Noctober

ByteFolio Issue 180;

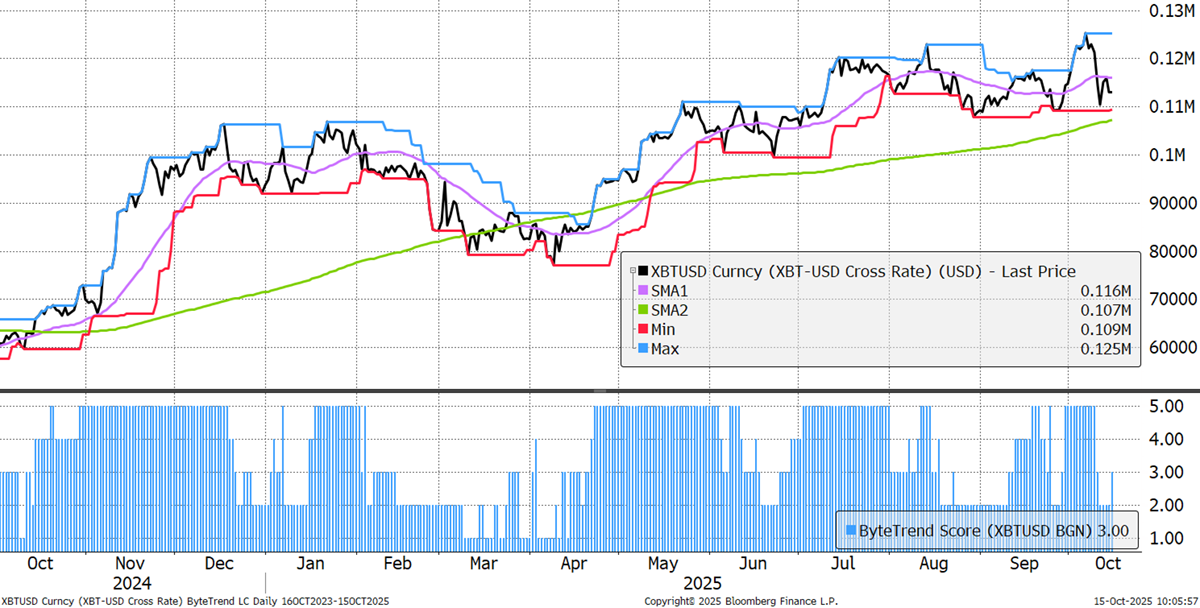

Bitcoin’s ByteTrend score drops to a 3, having visited 2 in recent days. Uptober has turned into Noctober, and the crowds are disappointed. Trump’s tweet on Friday triggered a liquidation event, as Ali will describe below.

Bitcoin Bull Market

You have to wonder if the expected progress in Bitcoin has been pulled down by the cycle. Since the last halving in April 2024, we are close to the time it took to reach peaks in past cycles. The counterargument is that the cycle is dead, as the impact of halving is much less than it was in the past, and Bitcoin has become an institutional asset.

Past Halving Cycles

If the cycle thesis remains relevant, there is a strong chance that it is weighing on the Bitcoin price rather than pulling it down. After all, this cycle has been soft compared to past cycles, but you’d expect that, given its size of $2.2 trillion.

In the midst of the turmoil, the star of last week was Binance (BNB), crypto’s largest exchange. Although the BNB token is not an equity, it strikes us that it behaves like one. After all, returns are delivered through quarterly burns, whereby a portion of the profits is recycled into BNB. This reduces issuance, just like share buybacks. In other words, BNB is rather like Coinbase (COIN).

Binance versus Coinbase

The curious thing is that BNB is a “volatile crypto”, whereas COIN is an equity. Yet COIN’s volatility over the past 90 days has been 68%, while BNB has been 44%. Maybe crypto is growing up, despite what the naysayers print.

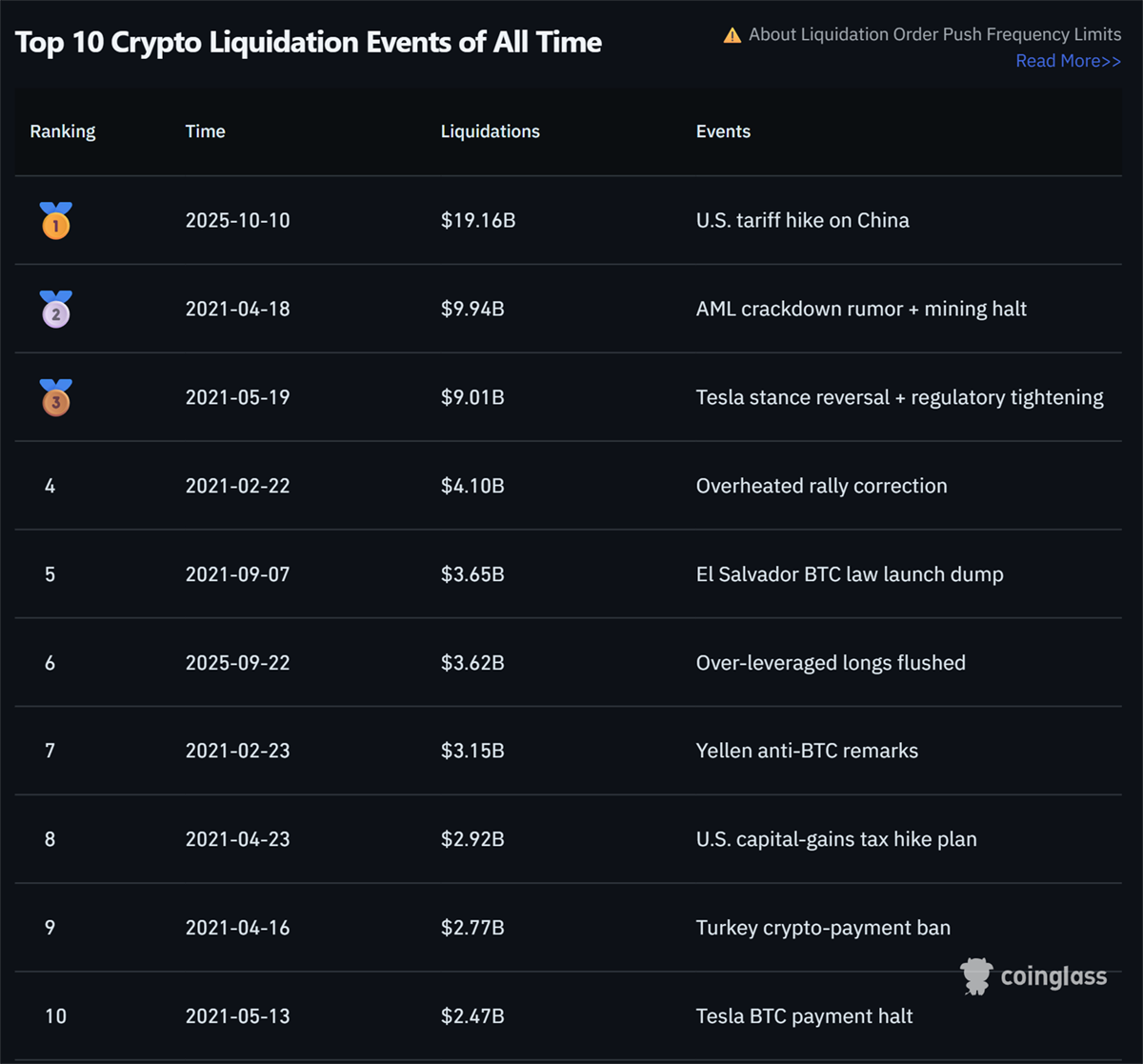

October 2025 Flash Crash: The Largest Crypto Liquidation Event

In a post on Truth Social, Donald Trump announced that starting 1 November 2025, the United States will impose a 100% tariff on all Chinese imports. The announcement sent immediate shockwaves through global markets, and none felt the blow harder than the crypto sector. Panic-selling erupted almost instantly.

Top-10 Largest Crypto Liquidation Events

Altcoins led the collapse, dragging the entire market down with them. From its day’s high on Friday, Bitcoin fell just over 10%, while Ethereum plunged 21%. BNB and XRP were down 30% and 44% respectively. Meanwhile, recent market favourites like HYPE (-54%), ASTER (-50%), and AAVE (-71%) took the heaviest hits.

On top of CEXs, the astronomical rise of perpetual DEXs like HyperLiquid and Aster reveals just how much leverage had been built up in the system. Many traders believed their 2x–4x positions were “low-risk”, but those were wiped out entirely. Social media was flooded with stories of devastated traders, some claiming to have lost their life savings in minutes. One tragic report even mentioned a trader taking his own life.

By the end of the day, an estimated $19.1bn in leveraged positions had been liquidated. For that to happen within hours is nothing short of extraordinary.

The takeaway is simple: there is no such thing as low-risk leverage. Leverage and safety do not coexist. Crypto is already one of the riskiest asset classes on the planet; adding leverage to it isn’t trading, it’s gambling with a multiplier.