Investment Trusts Part II

As we approach the quiet time of year in markets, I’ll continue to update you on the investment trusts. I’ll cover the remaining diversified funds this week, and get to the more focused equity, property and alternatives next week. This means that when markets reopen in January, we will have had a refresher and be ready to hit the ground running.

In which direction? I’m not sure, but this year has been too good to be true, and I am well aware that the bear gods could bite us in January. If things go according to plan, our defensive holdings, where our allocation has risen in recent months, will prove resilient. Market corrections are sometimes a shock, but at other times, somewhat predictable. But even if you see a correction coming, the shape of the damage that unfurls is always surprising.

Since the 2022 bond bear market, ByteTree clients have been throwing tomatoes at me for holding the Capital Gearing Trust (CGT) and the Ruffer Investment Company (RICA). You are not alone, as their open-ended funds have seen assets leave in droves.

I have defended them consistently because they are well-managed, with excellent long-term track records that have proven resilient during times of stress. Having resilient assets in a portfolio is invaluable, as it reduces losses when things go wrong, which enables a higher long-term rate of compounding.

I’ll address them separately at first, then individually. But big picture, their investment approaches are similar, at least to the uninitiated, as they invest with risk rather than return at the forefront of their decision-making process. They do not worry about what the stockmarket is doing, nor do they try to beat it.

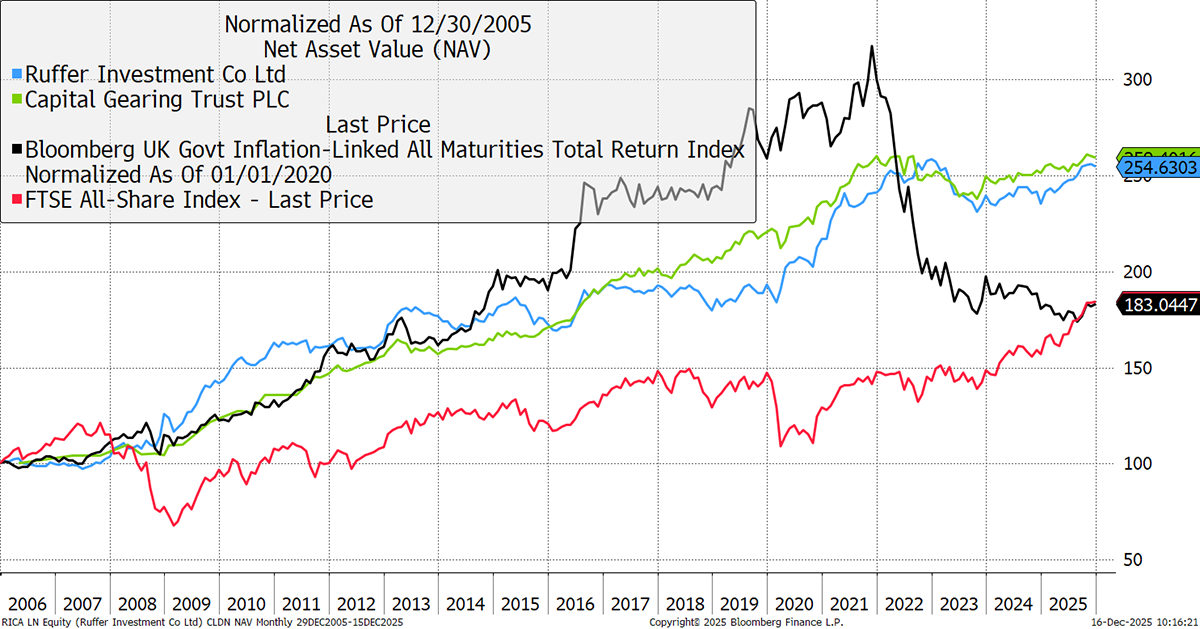

Yet, over 30 years, CGT has done twice as well as the FTSE 100, including dividends. RICA was launched in 2004 and had kept up with the FTSE until 2023, when both funds started to lag. The reason was a surge in interest rates. Both funds have embraced inflation-linked bonds (TIPS, Linkers, etc.) over the years, an asset class that collapsed in 2022/3. Yet still, they managed to avoid the pain.

The chart shows the capital return for CGT, RICA, and the FTSE, with the UK index-linked gilts’ total return (chart limitations, I’m afraid). It tells the story clearly. Their post-2023 returns have been pedestrian, and that is what has upset investors.

Capital Gearing, Ruffer, Linkers, and FTSE

I’ll go through both in turn.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd