Blue-Chip Bitcoin

ByteFolio Issue 178;

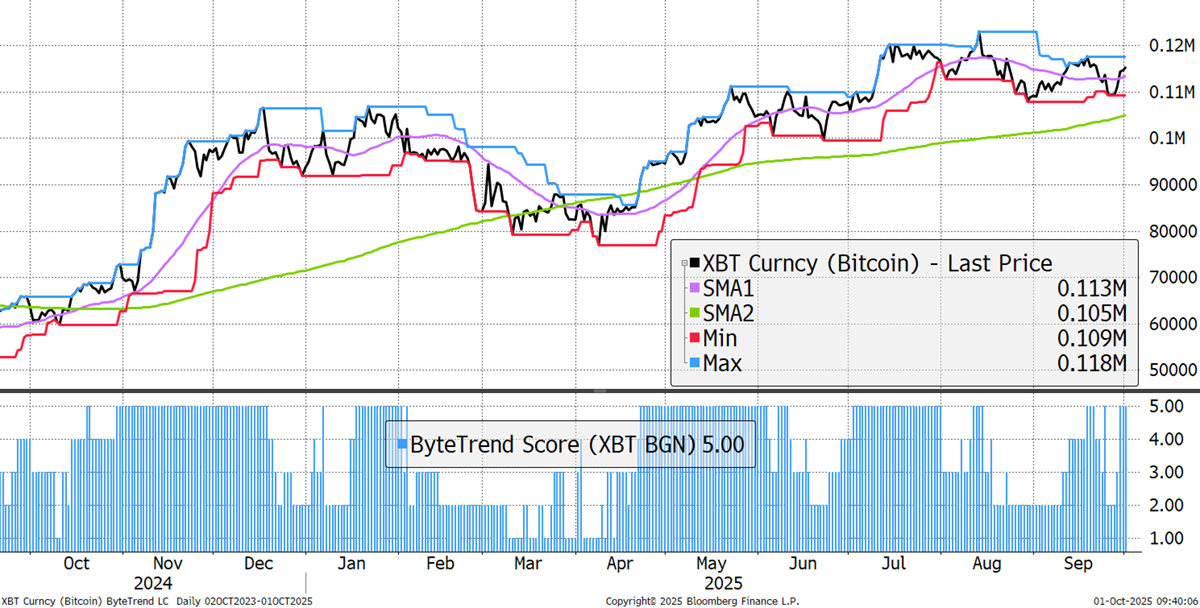

Bitcoin’s ByteTrend Score is back to a 5, but it doesn’t feel like or even look like it. But today is the first day of the long-awaited October, and it is best to give it the benefit of the doubt.

Bitcoin Bull Market

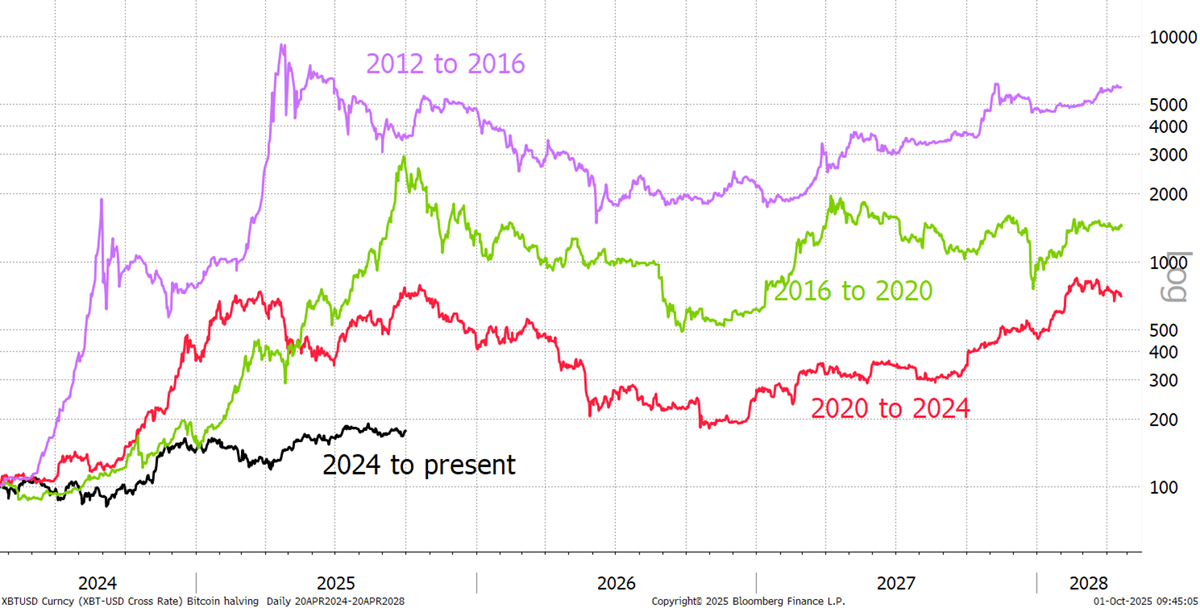

There are doublers because if Bitcoin is still subject to the four-year cycle, then the peak is around now. But even in 2021, it rallied 40% in October, which did mark the cycle top.

Bitcoin Halving Cycles

I don’t believe the cycle will be as strong as it was in the past, for the simple reason shown. Each cycle has been less painful than the previous cycle. Bitcoin has become an institutional asset, and with Bitcoin ETFs (ETNs, ETPs) set to open in London next Wednesday, 8 October, it is right to be optimistic.

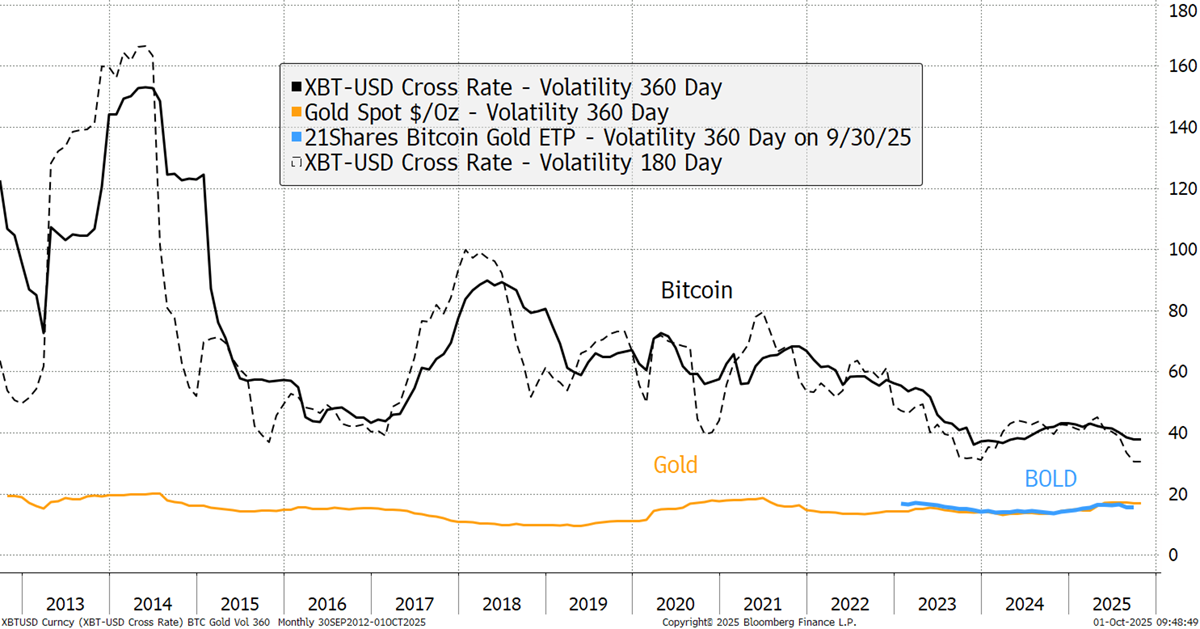

Bitcoin is a more mature beast these days, as demonstrated by its volatility, which continues to decline. The 360-day volatility measure (black solid) is now in the 30s, and the 180-day, which indicates where the 360-day is headed, just fell below 30%. Bitcoin is looking more like a blue-chip stock than a get-rich-quick scheme.

Bitcoin Volatility Is Falling

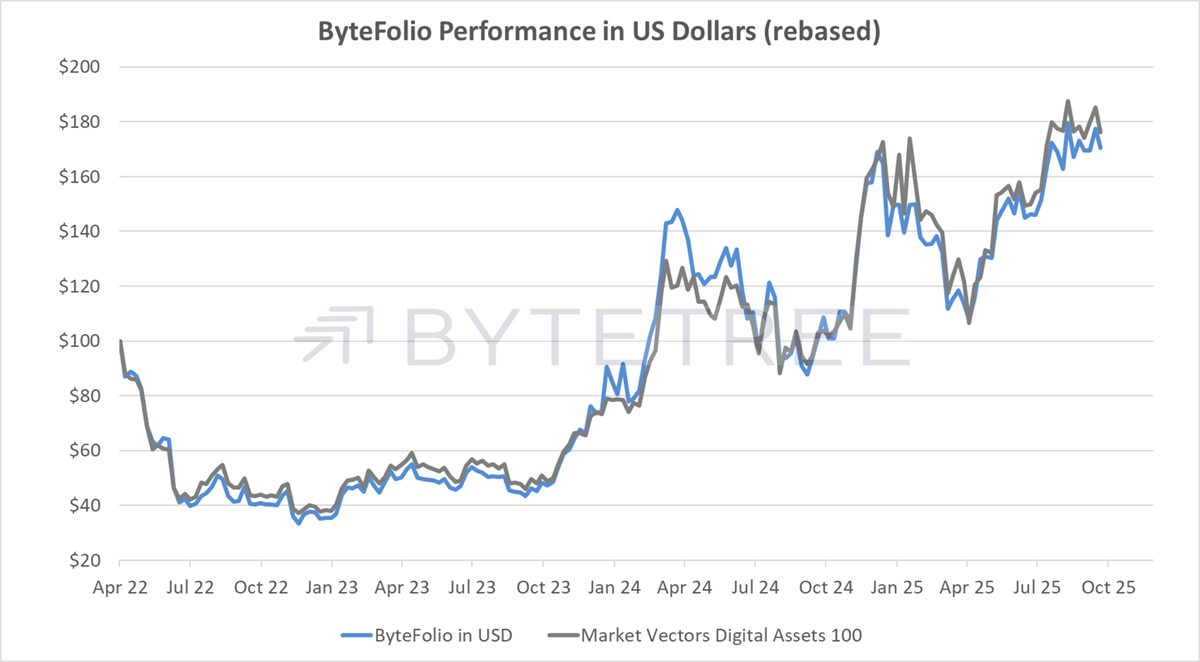

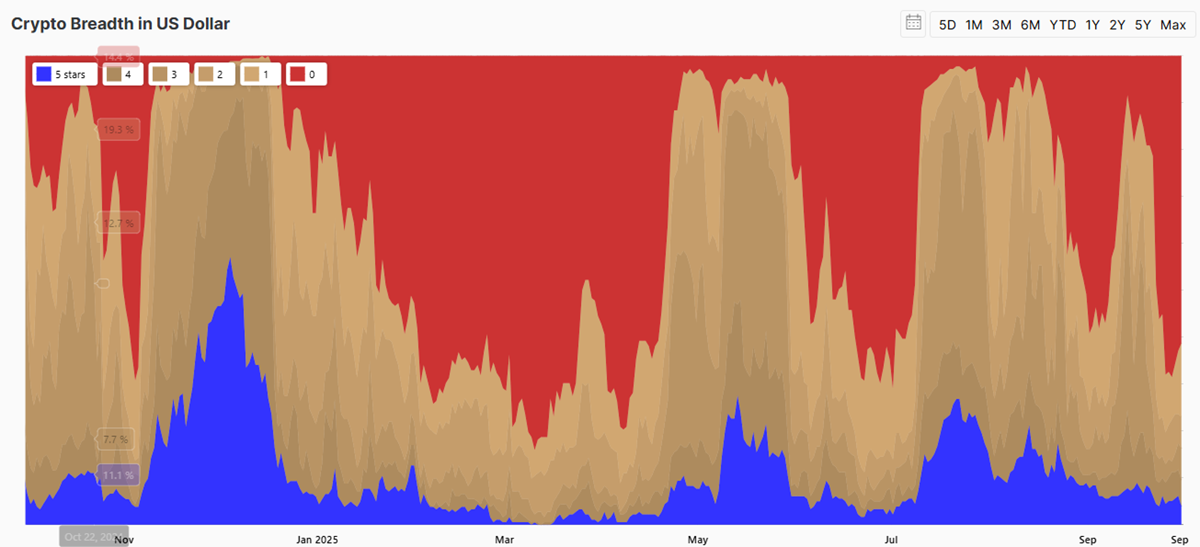

Moreover, it has detached itself from other crypto assets. Breadth in the sector has deteriorated with the onset of red skies.

Crypto Breadth in USD

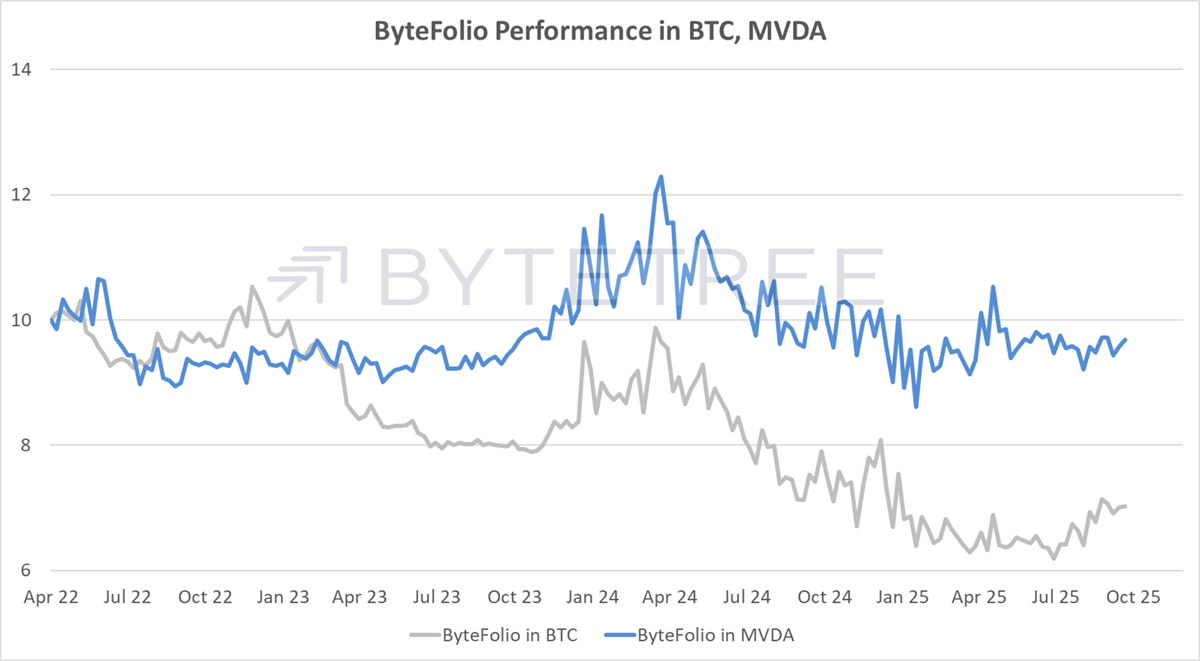

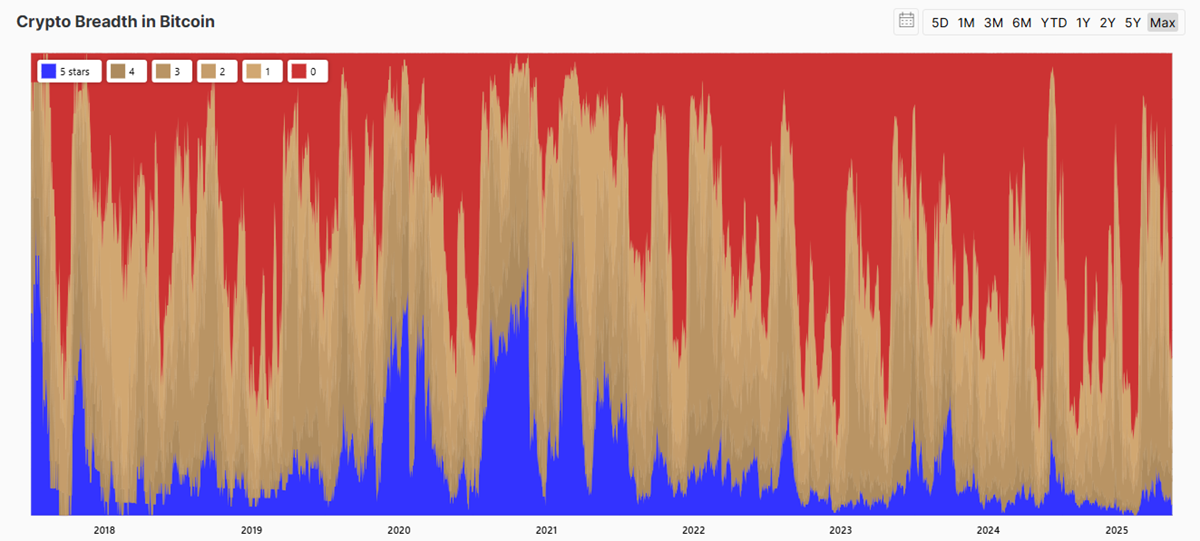

And seeing breadth in Bitcoin, the impact of altcoin rallies seems to be forever fading.

Crypto Breadth in BTC

This week, ByteFolio takes heed, with two changes to the portfolio.