Bitcoin Back in Trend

ByteFolio Issue 176;

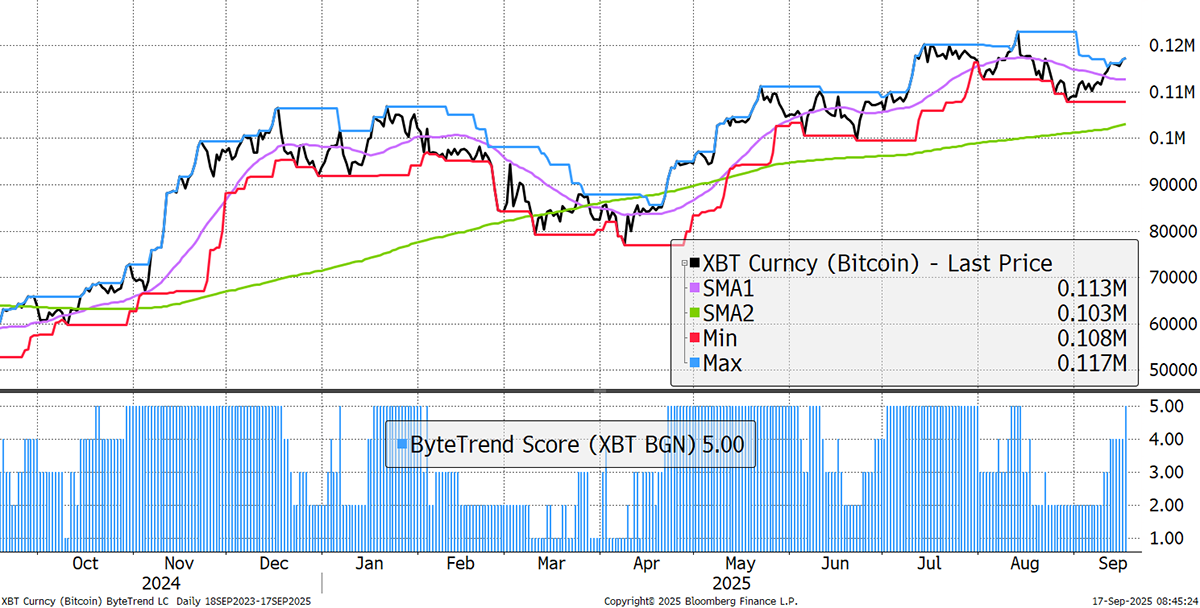

Bitcoin’s ByteTrend Score is back to a 5, which means the uptrend has resumed. This is a perfect setup just two weeks ahead of the strongest month of the year.

Bitcoin Bull Market

What’s more is that Bitcoin is just 14% above its 200-day moving average, which is modest. It means that a large move of 50% or more is plausible. That is not a forecast, but the timing and setup could work. I say 50% because the really big moves seem to be a thing of the past as Bitcoin matures. Still, it is right to be bullish.

Bitcoin Deviation From 200-Day Moving Average

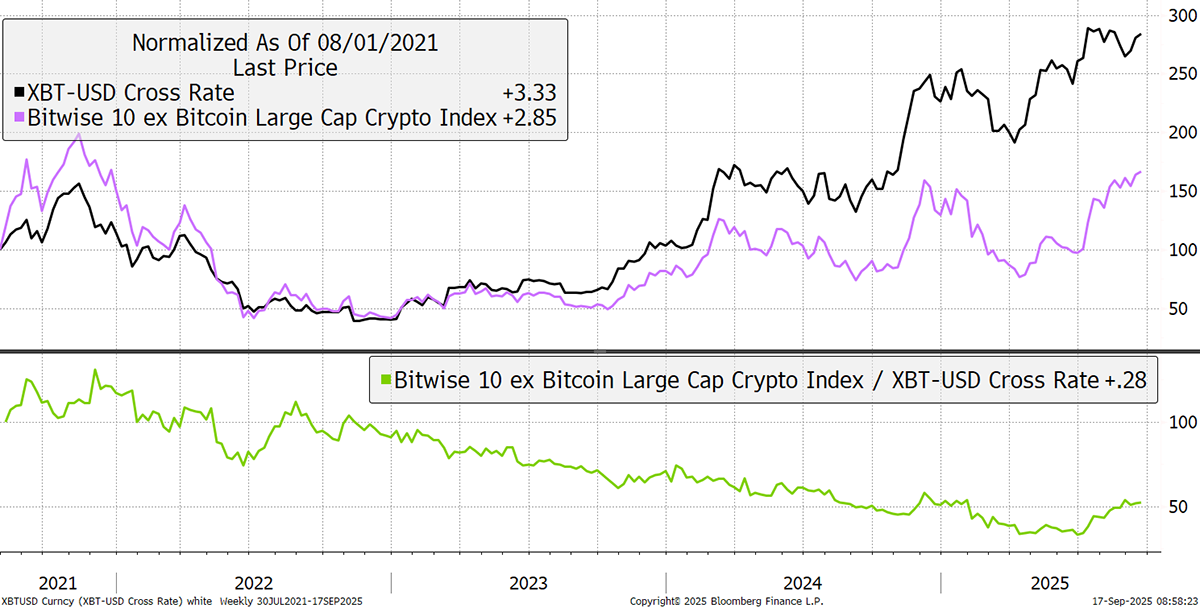

It’s also alt season, and this crypto top 10 index, excluding Bitcoin, is useful for demonstrating the alt market strength. Since 2021, alts have done half as well as Bitcoin but have started to catch up. There is plenty of juice in the catch-up trade. The really big moves are more likely to happen here.

Bitcoin versus Alts

Stay bullish.