Years ago, I read about two investors – Nick Sleep, and Qais Zakaria. Together they formed the Nomad Partnership and delivered some of the highest returns on record (921% in 13 years), while keeping a very low profile.

They focused on “scale economies shared” – businesses like Amazon, Costco, and Ryanair. These companies work feverishly to achieve the lowest possible cost, leading more customers to choose them, resulting in growth. The higher sales this generates can be invested to lower costs even further, attracting even more new customers and creating a virtuous cycle, or “flywheel”. This was when the penny dropped for me on the benefits of investing in powerful business models, and brilliant managers.

Quality Investing

In the ByteTree framing of investing, we say that you should buy good companies when they’re cheap and going up. That covers three factors: quality, value, and momentum. Different people weight them differently according to personal preference. Quality investors emphasise the former, believing that buying the very best companies is enough, and that if done well enough for long enough, valuation and momentum will matter very little, if at all.

“When we think about companies, the over-riding analytical consideration is the quality of the business and quality of management’s capital allocation decisions. The longer investors own shares the more their outcome is linked to these two metrics.” – Nick Sleep, Nomad Partnership.

Warren Buffett began as a value investor (focused on price above all), but Charlie Munger slowly converted him into the world’s greatest quality investor. He said,

“All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies”

Quality investing is about finding companies with sustainable profitable growth: durable competitive advantages that allow them to grow and compound over decades, turning revenues into profits at a good rate all the time.

Quality investors think in years and decades, rather than months and weeks, and focus on the sources of competitive power – things like brand, networks, relationships, cornered resources, counter-positioning, scale, or customer stickiness.

Many people see investing as a treasure hunt, seeking hidden gems. But quality investing is an exercise in treasure appreciation. Everyone knows that they're good, but it’s recognising how good, and for how long, that counts. Not only are they the best businesses today, but they also have characteristics that will help them stay that way for much longer than most people expect, compounding so much in the meantime that their slight premium to the broader market today becomes irrelevant.

There are some obvious examples – Unilever, Coca Cola, Hermes, Amazon, Costco, Microsoft. Brilliant businesses with dominant market positions, long-term vision, incredible execution and customer loyalty. The tricky part is – most people have already noticed what brilliant businesses they are, and they are widely owned already, i.e. rarely cheap.

Faced with this dilemma, quality investors face a choice. Go all in on quality, ignoring valuation, and holding through thick and thin. Or, incorporate a degree of discipline on value and momentum. In our view, there is too much of the former, as extreme valuations are rationalised, while a blind eye is turned to the price paid. At ByteTree, we are opting for the latter.

ByteTree Quality

ByteTree Quality is a new research service from Charlie and I.

It has a clear goal: to help you compound your wealth, over the long term.

It aims to do this using Charlie’s expert portfolio management and my enthusiasm for studying powerful business models with strong competitive advantages.

In the coming months, we will build a portfolio of 20-25 wonderful businesses, one recommendation at a time. We will remain disciplined on valuation and incorporate momentum into the investment process.

We started by building a universe of around 300 companies. We used screens to identify companies with quality characteristics. We also borrowed from the portfolios of the major quality investor’s funds – Berkshire Hathaway, Lindsell Train, FundSmith, GMO, Morgan Stanley Global Brands.

Within this universe, we are looking for companies that offer good value, while continuing to perform well. These opportunities may come from an overreaction to past overvaluation, or because market sentiment has turned sour. Or perhaps a problem of the kind that makes headlines today, but matters little to the company’s outlook ten years down the line. By being disciplined and patient, we hope to take advantage of those rare and often brief opportunities to buy long-term compounders at attractive prices.

In building the portfolio, we will diversify by product, sector, and geography. Quality companies are concentrated in a few sectors, which notably exclude energy, materials, real estate, and banks. While there are exceptions which we are open to, sticking to the sectors which have historically produced a greater number of high-quality businesses with great returns puts the odds in our favour.

The main reason for the sector tilt is that quality businesses are usually driven by human ingenuity, which places the key drivers of a company's growth and profitability within their control. The housing market, commodities, and banks are all driven most powerfully by things which are out of their control – oil and commodity prices, interest rates, and inflation.

Is Quality for Me?

Investing is a personal thing. There are many ways to invest well: there have been successful figures in value, growth, momentum, quality, private equity, venture capital, you name it. The point is to find the aspects which suit you.

Some people are very patient, trusting, care about having the best, and are well suited to quality investing. Others are always excited by the new trend, fashion, or technology and want to look for the next big thing – growth investors. The bargain hunters among us might prefer to look for deep value opportunities, while many people are happy to follow the crowd and go with the index funds.

They are all completely reasonable. It would be a bad idea for someone who is patient and long-term to follow a growth investing or venture capital strategy. Investing requires conviction, and the ability to stick with your strategy when things aren’t going your way. As Morgan Housel says, the best investing strategy is not the one which mathematically optimises returns over a given period, it’s the one you’ll stick with through thick and thin.

Quality investing lends itself to this, being a long-term approach in nature. The companies promise steady growth over decades, rather than extreme growth in the coming quarters, and this is achieved by various means. Quality is not easy to define, and comes in many forms.

It might be culture, like at Hermès, where a relentless focus on unbelievable quality of product, consistency, and reliability are ingrained into the culture, traits which have slowly built them into the world’s most formidable brand. Or perhaps, like Costco, they work harder on efficiency to gain a cost advantage and then recycle the savings into the business to improve its efficiency even further, making it ever more attractive to customers. Maybe they have control of unique resources or brands, or are so innovative that they are always stretching ahead of the competition.

In all cases, the secret ingredient is time, which leads to the compounding of value.

As an analyst, my job is to have a deep understanding of each company’s business model and competitive advantage, its management team, and identify which trends might carry it onwards in the next decade or two. Quality investing is about studying the best companies in the world, in great depth, to assess the likelihood of continued competitive superiority.

How does it work?

ByteTree Quality will write to you at least twice per month. This will typically take the form of one new recommendation, plus a more general piece on quality investing, portfolio updates on current positions, or financial market conditions.

As with The Multi Asset Investor, there will be a model portfolio where our recommendations are recorded and tracked. This helps our clients to see the portfolio, with the stock weights, and for us to measure investment performance over time. Every decision is fully transparent and accountable.

In the coming months, we will build our portfolio of recommendations from scratch. This means potentially two or three recommendations each month in the early days, depending on market conditions, reaching a steadier pace in 2026 and beyond.

Why Should I Subscribe?

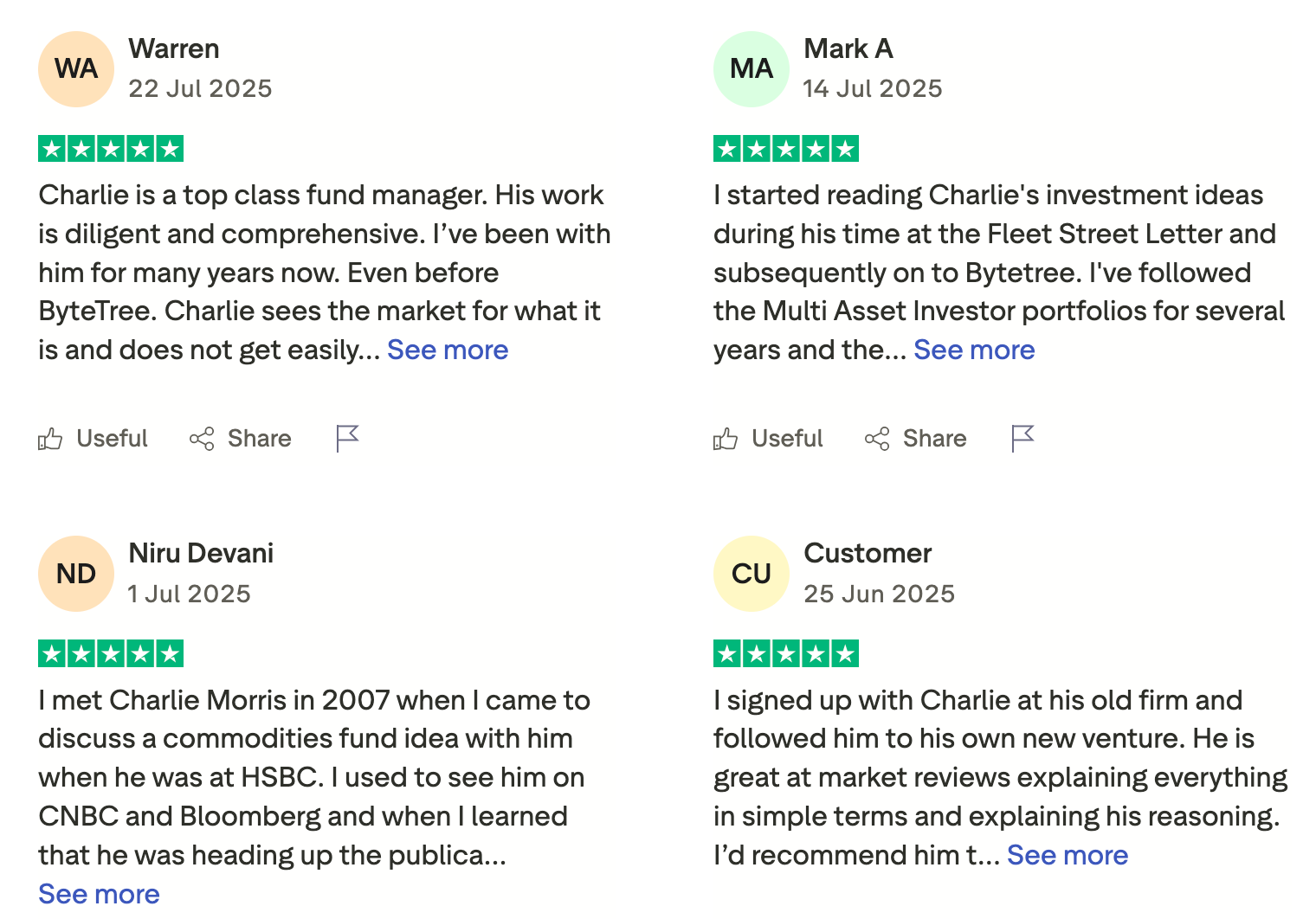

At ByteTree, we believe in offering excellent investment research services at reasonable prices. This is exactly what we hope to deliver with ByteTree Quality. Our track record and Trustpilot reviews reflect that.

After much discussion, we have decided that ByteTree Quality will be available to you for what we hope is an attractive price: £19/month.

Given the comprehensive, in-depth nature of the recommendations, the added layer of portfolio management, and the fact that quality has traditionally been the best way to invest, we think this represents exceptional value.

On top of every single note and recommendation we publish, the portfolio, and all updates on it, backed by extensive research and experience, you will get access to an array of in-depth reports on quality investing, from book reviews to breakdowns of key quality investing metrics. Plus, you will be able to email us and have your questions answered.

It’s a complete package, for a modest fee, and you can cancel anytime.

Tomorrow, we will release our first subscriber-only recommendation. It's one of the strongest brand portfolios in the world, and due to an array of short-term and external factors has fallen to valuation levels not seen in a decade or more.

To get full access to the recommendation as it's released, today is the day to act.

If you think you could benefit from identifying and understanding the best companies in the world, and investing in the most attractively valued ones...

Then join us today.

Become a ByteTree Quality client

Please note: if you are an existing client of The Multi Asset Investor, the “TMAI + Quality” bundle is now available on our site. By switching to this, you can add ByteTree Quality for just £10 extra (£49/month in total).

ByteTree Quality will be included for current ByteTree PRO clients. If that’s you, there is nothing to click, add, or change, it will simply be included in your subscription going forwards.

Yours Sincerely,

Kit Winder, CFA

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd