Spirits On Sale

In recent years, many quality stocks have come under pressure, and we believe these resilient companies are now being offered to investors at attractive prices.

Investment Case In Brief

“With over 200 brands and sales in nearly 180 countries, our portfolio has remarkable breadth and depth. From centuries-old names to the latest innovations, we're committed to building and sustaining exceptional brands.”

Drinking sprits has been a part of human history since our earliest days, and Diageo is the world’s premier spirits company. It has a broad portfolio of the best and most historic brands, a presence in all major markets, long-term partnerships with distributors and drinking venues, and after a few difficult years, is once again attractively valued.

Diageo’s key spirit brands include Johnnie Walker, Tanqueray, Baileys, Smirnoff, Captain Morgan, Crown Royal, and recent tequila addition, Don Julio. It is also the owner of the centuries-old and increasingly popular Irish beer, Guinness. Diageo was formally brought together in 1997, but many of its brands go back hundreds of years.

Competitive Advantage

Diageo’s success rests on a virtuous cycle. Firstly, high spending on brand investment (marketing), and secondly, innovation, to ensure great products. Investment in the product and the brand turn into higher volumes and premium pricing. This generates high cash flows, which can then be ploughed back into further marketing and innovation. By committing to quality products, extensive marketing, and high reinvestment rates, Diageo has built a flywheel that is hard to stop and hard to catch.

The secret ingredient is time – it takes years, decades, and sometimes centuries to build up the brand reputation that many of its spirits have got. A new competitor starting today would have to spend huge sums, and wait for decades, with no certainty of ever succeeding in taking share from Diageo’s well-loved labels.

Diageo’s success in recent decades has rested on people drinking better, even though they are drinking less. Its core strategy is premiumisation – encouraging consumers to spend a little more to get something a little better. However, two main threats have emerged in recent years.

Firstly, GLP-1s, weight loss drugs from Novo Nordisk and Eli Lilly which reduce people’s appetite and therefore weight. Some, including Terry Smith, see this reducing demand for alcoholic beverages at a faster rate. Secondly, young people drink less. However, they make up only a very small segment of current industry sales, and as cost-of-living pressures have eased, so has this trend. Together with GLP-1s, this has raised two warning signs that the eternal spring of growing.

As a result, the share price has sold off dramatically. Its Price/Sales ratio (PSR) has fallen from 8x to 3x. This is a low price for a great business.

Diageo Market Cap and Sales

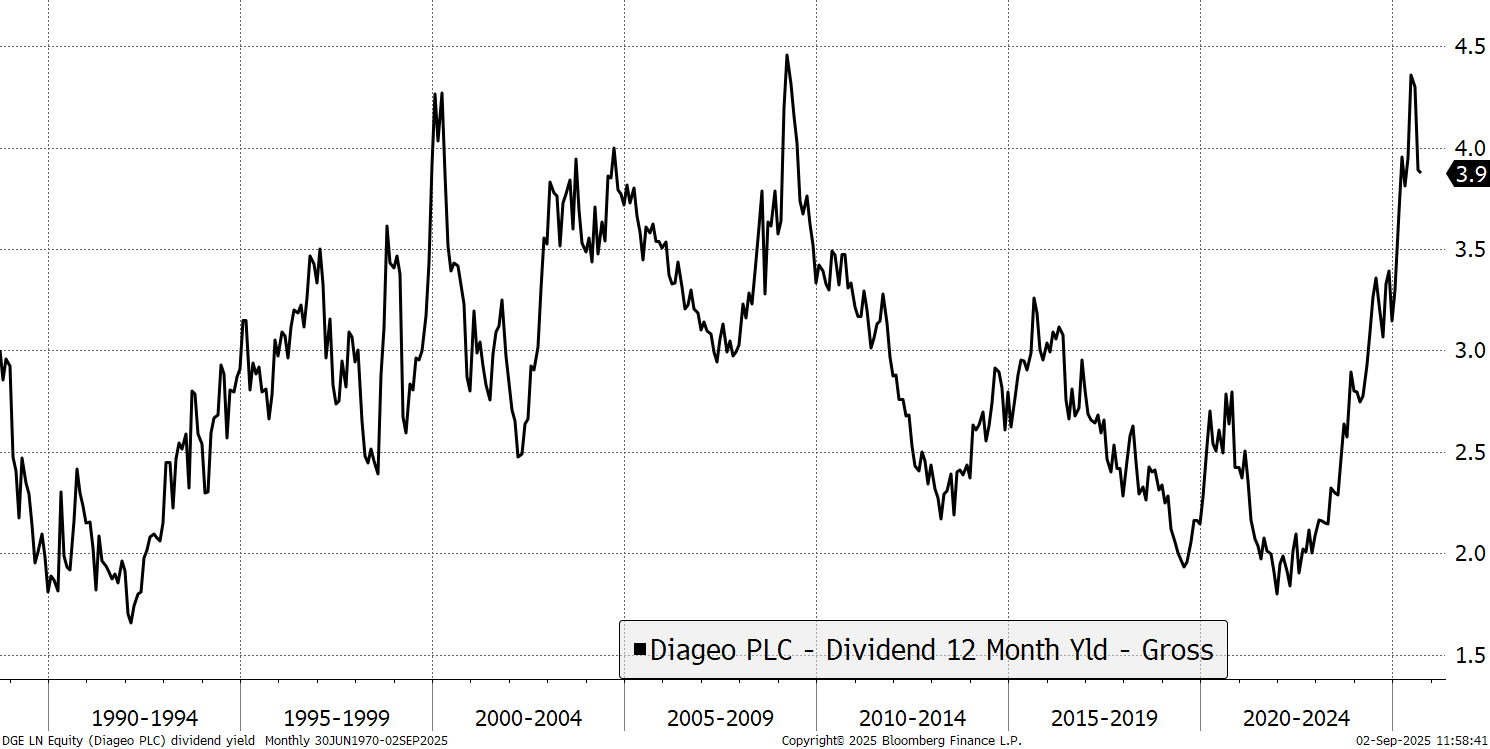

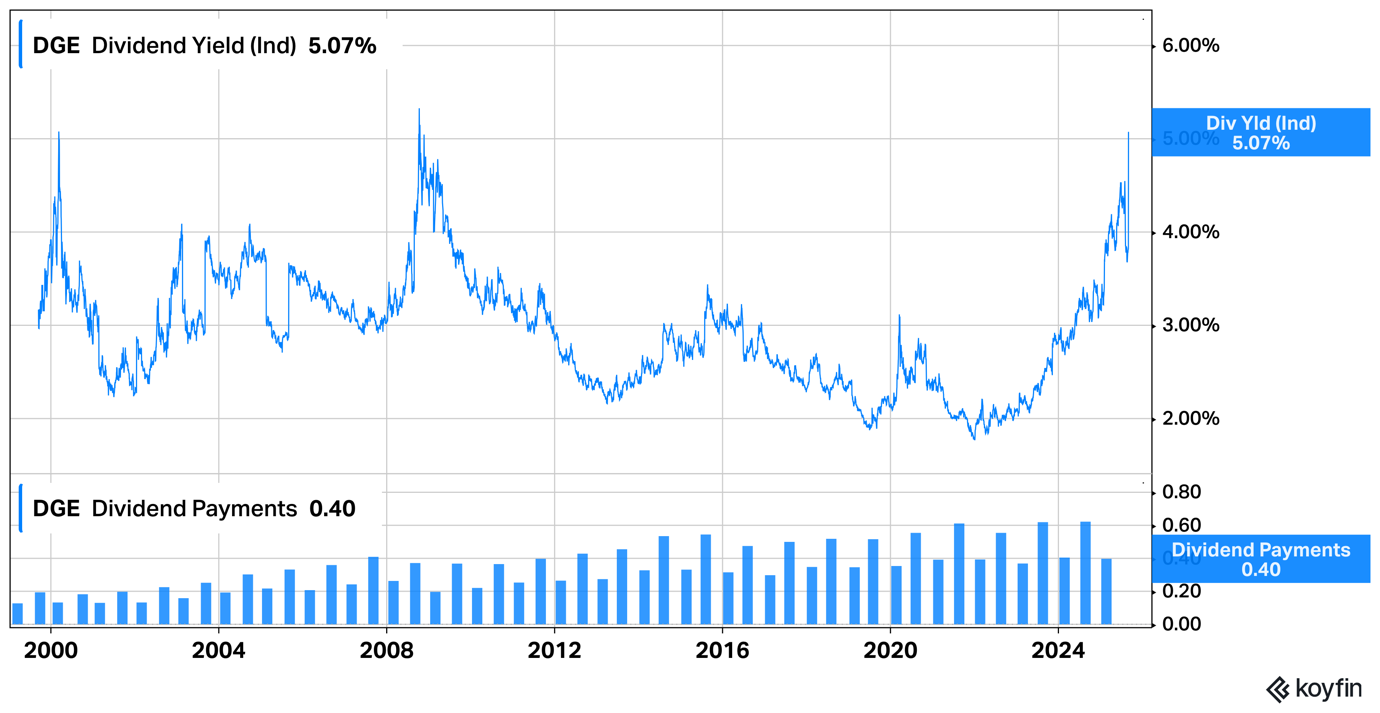

Given that alcohol consumption has been a part of human nature for millennia, and Diageo’s brands been meeting that desire superbly for centuries, the recent developments are not a cause for concern. At the very least, they are widely studied and have driven the valuation to levels where we feel adequately compensated for the risk. More to the point, there was a booze bubble during the pandemic, and many of us seem to have sobered up since. Diageo’s dividend yield has reached levels associated with historical highs.

Diageo Dividend Yield

It also stacks up well in terms of cashflow, and the company has been investing heavily for the future. Recently, the CEO was replaced, and the market took it well. The 24 analysts that cover Diageo, have 15 buys, 8 holds, and 3 sells. The buyers are increasing, and the sellers retracting.

Diageo Analysts’ Forecast

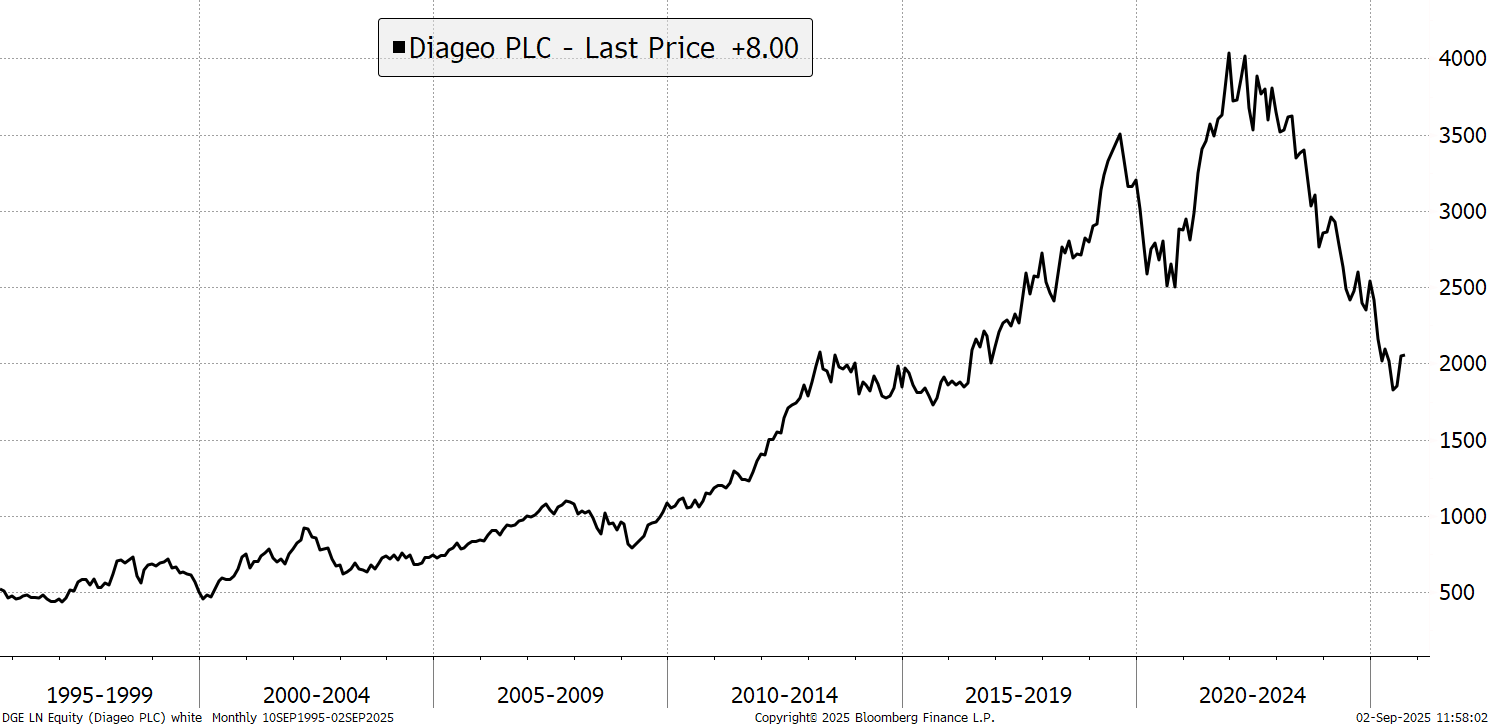

The share price has collapsed from the high in 2021 but is back to 2014 levels. It is a stronger company since then, heavily oversold, and weI believe this is an attractive entry point.

DGE Share Price

Investment Case In Full

In 1759, as the Seven Years’ War raged on in Europe, a man named Arthur entered a lease on a brewery at St. James Gate, Dublin. Paying £45 per year, he began by brewing ale before working on a new type of English beer called porter. It became so successful that he gave up on ale, andale and focused on what we now know as Guinness – Arthur’s surname. 266 years later, Guinness can claim a long history, but the beauty of the brand is that the lease he signed on the factory still has 8,734 years left on it. And it has plenty of room to grow: only 12,000 venues stock Guinness in Europe, which accounts for just over 5% of the market. The past gives it power, but the story is far from over.

Diageo was formally brought together in 1997 by the merger of Guinness and Grand Metropolitan, when it had other interests such as food, wine, and casinos. It has since focused its portfolio of brands, buying other spirit labels and selling unrelated ones. Like Guinness, many of its brands go back hundreds of years.

- 1627 - The first record of the Haig family — the oldest family of Scotch whisky distillers.

- 1759 - Arthur Guinness signs the lease in Dublin, and starts to brew ale.

- 1820 - John Walker opens a grocery business in Kilmarnock, Scotland, and starts blending whiskies.

- 1830 - Charles Tanqueray opens for business in Bloomsbury, London.

- 1864 - Pyotr Smirnoff begins making vodka using a revolutionary charcoal filtering process.

The Lindy Effect is a theory that says: the longer something has survived, the longer it is likely to survive. Guinness began in the 1750s, meaning that all crises under the sun have threatened it – wars, plagues, pandemic, economic crises, social changes, consumer changes – everything. If a company has survived all that, it’s probably very resilient. Quality is all about resilience. The longer a company can earn great returns for, the better. Diageo’s strength is that it has brought together, like streams to form a river, a huge portfolio of brands which span different sprits, and beer and non-alcoholic beverages too, in different countries. Guinness alone is resilient, but next to all its other brands, even more so.

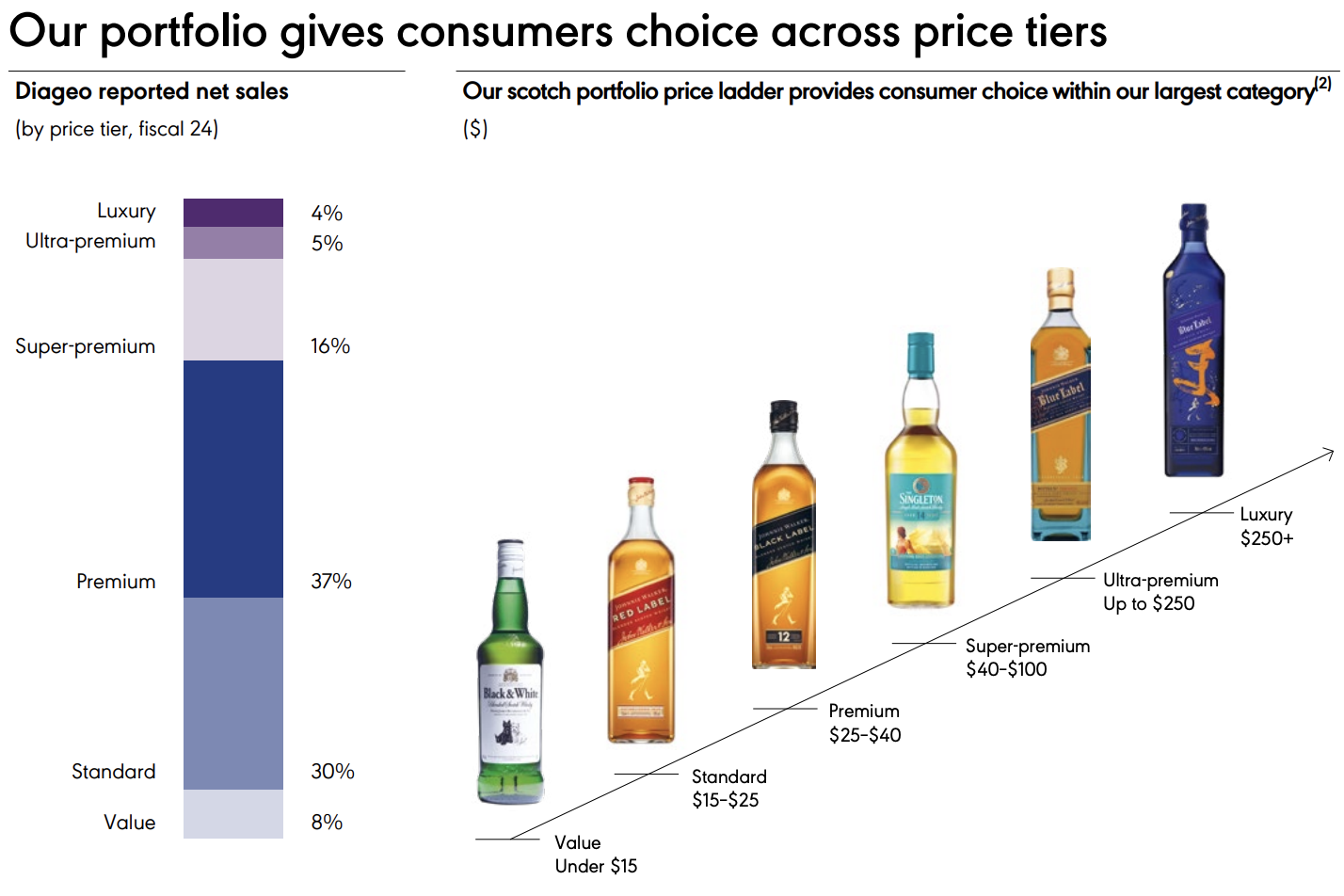

Diageo skews premium with its spirits, but retains exposure along the price curve. It continues to innovate, and current priorities are focused on non-alcoholic alternatives as drinking trends shift.

Geographically, it’s well diversified:

In terms of product, it’s very focused on spirits, but Guinness gives it a decent beer allocation too:

And by value, they skew towards premium and “above-premium”, but retain a broad coverage (and the picture changes by region):

It operates 130+ manufacturing sites globally, including distilleries and breweries. It runs them itself to ensure quality control and brand consistency. It sells into 180+ countries, with some tailored strategies for key markets, e.g. local breweries for Guinness in Africa. Positive relationships with partners are key for long-term security of supply. To reach consumers, it has a multi-channel network of wholesalers, retailers, e-commerce platforms, and direct-to-consumer sales. It does its bit on climate and drink awareness too, but that has faded as an investor priority for now.

Inventory is a key factor, as many of their spirits benefit from a long ageing process. Diageo’s “total maturing inventories” increased more than 42% between 2020-2024, resulting in $7.8 billion of total aged inventory. This leaves a lot of company capital tied up in barrels of whisky and the like, but it’s a valuable asset. Many products risk becoming obsolete the longer they sit in inventory – for Diageo’s brown spirits it’s the opposite: aging increases the value. What this means is that an upstart competitor would take ten years before they could compete in the 10-year aged whisky category, and they wouldn’t know until then whether they’d even produced a good product.

It sources ingredients, develops products and then makes them, before marketing, transporting and selling them itself, alongside retail and wholesale partners. That means it is highly vertically integrated. It even owns and operates some farms itself too, e.g. agave farms for Tequila which take a long time to mature (another barrier to entry for competitors). This extremity of vertical integration is a classic hallmark of quality companies, which want to maximise control over the quality, consistency and branding of their products. They also want to capture as much of the value as possible, but vertical integration takes time, money, and the ability to expand outside of core competencies.

Time is such a key factor in all this – brand power, diversification, inventory, integration. A historic, global, multi-brand, highly integrated business cannot be quickly, easily, or cheaply replicated. Rome was not built in a day.

The final piece of the resilience puzzle is that alcohol has been consumed by humans for up to 8000 years. Great leaders were buried with it, reflecting its significance. Wine in Greece and Rome, sake in Japan, beer in England, whisky in Scotland, Tequila in Mexico, vodka in Russia, rum in the Caribbean, brandy in France, grappa in Italy… Wherever humans have found themselves, they’ve found a drink and we fully expect that to continue in the future.

In more recent times, Diageo was seen as a lockdown beneficiary during the pandemic. Fewer things to spend money on meant more flowing to things you could – like alcohol, leading to higher volumes and an acceleration of something called “premiumisation” – a favoured word by alcohol executives at the time. If you’re stuck at home with extra cash floating around, might as well brighten your day with the good stuff.

At a capital markets day in 2021, Diageo set a target of consistent 5-7% growth in sales forever. This, it turned out, was a rash target, and it was missed. In fact, total sales fell in 2024, and the target became a weight around their neck. They recently gave up on it, which was no more than a recognition of reality. Beyond the reality of a sales slowdown, there are two main concerns around the stock Firstly, GLP-1s (weight loss drugs) reducing consumption, and secondly, young people drinking less.

The other things people spent money on in 2021 were stocks. Quality stocks like Diageo enjoyed a golden moment, and many stocks were bid up to record valuations. The short-term boost from the lockdowns was seen as a permanent shift, but it was not. Consumer demand struggled in the face of higher prices, investor enthusiasm faded, and the shares have fallen by around 45% since January, 2022. The CEO of just two years has been replaced, and there is talk of fresh beginnings.

And so, we arrive at today: a brilliant and resilient company, tapping into a huge global market, with a huge portfolio of high-end, historic brands, that got caught up in the post-lockdown bull market for spirits and stocks, but has now fallen on hard times.

DGE Price/Sales Ratio

Diageo Today: 2024 Results

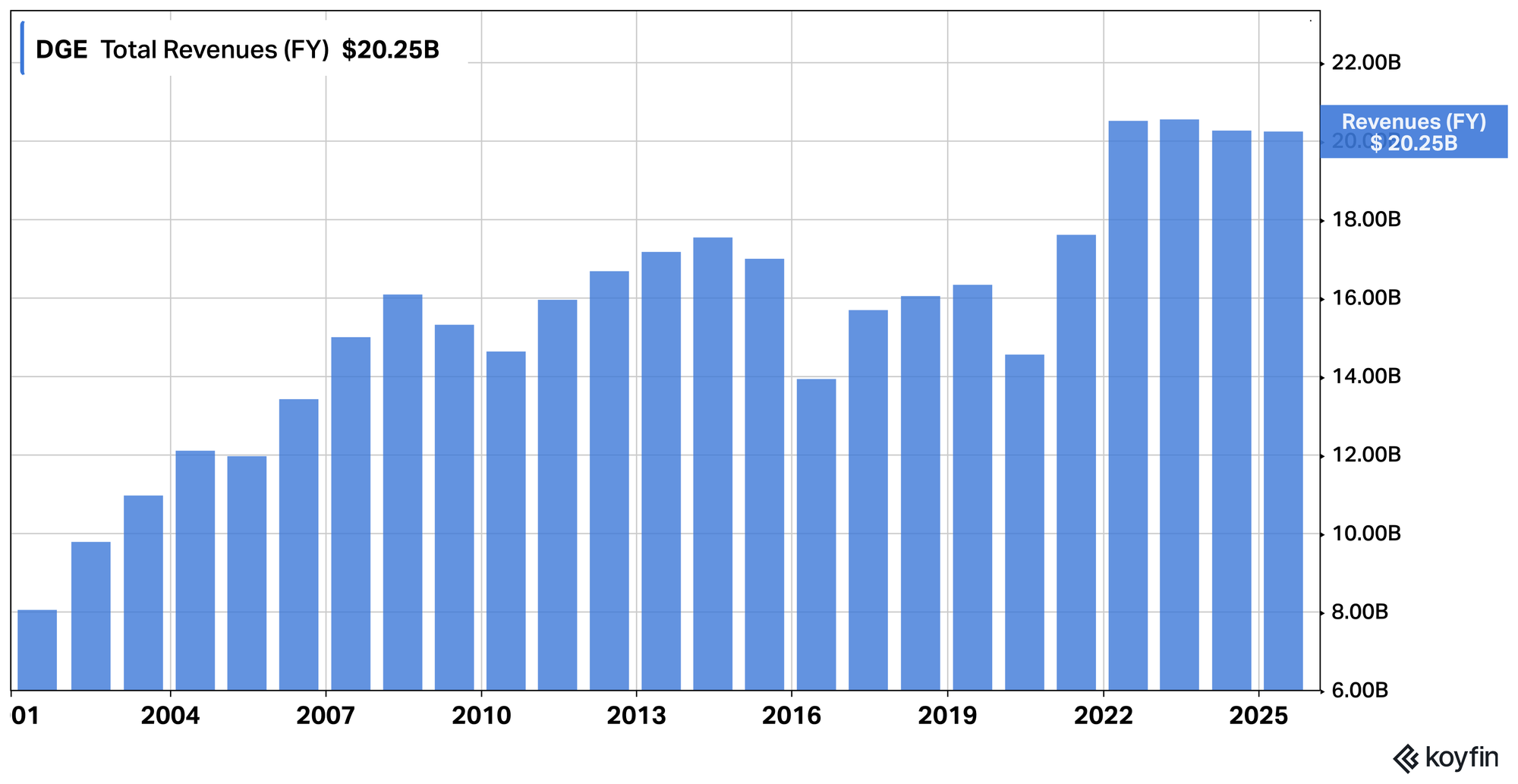

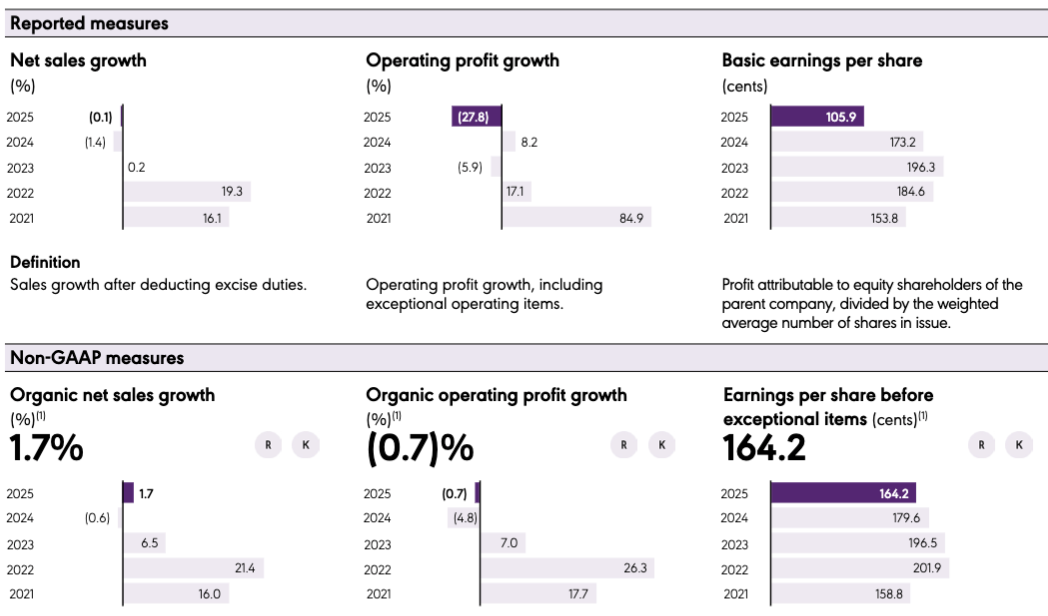

Between 2021-2023, Diageo achieved 14.5% compound revenue growth. Then, in 2024, group organic net sales declined 0.6%, and in 2025, they failed to bounce back. This is the main reason why the shares are down as much as they are.

DGE Total Revenues, 2001-2025

The near-term main driver was materially weaker performance in Latin America & the Caribbean (LAC), which makes up nearly 8% of Diageo’s organic net sales value. Excluding LAC, sales still only grew 1.8%, led by growth in Africa, Asia Pacific, and Europe, partially offset by weakness in North America. The negative GLP-1 and youth drinking narratives gained traction with these results.

Struggles were industry wide though, so Diageo still managed to gain or hold market share in over 75% of measured markets. This was a key issue for them in 2023, when they only managed to grow share in 30% of their business lines. Spirits and alcohol are a competitive space, as all the world has alcohol already, so gaining market share and raising prices is a way for Diageo to keep growing.

On the bright side, Guinness (including non-alcoholic) drove European market resilience: double-digit growth. Guinness 0.0 is still a small share of the total, but net sales and volume more than doubled in 2024. Meanwhile in Africa, Guinness is pushing a more capital light business model. For example, in Nigeria, it has entered into a long-term licensing and distribution agreement with a local firm, Tolaram.

In this model, Diageo is just the brand manager, selling production rights to local companies. This is similar to the Dominos or McDonalds franchising model, where the capital expenditure is taken on by the partner, while the parents collects fees in return for the use of its brands and IP, monetising its brand value more directly.

2025 Results

Full annual report here.

The new Interim CEO (more on him later) outlined three key priorities, as 2025 saw a similar set of flat results to 2024. These are: consistent delivery of free cash flow, cost savings, and deleveraging. Less debt, lower costs, higher free cash flow. This is a return to basics, focused on the metrics that investors want to see. Free cash flow and high debt are the two most significant financial issues at the company, and need to be tackled. Diageo is far from home and dry, but we are encouraged by these intentions.

The dividend was unchanged and Diageo now has a c. 5% yield, while earnings per share (EPS) fell by 9% on foreign exchange effects and lower income from its stake in Moet Hennessey. Guinness and Tequila were again the standouts, growing over 10%, while the rest of the portfolio was generally shrinking by a percent or two.

Moving on, we can run through a few of its major categories.

Tequila

Diageo’s portfolio is positioned towards fast-growing categories and tequila is the fastest growing spirits category (+9% growth 2022-2023). The 2021 Bacardi Global Brand Ambassador Survey placed tequila as the top trending spirit for 62% of global bartenders (rising to 76% in the US). It’s particularly strong in super premium category, and consumption is roughly 50/50 split between male/female, which is another advantage as it gives it a larger market opportunity than some other spirits.

Diageo was among the early entrants into the space and continues to be the global leader in tequila with around a quarter of value share. Within tequila, Don Julio is the key brand, having been acquired in 2015. In 2025, it grew net sales by 41.9%.

“Established in 1942 by Don Julio González who spotted a unique opportunity in the production of tequila. He chose quality over quantity, painstakingly planting each agave further apart to allow proper room to grow and fully mature before harvesting.”

It grew 15x faster than the US tequila market in 2023, was the number one selling tequila at London Heathrow Airport throughout most 2023, and is now available in nearly 60 countries. They are focused on the Paloma cocktail as the emerging trend, using it as a way to bring new drinkers to tequila, and it’s proving popular.

Tequila has grown from less than 10% of Diageo’s premium spirit sales to more than 40%. It is a market leader in the space. Many people don’t know this, but tequila has a DO (Denomination of Origin) - just like cognac and champagne, which can only be called that if they are grown within a certain geographic area, using certain methods. This protects quality and authenticity, and constrains supply. Moreover, the blue agave plants needed to make it take 5-8 years to mature, which makes it harder for new competitors to enter the space. Again, these are all barriers to entry.

Diageo has invested heavily into the space:

- 2017 – paid $1bn for Casamigos (high end tequila, by George Clooney). Grew production from 170k litres then to 1m by 2020.

- 2021 – invested over $500m in new facilities in Jalisco state.

- 2023 - $160m on new capacity in Atotonilco and Jalisco.

When celebrities like Clooney are getting in the act, the journey to status symbol is complete.

Scotch

Diageo remains the world leader in scotch, and it is their largest category. In 2024, they gained market share in 9/10 of the largest measured scotch markets. Johnnie Walker is the key, driving half of their organic net sales in the category, as the number one international spirits brand by value and volume.

Its “Keep Walking” brand/ad campaign has been a key pillar of that success. One commentator wrote, "The universally recognisable brand icon of 'The Striding Man' was resurrected from the brand's history to forge a deep connection between the universal human desire to progress and the Johnnie Walker brand." Johnnie Walker’s retail sales value (RSV) has increased over 400% between 2002-2024.

Elsewhere in Scotch, another example of their range and brand building is in the Indian Premier League (IPL) cricket tournament. One of the founding teams, Royal Challengers Bangalore (RCB), is named after renowned Indian whisky brand Royal Challenge which is owned by United Spirits, part of Diageo. This ownership gives Royal Challenge whisky unprecedented visibility in India, one of the largest whisky markets in the world.

Guinness

Their 2024 results said, “Whilst Guinness has been the official partner of the Six Nations Rugby Championship since 2019, in 2024 the tournament helped it reach new heights. During this year's Six Nations, sales of pints of Guinness in stadiums were up 15% compared with 2022, while there was a 26% increase in pints of Guinness 0.0 sold in stadiums compared with 2023.”

In June, Guinness announced that from August it would also be the official beer of the English Premier League. Premier League games are broadcast into 900 million homes in 189 countries, heightening the brand's relevancy and visibility even further. The four-year agreement will also see Guinness 0.0 named as the official non-alcoholic beer of the Premier League.

Cocktails

The cocktail industry is experiencing significant growth, particularly in the ready-to-drink (RTD) segment (the canned cocktails you see everywhere now). This growth is driven by factors like convenience, the appeal to younger demographics, and increasing social media influence. Furthermore, the trend toward premium, innovative, and flavour-focused cocktails is also contributing to the overall growth. Beverage think-tank IWSR expects RTD growth of 12% annually, making this a key trend.

Diageo has also created an AI platform pairing cocktails with food, called What's Your Cocktail? to help people pair (its own) spirits with their food or environment, to try and grow that association, like with wine.

Zero Alcohol

Across 10 key markets, per capita consumption in litres of pure alcohol is at 80% of its level in 2000. Moderation is a real trend, and as it grows, zero-alcohol replacements are filling the gap. The no-alcohol segment recruited more new consumers than its low-alcohol counterpart, with an increase of 61m buyers versus 38m from 2022-2024. 0% Spirits are expected to see 5-10% growth in the coming years. Diageo is a leader in this field, with three of the top five brands in 0% spirits (e.g. Seedlip), plus the hugely successful Guinness 0.0.

Elsewhere in the sector, Heineken (HEIA) has committed 10% of its brand marketing budget to Heineken 0.0, which is their fastest growing product, already available in 95 markets. This is an industry-wide trend, and Diageo is well positioned.

Marketing

Marketing is another huge pillar of Diageo’s success, and it spends heavily to support its many brands. This is enabled by its scale and profitability, which give it more advertising firepower than most peers. DGE spent $3.66bn on marketing in 2025, on sales of $20.24bn. Compared to previous years:

| Year | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Marketing spend $m | -2,868 | -3,616 | -3,663 | -3,691 | -3,662 |

| Net Sales $m | 16,880 | 20,516 | 20,555 | 20,269 | 20,245 |

| Ratio % | 17.0% | 17.6% | 17.8% | 18.2% | 18.1% |

It has increased the money it puts behind its brands year after year, in absolute terms and relative to sales. It knows you have to keep working to support brands, and that the returns are as enduring as they are hard to measure. It’s most visible in brand strength, which leads to the high returns on capital. They are trying to nudge this number back down through efficiency now, predominantly using AI.

Key Drivers

Overall, Diageo’s key drivers are: Drinking volumes/mix, cost vs price inflation, health culture/GLP-1s, population growth (c. 80m people turn legal each year), geographic expansion, middle class development, and premiumisation (drink less but better). The Chairman’s Letter in 2024 said,

“We are confident in the long-term trend of sector premiumisation and we believe that it will continue, supported by demographic trends, rising incomes in developing markets and spirits continuing to take share from beer and wine.”

We would also highlight three specific things. Firstly, the potential for growth in China. In 2022, the Chinese white spirit Baijiu accounted for over 90% of all spirits sales in China, leaving Western spirits with less than a 10% share and plenty of room to expand. Secondly, tequila, which is both fast-growing and high-end. Finally, innovation, which is more important for spirits than wine and beer.

Looking nearer term, potential catalysts include: South America turnaround, a return toward historic growth rates, margin expansion, potentially new/better management, and a revival in on-trade (pubs & bars) would also be a positive. After years of post-Covid disruption, the on-trade channel is showing signs of revival in key countries, such as China, Germany, Italy, Mexico, the UK and the US.

Industry & Market Opportunity

Premiumisation was talked about a lot just after the pandemic struck as people weren’t paying marked up pub or bar prices, and chose to spend those savings on better bottles at home. But premiumisation is actually a longer-term trend that has been benefitting Diageo for decades.

Diageo is well placed in this regard as 60% of Diageo’s net sales in the last financial year were in the premium and above price brackets, compared with an industry average of 35%. As one key investor wrote,

“Premium” spirits (definitions vary) account for just 9% of the total international spirits market, but have enjoyed an 8% p.a. compound growth rate between 2010 and 2020, compared with +4% for the whole international spirits market.”

Geography

The Diageo leadership have repeated the mantra that an additional 500 million legal-age purchasers will enter the alcohol market in the next five years, driven by ageing, population growth and economic development. The percentage of adults who drink differs by country. The Middle East and North Africa are kept down by religion, but otherwise, wealth and alcohol consumption are closely correlated.

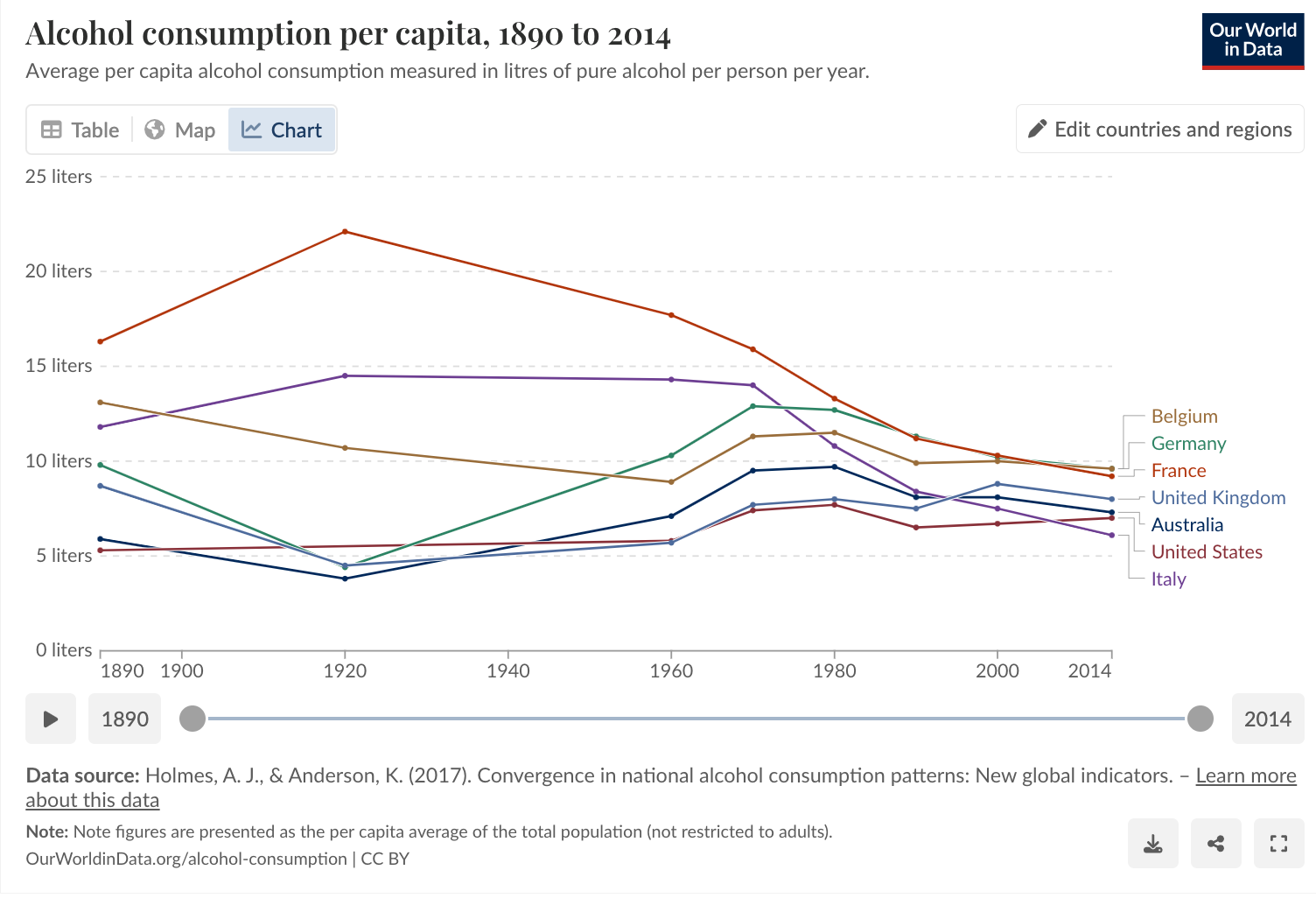

Globally though, volumes of alcohol are decreasing, shown by the downtrend in per capita consumption, which generally began in 1980.

Growth has partly come from market size, rather than per capita consumption. Global population and economic growth have expanded the market, while people have also been moving up the price curve towards Diageo’s premium products. When you look at the map below, the market opportunity is quite clear – it’s about the people moving from dark purple to light, then to green. The dark green markets are saturated, and premiumisation is the key driver there, but a large, long-term economic opportunity remains in the rest of the world. On a global basis: total alcohol consumed per year increased 70% between 1990 and 2017, driven almost exclusively by low and middle-income countries including Vietnam, India and China.

World Income Per Capita

It’s worth noting the demographic picture too. Population growth is slowing at a global level, and we are nearing a plateau. Births per woman have fallen all the way to 2.3, where roughly 2.1 gets you a stable population. There are still new customers and new markets to be found, but the next forty years will see slower growth than the last forty, which could lead to greater competition.

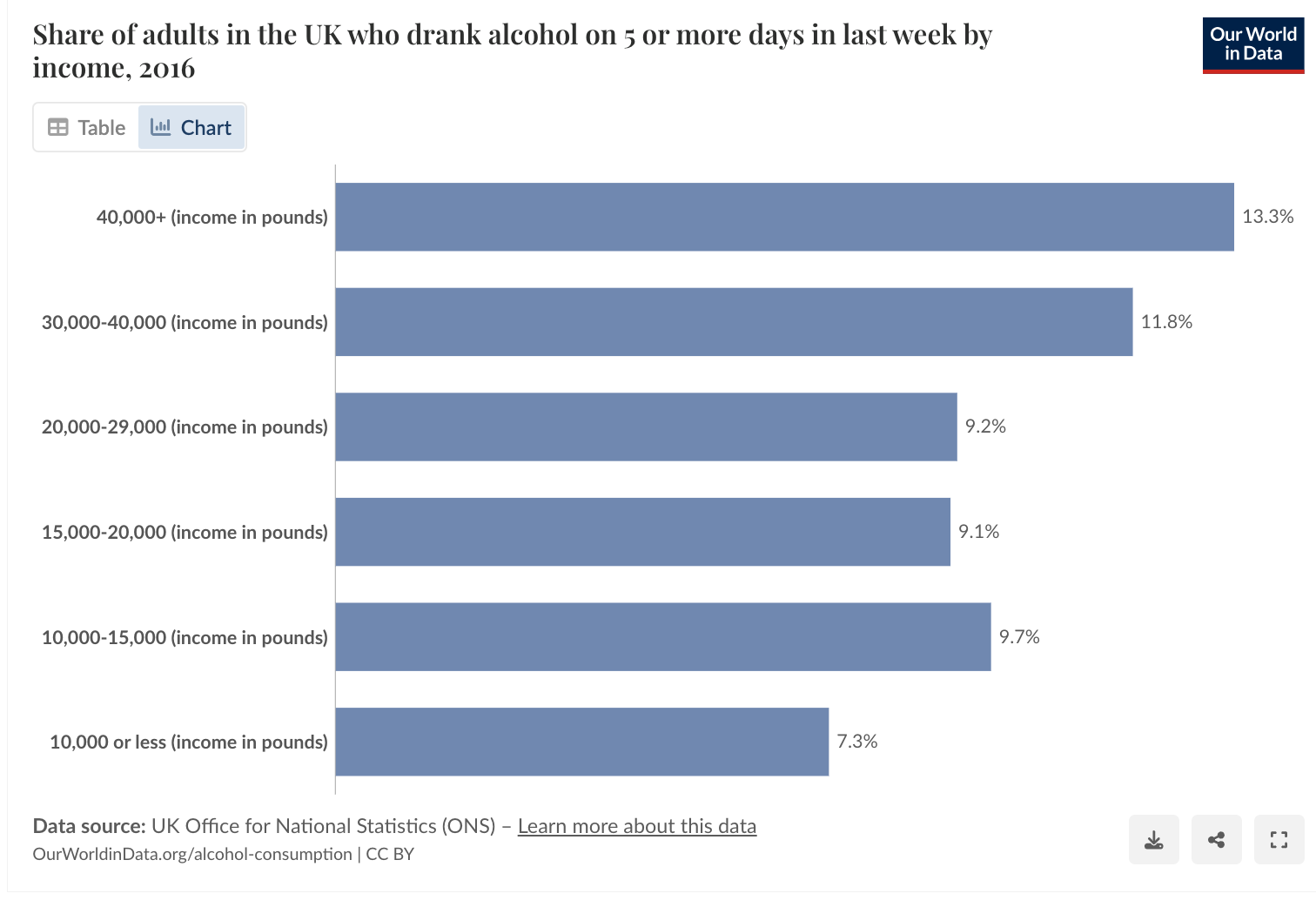

Interestingly, the share of GDP spent on alcohol hasn’t really changed in 25 years. People who earn more, drink more, so for Diageo, global GDP growth is a key driver, and consumer spending is a key metric.

Drinking Rate by Wage Band

Looking shorter-term, the key trends investors are watching in 2025/6 remain: moderation, premiumisation, and emerging markets. Moderation spans all age groups, regions and demographics, but is predominantly among younger consumers who are a small fraction of the market for now. It involves lighter consumption, temporary abstinence, and “single-category occasions” (not mixing drinks, which typically leads to drinking less).

On the other side, gains will be largely driven by high-population countries – India, China and the US – followed by the likes of Brazil, Mexico, South Africa, Vietnam and Nigeria. The strong momentum displayed by emerging markets is actually being driven by younger populations (counter to the narrative), rising disposable incomes, and expanding middle classes.

Premiumisation is slowing in the short term across all key markets. Downtrading is happening in both volume and value terms among lower-income consumers, while higher-income drinkers are more likely to reduce volume without trading down in value terms. However, this is a pullback from the premium rush during the lockdowns, and we don’t see this as the end of premiumisation longer-term.

Competition

In the US, the number one and number three drinks companies (broader than just spirits) are European businesses, with the top slot taken by Anheuser-Busch InBev (ABI) and the third slot taken by Heineken (HEIA) thanks to their strong portfolios of US and Mexican brands. At number two is Molson Coors (TAP) – a US-Canadian hybrid formed by a merger 20 years ago and swelled by the richly-valued $12bn acquisition of Miller in 2016. In the four years following the deal, TAP’s market value dropped by 70%, and today the entire business’s value is $1bn less than the price paid for Miller.

These are all primarily beer companies though. Spirits occupy a different category, where Diageo is the largest, competing with Pernod Ricard (RI), Brown-Forman (Jack Daniels), Bacardi (private), Suntory in Japan, and the H of LVMH.

Diageo vs Competitors

| Ticker | Name | Mkt Cap (bn) | ROIC | Vol (1Y) | FCF/EV Yld | EV/S | 7Y Rev Growth | 7Y FCF Growth |

|---|---|---|---|---|---|---|---|---|

| 2587 | Suntory Beverage | 9.8 | 9% | 21 | 7% | 0.8 | 5% | -1% |

| STZ | Constellation Brands | 26.6 | 17% | 31 | 5% | 3.8 | 4% | 12% |

| BFB | Brown-Forman | 13.6 | 14% | 39 | 4% | 4 | 3% | -3% |

| CPR | Davide Campari-Milano | 8.6 | 8% | 40 | 4% | 3.2 | 8% | 1% |

| DGE | Diageo | 60.7 | 13% | 25 | 3% | 4.2 | 3% | -3% |

| RI | Pernod Ricard | 28.9 | 8% | 28 | – | 3.3 | 3% | – |

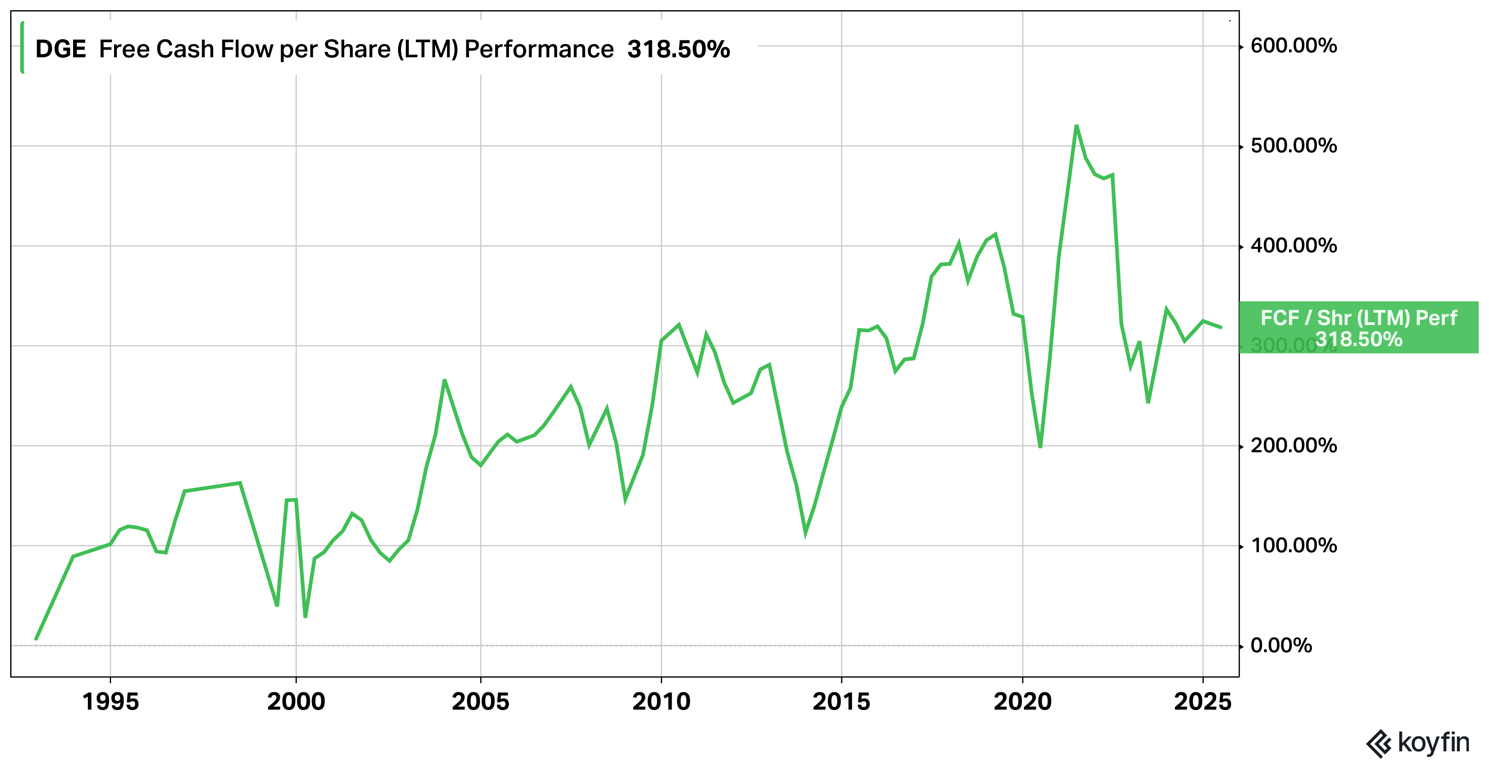

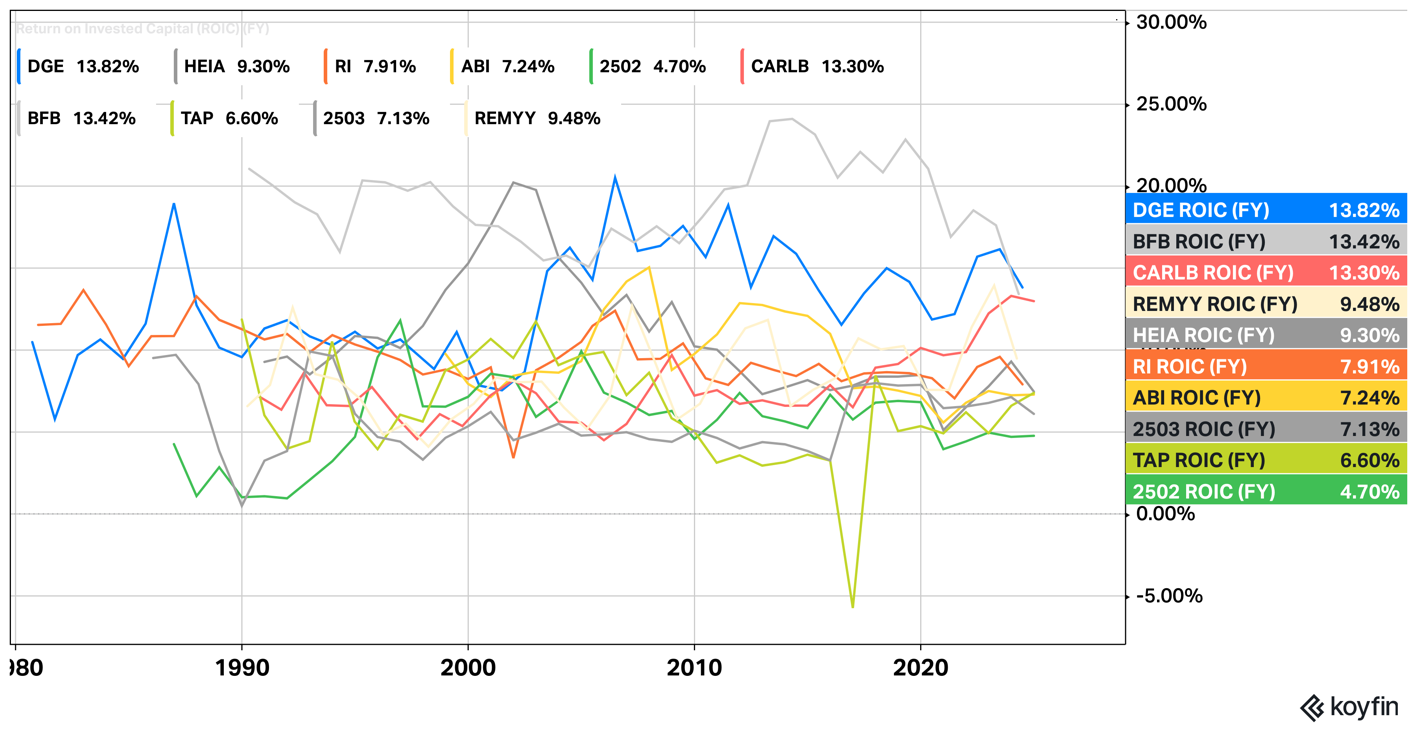

Diageo stands out as having the highest returns on invested capital (ROIC). Its low 1-year stock price volatility also highlights its quality, despite the recent fall. The 7-year revenue growth is solid, but its free cash flow generation doesn’t match up. FCF/share has been roughly flat for fifteen years and that is certainly an issue. However, looking longer term, the uptrend is still clear. We will dig into this further down, but the bottom line is to reiterate that the company has had a tough few years, but that we believe this issue will be overcome.

DGE FCF/Share since 1990

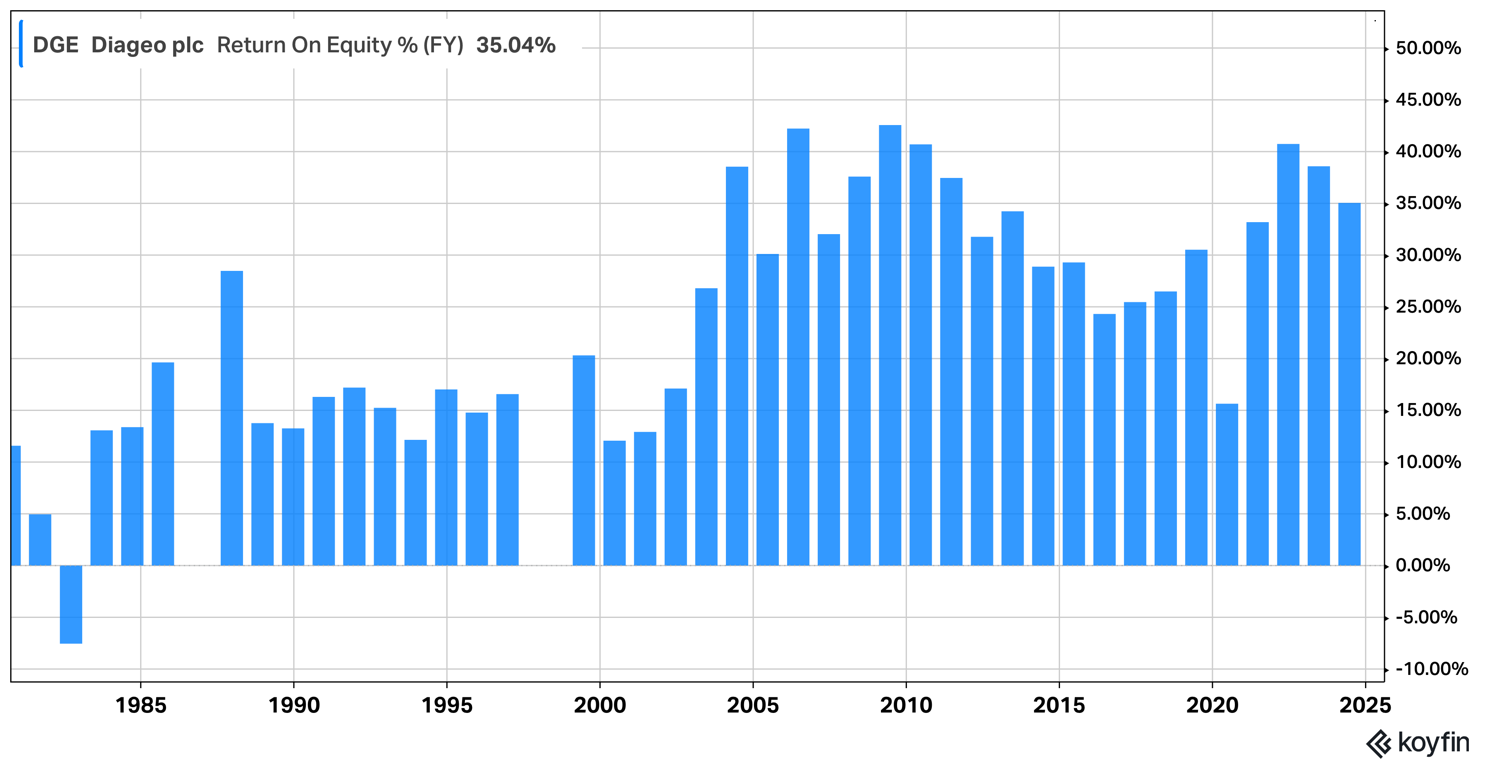

ROIC differs slightly from ROE, return on equity, by including the use of debt in the denominator to make companies with different debt levels more comparable. On returns on equity, Terry Smith quotes Buffett (and it still applies here), who says,

“The primary test of managerial economic performance is the achievement of a high earnings rate on equity capital employed (without undue leverage, accounting gimmickry, etc) and not the achievement of consistent gains in earnings per share.”

Because Diageo has quite high debt levels at the moment (another thing it has committed to improving), we will use ROIC for now. DGE, in blue, has consistently maintained higher returns than peers over time, especially since 2000, and currently leads the field. It has struggled, but so has the industry.

Alcohol Companies’ ROIC

Because of its quite heavy use of debt, it has an even higher return on equity of 30%-40%. Its ROE has risen 10 percentage points since 2016, but has just slid backwards in the recent difficult years.

Diageo Return on Equity

Overall, Diageo’s competitiveness shines through in its profitability, both on equity and total capital return metrics. As Smith and Buffett point out, this is the key test of management quality and competitive advantage.

Culture, Management, and Backers

The CEO from 2023-2025 was Debra Crew. She initially stepped in as interim CEO when her predecessor Sir Ivan Menezes fell ill. He followed Paul Walsh, and both served for a decade or more, driving the premiumisation strategy successfully. Walsh oversaw the merger with Seagram’s in 2000 which made Diageo the world’s largest spirits company.

The poor share price performance (although better than its peers), saw Crew replaced abruptly in July, 2025. They have appointed an interim CEO, which will be Nik Jhangiani, the CFO. He is an accountant by training, with experience at Deloitte, Colgate-Palmolive, and Coca-Cola. He was only appointed CFO at Diageo in September 2024, but supposedly has come in with a lot of energy and ambition. It will be interesting to see how he gets on, and if they consider him for the permanent role.

The chairman of the board has also just changed. It was Javier Ferrán, who was in place for 9 years, but he stepped down in February 2025. Colleague and Non-Executive Director Sir John Manzoni has been appointed as successor, so it is a moment of great change at the top of the company. This is at a difficult time for the business. Fresh faces might be just what’s needed, especially as Crew faced investor scepticism due to the struggles of the business. Fair or not, a CEO can’t avoid blame when things aren’t working as they used to. The talk now is of a refocus on growth, free cash flow, and margins.

In terms of culture, successive CEO’s have championed the culture of the business, enshrined in the Diageo Code of Conduct, which celebrates passion for customers, being the best, and doing the right thing, every time. Culture at such large organisations is hard to gauge, and each brand will be different, but Diageo has a good reputation as a business which is hard won. Their “ambition is to be one of the best performing, most trusted and respected consumer products companies in the world.”

On the shareholder register, UK active quality fund Lindsell Train holds a large stake, while Terry Smith has recently sold it. A recent interview with Nick Train is illuminating:

“Diageo is that it is the biggest [company] of its type in the world, and yet it only speaks for 4% of global alcoholic beverage, so even if the other 96% is under pressure or isn’t particularly growing, that doesn’t mean that Diageo doesn’t still have a huge opportunity to grow its brands. People say, “young people aren’t drinking anymore”, but they are drinking a lot more tequila and Diageo has the best tequila brands in the world. They are drinking a lot more Guinness, and Diageo is the company that owns Guinness. That’s why we still own Diageo and have added to it when we can.”

In their latest commentary on Diageo’s weak recent performance, they wrote:

“Consumers have felt the pinch from higher interest rates and, at the margin, traded down their spirits consumption to more “value” brands. This has impinged on Diageo, given its strong growth in the US since Covid-19 had been driven by its higher price and higher profit margin premium brands. Nonetheless, it is important to note here that, at the global level, Diageo’s revenues were c.$15 billion in 2020. This year, a “disappointing” year, we expect they should be over $20 billion. In other words, Diageo has grown notably since 2020 and will continue to grow. Just not in a straight line. We are also sure that this orientation of Diageo’s product portfolio towards premium brands is beneficial for investors over anything but the short term.”

And back in 2014 they wrote,

“Premium spirits are our tipple of choice for a number of reasons. Firstly, they are under-penetrated globally and there remains a considerable opportunity as the world shifts from local spirits to western liquors. History has demonstrated in locations like Japan that rapidly westernising countries tend to switch from local spirits to scotches and other brown spirits, so a large-scale conversion to such beverages in China alone would be very exciting.

In summary, there is a lot of change in the senior management team, but investors have welcomed the CEO’s departure, while the culture is strong, and shareholders include long-term quality investors we are happy to invest alongside.

Financials and Valuation

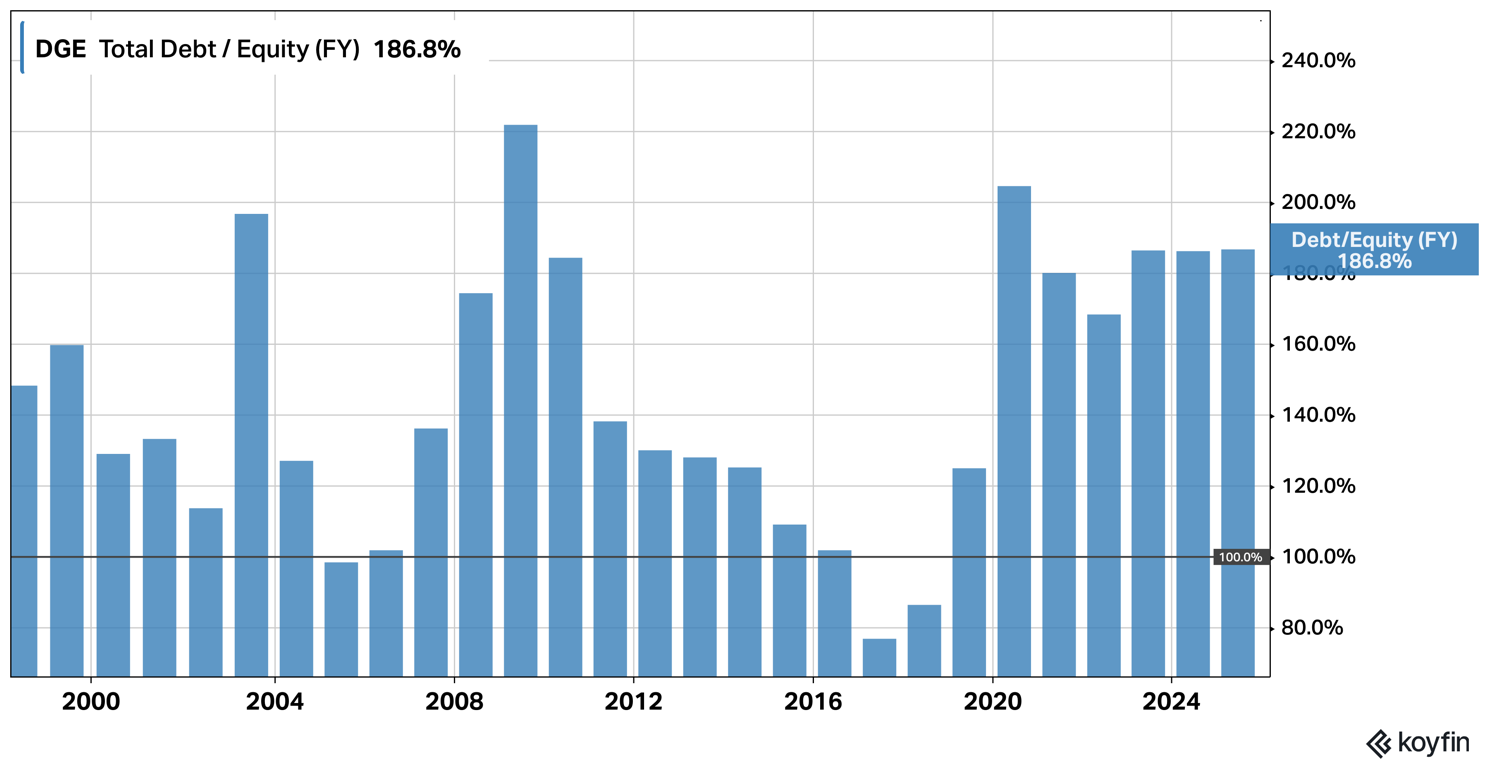

Diageo’s debt grew sharply on top of a rising trend during Covid. While it has pulled back a little since then, it remains at very high levels relative to equity, both for its own past and against alcohol company peers.

Debt/Equity since 1997

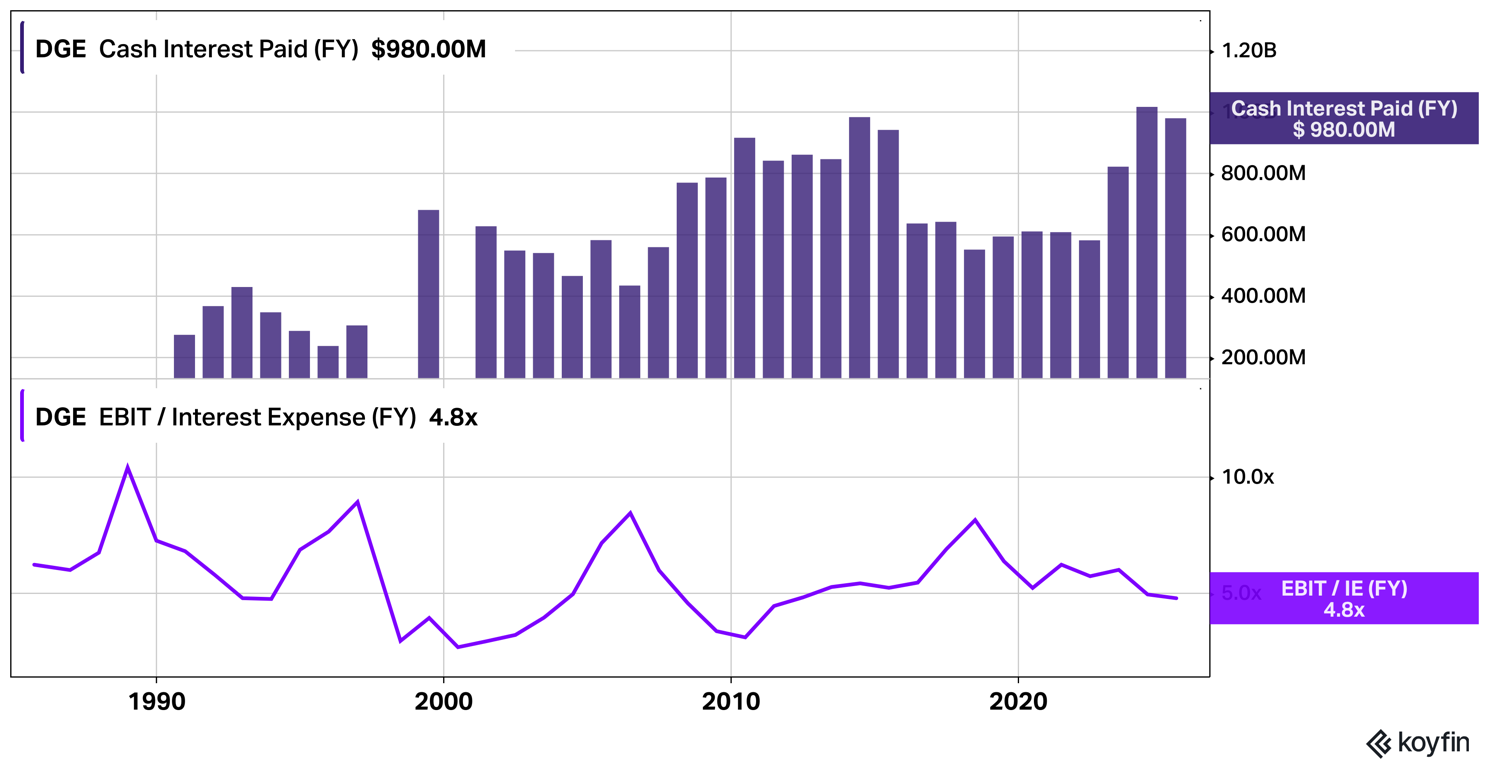

Comparing debt levels to earnings, net debt to EBITDA is at 3.3x, and has only been higher 5% of the time in the last decade. Rising interest rates have made this an issue: cash interest paid in the chart below (purple bars) has doubled in the last few years. However, looking at EBIT/Interest expense (line), it is down to the lowest levels since 2007-9, suggesting that relative to operating earnings, debt might not be as problematic as the other statistics suggest.

DGE Interest Paid and EBIT/Interest Expense

Despite that mediating factor, the debt picture isn’t perfect, and is a key reason for increased scepticism around the stock. Low leverage is a preference of Quality investors, so it’s good to see that this is being flagged as a top priority by the new management team in the 2025 annual report.

Meanwhile, FCF/share, another key metric, has moved around but ends up flat since 2010 or 2020, although as we mentioned before, remains in a long-term uptrend.

Diageo Free Cash Flow Per Share

Free cash flow is also a core target for the new management team. They will be lowering their capex as a % of revenue by 2-3%, and perhaps cashing in on some of their maturing inventory. This will shift their investment/inventory profile and boost free cash flow. Cost savings will come from advertising efficiencies (AI), reduced headcount, and supply chain optimisation which is a constant process.

Looking at the 5-year key performance metrics in the 2025 annual report, you can see why the shares are down in the last few years. Everything has gone backwards.

However, FCF still grew in 2024, and ROIC remains good, if a little lower than before. A shorthand for economic value creation is that ROIC must be above the cost of capital, often called the WACC, and that remains true for Diageo.

As for the dividend, Diageo now yields over 5%. It has only hit such attractive yields twice before in the last 40 years. Each time, it has been a good moment to buy. Diageo is a high quality company and rarely falls this far for long.

Diageo Dividends Paid, and Yield

It is also further below its 200-week moving average than it has ever been. Unless Diageo’s multi-century dominance is now coming to an end, this is a good opportunity to buy. Its 1Y volatility is 24, up slightly on recent times but still low, reflecting its quality status. It has also shown some strength in recent weeks, outperforming the MSCI World Index since 1 July.

Having said that, this remains risky, not least because negative long-term momentum can be hard to break.

Risks

Tariffs are a big question mark for any global business with complex physical supply chains. The macro story created by Trump’s trade and other policies is clearly the live threat to markets in 2025. It’s partly what has driven Diageo back to an attractive share price. It estimates a $200m hit from tariffs, should they remain unchanged, which we all know is unlikely. That could be around 10% of EPS – a significant amount.

Other risks exist too, such as:

- Drinking less outpaces drinking better

- Lower barriers to entry – craft spirits are growing faster

- Slowing population growth

- New management are not up to former standards

- GLP-1s such as Ozempic and Wegovy accelerate the habits of moderation

The GLP-1 drugs are definitely a threat. Studies find that it suppresses alcohol consumption in between a third and a half of people taking them. They are suppressing appetites and cravings as well as driving weight loss, which is a curious and not-fully-explained phenomenon. Either way, the threat is real, and may get more so, as the very high cost of these drugs starts to fall with patents expiring and generic copies coming to market.

As for moderation and less drinking among today’s youth, we reiterate the comfort we take in the very long history of human drinking habits, premiumisation, other global opportunities, and some recent evidence that it was price driven as well as health driven, suggesting they can may be interested at the right price.

Finally, a global recession, or bear market, would clearly affect Diageo. US stock market valuations and concentration are at extreme levels, and this is a risk. However, we would expect true quality stocks to see more stable demand, and we take comfort in the fact that Diageo has already halved its valuation, and taken actions to improve the business.

Nonetheless, we deem it medium to high risk.

Seven Powers

Scale Economies – Diageo is the dominant player in most markets. It is vertically integrated and diversified by product, price, and geography. This gives it protection from shocks and cycles, and takes time and capital to build, creating a wider moat. Scale also brings cost advantages through strong supplier/partner relationships, and the ability to buy into successful new companies and trends.

Network Economies – Crowd psychology means the more people are seen with something, the more people want to join them and the more comfortable it is to be part of the in-crowd, so there is a slight social network effect there.

Process Power - Diageo’s operational efficiency drives superior margins. It maintains high returns on capital, reflecting streamlined production, data-driven marketing, and cost-effective supply chains. Its vertical integration gives it control over much of the supply chain, enabling it to ensure quality from grain to gram. Also, its cash generation enables higher levels of investment in marketing and innovation, which helps keep competition at bay.

Branding - Diageo’s strong brand portfolio creates a premium perception and customer loyalty. These brands command higher prices and resist competition through decades of investment in marketing and consumer trust. You know what you're getting, that you like it, and that it will be the same as ever. Additionally, as Lindsell Train have written,

“Alcohol brands with a premium or luxury positioning tend to be highly differentiated, with a greater ability to increase prices over time than a “value” or mass market brand – even in downturns or periods of turbulence.”

Switching Costs - While less pronounced, Diageo’s brand loyalty creates soft switching costs. Consumers and retailers may prefer its established brands due to familiarity and quality, making alternatives less appealing. Switching involves a leap of faith, many prefer to stick with what they know and like.

Counter-Positioning – N/A. Diageo’s products are unique in some ways, but not designed to challenge existing alternatives in their main function or process.

Cornered Resource - The company controls exclusive brands and intellectual property, such as patented distillation processes and trademarks. For instance, Johnnie Walker Black Label’s 18-year maturation process is a unique asset that competitors cannot easily replicate.

Summary

Diageo is a quality company with historic brands. While population growth is slowing, global economic development continues and alcohol consumption will folllow. Having been dragged down to more reasonable levels, it's a great company at a fair price.

Portfolio

The portfolio will go here from the next issue.

Postbox

If you have feedback or questions, please do send them to quality@bytetree.com.

Sign up

We hope you enjoyed today's free note. The next recommendation will be for paying subscribers only.

If you wish to receive it, you can sign up below at a very reasonable price.

Start your quality investing journey today

Or if you'd just like to learn more for now, please visit our About page, and see our first post which introduces the service.

ByteTree Pro clients will have full access and don't need to do a thing, it will be automatically included in your subscription. For clients of The Multi Asset Investor, we have made the "TMAI + Quality" bundle, offering a discount to the combined price.

Many thanks,

Charlie Morris & Kit Winder

Editors, ByteTree Quality

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd