Gold, TIPS, and Linkers

Trades in the Soda and Whisky Portfolios;

BOLD is not yet listed in London. I’ll update you when the date becomes known.

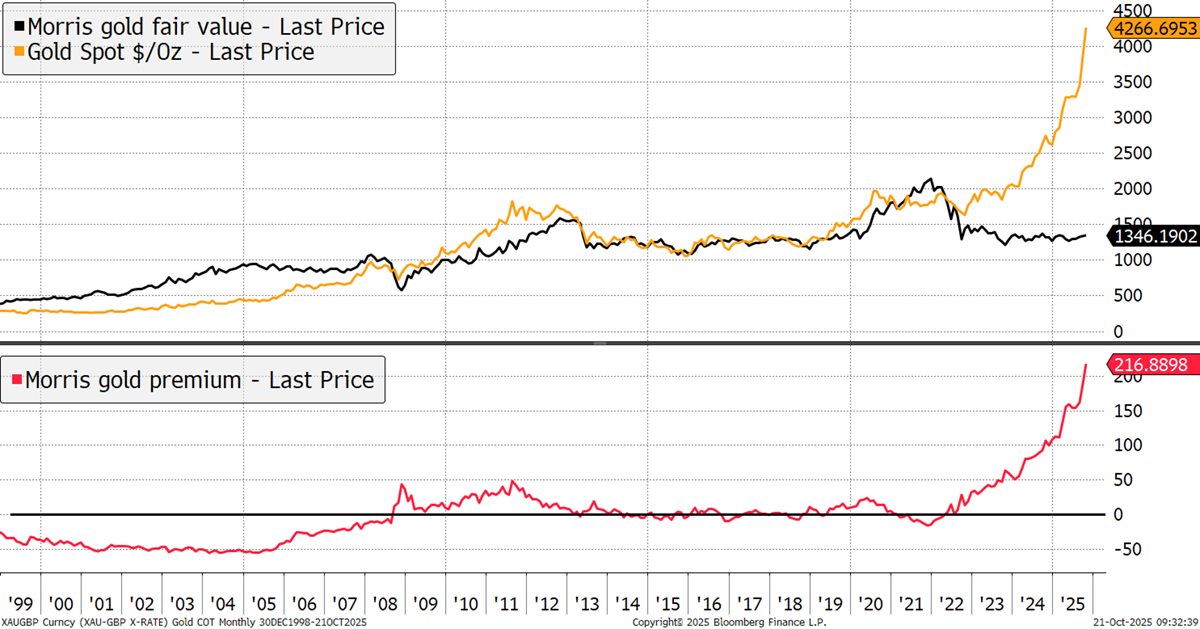

Since 2022, the price of gold has soared, and thankfully, we have held it. Prior to that, gold had sat comfortably in a regime whereby the price mirrored real interest rates. That is, gold would rise when rates fell below the expected future rate of inflation and fall when rates rose above inflation. The gold price moved inversely to real yields. I modelled this with a synthetic US Treasury Inflation Protected Security (TIPS).

Gold and the TIPS Model

Then, in 2022, the central banks accelerated their gold purchases, most likely due to the war in Ukraine and more importantly the confiscation of Russian reserves. The TIPS model never followed because real interest rates rose and then remained high, at least until recently. The model broke as gold faced a regime change.

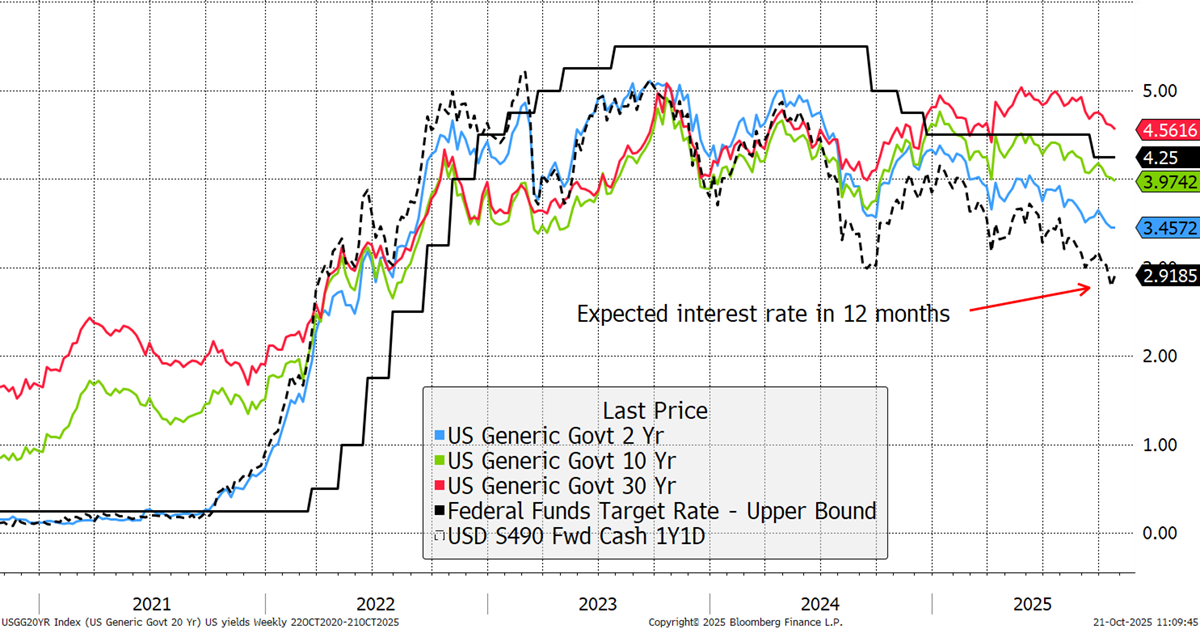

In late 2022, I flirted with TIPS, and the UK equivalent index-linked gilts (linkers), but it was too early. Bond yields are finally starting to fall, while inflation remains sticky. As illustrated in the chart below, the 2-year (blue), 10-year (green), and 30-year (red) bond yields in the US have been following interest rates (black) lower. The dotted black line shows where interest rates are expected to be this time next year. Just 2.9%, when the old tried and tested Taylor Rule, an old-school guide for policymakers, would suggest rates should be 6%.

US Bond Yields and Interest Rate Expectations

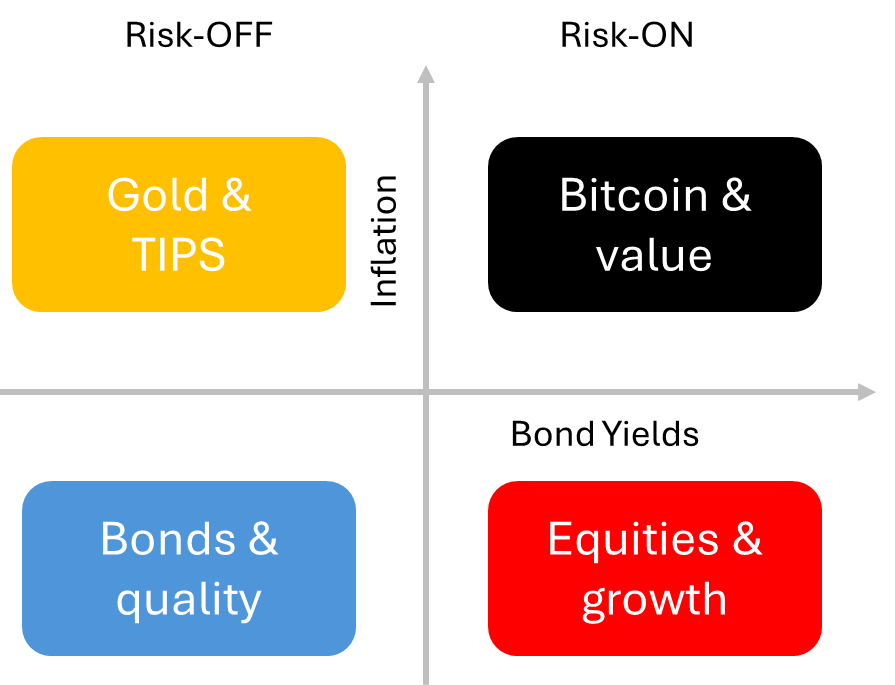

To cut interest rates while inflation is 2.9%, and therefore still above the 2% target, suggests that the US Federal Reserve is prioritising cheap borrowing over controlling inflation. Say one thing, price stability, do another, cheap money please. This means we are undergoing a regime change from high rates and low inflation to low rates and sticky inflation. ByteTree’s Money Map therefore shifts from the right to the left. The price of gold has seen this coming.

The ByteTree Money Map

But gold has done so well, and at the very least, we must assume it won’t repeat the post-2022 performance, unless the financial system gets into real trouble. We aren’t there yet, and so it's time to consider TIPS again.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd