The Real Willy Wonka

Trades in the Whisky Portfolio;

I am instead going to look at the chocolate market, which brings a smile. But before I hand out the finished goods, we have to make them first, and it’s a complex task.

According to Google, we have to head off to Ghana or the Côte d’Ivoire to select our cacao beans from cacao trees. We ferment them for a few days while still covered in a white, fruity pulp, which develops the rich and complex flavours and aromas of the chocolate. We dry them in the sun to reduce the moisture content, then roast them to make them brittle, before removing the shells from the inner nibs in a process known as cracking and winnowing.

Next, we grind the cacao nibs into a fine paste known as cocoa liquor. We blend in sugar, cocoa butter, and other ingredients, such as milk powder for milk chocolate. The mixture is processed through a conche to further smooth the texture and develop the final flavour and aroma of the chocolate. After that, the melted chocolate is carefully tempered by heating and cooling to specific temperatures, before being moulded into bars or other shapes. The chocolate is cooled and packaged for consumption.

Feeling peckish?

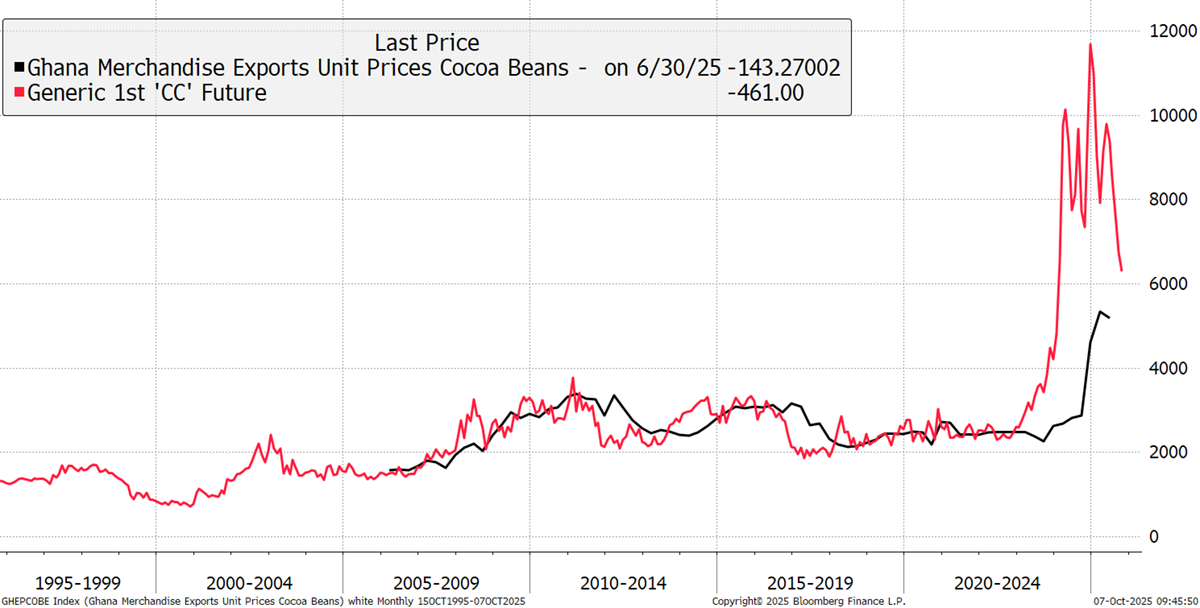

As I said, first we need to head off to West Africa, the centre of production, but we could also visit Cameroon, Nigeria, Brazil, Ecuador, Peru, or even Indonesia. We wish we’d gone a couple of years ago, because cocoa prices have soared. I show cocoa futures against the minimum farmgate price in Ghana.

Cocoa Futures and Farmgate Prices

Having been stable for years, the price of cocoa soared in 2023/24, as global production, of which half comes from West Africa, went into a shortfall. The chocolate industry was caught off guard and suffered from a combination of high prices and falling inventories. Other factors contributing to the lower production came from deforestation laws, a surge in global fertiliser prices following the war in Ukraine, ageing tree stocks, and the spread of the cacao swollen shoot virus.

This year, the price has collapsed, in part due to hedge funds, such as Andurand, exiting the market in the face of huge losses. On top of the events in the real cocoa economy, financial speculation had caused prices to spike beyond fundamentals. Cocoa prices are now cooling back to farmgate prices, set by the Ghanaian government, which acts as a floor for producers. It is a thin market, which has burned many investors over the years due to the wild price swings.

The Multi-Asset Investor Q3 Webinar

On Thursday, Kit and I will discuss this quarter’s performance for the Multi-Asset Investor portfolios, broader themes, and the outlook from here. The webinar will be approximately 30 minutes in length, and there will be time for questions at the end. Please send your questions in advance to charlie.morris@bytetree.com or prepare to ask them during the presentation.

In 2024, the chocolate market saw over $130 billion in retail sales, making it a major market. The leaders are Mars (private), Nestlé, Hershey, and Mondelez, with many smaller companies around the world. High cocoa prices have increased costs, which have dented profits, but mass market chocolate has a low cocoa content, making the impact lower than you think. The global chocolate market is expected to grow at a 5.2% rate for the rest of this decade.

After a period of rapidly rising costs, the situation appears to have stabilised, and the industry is adapting to a new normal. Part of that comes from a recovery in production, as the market moves back into a surplus, but another outcome has been driven by innovation. As they say in commodities, the best cure for high prices is high prices. I sense an opportunity.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd