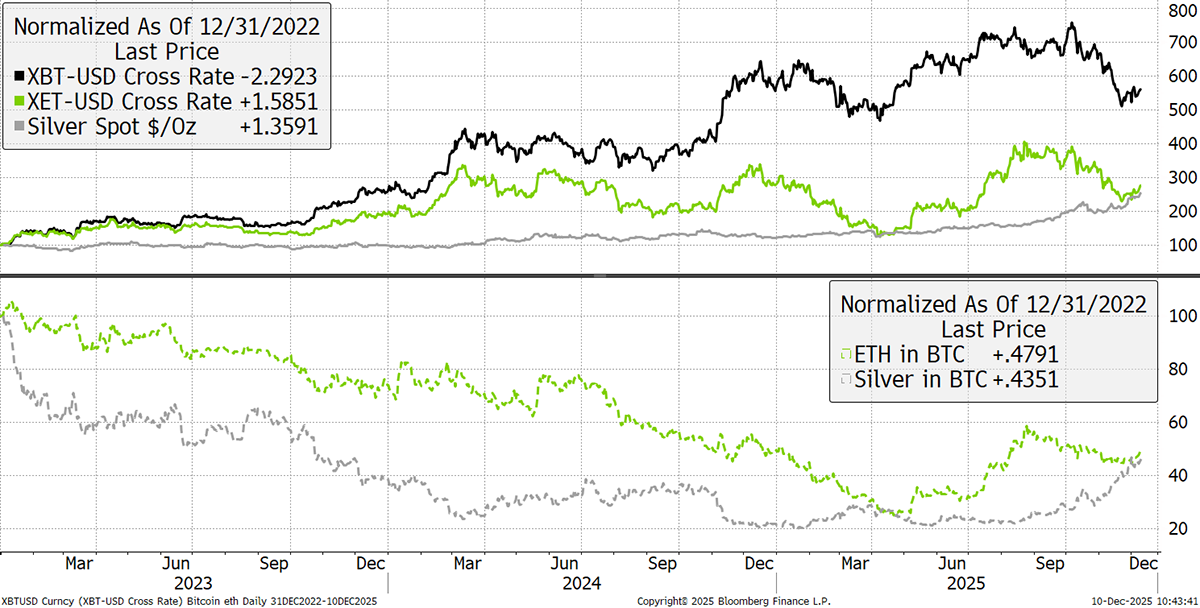

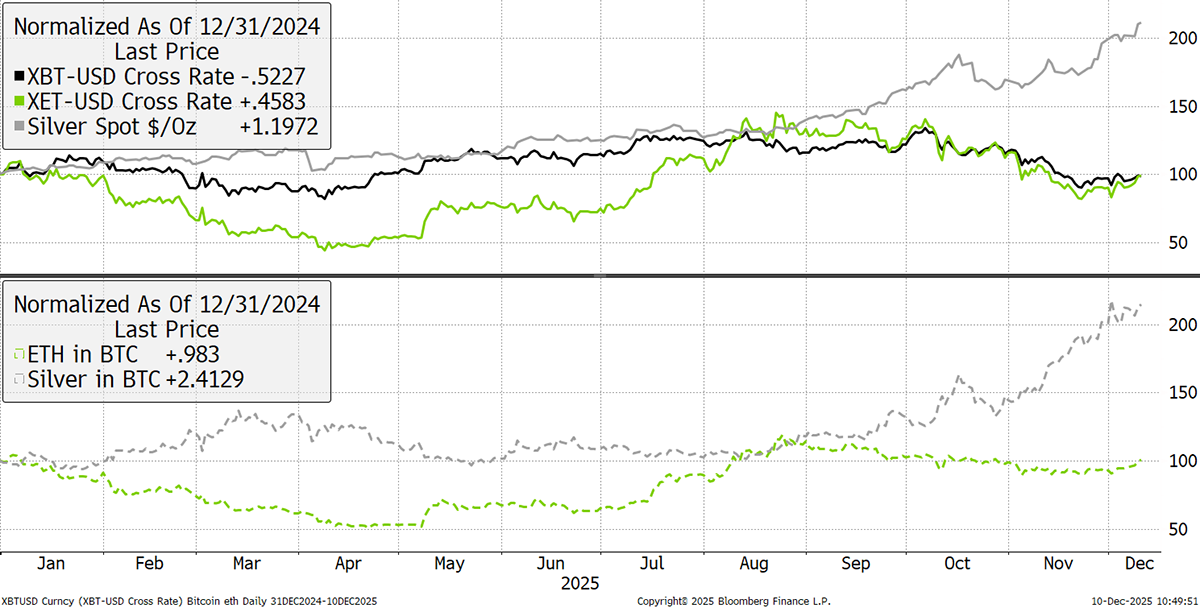

Just as Bitcoin was the new gold in crypto circles, Ethereum was the new silver (or was that Litecoin?). Since the Bitcoin bull market began in late 2022, the price is up by 469%, whereas Ethereum is up by 177% and silver by 154%. That said, the lower chart shows how both Ethereum and silver are now outperforming Bitcoin.

Bitcoin, Ethereum, and Silver since the 2023 Bitcoin Bull

Going back to the previous bull market, which began in early 2019, we see how Bitcoin and Ethereum have enjoyed similar returns, or around 24x, while silver has risen 293%. That is a respectable result for silver, but nothing compared to the achievements of the crypto leaders.

Bitcoin, Ethereum, and Silver since the 2019 Bitcoin Bull

Yet here we are in 2025, and silver has returned 112%, while Bitcoin and Ethereum are flat. Just as crypto has seen assets leave the ETFs, silver ETFs have seen huge inflows. Not only is silver currently leading Bitcoin, but so is Ethereum, which also has a bullish ByteTrend Score of 5 out of 5 in BTC.

Bitcoin, Ethereum, and Silver in 2025

I am bullish on Bitcoin, Ethereum, Gold, and Silver, but accept that they cannot all lead at the same time. I suspect that Bitcoin will pick up again when silver loses steam. That is unlikely to happen soon, as silver mania is in full steam, but it won’t last forever.