Silver $175 by 2030

Atlas Pulse Gold Report Issue 109;

It’s silver’s moment, and I doubt we have seen the end of it. But it’s overbought and may take more time. I certainly hope it does, because silver mania normally marks the peak of gold bull markets as well. And we don’t want that.

Gold peaked at $4,356 on 20th October and, after a 10% fall, is now down just 4%. Since then, and despite an initial 12% pullback, silver has been off to the races. I will put this into a historical perspective, provide some targets, and make comparisons with Ethereum. After all, if Bitcoin is digital gold, Ethereum is digital silver. Or so they say.

Gold and Silver since the October Peak

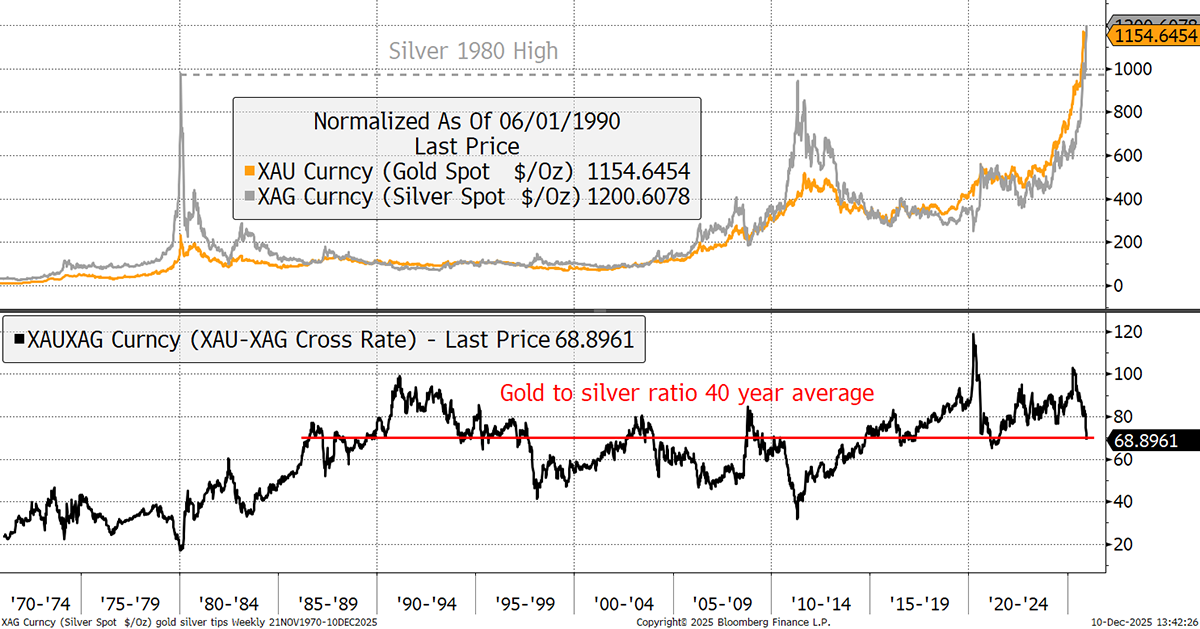

Starting with silver versus gold in 1970, rebased to the gold-to-silver ratio average in 1990, silver and gold have enjoyed the same 35-year return, which is unsurprising since the gold-to-silver ratio has returned to that average. The implication is that silver has caught up with gold, after a long period in the doldrums. Silver has been cheap vs gold since 2014, with a brief premium in 2020, at the highs during the pandemic.

Gold and Silver since 1970

With a silver bull market, fair value is a low-ball target, but there is no telling whether that happens now or in the years ahead. Given we are talking about silver, aka gold on crack, sooner rather than later seems likely, as there’s nothing stopping silver fever when it catches.

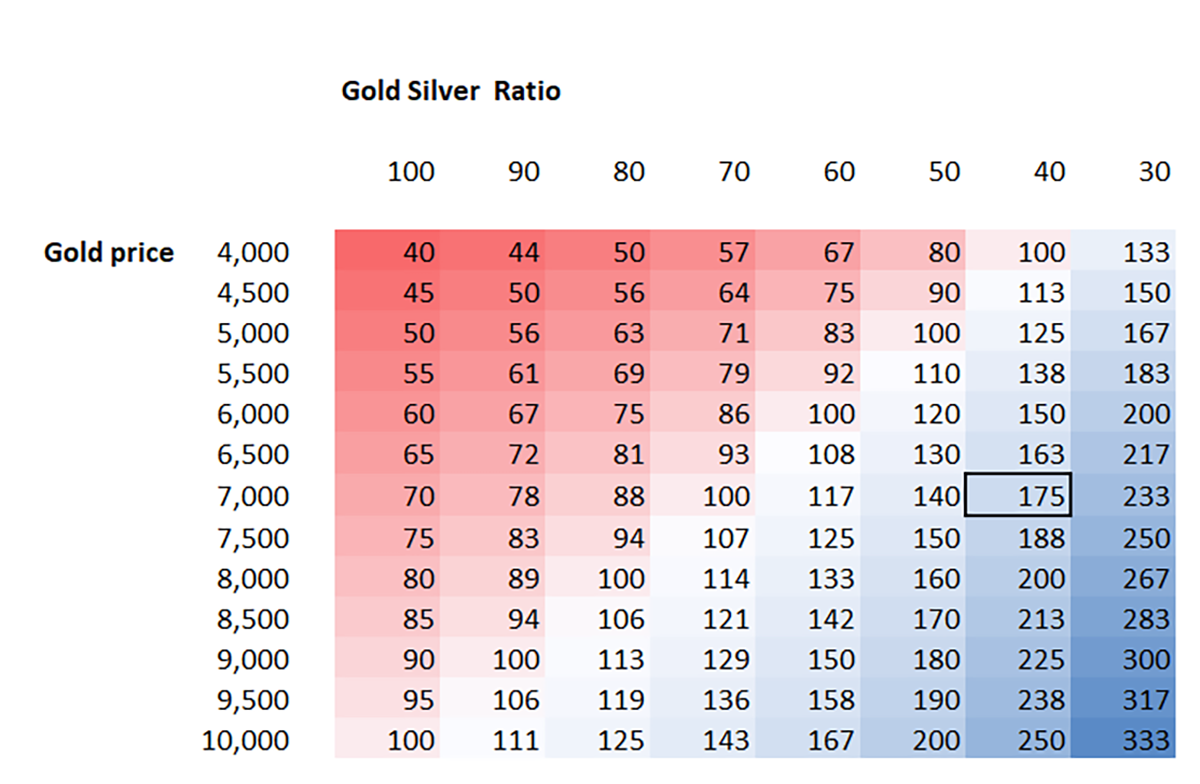

To forecast the high in silver, we need a forecast for gold and a forecast for the gold-to-silver ratio. My published gold forecast is $7,000 by 2030, which no longer looks fanciful, but it did five years ago when it was published by the LBMA in 2020. The gold-to-silver ratio touched 40 in 1998, and that wasn’t even a bull run. It managed 17 in 1980, and 35 at the 2011 peak. I’ll go with a conservative 40 as a bullish target, with a lower target as an overshoot. That means, $7,000 gold with a gold-to-silver ratio takes us to $175 silver price by 2030.

Silver Price Targets

Bear in mind, this is a bullish target, with room for an overshoot, but silver never seems to hang on to high prices when it gets there. That means when it gets there, switch back to gold. Still, with silver trading at $60, a 3x target is something to look forward to.

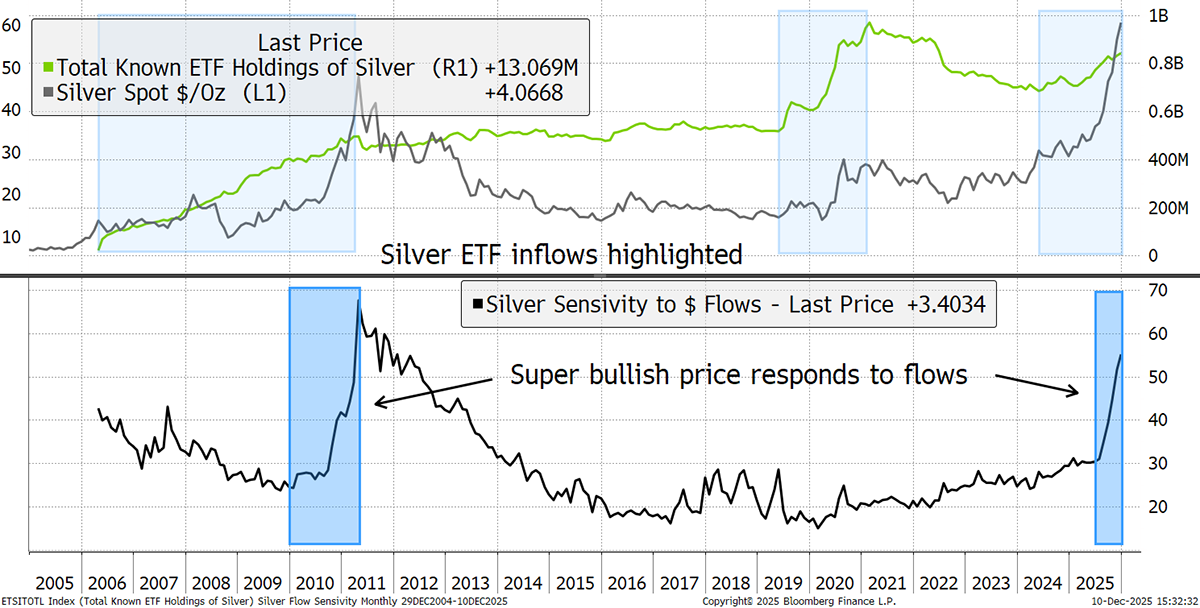

The silver ETF flows are currently supportive, with the price (grey) moving higher when the silver ETFs are growing (green), as they are today. In the 2019/20 silver bull market, the price never moved ahead of the flows (black). Contrast that with the big moves in the 2010/11 bull market and recently. During those times, every marginal dollar added to the silver ETFs or futures has had a disproportionately positive impact on the silver price. That means anyone buying silver will make the price go up, and that has not always been the case.

Silver and ETF Flows

What about the risks? Sorry to throw ice onto the fire, but it’s an important question. Fundamentally, the silver price is not overbought because the gold-to-silver ratio has merely fallen to the historical average. In other words, silver has moved from cheap relative to gold to being in line with gold. For the value investor, the job is done.

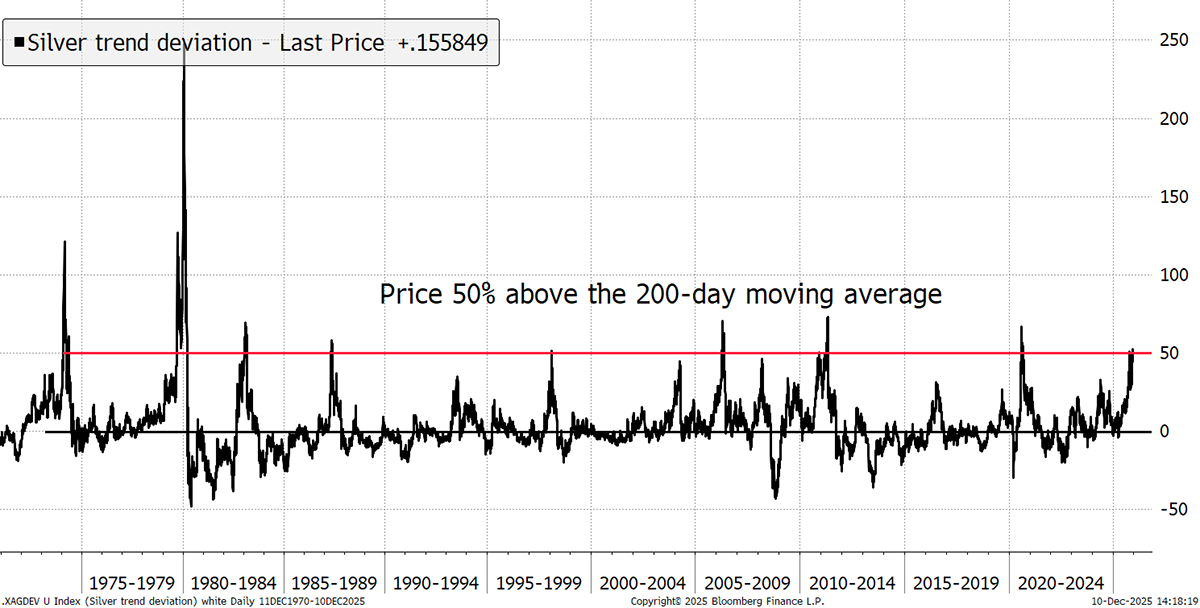

But silver overshoots are the norm in bull markets, and why should this one miss out? It shouldn’t, but we should be focused on the pace of the bull market. The price of silver is 52% above its 200-day moving average. That is certainly overbought. But it has a history of going higher. In 2020, which wasn’t even a proper bull market, it managed 67%, and in 2011, 72%. But hey, it managed 122% in 1974 and 247% in 1980.

Silver Deviation from the Trend

No doubt these are exciting times for silver investors, and the set-up is fabulous. An all-time high after a 55-year wait should certainly be celebrated. Compared to gold, it makes sense, but the price is stretched. What is also clear is that sensitivity to flows is positive, which means new money will send the price soaring from here.

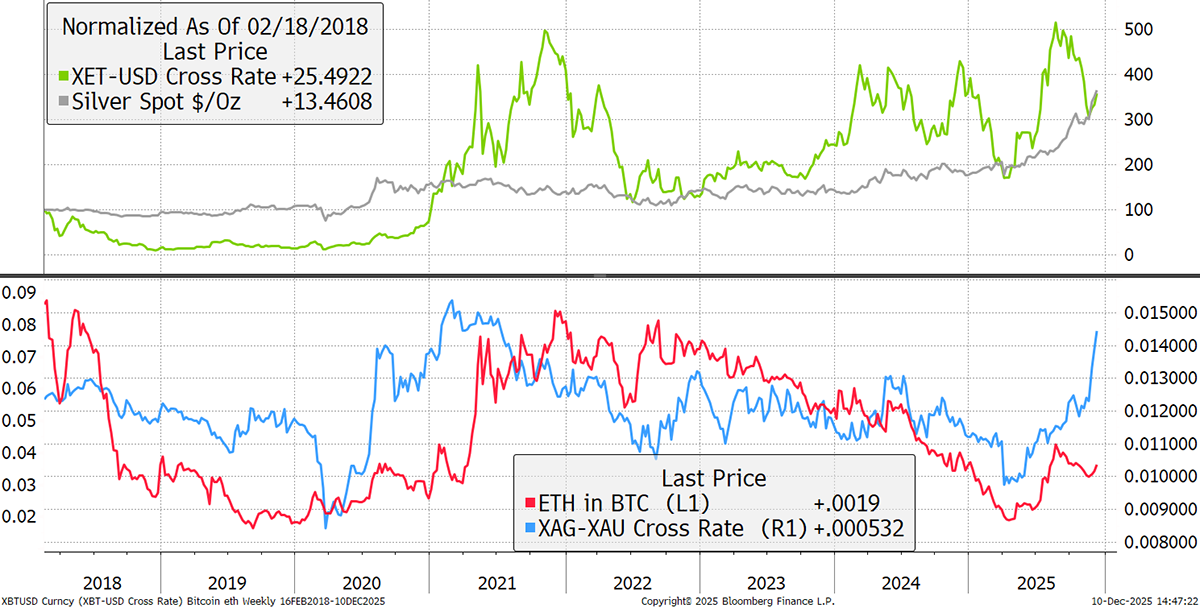

One more thing. Just as silver is the second most important market in precious metals, Ethereum is the second most important market in crypto. I couldn’t help but notice that the price of silver relative to gold (blue) has followed a similar path to Ethereum relative to Bitcoin (red). It is by no means a perfect correlation, but it certainly makes you think.

Silver vs Gold, Ethereum vs Bitcoin

Just as silver (grey) is beating gold, Ethereum (green) is beating Bitcoin. Yet its price is 6% below its 200-day moving average, so that will be a good switch out of silver at some point. It is remarkable how silver and Ethereum have delivered the same return since early 2018, notwithstanding the fact that Ethereum started with a severe bear market that first year.

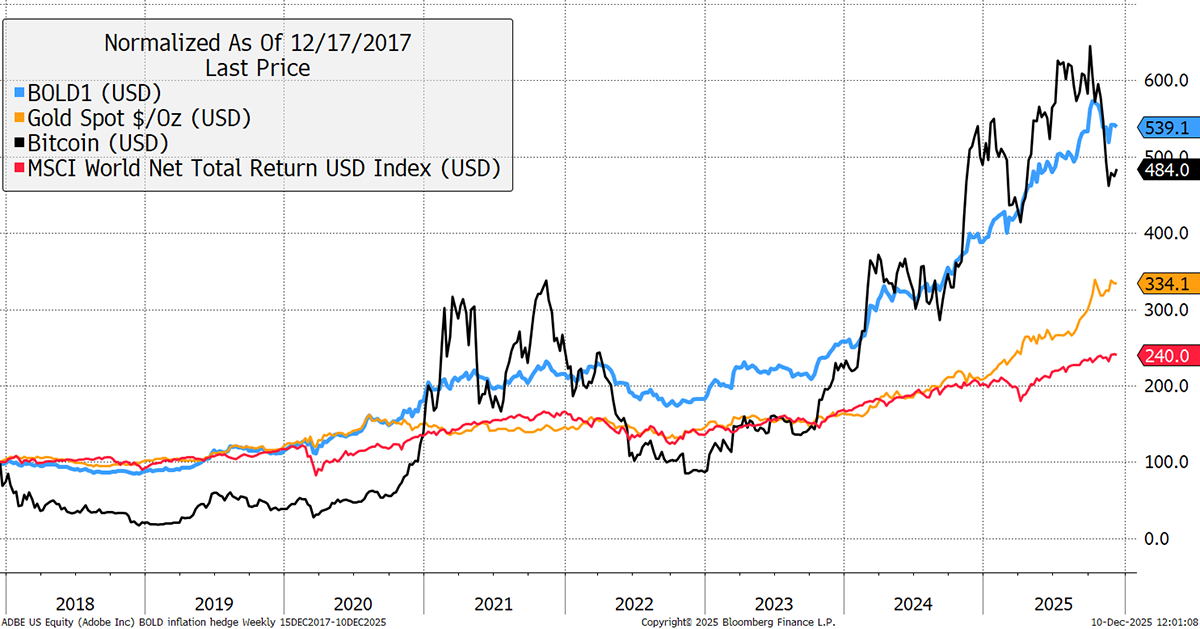

Which takes us neatly onto Bitcoin, Gold, and BOLD. Since the 2017 Bitcoin high, which was days shy of eight years ago, Bitcoin has performed well. Gold hasn’t been a slouch either, with both assets comfortably ahead of global equities, including dividends. Yet the Vinter ByteTree BOLD index has beaten the lot.

Bitcoin, Gold, BOLD, and Stocks

BOLD is currently around one-third Bitcoin and two-thirds Gold, but the 8-year average weight has been 19.6% Bitcoin and 80.4% in gold. An investor who bought those average weights in late 2017 returned 278%, compared to 234% for Gold and 384% for Bitcoin; a weighted average. Yet BOLD managed to beat both assets, returning 439%, which is 161% ahead of the average.

To learn more about why there is such a strong case for rebalancing your Bitcoin and Gold, visit BOLDETF.com.

BOLD is coming to the London Stock Exchange soon, hopefully in January, but we will keep you posted.

Summary

It’s silver’s moment, and I doubt we have seen the end of it. But it’s overbought and may take more time. I certainly hope it does because silver mania normally marks the peak of gold bull markets as well. And we don’t want that.

Thank you for reading Atlas Pulse. The Gold Dial remains on Bull Market.

Charlie Morris is the Founder and Editor of the Atlas Pulse Gold Report, established in 2012. His pioneering gold valuation model, developed in 2012, was published by the London Bullion Market Association (LBMA) and the World Gold Council (WGC). It is widely regarded as a major contribution to understanding the behaviour of the gold price.

Please email charlie.morris@bytetree.com with your thoughts.