Helium Redefined: From IoT Dreams to Mobile Reality

Token Takeaway: HNT;

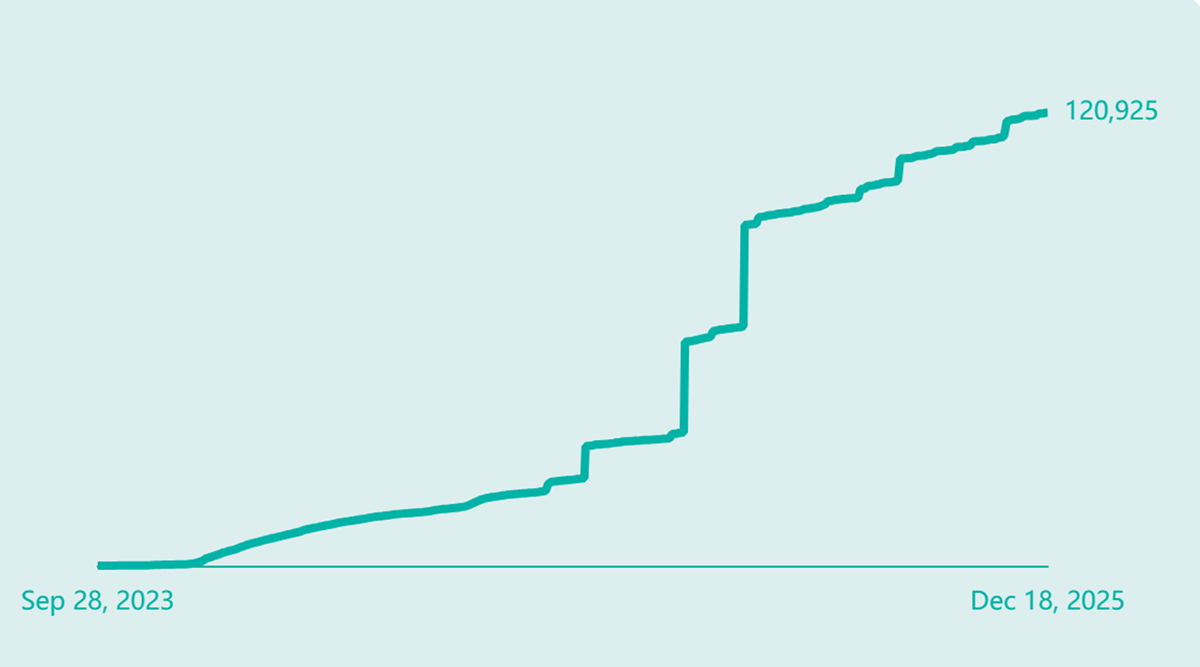

While the HNT token has struggled amid broader market weakness, the underlying network continues to grow. Helium has been on our radar for some time, and with Helium Mobile now delivering tangible, real-world value, it is timely to revisit the project.

Today, Helium stands as one of the largest Decentralised Physical Infrastructure Networks (DePIN) focused on telecommunications, with an encouraging growth outlook. That said, Helium IoT, which was once positioned as a breakthrough for Internet of Things (IoT) devices, has largely faded into irrelevance. This Token Takeaway examines the fundamentals of Helium and HNT, what is holding the network back, and its future outlook.

Overview

Helium was first introduced in 2013 by Amir Haleem, Sean Carey, and Shawn Fanning, who also founded the peer-to-peer music/file-sharing platform Napster. Their mission was to create a peer-to-peer, decentralised wireless network that could support the growing IoT industry. Helium launched with a $2.8m seed funding round, led by SVA, Slow Ventures, and Shawn Fanning. Since then, Helium has held numerous funding rounds and ICOs, bringing its total capital raised to just under $365m. Tiger Global Management, Pantera Capital, and Google Ventures were among the other backers.

However, today, the network looks very different from its original blueprint. Helium has gradually pivoted away from its IoT-first narrative, redirecting most of its focus and resources towards Helium Mobile and the broader telecommunications stack built around it. This shift reflects where real usage, revenue, and user growth are now emerging.

Helium Mobile Hotspots

By contrast, Helium IoT has been in steady decline. Once boasting close to one million hotspots globally, the network has shrunk to roughly 236k active hotspots, a drop of around 76%. Without meaningful change to incentives or renewed demand, this figure is likely to continue falling. The contrast between a growing mobile network and a fading IoT deployment has become one of the defining features of Helium’s current state. For a more detailed review of this transition from IoT to Mobile, read our previous Token Takeaway update on Helium.

What is the Helium Mobile Network?

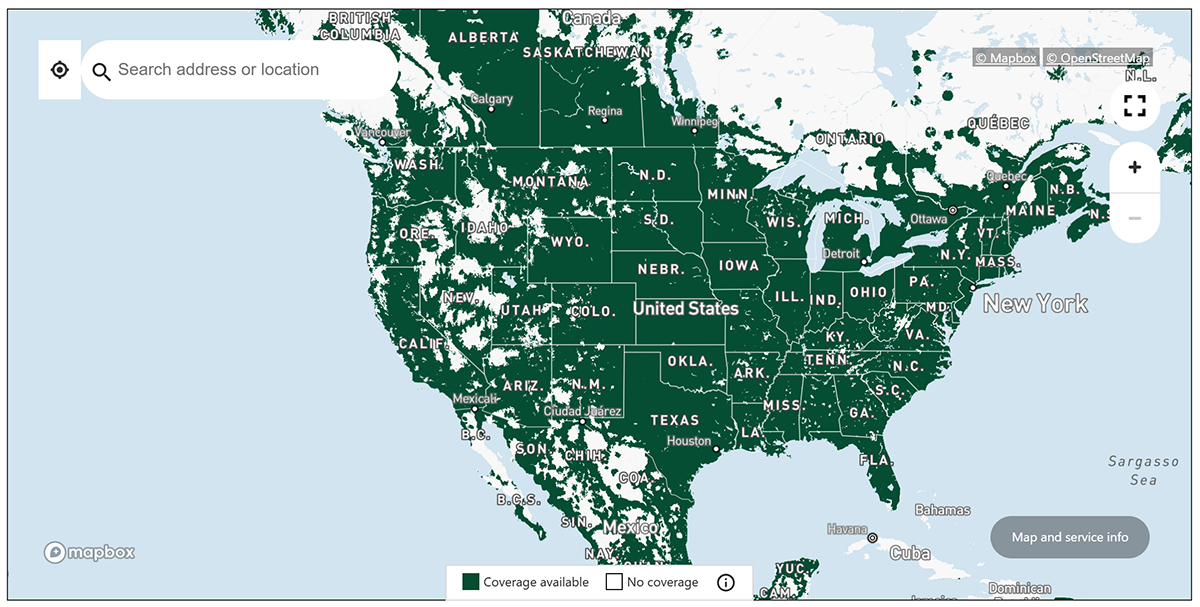

Helium Mobile is a decentralised virtual mobile network operator (MVNO) that delivers mobile data through a hybrid model. Coverage is provided by a community-powered network of Helium hotspots, supplemented by T-Mobile’s nationwide 5G infrastructure. In practice, this means a user’s phone automatically connects to whichever network is available - Helium, where possible, and T-Mobile, where needed - ensuring continuous connectivity.

This hybrid approach allows Helium Mobile to offer near-nationwide coverage across North America, while gradually reducing its reliance on traditional telecom infrastructure as its own network footprint expands. It also highlights the core DePIN thesis behind Helium, shifting parts of the telecom stack from centralised operators to community-owned infrastructure.

Helium Mobile Coverage

Coverage alone would not be enough to stand out in a crowded mobile market. Where Helium Mobile really differentiates itself is in pricing. The US-based service currently offers three plans: Zero, Air, and Infinity. Each plan is designed to undercut traditional mobile operators while still providing meaningful data allowances.

Helium Mobile Plans

| Plan | Data Allowance | Calls & Texts | Price (USD/month) |

| Zero | 3GB | 100 mins, 300 texts | $0 |

| Air | 10GB | Unlimited | $15 |

| Infinity | Unlimited 5G | Unlimited | $30 |

Helium Mobile Zero Plan

As the name implies, the Zero plan costs nothing. Subscribers receive 3GB of mobile data, 100 minutes of voice calls, and 300 texts per month at no charge.

Beyond being free, the plan introduces an additional incentive mechanism. Users can earn Cloud Points through usage, which can be redeemed for eGift cards covering categories such as travel, dining, shopping, and streaming via the Helium Cloud Store. Once the included 3GB of data is exhausted, additional data can be purchased at $7.50/GB.

Helium Mobile Air Plan

The Air plan sits in the middle of the range, priced at $15 per month. It includes 10GB of mobile data alongside unlimited calls and text messages. Like the Zero plan, Air subscribers are eligible to earn Cloud Points, and additional data is available at the same $7.50/GB rate once the monthly allowance is used.

Helium Mobile Infinity Plan

At the top end, the Infinity plan offers unlimited 5G data, unlimited calls, and unlimited texts for $30 per month. Cloud Points can also be earned on this plan, maintaining the incentive structure across all tiers.

Mobile Coverage Plans in the US

When compared with prepaid offerings from major US carriers such as T-Mobile, Verizon, and AT&T, Helium Mobile’s pricing stands out. Traditional providers typically charge between $40 and $45 per month for plans capped at 15GB of high-speed data, with higher-tier unlimited plans ranging from $45 to $60 and often subject to speed slowing after 50GB exhaustion.

| Provider | Plan | Data Allowance | Calls & Texts | Price (USD/month) |

| Helium | Zero | 3GB | 100 mins, 300 texts | $0 |

| Air | 10GB | Unlimited | $15 | |

| Infinity | Unlimited 5G | Unlimited | $30 | |

| T-Mobile | Starter Monthly | 15GB 5G data, then slowed | Unlimited | $40 |

| Unlimited Monthly | 50GB 5G data, then slowed | Unlimited | $45 | |

| Verizon | 15GB plan | 15GB | Unlimited | $45 |

| Unlimited | Unlimited | Unlimited | $60 | |

| AT&T | 15GB plan | 15GB | Unlimited | $40 |

| Unlimited MAX | 50GB 5G data, then slowed | Unlimited | $55 |

Source: T-Mobile, AT&T, and Verizon

By contrast, Helium Mobile offers a free entry-level plan, a $15 option with meaningful data allowances, and a truly low-cost unlimited plan at $30 per month. Across every tier, Helium is cheaper than incumbent providers, often by a wide margin, while still delivering nationwide coverage through its hybrid network model. This aggressive pricing strategy is a key driver of adoption and a clear demonstration of how decentralised infrastructure can translate into tangible consumer savings.

But does this attractive pricing and coverage actually attract users?