Money Back to Work

Trades in the Whisky Portfolio;

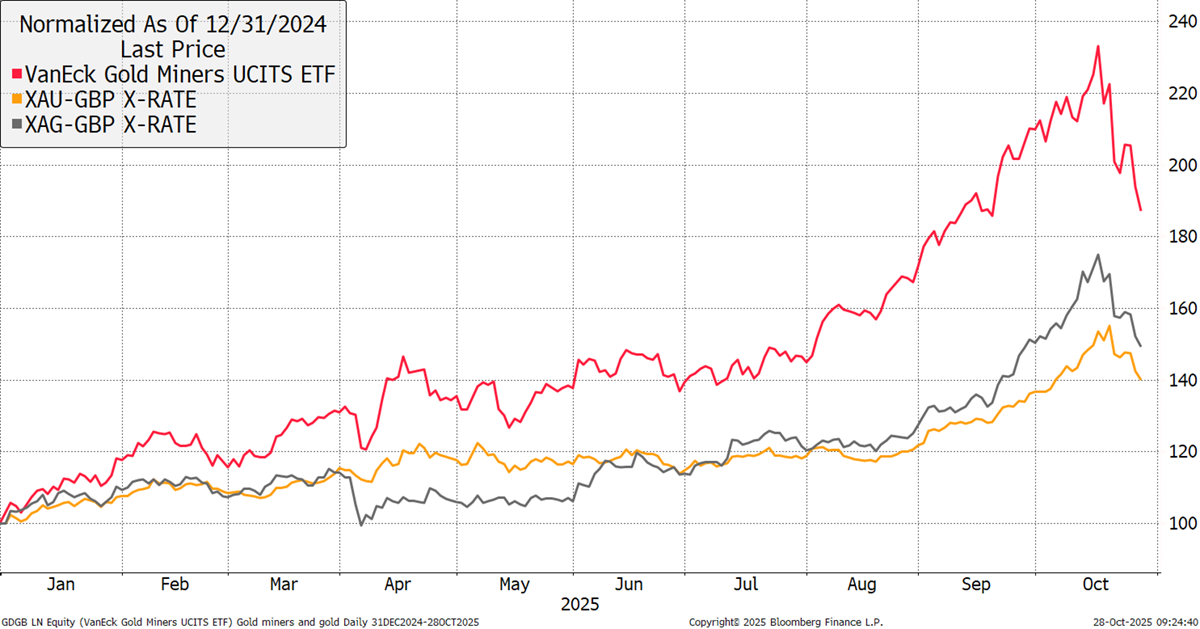

The biggest shake-up since I last wrote has been the correction in the price of gold. Peak to trough, it has fallen by 9.5%, which sounds harsh. A more upbeat way to frame it is that gold is only up by 2% in October, having given back some ground. Silver in October is flat, and the gold miners are down by 11%. In 2025, gold miners are up +90%, silver +50%, and gold +41% in GBP terms.

Gold, Silver, and Miners in 2025

Two weeks ago, I exited the junior miners from the Whisky Portfolio, and last week, I made further cuts across the precious metals space. It was unfortunate to hit a major down day, but I am in no doubt that it was the right thing to do. Going forward, the portfolios still have exposure to precious metals, but to a much lesser extent. I remain long-term bullish, and our position size is right-sized to weather the storm.

The problem now? We are awash with cash, and I need to put it back to work.

As a value seeker, there is plenty to do that is detached from the bubbles and manias. Step one last week was to look at TIPS and linkers for the Soda Portfolio to lock in attractive real interest rates. Step two is to find new opportunities for the Whisky Portfolio.

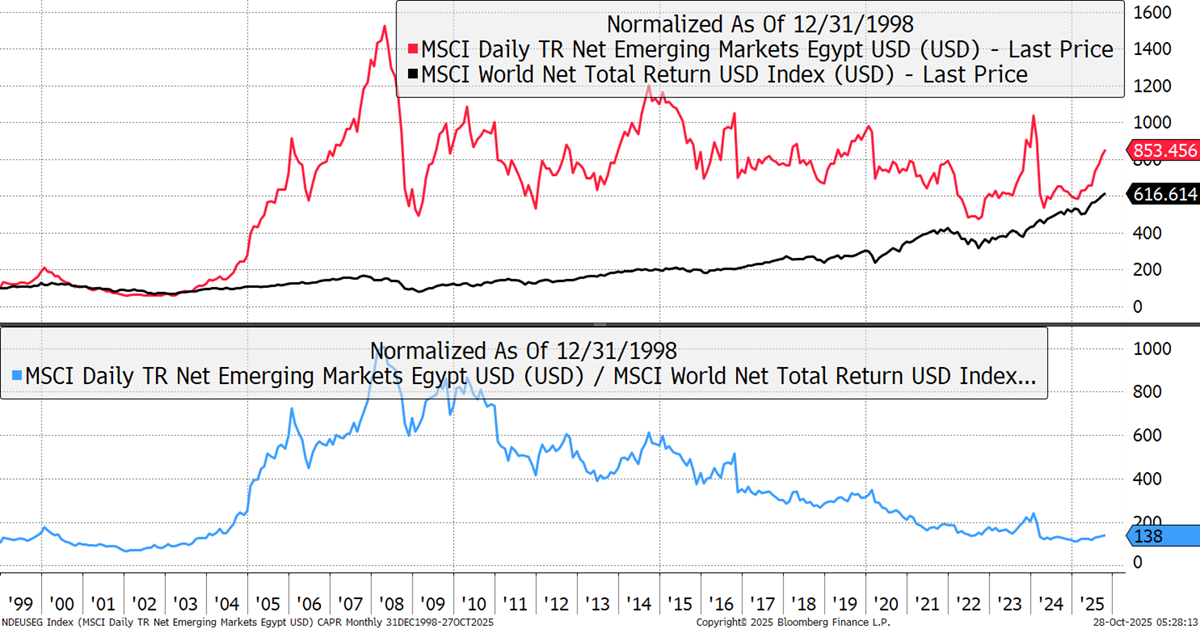

Show this next chart to someone under the age of 40, and they won’t believe it. They still don’t get the fact that emerging markets (EM) are high long-term return allocations for the simple reason that they are faster-growing countries and, more importantly, tend to offer better value.

For example, Egyptian stocks raced ahead in the 2000 to 2008 era, in the aftermath of the dotcom bubble. They have treaded water for 17 years, giving time for the rest of the world to catch up. Egyptian share prices are down 63% from their peak in dollar terms, or up 3x in local currency, but the dividends have helped too.

Egypt relative to the World

All in all, Egyptian equities have beaten the world since this data series began in 1999. I can tell you for certain that no one was talking about Egyptian equities back then, and they still aren’t today. This remarkable feat has happened while the Egyptian Pound has fallen by 93% against the US dollar over the period. That’s a wipeout, yet their equities are still ahead, because equities are a real asset; at least that holds true when they offer good value. I have little doubt that Egyptian equities will beat the S&P 500 over the next decade.

Buy Egyptian equities?

Good luck, as market access is tricky. If you called Hargreaves Lansdown to trade, they’d wonder what you had been smoking. There was an ETF by VanEck. The London shares ceased trading in 2018, and the US version shut up shop in 2024, due to a lack of demand. The joke among EM investors is to buy a market when the last fund has closed, and it holds true. I would love to buy Egyptian equities, but there is no longer a way for UK retail investors to access the market, so I’ll suggest something else instead.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd