Baby Bear

ByteFolio Issue 185;

Bitcoin’s ByteTrend Score drops to 0, which means the trend is now bearish. There have been five new all-time highs since January, none of them spectacular compared to the past. There is no new low yet, but that now seems increasingly likely.

Bitcoin

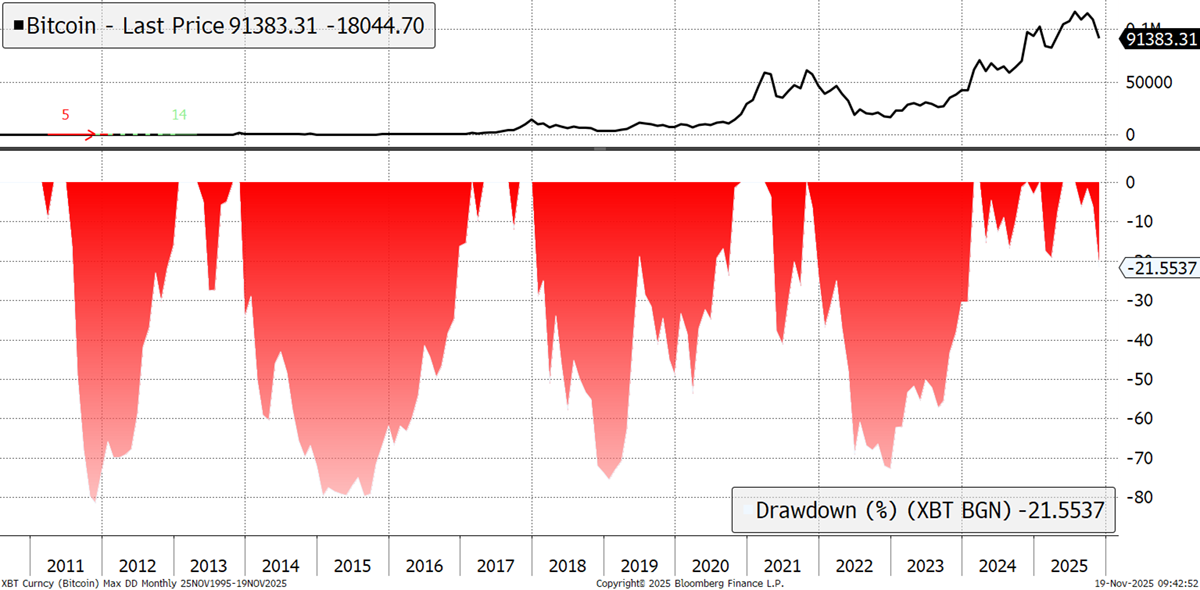

In the past, the price of Bitcoin has fallen sharply during bear markets. In 2011 and 2015, it fell by 80%; in 2018, by 75%; and in 2022, by 70%. These drawdowns have been shrinking, but they are still vast. Of course, they don’t matter as much as new highs follow, which they always have, and presumably always will. So long as the digital economy keeps on growing.

Bitcoin Drawdowns

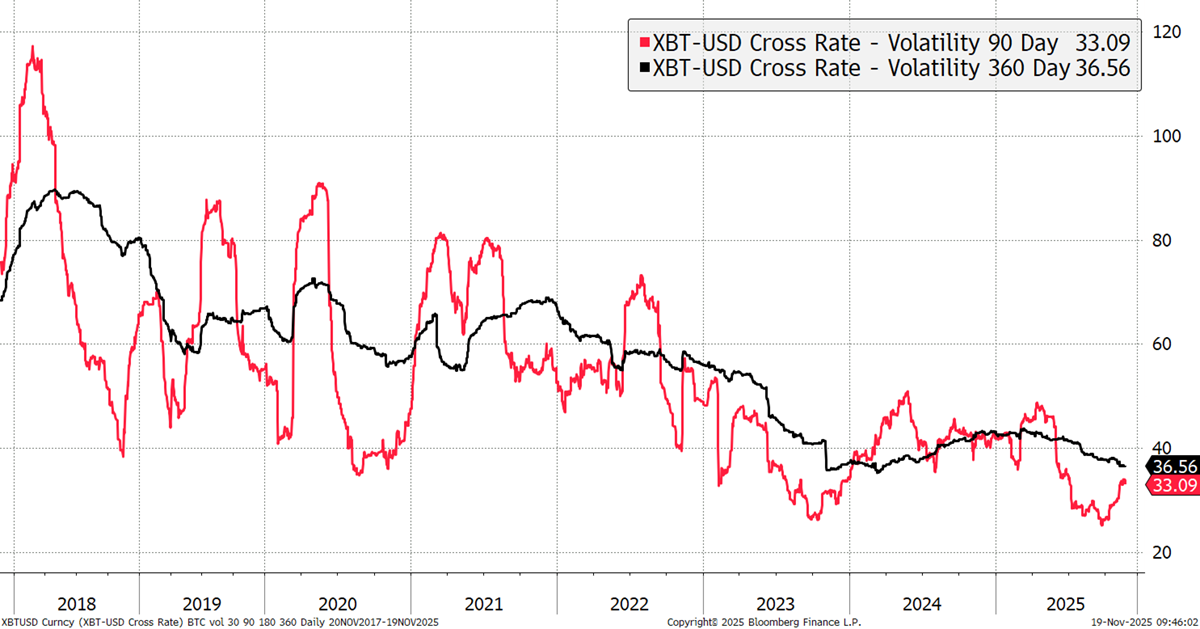

Bitcoin’s volatility keeps falling, but the large declines saw 90-day volatility at 100%+ in 2018 and 70% in 2022. So far, it is just 33%, so a large imminent drawdown seems unlikely without some form of warning beyond a weak trend.

Bitcoin Volatility

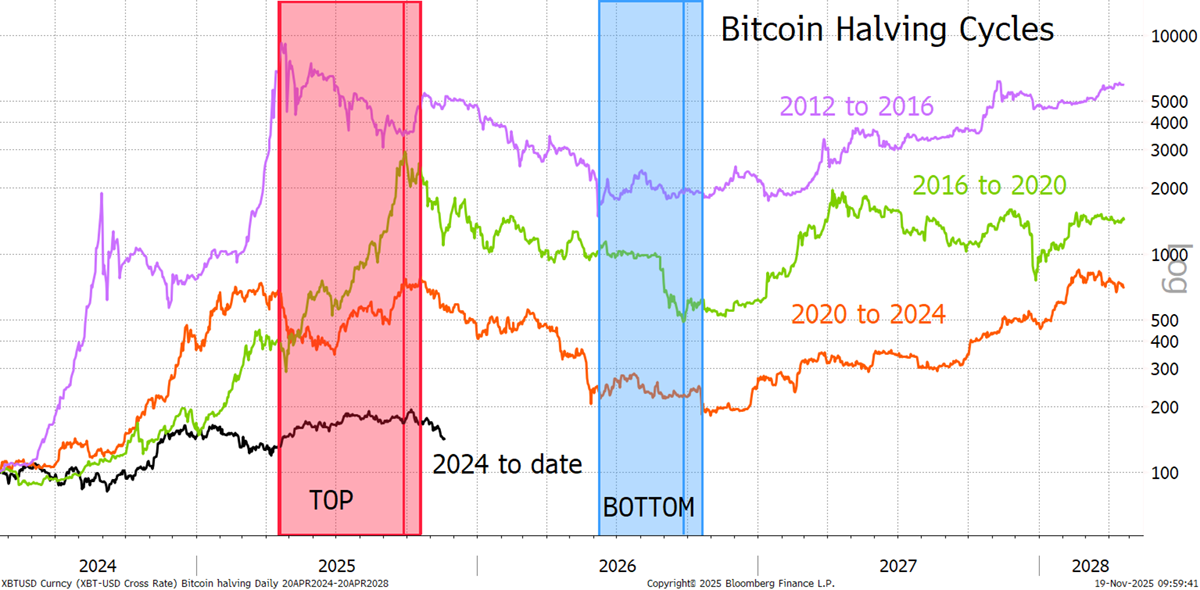

I have shown this chart several times with the cycle tops. This time, I have added bottoms. The good news is that while it’s just 31 days until Christmas, it's only 230 days until the next bottoming cycle.

Bitcoin Halving Cycles

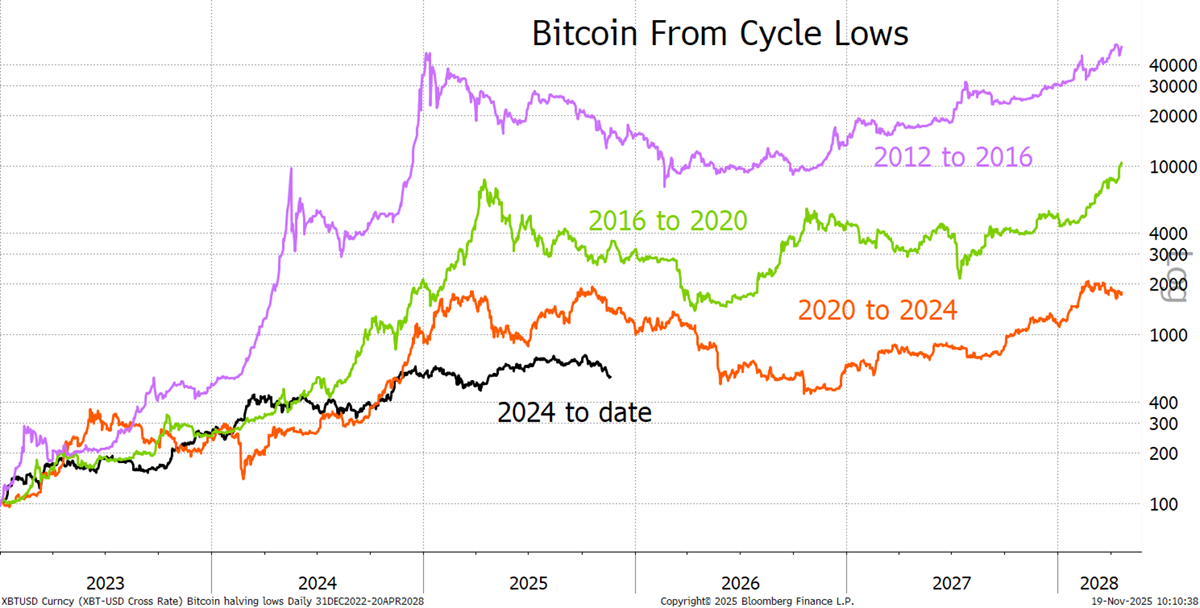

To those claiming this cycle has been weak, it started off very well. The chart starts from the cycle low, and this time has been excellent, given that Bitcoin is these days measured in the trillions of dollars.

Bitcoin Halving Cycles - Performance since Lows

The $100k level has been broken, and a bear market fits the four-year cycle thesis. Many smart minds doubt its relevance, but it appears to be happening. At least a baby bear.