Malaysian Bond Yields Are Lower than Gilts

Trade in Whisky Portfolio;

With a lofty World Index, packed with massive bubble stocks, my job is to scout around the world in search of value. After last week’s trip to Switzerland, today we are off to Malaysia. Located between Singapore and Thailand, it’s a fabulous country that I have visited several times. The people are warm, and the beaches are delightful, as is the food. That said, go easy on the laksa, as the level of spice is beyond the threshold of a typical Englishman.

I was reading the book “The Jungle is Neutral” by Spencer Chapman while sitting on a beach in Pulau Pangkor Laut, an island off the west coast. Chapman was sent to Singapore in 1941, just before the Japanese invasion the following year. His mission was to organise stay behind parties in Malaya, as it was then called, to stall the advance.

Chapman worked with the Chinese Communists - your enemy’s enemy is your friend - to organise a counter-insurgency. Armed with explosives, he caused mayhem by blowing up bridges, derailing trains, and ambushing trucks. He was captured by the Japanese, twice, I believe, and escaped on both occasions. He said the jungle was a neutral environment where neither he nor his enemy had an advantage. He survived several diseases, and towards the end of the war, was evacuated to Ceylon, now Sri Lanka, by a British submarine. That pickup was just 100 yards off the beach where I was reading the book at Chapman’s Bar, captivated by his story.

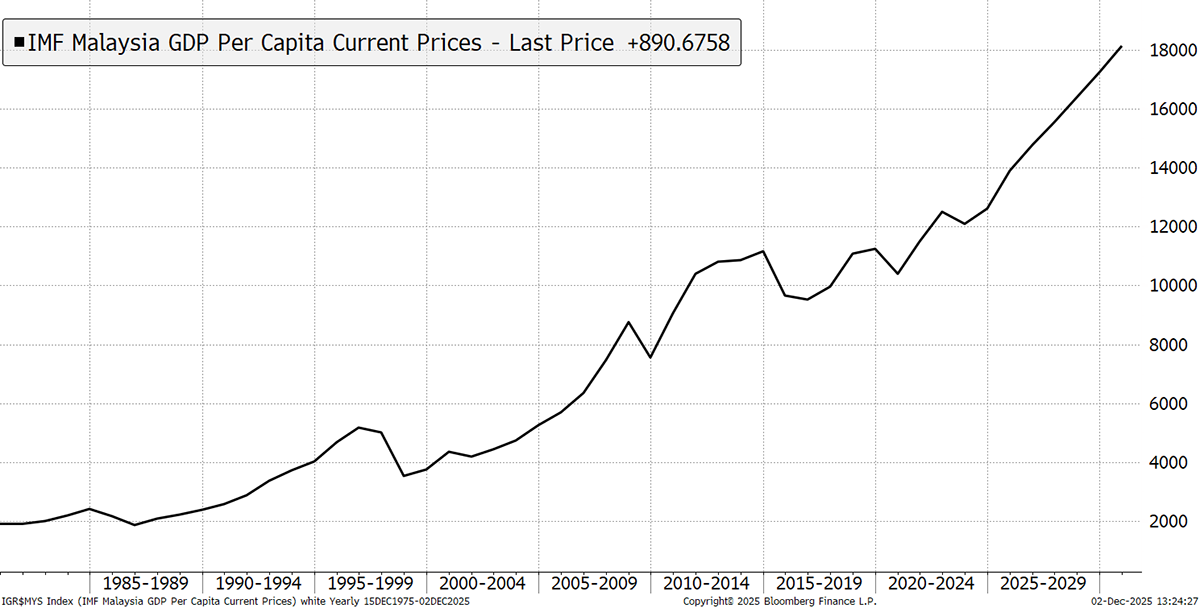

Malaysia today is a proud country of 35 million people. In 1965, it split from Singapore, which went on to become one of the world’s wealthiest nations. Malaysia lagged behind, but became a middle-income country by 2008, and is now on its way to becoming a wealthy nation itself. GDP per capita is headed to $18k by 2030.

Malaysia GDP Per Capita

The growth rate is 5%, while inflation is a cool 1.3% and stable. The country’s current account is in surplus, as is its trade. Its government debt to GDP is on the high side at 66%, caused by persistent budget deficits, which seems to be the standout negative. It is political, with heavy spending on the civil service, infrastructure projects and debt-servicing. There are also energy and food subsidies, which are undergoing reform. The new Fiscal Responsibility Act 2023 aims to address this, and so at least there is a will. The deficit was 7% of GDP at the height of the pandemic, and has narrowed to 3.5%, which is uncomfortable but stable (UK 5.4%). The country has a relatively low tax burden, which is supportive of commerce and high-net-worth individuals. Having Singapore as a neighbour clearly helps.

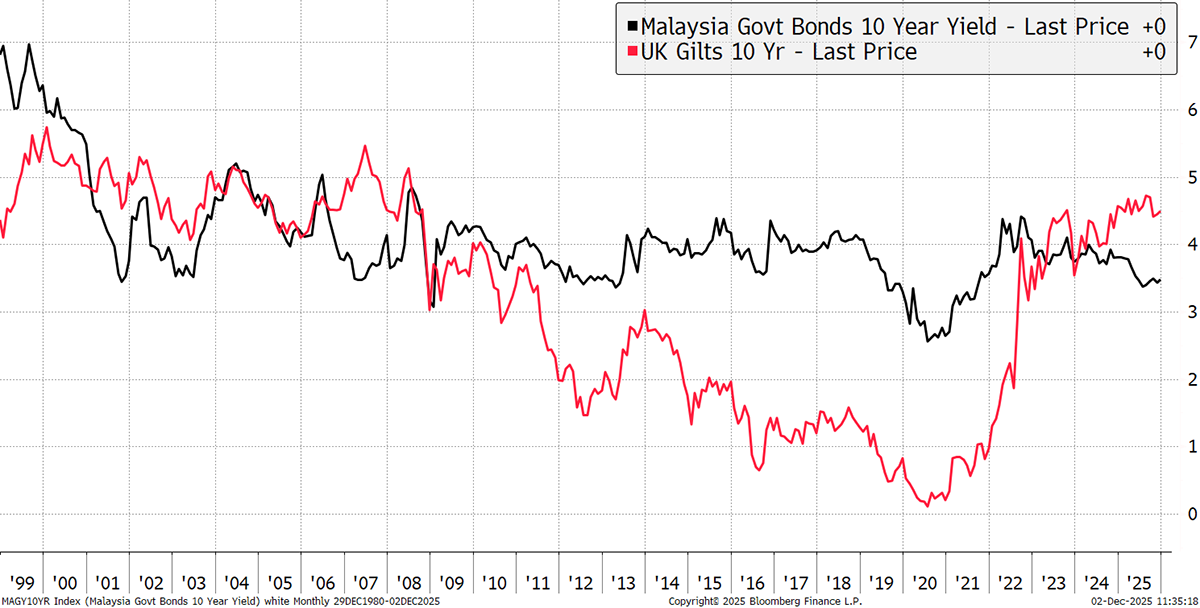

All in all, Malaysia has a 10-year government bond yield of 3.4%, which is 1.1% below the UK’s 4.5%. The bond market sees it as stable.

Malaysia versus UK 10-Year Government Bond Yield

Not only does Malaysia have a lower cost of borrowing than the UK, its currency, the Ringgit (MYR), has beaten the pound since the Asia crisis in 1997/8. The chart since 1995 shows the MYR against the pound. The Asia crisis saw its currency break its peg from the US dollar, but it has since been slightly stronger than the GBP.

Malaysian Ringgit versus the Pound

In other words, financial markets think Malaysia has a safer bond market and a stronger currency than its once mighty ruler, the UK. How things change.

What about its stockmarket?

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd