Venture: Portfolio Update

Issue 85;

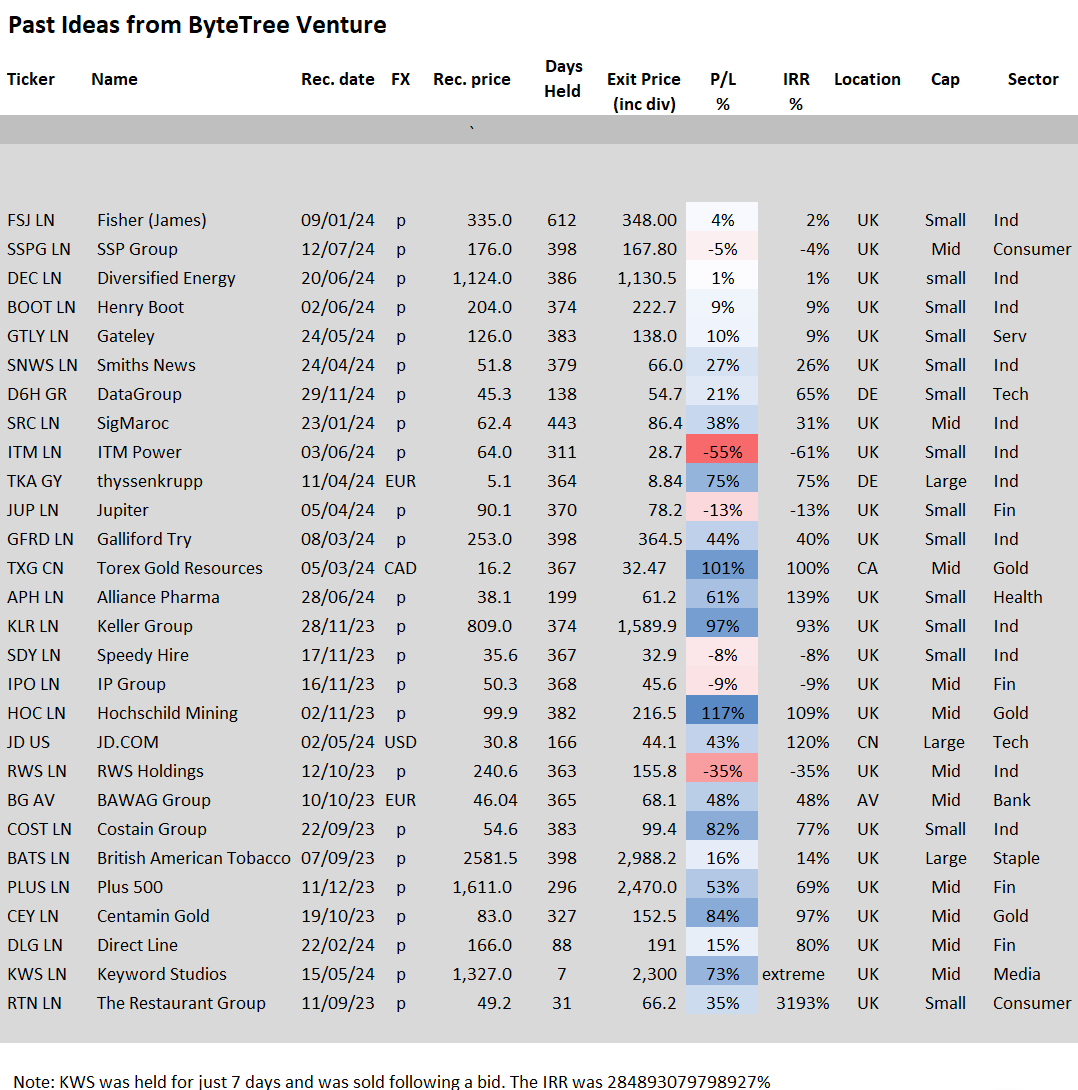

As I mentioned last month, Venture will become more global and be driven directly by the ByteTree Global Trends data set, which covers 2,500 stocks. There are two reasons for this. The first is that it presents an opportunity. ByteTree, in this case Rashpal Sohan, has built a powerful data set that enables us to stay on top of global equities and, in particular, new and emerging trends. The other reason is that the fertile lands of UK small and mid-caps aren’t what they were two years ago. We managed to capture significant gains from a deeply undervalued market at the time, but the easy pickings are behind us.

The best thing about a global opportunity is that there is always something interesting happening somewhere. Global Trends is a powerful tool in that regard because it gets us to the sweet spot each week. The data is calculated as at Friday’s close, and by Monday morning, we go through the new and emerging trends, assess them for value, and then dig in. By Monday afternoon, our aim is to publish that week’s best idea from the global universe.

There are two advantages of doing this. Firstly, by finding the best idea, we should continue to have a good hit rate, just as we have done over the past two years. Secondly, by selecting new trends each week, some will absolutely fly. Better still, these will be spaced apart, so the portfolio will continuously evolve by geography and sector. It does mean some ideas from faraway places will be harder to buy on the domestic broker platforms, but the global brokers will cover everything we select.

I feel this is a significant step up for ByteTree Venture, which deserves to be renamed to better reflect what it does. A prize for the winner.

Action

Sell James Fisher (FSJ UK).

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd