Hesitation at the High

ByteFolio Issue 179;

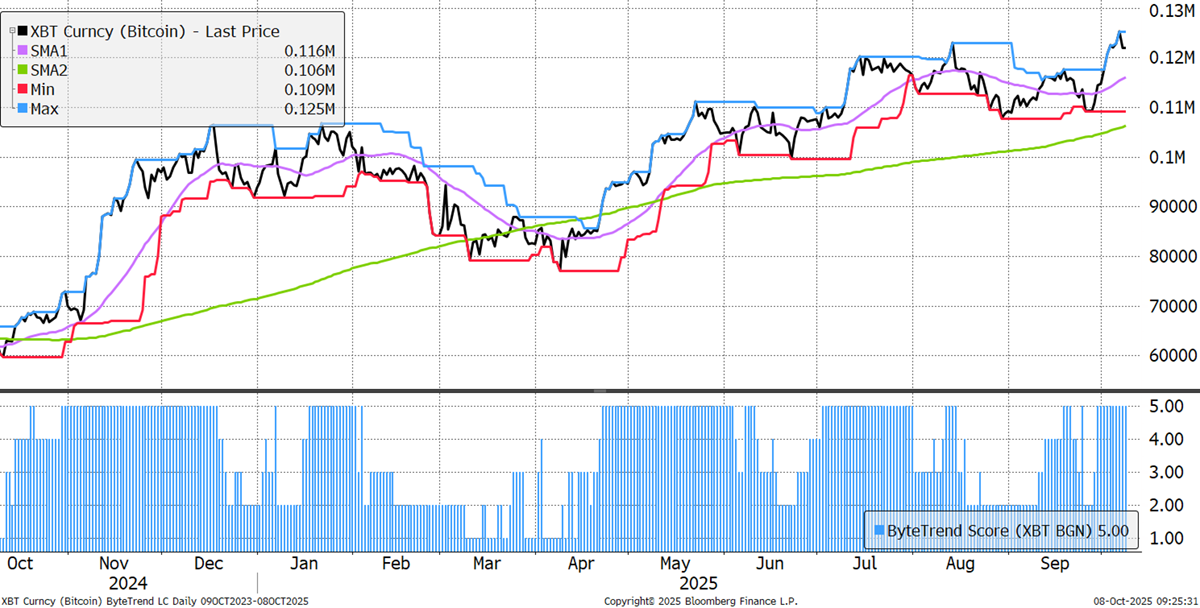

Bitcoin’s ByteTrend Score remains a 5, despite yesterday’s pullback. We keep seeing new highs, but each one has hesitated. In the good ol’ days, a new high was followed by a 10x move. It’s like a large weight is pulling it down.

Bitcoin Bull Market

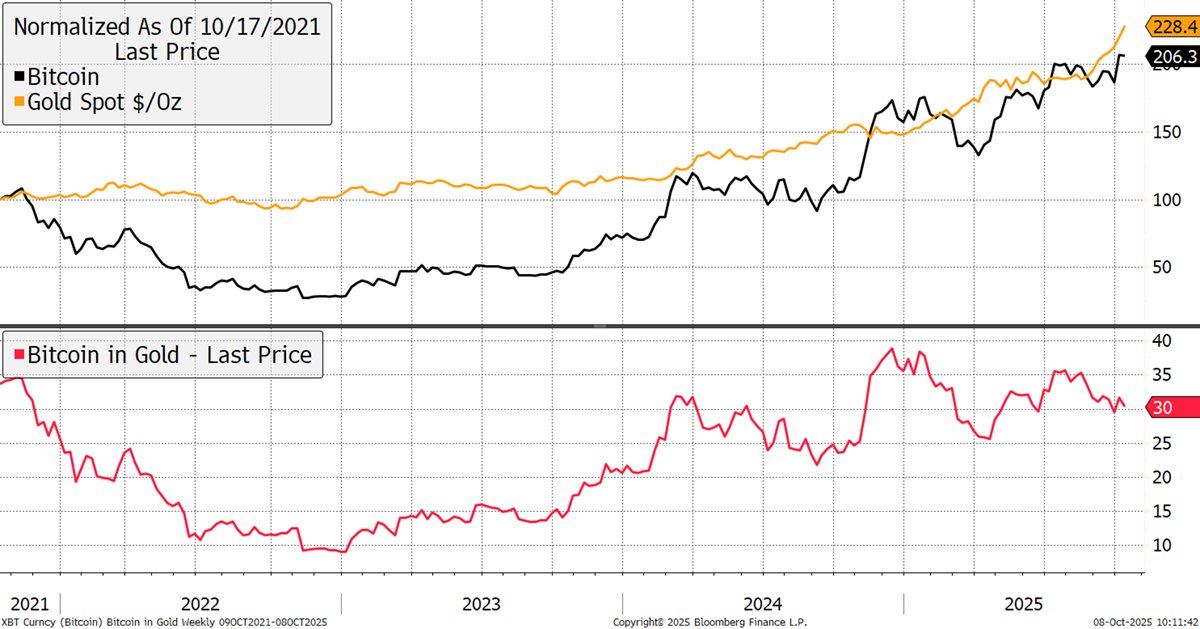

With gold at $4,000 for the first time in history, Bitcoin has a challenger. The narrative that Bitcoin is the macro challenger has been handed back to gold, at least for the time being. A single Bitcoin is now worth 30 ounces of gold (red).

Bitcoin and Gold

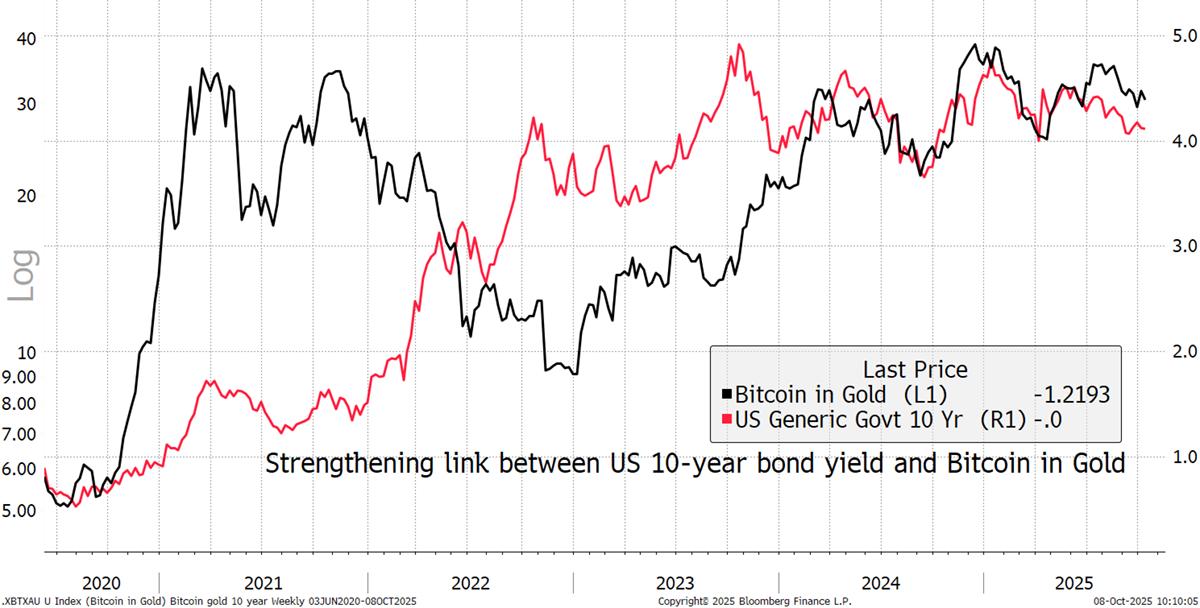

As ByteTree has long observed, Bitcoin prefers a rising 10-year treasury yield to a falling one. That’s because Bitcoin benefits from the combined effects of monetary excess, growth, and inflation. Treasuries sold off earlier this year but failed to make a new high. This is most likely manipulated, but still, I believe Bitcoin would be stronger with rates rising rather than falling. It is gold that thrives on lower rates.

Bitcoin and Bonds

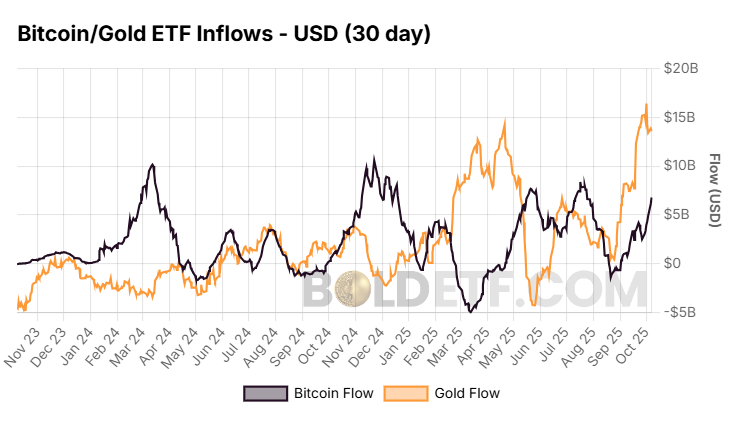

Still, the flows into the ETFs are picking up again and may even catch up with gold. A big change is that these flows are both rising simultaneously. Bitcoin must have more structural selling pressure from long-term holders than gold.

Bitcoin and Gold ETF Flows in USD

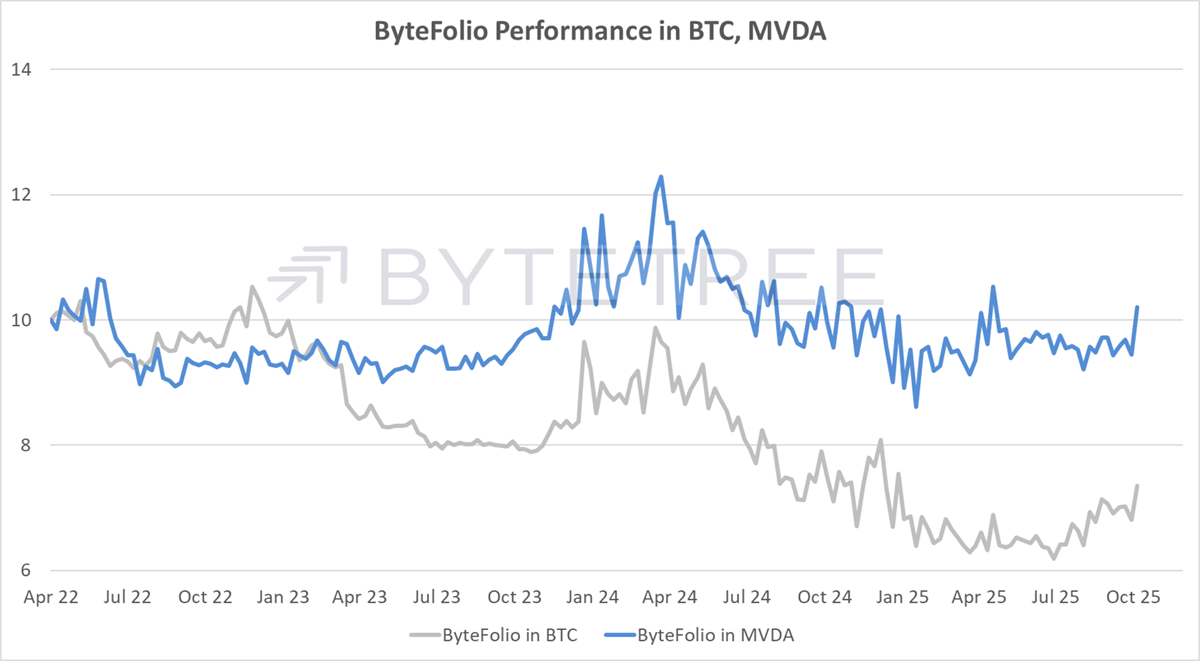

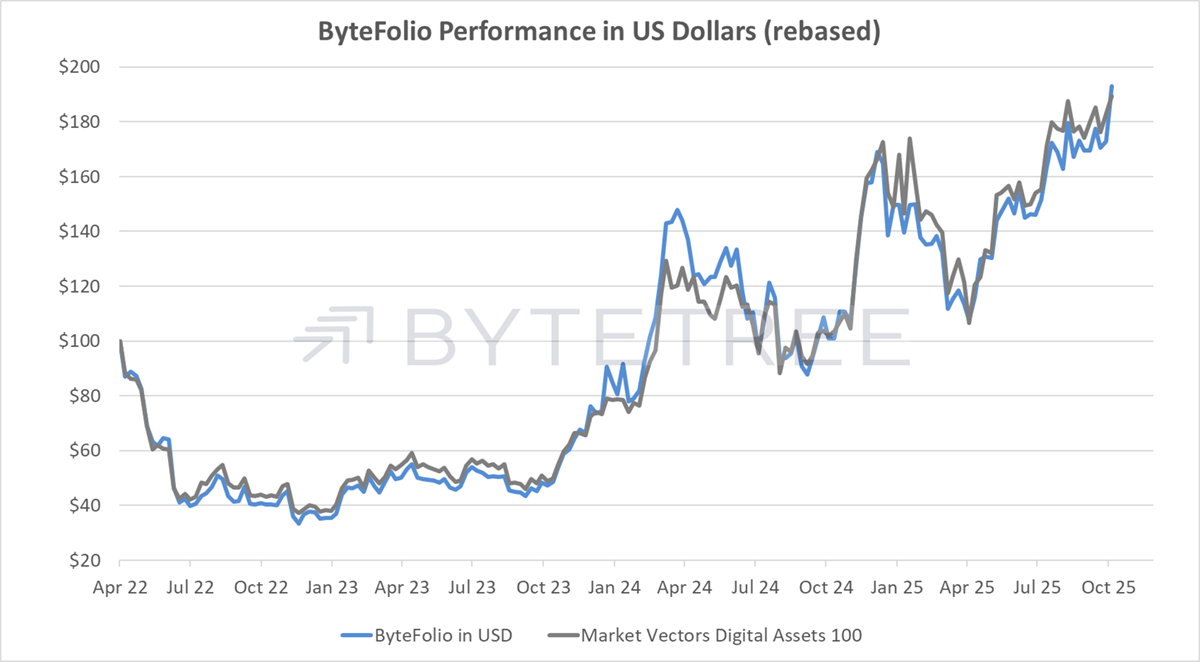

A strong move in ByteFolio. It only holds five coins, but that is what happens when you focus on Quality. We don’t own Ripple (XRP), which hurt us last year as it has a large position in the index. XRP went up faster than the ByteFolio. We are confident that it will be reversed at some point because we believe it is a low-quality project that doesn’t meet our standards. Still, nice to be ahead once again.