Chinatown

Trade in the Whisky Portfolio;

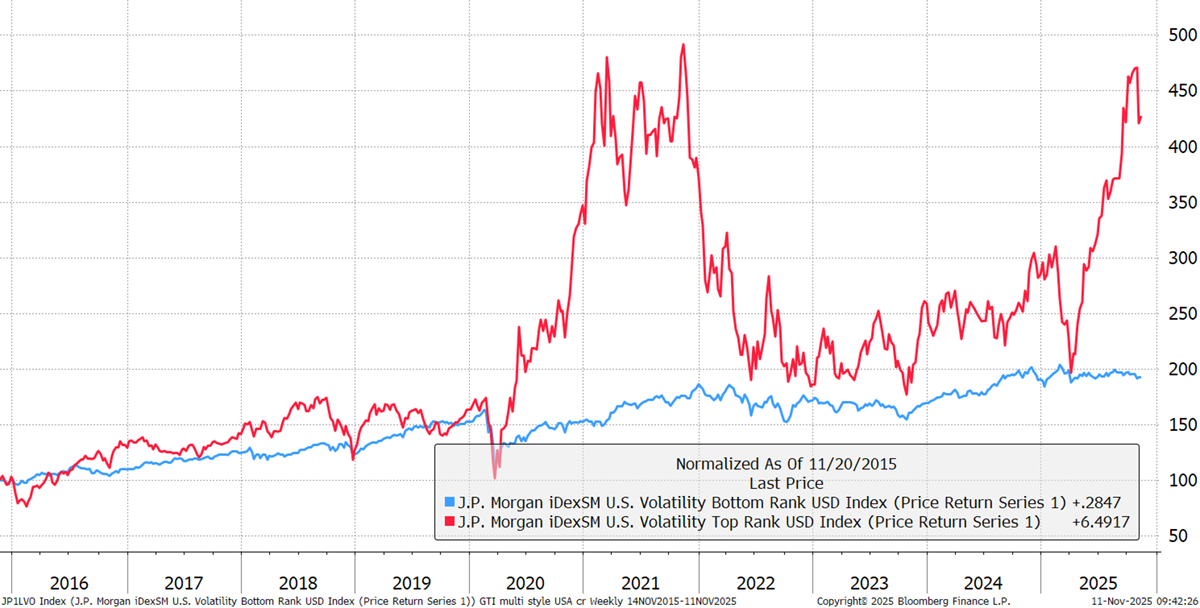

I’m getting very excited about this chart, which shows high-volatility stocks —the epicentre of the market bubble —and low-volatility stocks, which still haven’t noticed there’s been a bull market. You’ve seen this before, but I'm showing it again because it is currently so important —it illustrates clearly what's been happening. The riskiest stocks have taken the lead, which is rarely a good thing.

High-Volatility Stocks Versus Low-Volatility Stocks

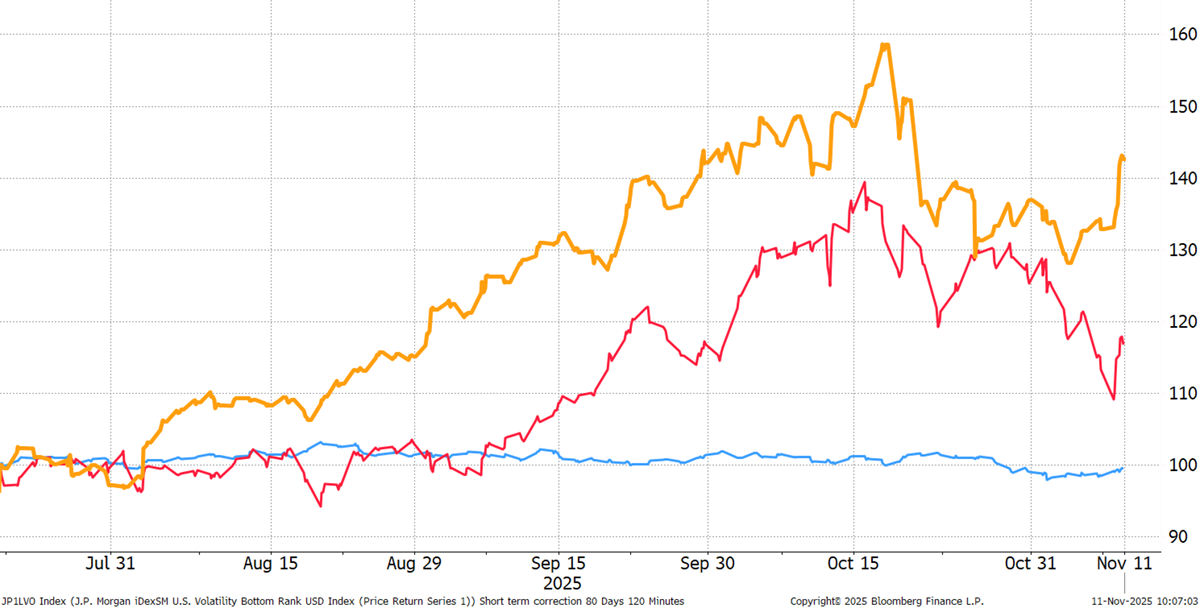

I question whether the recent correction from the high on 15 October and the subsequent 23% correction are a major signal? In the chart below, I have zoomed in since the summer and added the gold miners. In November, there has been a divergence where the high-volatility stocks have corrected further than the miners, which have bounced. Does big tech join the high-volatility train wreck? Sooner or later, it undoubtedly will.

High-Volatility Stocks Versus Low-Volatility Stocks with Gold Miners – Short-Term

It’s an encouraging sign, and the miners remain a core holding, but I am far more comfortable moving ahead with lower exposure than we had. I suspect gold’s advance will moderate from here, but it’s still a great trade. However, the thing that excites me most about the chart is the positive reaction from low-volatility stocks (blue). It may be slight, but it’s positive, which implies that if risky stocks are sold, safe stocks are bought. Where there’s a bubble, there’s an anti-bubble, and that is where I am most focused.

Let us not forget that the most terrifying investment of all is cash, especially in the UK, as the pound has seen better days. I prefer a diversified, value-oriented portfolio of liquid assets. I am currently working double-time to recycle that value.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd