ByteFolio Issue 174;

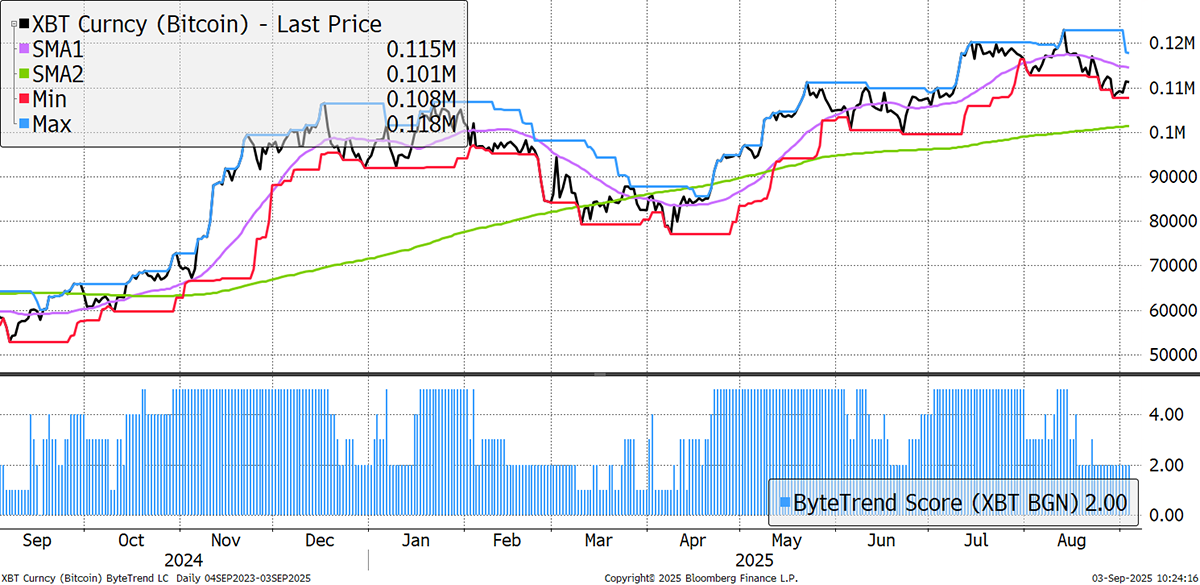

Bitcoin’s ByteTrend Score has dropped to a 2. This is so far a minor pullback, within a strong trend. The 200-day moving average is strong, and the price is comfortably above.

Bitcoin Bull Market

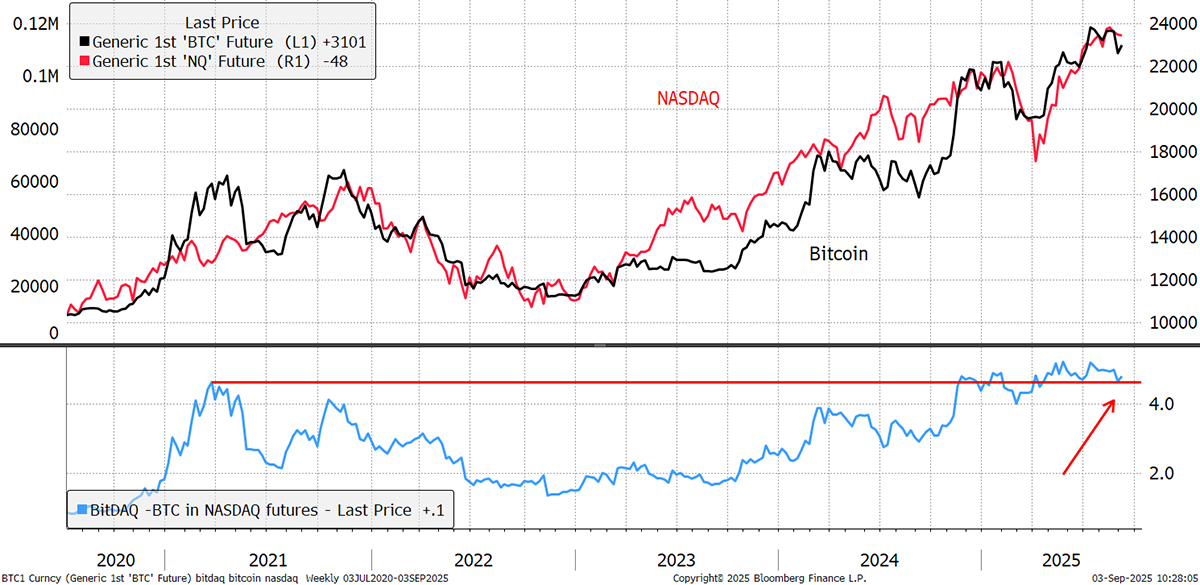

It’s subtle, but Bitcoin maintains its relative strength (blue) versus the NASDAQ. Both have rolled over to a minor degree, but Bitcoin remains above the line. Tech investors see Bitcoin as a diversification opportunity against a tired NASDAQ.

Bitcoin versus NASDAQ

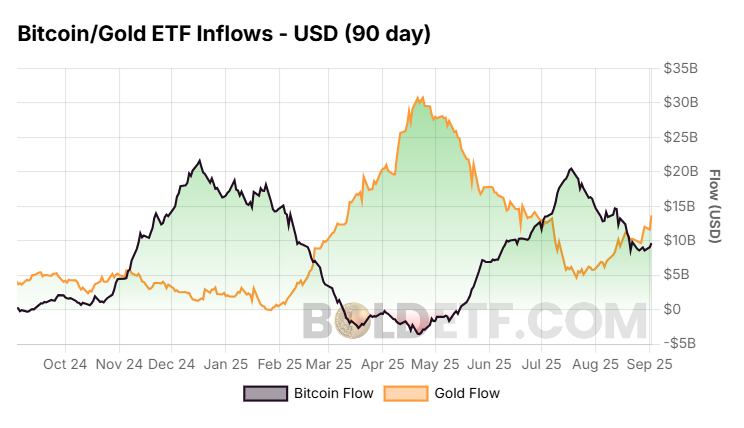

It should be noted that gold made an all-time high, while Bitcoin pulled back. This is the low correlation in action, and I suspect that Bitcoin will pick up when the gold rally slows. Indeed, that may have already started as the gold flows have been strong for a while, and Bitcoin flows have turned positive again.

Bitcoin/Gold ETF Inflows

The current cycle sees 164,250 BTC mined each year. The ETFs have purchased 349,600 BTC over the same period. Add in the demand from treasury companies, and it seems the OGs have been selling. Bitcoin ETFs are about to go international from 8 October as they list in London. I suspect a rally will begin before D Day.