Trust the Rothschilds

Trades in Soda;

It’s interest rate week, with the US Federal Reserve showing their hand tomorrow. The Bank of England then moves on Thursday, and the Bank of Japan on Friday. The European Central Bank held firm last week. The market is looking for a 0.25% cut in the US and holds elsewhere. Investors are getting excited.

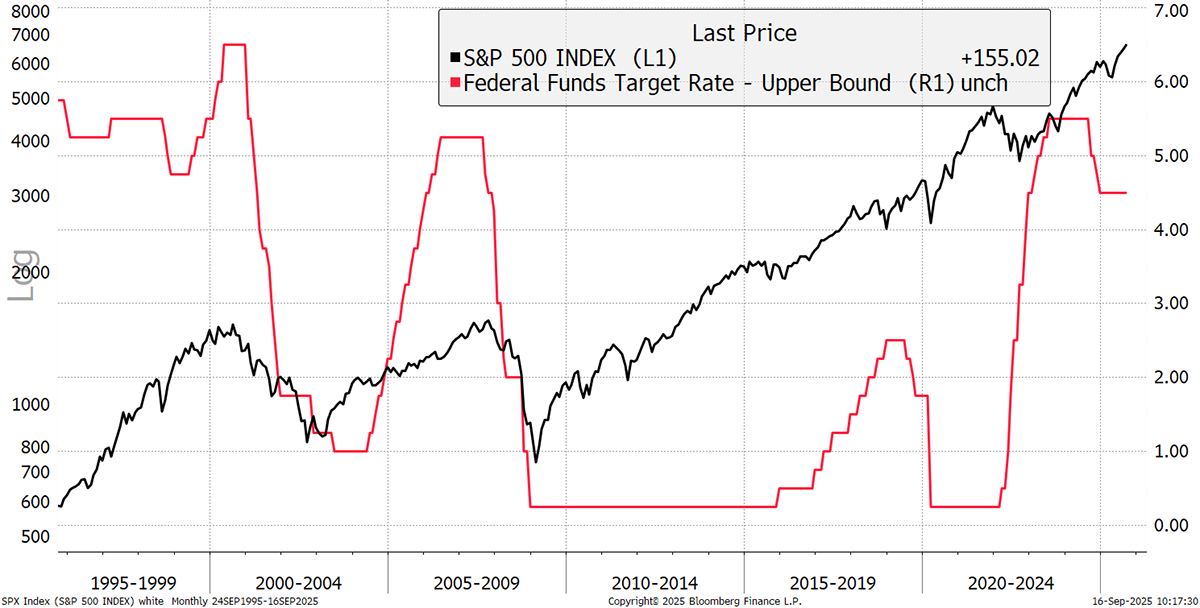

I would remind them that rate cuts aren’t always a good thing. They were positive in the late 1990s, but in 2001/2 and 2007/8 they oversaw the stockmarket collapse. We should question why interest rates are being cut. In 2001/2 and 2007/8 it was to offset recessions. In 2020, it was to offset lockdowns, which turned into a boom when the world reopened.

S&P 500 and Interest Rates

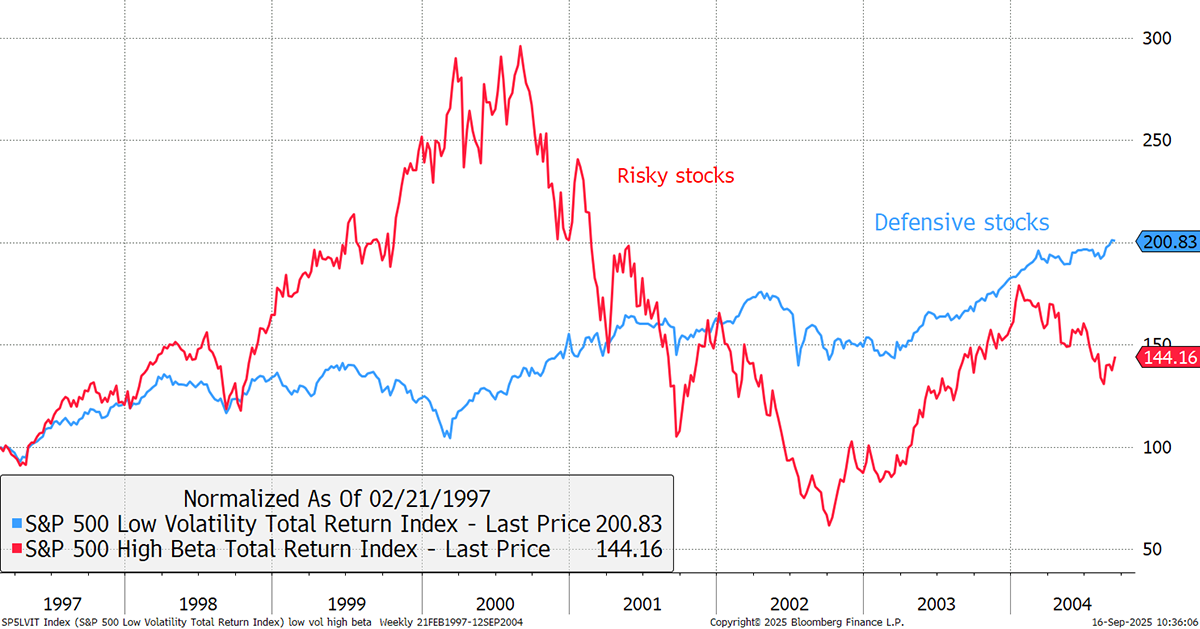

Despite signs of a weakening consumer and jobs market, this time will stand out as rates will be cut for political rather than economic reasons. US CPI is 2.9%, with a 2% target, yet rates will be cut regardless. As I said, rates were cut in the late 1990s after the Asia crisis, which led to a boom in tech. While tech boomed, the defensive stocks spluttered but then provided sanctuary in the 2000 to 2002 bear market.

Defensive versus Risky 1997 to 2004

This is a follow-on point from yesterday’s Global Trend piece, which I hope you enjoyed. I see the rotation back into defensive stocks (quality) as a likely outcome when the risky market leaders finally throw in the towel. The launch of ByteTree Quality might be a little early, but strategically, the timing feels right.

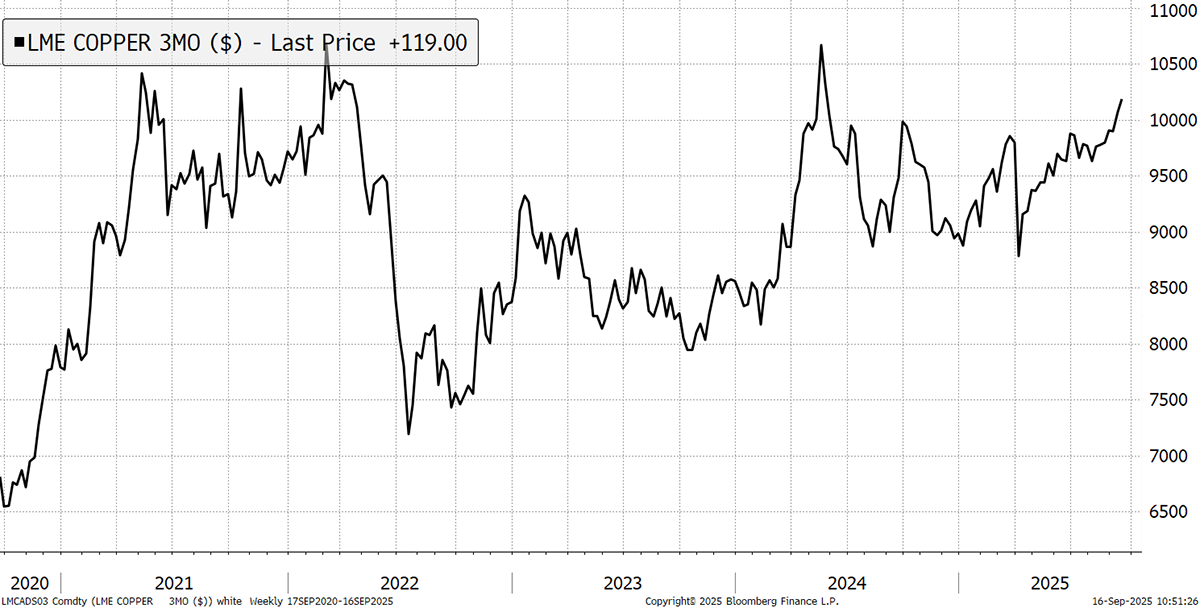

One problem that has been overlooked is that by cutting rates now and anchoring the long bond yield rather than letting it spike, the risk is inflation next year. Still, there are no signs of that happening, except (of course) for a roaring gold price. Copper is not looking too shabby weather, which is driving Glencore (GLEN).

London Metals Exchange - Copper

We shall return to this subject when the evidence starts to come through. In the meantime, I wanted to update clients on Man Group (EMG), which has lagged the Whisky Portfolio since purchase.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd