Yodel

Trades in the Soda and Whisky Portfolios;

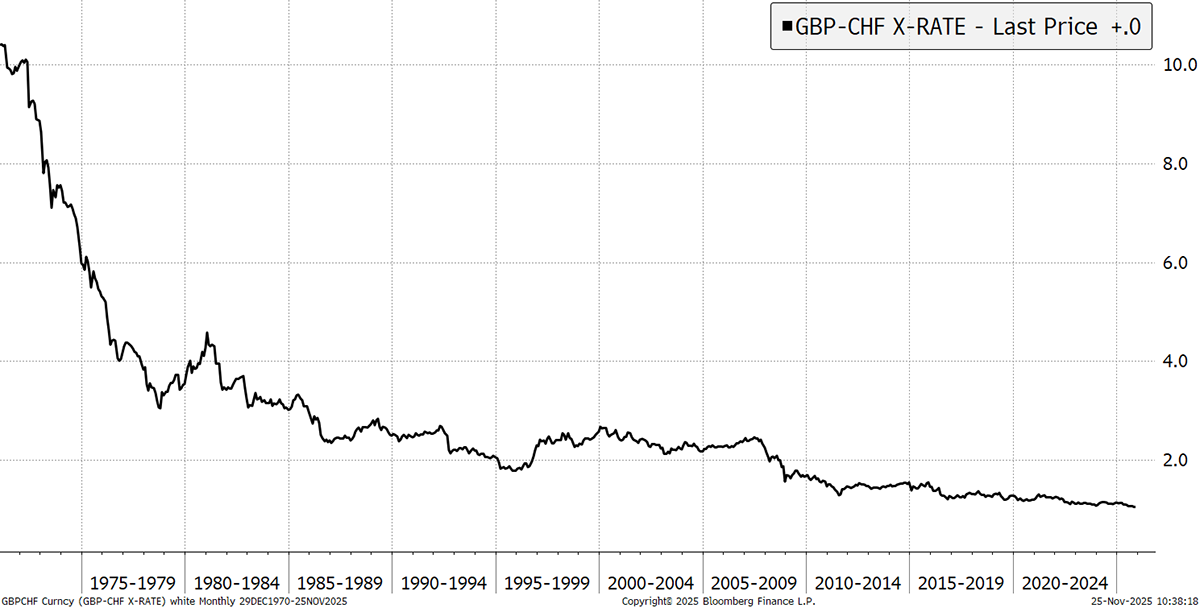

This week we’re off to Switzerland. We’ll be eating rösti and drinking glühwein, so grab your coat because it’s cold in the mountains. You’ll also need some cash. A pound once bought 10 Francs, and today, it buys 1.06 Francs. I hope you changed your pounds into Swiss Francs five decades ago.

The Pound versus the Swiss Franc

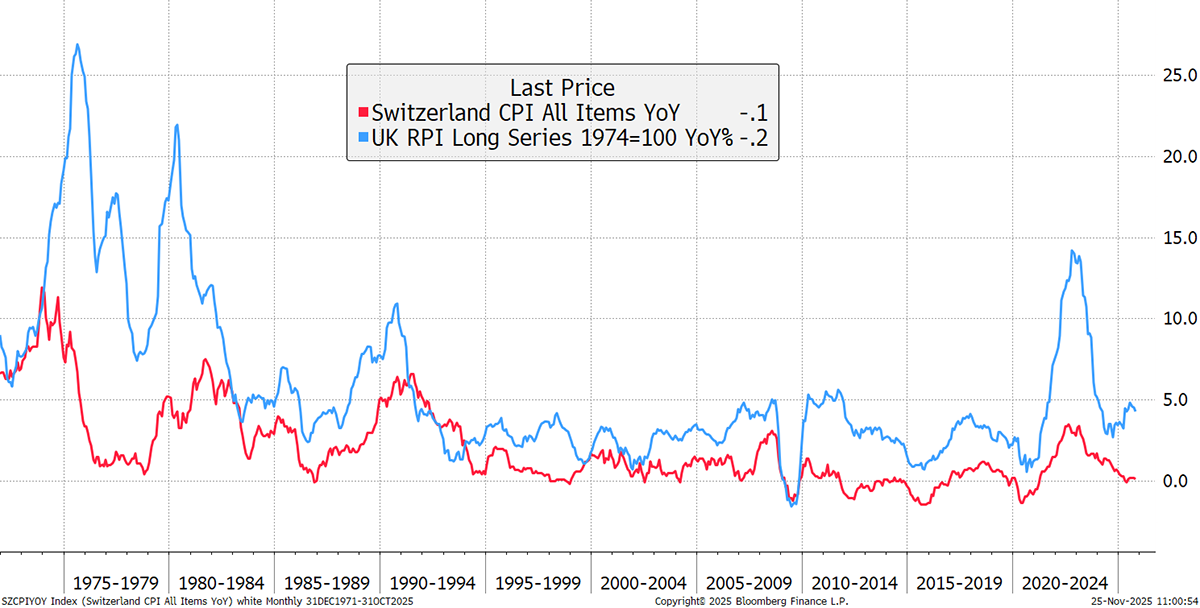

There are various reasons why currencies rise and fall, but inflation is the one that always bites hardest in the long run. Over 30 years, Swiss inflation has totalled 19%. In the UK, 170%. In other words, a Swiss Franc buys more or less what it did a generation ago, whereas a pound has lost the majority of its purchasing power.

Swiss vs UK Inflation

Switzerland is a European democracy, except that, unlike the UK, it is a well-managed democracy. They vote on everything, stay out of trouble, and, above all, they balance their budgets, only embracing deficits during major events such as the pandemic.

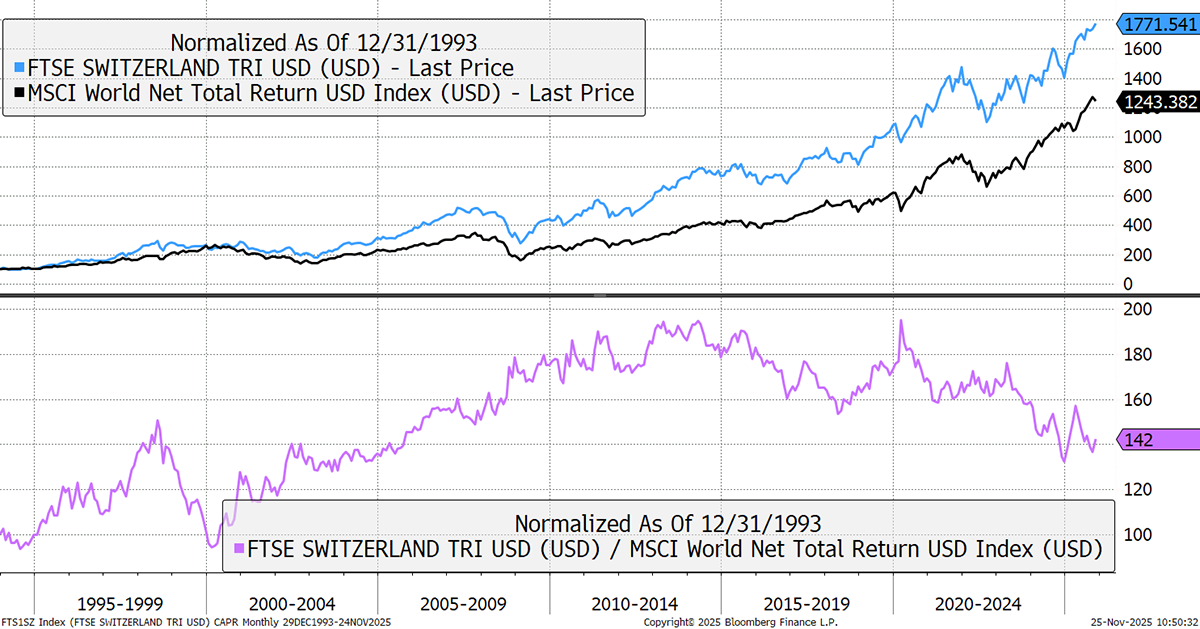

The Swiss stockmarket has been no slouch either. Having a strong currency means that only the best companies can survive. The Swiss Market Index (SMI) is ahead of the World Index over the past three decades, and there isn’t a tech stock in sight. Moreover, the volatility of the SMI is approximately the same as the World Index, which is impressive as it holds just 20 stocks, whereas the World Index holds 1,320. But the best bit is that it has a good record of being a better place to be invested in when things go wrong. The SMI is not only a performer, but defensive to boot.

Switzerland vs the World

Being defensive means much of its exposure is in non-cyclical sectors. A sizeable 35% is in healthcare, as Switzerland hosts many of the world’s leading pharmaceutical companies, and 15% in consumer staples, mainly chocolate. Additionally, 6% is held in UBS, which now includes Credit Suisse, with other financial exposure in insurance. In the current environment, this is compelling.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd