What’s Gold Really Telling Us?

Credit dates back to the origins of finance. When used in the right way, it has built nations, homes, and railways, making society a better place. Used the wrong way, it has financed wars and had its hand in every financial crisis on record. Excessive leverage in the system is the most dangerous thing out there. This is well known to central banks and financial regulators, who are always trying to understand the risks derived from credit. The trouble is that the credit creators are not only much smarter but generally have lower moral standards.

In the 1980s, there was the junk bond king, Michael Milken. In the dotcom era, Arthur Andersen helped to hide debt in special purpose vehicles for Enron and WorldCom. In the credit crisis, they layered debt in the infamous credit default swaps. What these things have in common is that they live in the shadows. It didn’t work last time, but they’ll do the same thing again next time, just with different packaging. This time, it's private credit.

One of the mysteries of this equity bull market is its drivers. The consumer is weak, wages are softening, house prices have peaked, industrial demand remains slack, and global logistics have slowed. Yet the stockmarket trades at an all-time high despite lower forecasts for corporate profits. While stockmarkets over the long term are driven by profits, they can deviate over the medium term, provided there is plenty of credit in the system.

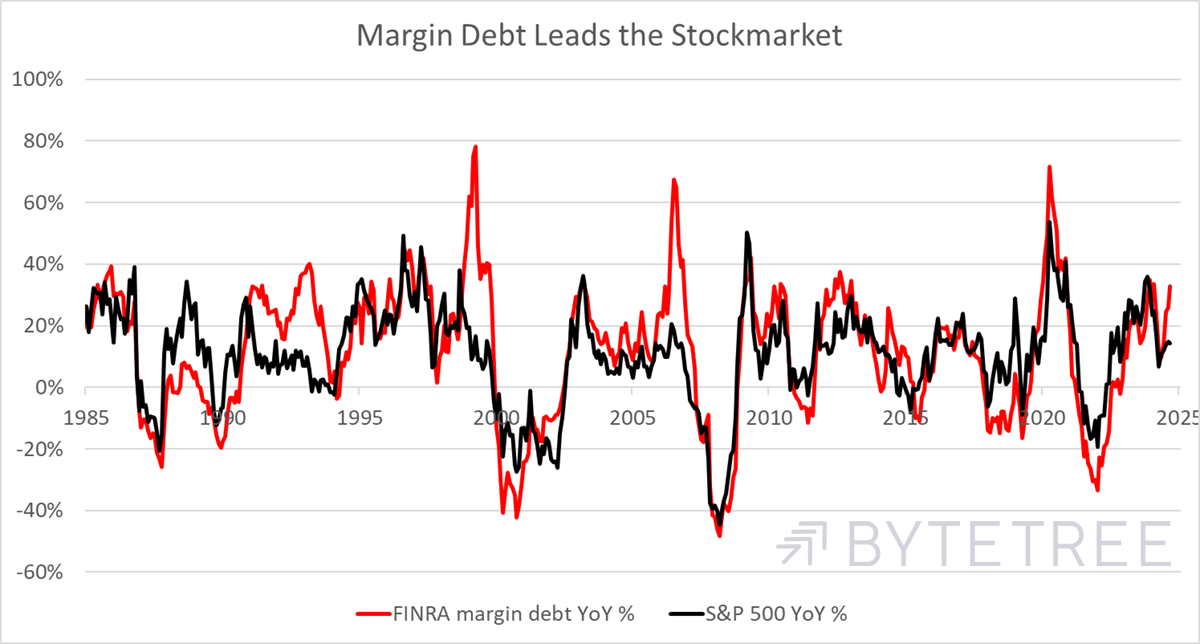

That can be demonstrated with the margin debt. That is the data recorded by the US Financial Industry Regulatory Authority (FINRA), collated from brokers to measure the amount of leverage in financial markets. This data, to the end of August, shows another surge (red) in margin debt. It means investors are highly leveraged and headed for levels last seen in 1999, 2007, and 2021. We know what happened next.

Margin Debt Leads the Stockmarket

Value investors pride themselves on being invested in the less popular stocks. When the financial system tightens, investors are margin called and have to sell. This impacts the speculative stocks much more so than the quiet stocks. Speculative stocks are more volatile, while “defensive” stocks have much lower volatility. You won’t see the stockmarket bulletin boards salivating over Unilever’s latest results; that’s left to the likes of NVIDIA. The bottom line is that when the music stops, the less racy stocks may not even notice. Hence, we have launched ByteTree Quality, as the timing feels right. Some of these stocks will end up in the Whisky Portfolio, which will also embrace other assets and sectors.

While I have spent much time discussing the issues with government debt, it seems clear that private debt is also at alarming levels. At a recent presentation by Andrew Hunt Economics, private credit, which is “invisible credit”, came up. They believe it amounts to $1 trillion or more and is not being measured by the authorities. They only act when instructed to do so – which is always after the event. This is the canary in the coal mine. Not only is this money hidden debt, but it also shows up in the national accounts as profits. At least Hunt makes this assumption, given the receipts from private equity and private credit are being recorded as income, and the balance sheet can’t be reconciled. You can’t make this up.

It was also highlighted that never before in 100 years of data have we seen such concentration in profits and CAPEX. That reiterates the point that just a few companies are bearing the fruits, while the median company has far from spectacular results.

Yet, much bigger are the government bond markets, which are struggling to cope with the deficits. They face a debt trap whereby the only short-term solution is lower yields, and therefore lower interest rates, which would make it cheaper to service historical debt. If yields stay where they are, they will soon be compounding at twice the level of GDP growth, causing outstanding debt to spiral. The problem is that this comes to a head within the next 3 to 6 months, which is no time at all. Of course, if economic growth were to pick up, that would be marvellous, but as I learned many years ago, hope is not a strategy.

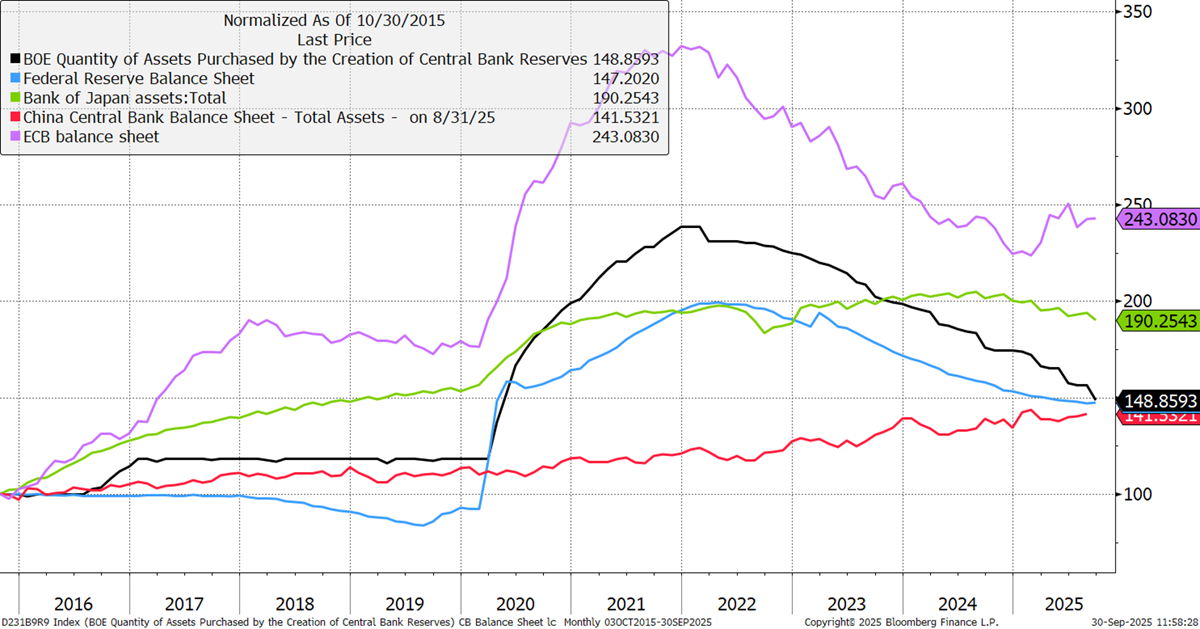

The serious consideration, coming to financial markets sooner than you think, is another round of quantitative easing. Recently, the Western central banks have been concerned about inflation, and have been shrinking government balance sheets, which have been overloaded with bonds since 2008. Yet since 2022, they have been undergoing quantitative tightening, which means they have been buying their bonds back, often at a capital loss. The Bank of England has been eager on this, shrinking the balance sheet faster than the others, while Europe and China are still expanding.

Central Bank Balance Sheets – Bond Holdings

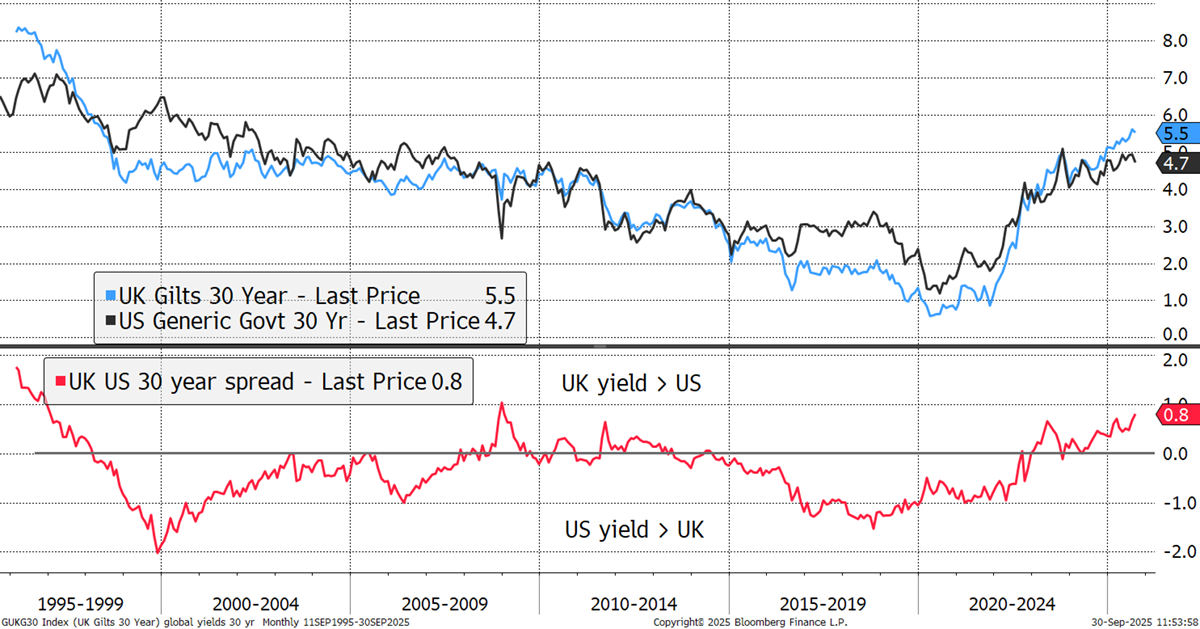

That eagerness, which in part caused Liz Truss to lose her job, has led to higher bond yields and the widest spread with the US since the credit crisis. US borrowing costs are unsustainable at current yields, which means UK borrowing costs have become punitive.

UK versus US Borrowing Costs – Long Bond Yield

Another round of QE, a round likely to persist, would keep a lid on the long bond. This combination of low interest rates, quantitative easing, and persistent high deficits will almost certainly fuel inflation. This is financial repression in action, as Russell Napier has been saying for several years. New readers can watch my discussion with him here.

I think this has been somewhat missed by the financial markets. The bond market gets it, but inflation expectations do not (see Postbox). The high-growth stocks don’t get it either because future high profits are diminished by inflation. Yet, the market has begun to reward hard assets such as gold.

When you recognise that we are living in financial repression, cash becomes less attractive. In a world where we no longer trust our governments, why would you trust their currency? In 2021/22, the financial markets looked through, believing the surge to be transitory. In part it was, but now we face phase two. The likely scenario is higher long-term expectations as inflation becomes structural, and, more to the point, essential to maintain economic order.

The alternative is financial austerity. It’s the correct solution if you want to fix the system, but that’s not what politicians want to do. Their objective is to get re-elected. I cannot imagine the UK or the US implementing a harsh austerity programme, as the Irish, Greeks, Portuguese, Danes, Swedes, Dutch, and others did.

I have no idea how some countries have managed to balls it up so badly, while others have managed to balance the books. In these cases, democracy has failed. It’s a state of shambles, but only for investors who are unprepared. If we listen to people like Andrew Hunt and Russell Napier, there will be no surprises.

I am confident that investors can get through this, but they must embrace the world in search of potential safe havens and not depend on their own country. They also need to embrace value and diversification and avoid the landmines.

ByteTree’s Global Trend Investor is key for this, as it will flag both the opportunities and threats. The portfolios are looking strong, and I see no need for any material changes because our strategic positioning this year has been on point. But things change, and my job is to embrace it.

Postbox

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd