Deep Value in Crypto

ByteFolio Issue 182;

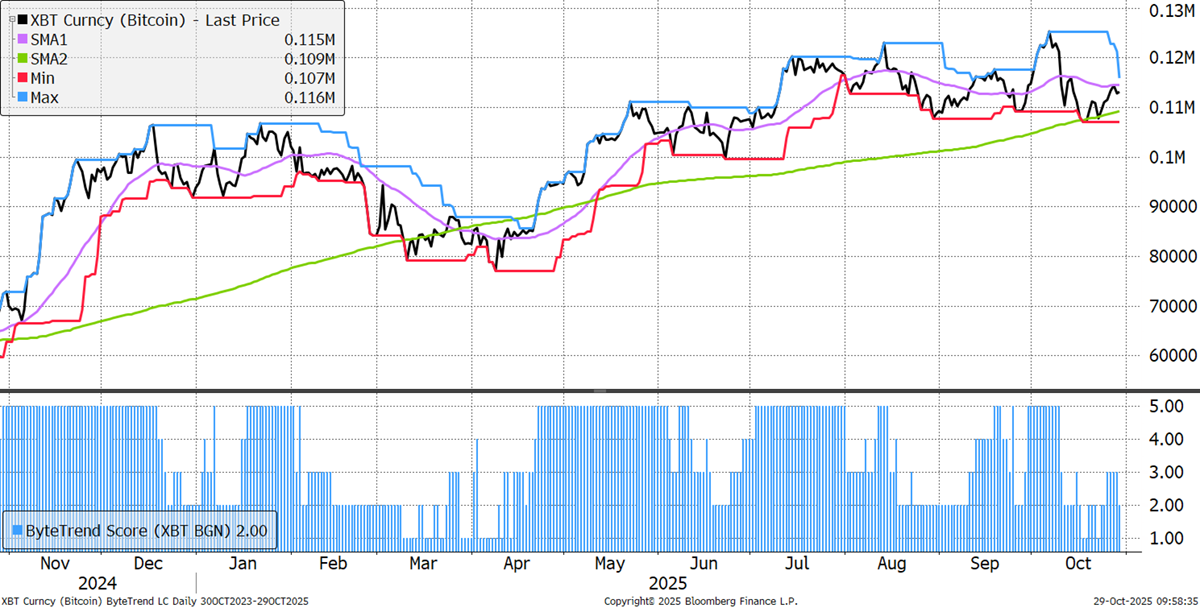

Bitcoin’s ByteTrend Score stays at 1. Do you remember the days when Bitcoin was really exciting? It’s not over yet, because the 200-day moving average is still rising, and a bull run could kick off at any time. Think on the bright side. Bitcoin’s latest retreat could have been much worse —and not only that: while gold has dipped, it has rallied. That counter-cyclicality in the liquid alternative asset, aka the debasement trade, makes it a highly relevant asset.

Bitcoin Bull Market

Many bright minds in crypto believe the four-year halving cycle is behind us, and I agree with them in principle. But if that view is wrong, the cycle's end would be upon us.

The Bitcoin Halving Cycle

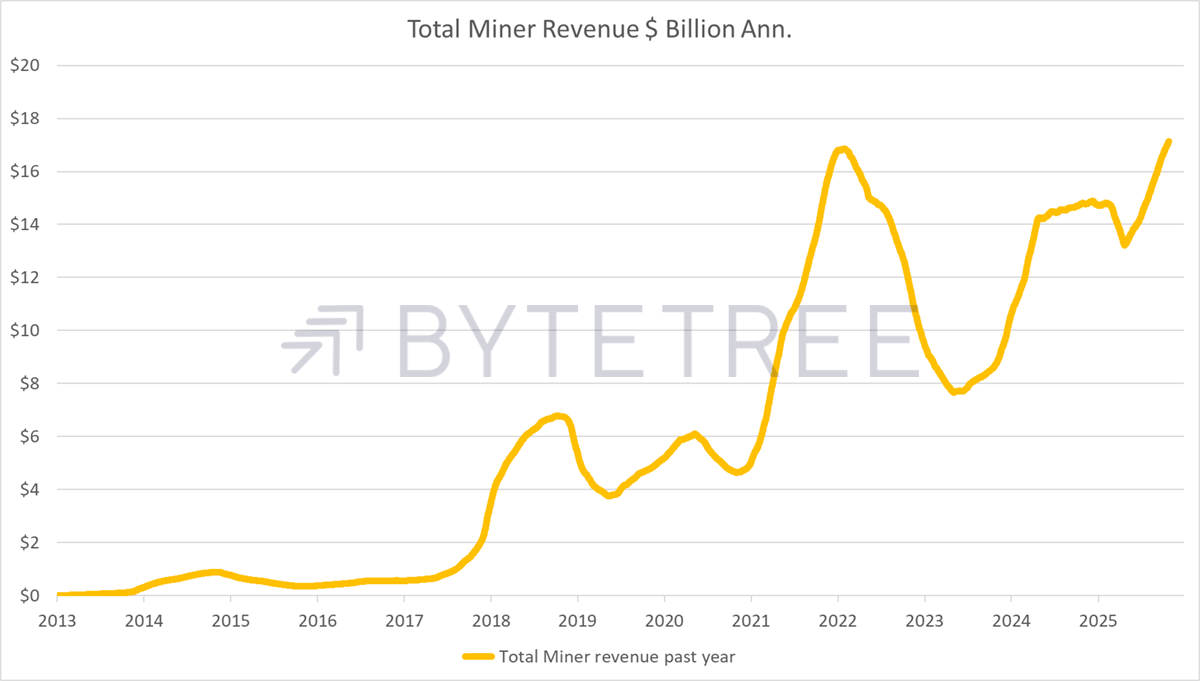

Bitcoin’s supply growth is down to 0.8% p.a., which is a low number, or a stock-to-flow ratio of 119.5. Presumably, that makes halving events less relevant than they were in the past.

Against that, Bitcoin mining is a real cost, estimated to be $17.1 billion p.a.. For a sustained bull market, inflows must exceed that. ByteTree data shows that the ETFs alone have invested $35.3 billion in Bitcoin. There are also the treasury companies, so the conclusion must be that some OGs are selling.

Total Bitcoin Miner Revenue

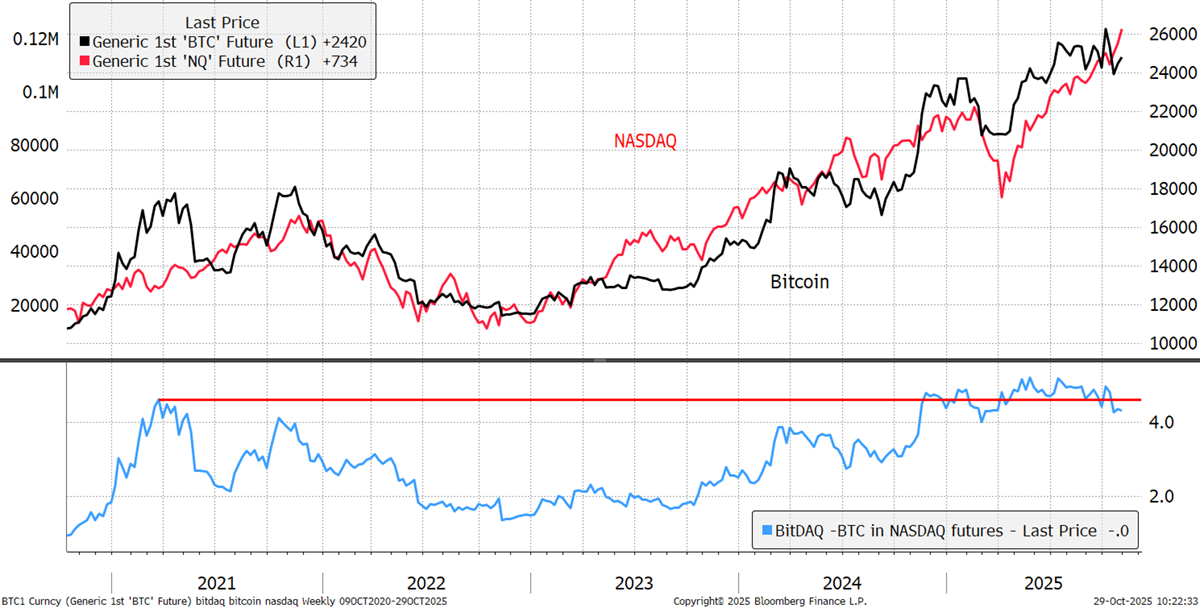

I continue to believe that the chart below is the single most important chart for Bitcoin. Technology stocks have made another new all-time high and have left Bitcoin behind. This is far from a disaster, but a material break will kill the narrative that Bitcoin is part of the tech trade. The dream is that when tech eventually blows up, Bitcoin carries on. At least, that’s my dream.

Bitcoin versus NASDAQ

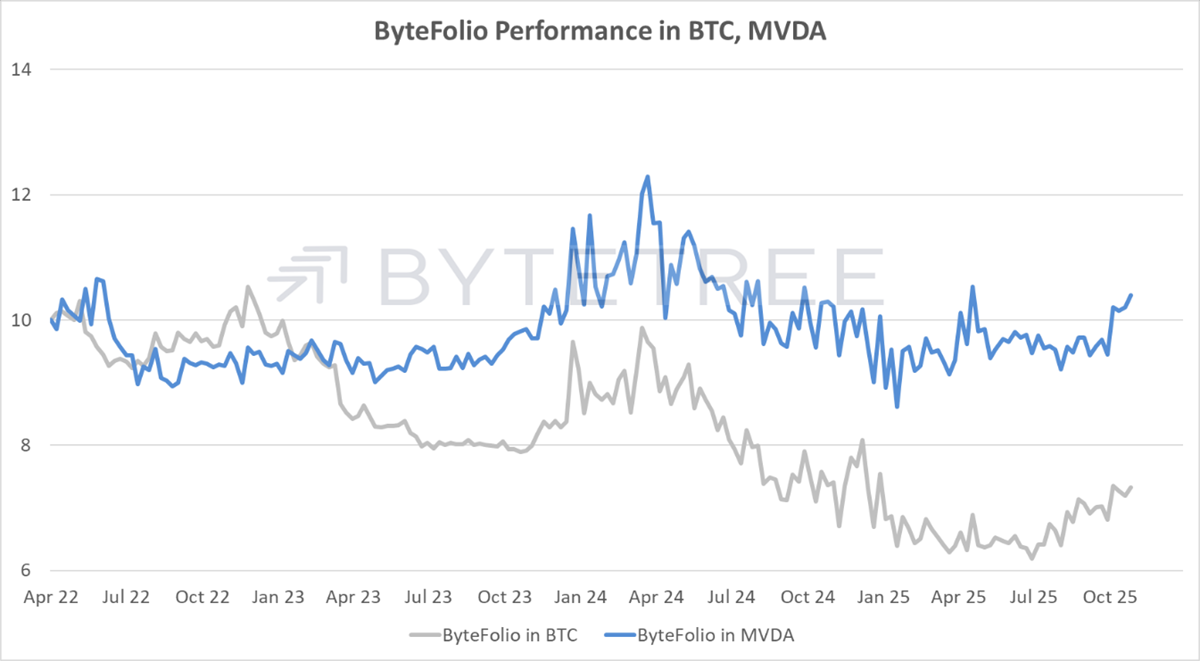

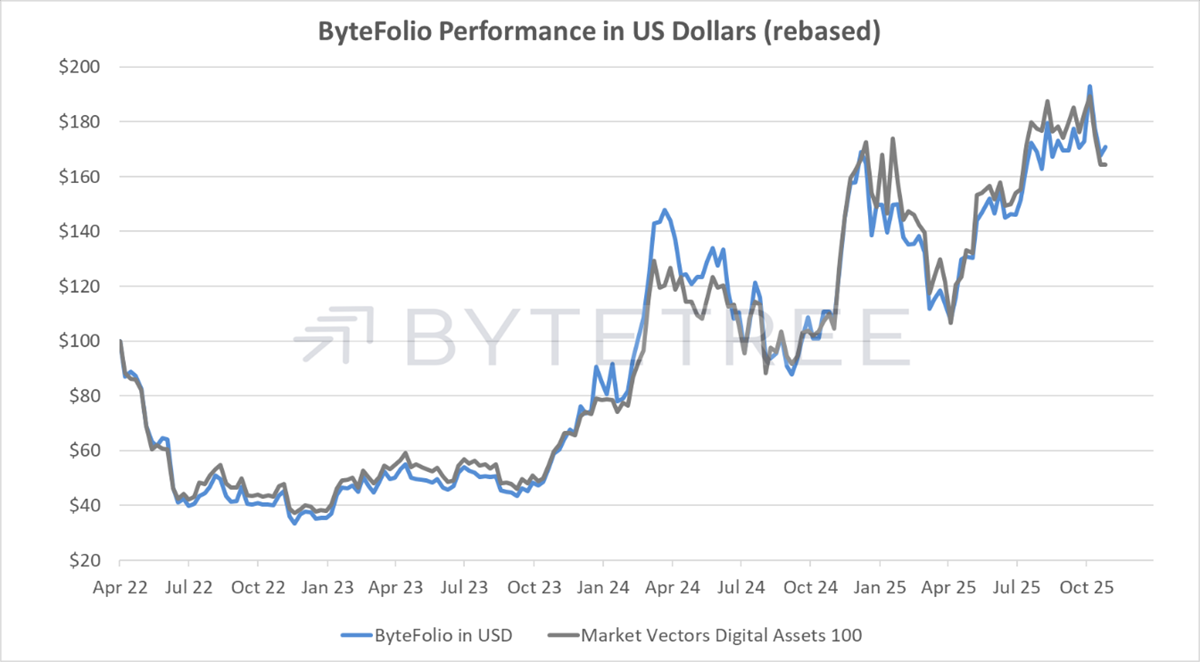

ByteFolio is doing well, and this week, Ali has a deep value idea that we will add. It’s lagged Bitcoin by 90% or more in recent years, and you won’t believe it, but it has a real-world use case.

Deep value investing comes to crypto.