Budget Deficits Drive the Silver Breakout

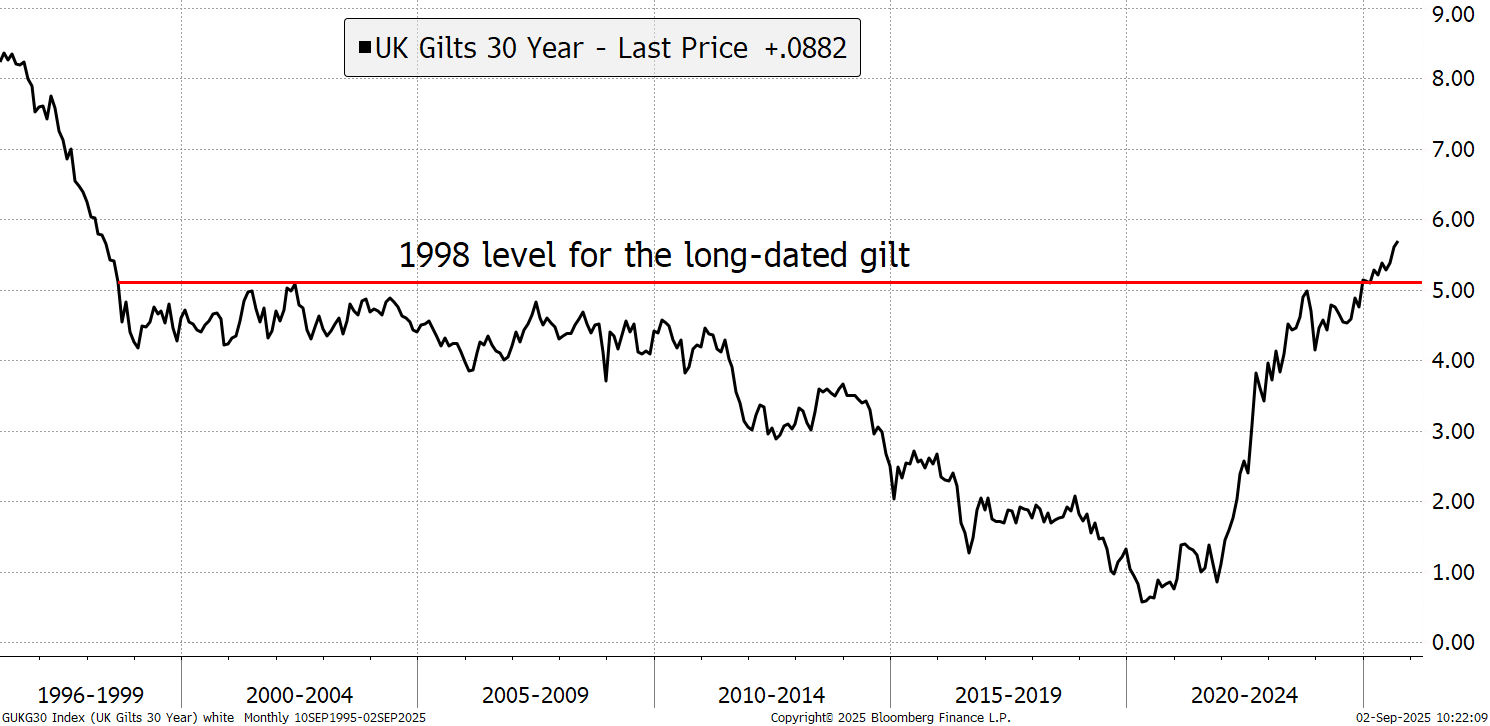

I showed this last week but given the UK long bond yield is up again, it remains highly relevant. Long bond yields continue to rise around the world, but in this case, being at the front of the pack is not a good thing.

UK Long Gilt Yield

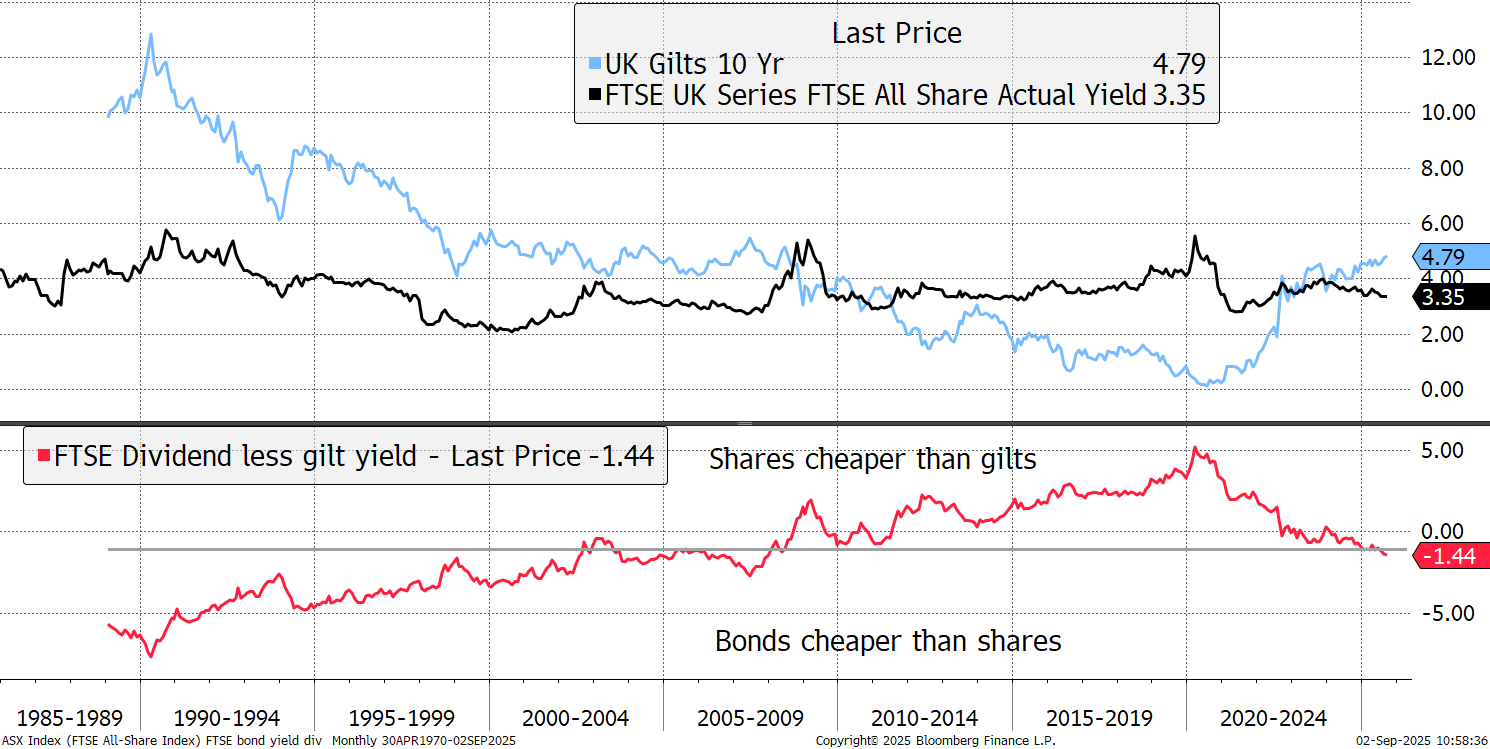

The gilt yield has now reached the point where it is showing better value than UK equities. Since the aftermath of the pandemic, UK shares have offered better value than bonds, as measured by the yield.

Now that has shifted back and now favours of bonds for the first time since 2008. No doubt gilts will be a buy at some point, buy it still feels early.

UK Equities versus Bond Yields

Notice the 37-year average line above is at -1%, where the yields recently crossed over. That shows gilts need to earn 1% extra to offer better value than equities, as equities deliver long-term growth. Also see how the gilt yield earned 7.5% more than shares in 1990, which means these could still be early days, and gilts could diverge for years to come.

There can be no doubt that the danger is not so much a high gilt yield, but a rising yield, and that is what seems to be driving the gold price, with silver playing catch up. So far, the gift has been a falling US dollar, which has kept the pound buoyant. We are also yet to see signs of rising inflation signals from the bond market as inflation linked bonds are yet to show signs of resilience. They should outperform if inflation is coming, and they are not.

That means this is a fiscal crisis, rather than an economic crisis. It stems from government spending which remains in deficit in most major countries, with the UK leading the way. High spending has become structural, and with low economic growth, there is falling confidence given that this can’t continue indefinitely. Higher taxes will dent growth further, and the pragmatic way forward is to cut spending. No one is doing it, and even in the US, Project DOGE seems to have fizzled out. At some point, the bond market will leave our leaders with no alternative but to make drastic cuts.

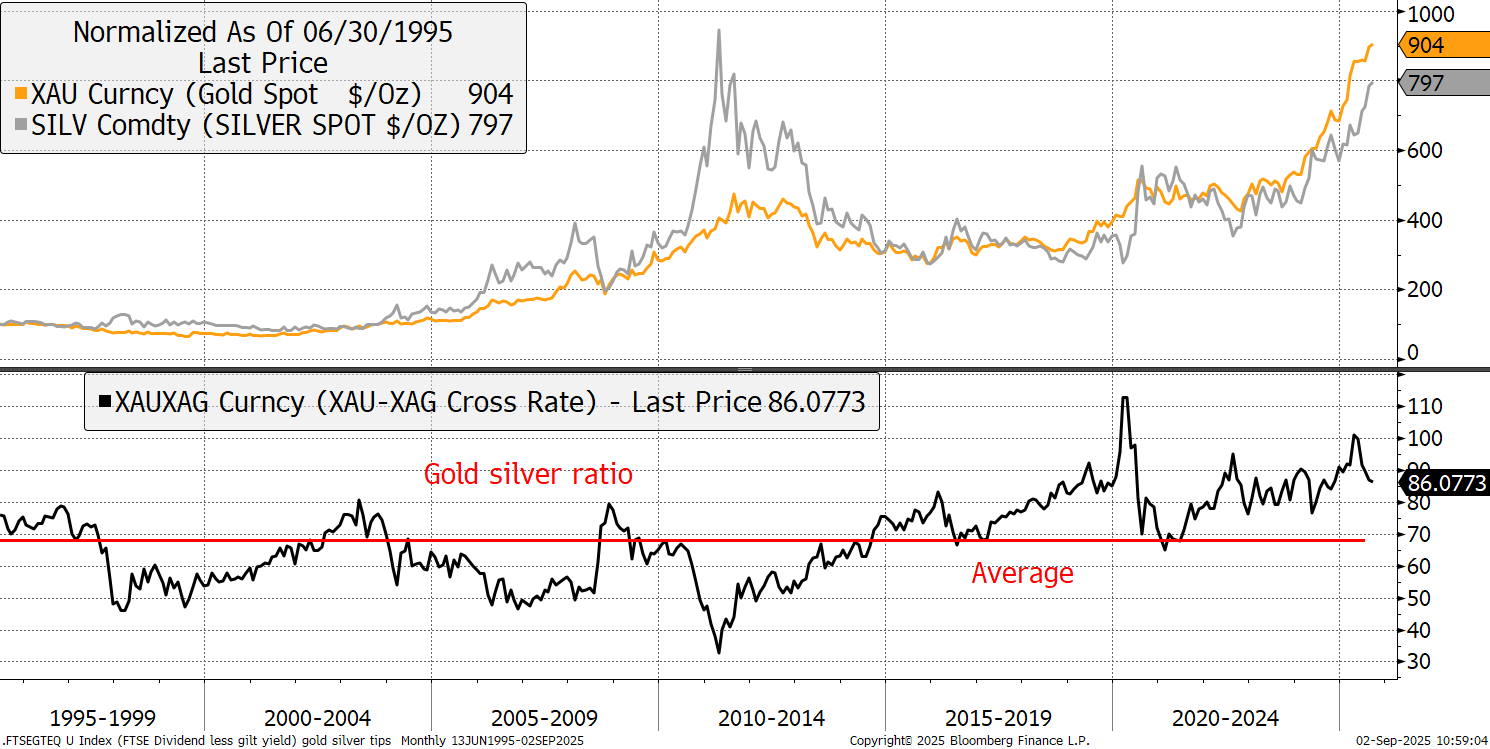

Governments around the world continue to increase their exposure to gold in lieu of bonds and gold’s recent breakout to a new all-time high is not driven by a speculative frenzy, but by sustained high demand.

We have been patient with silver, but its time has come. With the gold to silver ratio at 86, it is still cheap gold, given the historical average is below 70. But we should acknowledge that the central banks are unlikely to be buying silver. That is being carried out by investors and solar panel makers. I like that fact that silver is still cheap gold, because when it shoots past, that will signal a speculative frenzy. The longer we can hold that at bay, the longer this gold bull market will last.

Gold and Silver

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd