A Penny for Your Thoughts

Trades in the Soda and Whisky Portfolios;

Index funds are one of the greatest financial innovations of all time. They offer a cheap and simple solution for large quantities of money to mimic market returns. While they will never outperform, they will only underperform by fees, which ought to be low. Ironically, for many private investors, those fees end up being high because many pay an advisor to select and hold the index fund on their behalf, thereby negating the benefits of the exercise.

I rarely select index funds, but when I do, it’s not fees that concern me. I do not get excited by low fees, nor am I dissuaded by high fees. A poor investment that charges low fees is no consolation for tying up your capital unproductively. In contrast, a great outcome with high fees is well worth the money. A penny for your thoughts? Index funds deserve to be cheap because no one is thinking.

While I respect what index funds have done for investors, the big problem comes when the majority are in agreement. If too much money is tracking the index, there is not enough managed money making active decisions that set prices. We have come through an era when the index funds have done well, and as a result, have attracted more money, and as a result, have continued to do well, which has attracted more money… and so it goes on.

The result has been a concentration effect, whereby mega-caps have beaten large-caps, which have beaten mid-caps, which have beaten small-caps. A company’s participation in capital markets and demand for its shares are more closely related to its valuation than anything else. Index funds have flattered the largest over everything else.

The distortion has been noticeable in the World Index, where the top 10 stocks make up 31%, which is 10x more than the global energy sector. Ah, but tech makes lots of money, they say, but so does energy. We’ve hit the point where, if tech and AI want to scale much further, they will have to drag the energy sector along for the ride. Sizewell C, which will generate 3.2 GW by 2035 or later, is the UK’s largest planned electricity plant. Some estimates suggest that AI will need over 10 times this amount each year, to make computers think so we don’t have to. As I said, a penny for your thoughts.

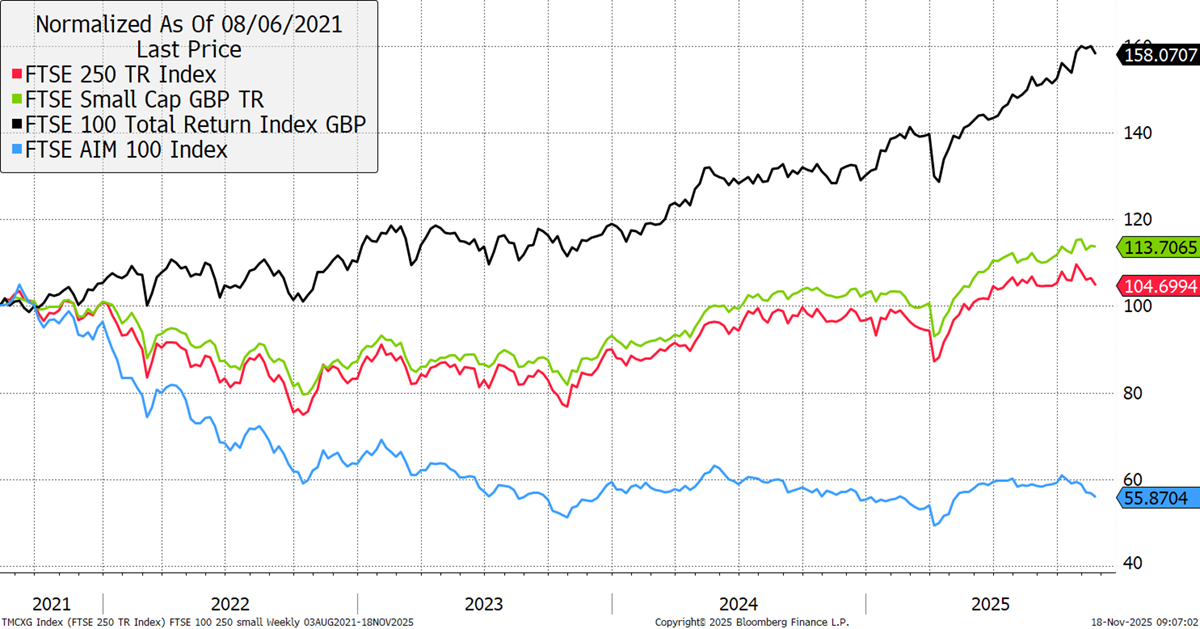

Equity indices, which are generally weighted by market cap, have skewed markets, especially since the market peak in 2021. Since then, the FTSE 100 has beaten small- and mid-cap stocks, which have left AIM stocks for dust. I suspect this is true around the world, but is certainly most prevalent in tech-focused stockmarkets.

UK Large-Cap, Mid-Cap, Small-Cap, and AIM Since 2021

What to do as an investor over the next ten years is obvious. Sell the large and buy the small because whatever the problems with the world are, you can be fairly sure that your margin of safety is greater in the basket of companies that are down by 50%, as opposed to those up by 50%. Remember, these are diversified portfolios, so you can’t credibly claim that the larger companies are better, because we know that the “size effect” is mean-reverting. That means sometimes investors reward large stocks, sometimes small, but in the end, and over the years, small beats large. It’s in the textbooks. But maybe don’t buy small-caps quite yet, as it’s always best to buy into a rising market.

To be clear, the surge in popularity of index funds has caused this almighty dislocation in markets, and payback time is upon us. I believe holders of the mainstream index funds, such as the world, USA, Asia, and so on, will lag a half-decent active manager by a wide margin over the next ten years. And, let us not forget, there are excellent managers out there too, but after a decade of indexation worship, we have forgotten who they are.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd