Farewell the Treasury companies

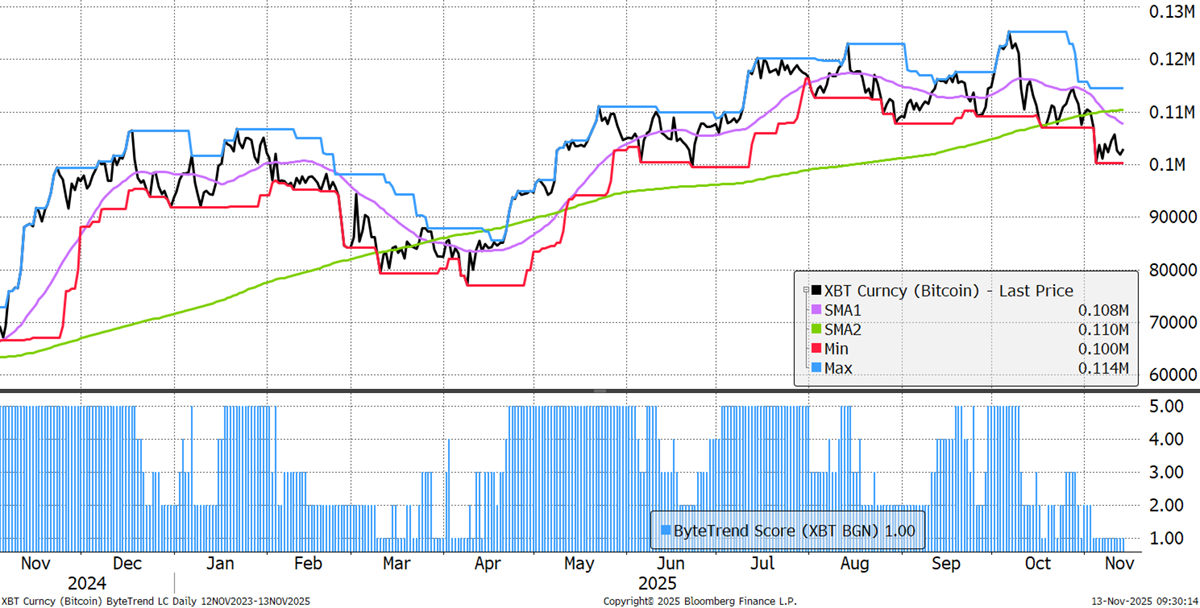

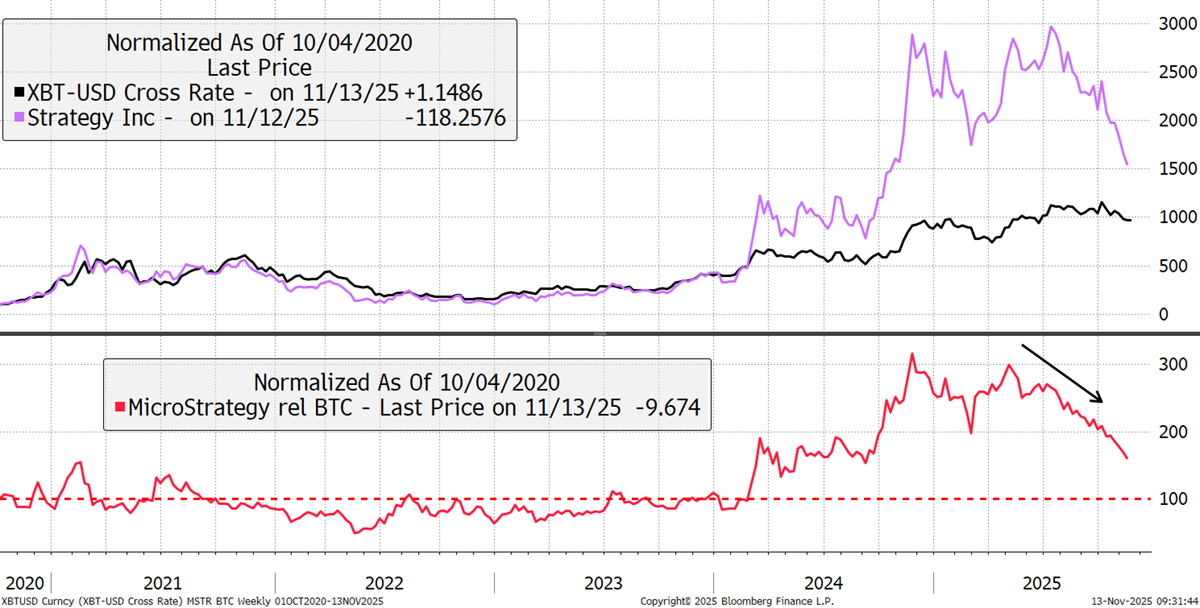

ByteFolio Issue 184;

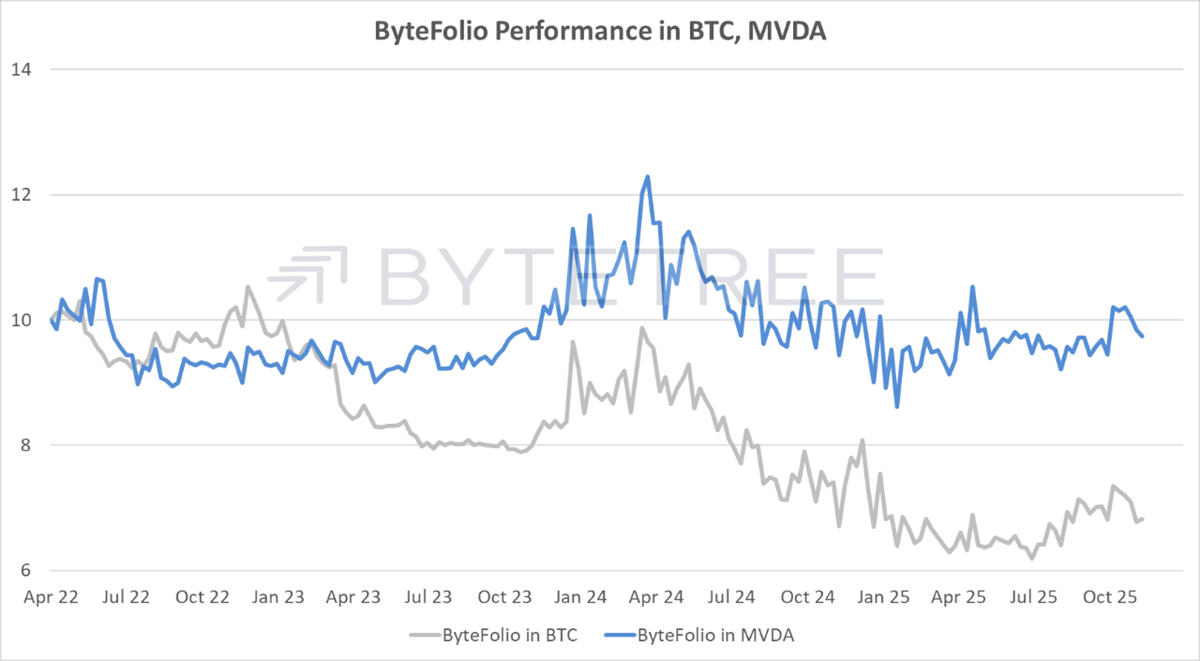

Bitcoin’s ByteTrend Score stays at 1. The 200-day moving average remains upward-sloping, but with a clear death cross, where the 30-day moving average cuts through the 200-day moving average. Things have been better.

Bitcoin Bull Market

Bitcoin was the first to correct from its all-time high on 6 October. Gold peaked 10 days later. Since then, gold has been recovering strongly, whereas Bitcoin has been holding above $100k.

Bitcoin versus Gold

This relationship is also important. High-volatility stocks, related to AI and other tech themes, surged, leaving Bitcoin behind. There’s a correlation, but for some reason, Bitcoin didn’t follow the pack.

Bitcoin and High-Volatility Stocks

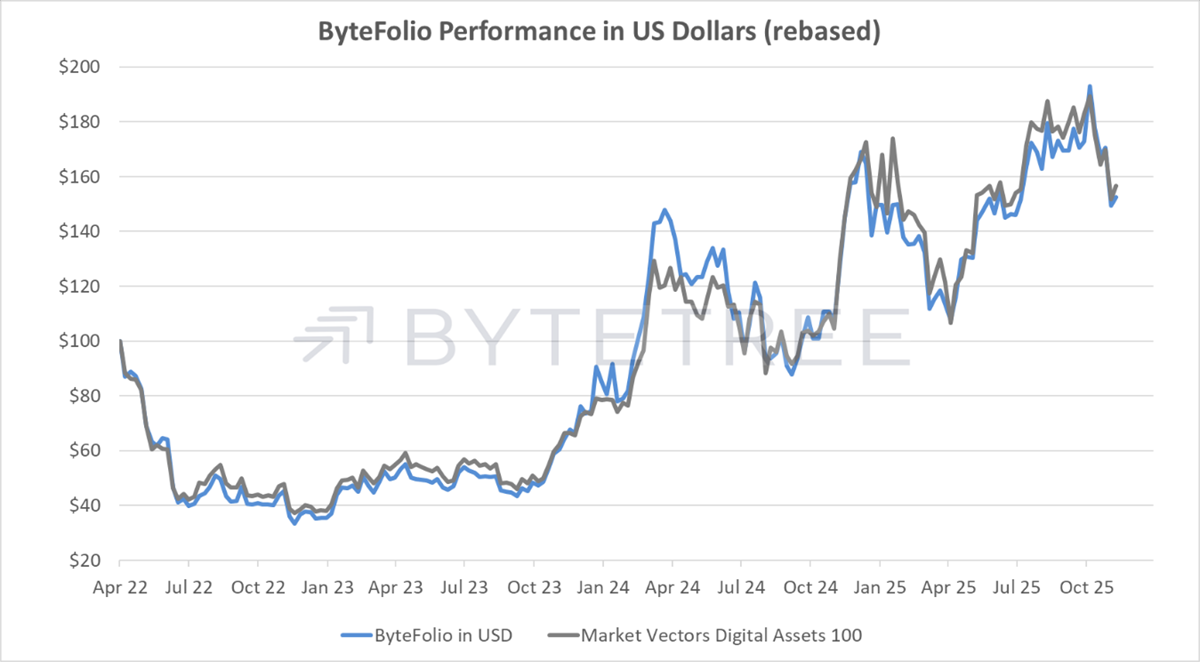

Strategy (MSTR), formerly known as MicroStrategy, is being dumped at pace. The stock is up 15x since it adopted a Bitcoin treasury strategy in October 2020, while BTC is up 10x. Yet that outperformance (purple) is being given back. It was 3x ahead of BTC; now it’s just 50%. The bonds are falling, and the premium, or mNAV in speak, is being eroded.

Strategy versus Bitcoin

To me, it was always clear that MSTR was a regulatory arbitrage. Investors bought MSTR as a Bitcoin proxy as the ETFs (or ETNs) were banned in major financial centres such as London. In June, the UK regulator, the FCA, announced their intent to lift the ban on retail Bitcoin ETNs. Then they announced a consultation period. There was a short delay ahead of launch, and then trading began. With the exception of the delay, which proved to be short-lived, each of these events caused MSTR stock to slide versus Bitcoin.

MSTR and Bitcoin

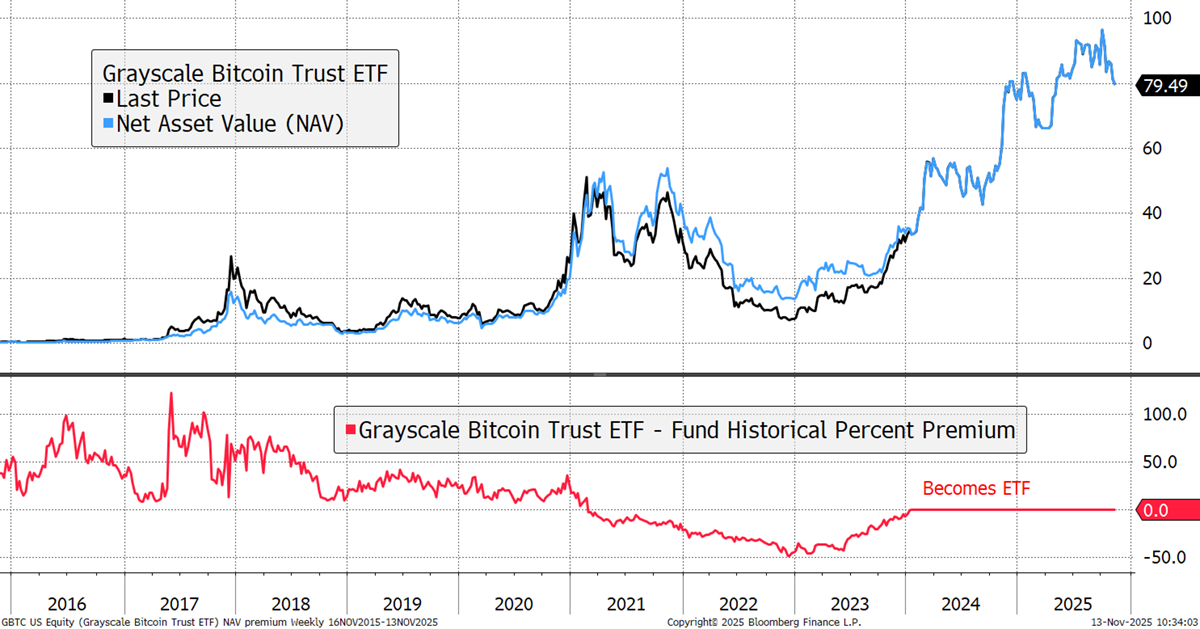

If MSTR was just an investment product, it wouldn’t matter. But they hold 641,692 BTC, and the ETFs have removed a major source of demand. The risk is that the premium turns into a discount, just as it did for the Grayscale Bitcoin Trust (GBTC). That discount dropped to 48% in late 2022, or an mNAV of 0.5.

Grayscale Bitcoin Trust

The excitement around MSTR accumulating BTC was a tailwind that has turned into a headwind. The risk is that they move from being a Bitcoin buyer to a seller. That is not coming soon, but an mNAV below one will wake people up.

MSTR profited from a regulatory arbitrage, which has eased in London, and will see more places ease in the coming years. Farewell, the Treasury companies; it was fun while it lasted.