Banking Without Banks: Aave Protocol’s DeFi Revolution

Token Takeaway: AAVE;

Aave is the largest and most liquid decentralised lending platform in existence, anchored on Ethereum and now operating across more than fifteen blockchains. With nearly $70bn in deposits and more than $400bn in trading volume processed in the past 30 days alone, Aave has grown into a real-world financial behemoth, rivalling the scale of mid-sized banks, but in a fully on-chain, permissionless environment.

This token takeaway takes a closer look at Aave’s ecosystem, its unique positioning as a decentralised alternative to traditional finance, and the role of its native token, AAVE.

The digital asset landscape is vast, fast-paced, and constantly evolving. Stay ahead of the curve with Token Takeaway. Our in-depth qualitative research delves into the leading crypto protocols, evaluating their merits, risks, and value propositions of their native tokens.

Introduction

Originally launched in 2017 as ETHLend, Aave was founded by Stani Kulechov, who continues to serve as the CEO of Aave Labs, the protocol’s primary development contributor. That same year, Aave conducted its initial coin offering (ICO), raising $16.2m through the sale of its ERC-20 token LEND, which has since been replaced by the governance token, AAVE. Additional funding rounds brought total capital raised to $49m, establishing the foundation for what would become the largest, multi-chain financial infrastructure.

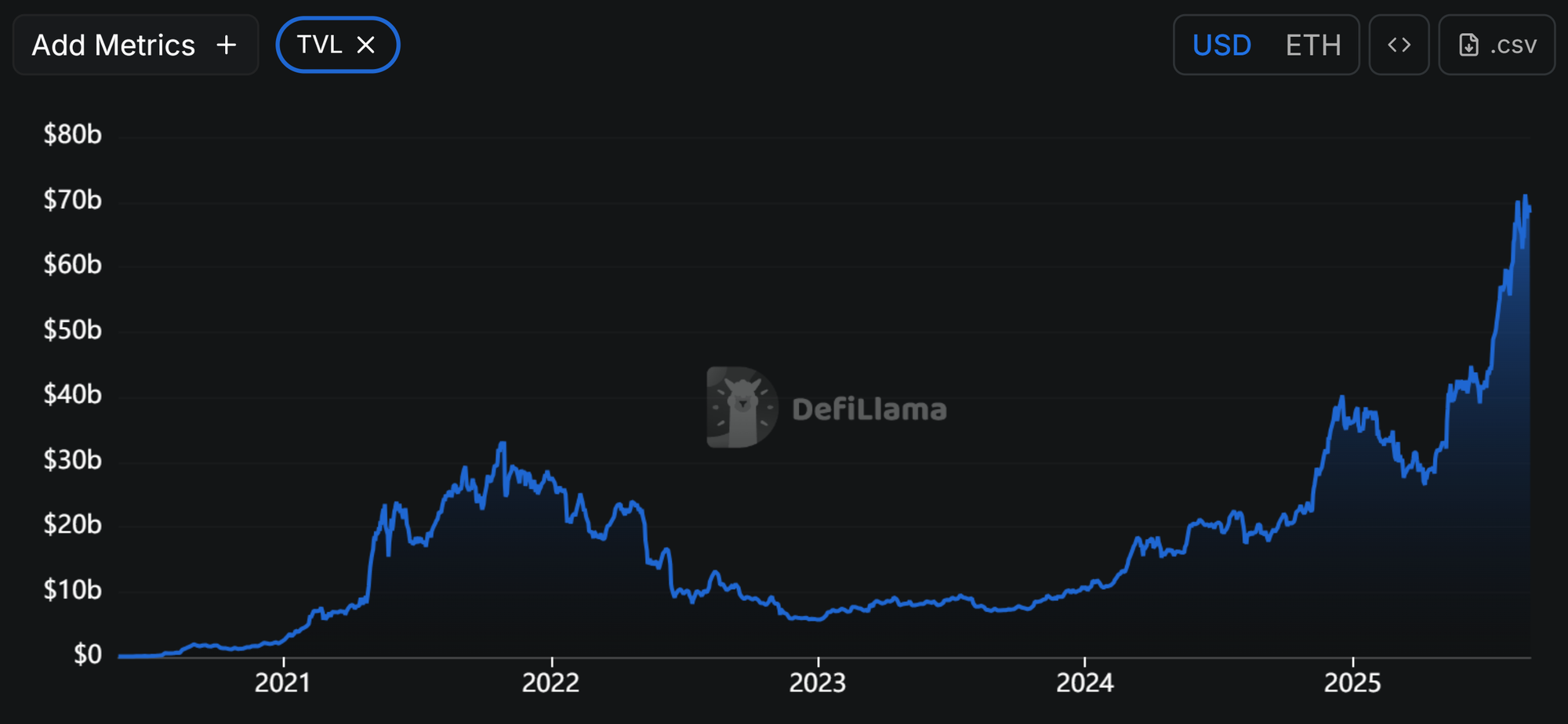

Total Value Locked (TVL) on Aave

Today, Aave manages more than $68bn in user deposits, making it by far the largest DeFi protocol in terms of liquidity since the dawn of crypto. Operating in a non-custodial and permissionless smart contract environment, the platform enables users to lend, borrow and earn yield on digital assets without the need for intermediaries. Its open-source and fully transparent architecture ensures that every transaction is verifiable on-chain, enhancing both accountability and trust.

Over the years, Aave has become one of the most trusted and widely used platforms in crypto lending, renowned for its robust security standards, innovative features and global reach. By combining deep liquidity, user-friendly infrastructure and full-transparency, Aave now competes not only within DeFi but also with banks, positioning itself as a true alternative to legacy financial system.

So, what truly powered Aave’s meteoric success? The answer lies in its foundation, Ethereum. Without Ethereum’s decentralisation, security and reliability, Aave’s vision could never have scaled into reality. It’s the bedrock that transformed a bold idea into the world’s largest decentralised credit market, which by the way is still in its early stages.

DeFi on Ethereum

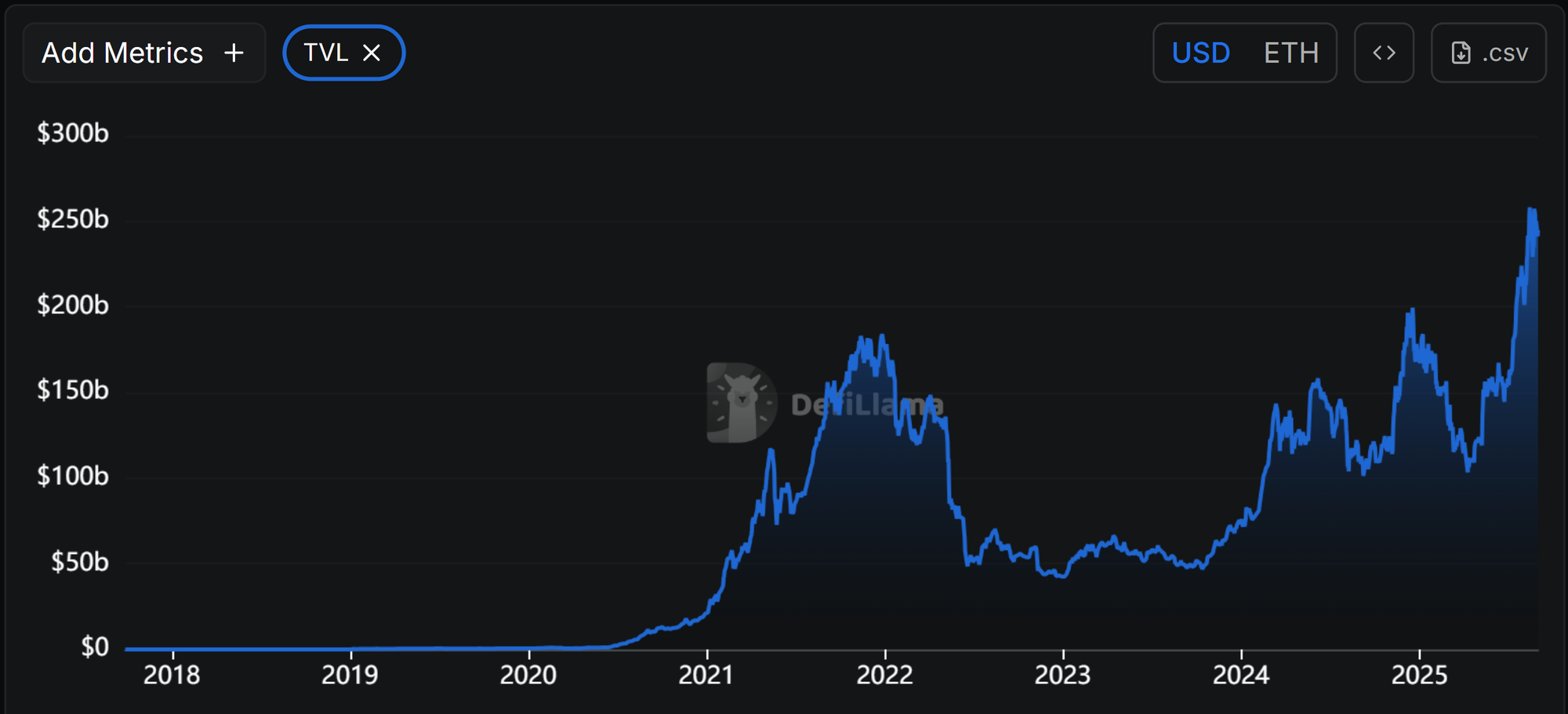

Despite its relatively high transaction costs and limited throughput, Ethereum has always been the home of decentralised finance (DeFi). Numbers tell the story: Ethereum today underpins almost a quarter of a trillion dollars in Total Value Locked (TVL), with $171bn added since January 2024 alone.

TVL on Ethereum

Competing Layer-1 blockchains such as Sui and Avalanche offer significantly higher speeds and lower costs, and there are numerous purpose-built DeFi blockchains like Radix and DeFiChain. Yet none of them have managed to attract meaningful liquidity. The reason lies in what is commonly referred to as the blockchain trilemma, the inherent trade-off between decentralisation, scalability and security. Most blockchains can excel in two dimensions, but rarely all three. Ethereum, by prioritising decentralisation and security above raw performance, has built a foundation of trust that continues to attract the lion’s share of DeFi liquidity.

While Ethereum has improved transaction speed and reduced on-chain costs compared to its early days, its unique selling point is decentralisation. This is not accidental, but a deliberate design choice, powered by a vast global network of validators and a widely distributed ETH supply that underpins its governance model.

Scepticism is natural when it comes to entrusting money, even with traditional financial institutions. For DeFi, credibility is even harder to earn. Few users would feel comfortable depositing their funds into a “decentralised” application secured by only a few validators. Consider the XRP Ledger, which has recently pivoted toward DeFi and real-world assets (RWAs) rather than its original mission to “replace SWIFT”. With fewer than 200 validators, its claims of decentralisation fail to meet the standards institutional liquidity demands. You can read more about XRP Ledger here.

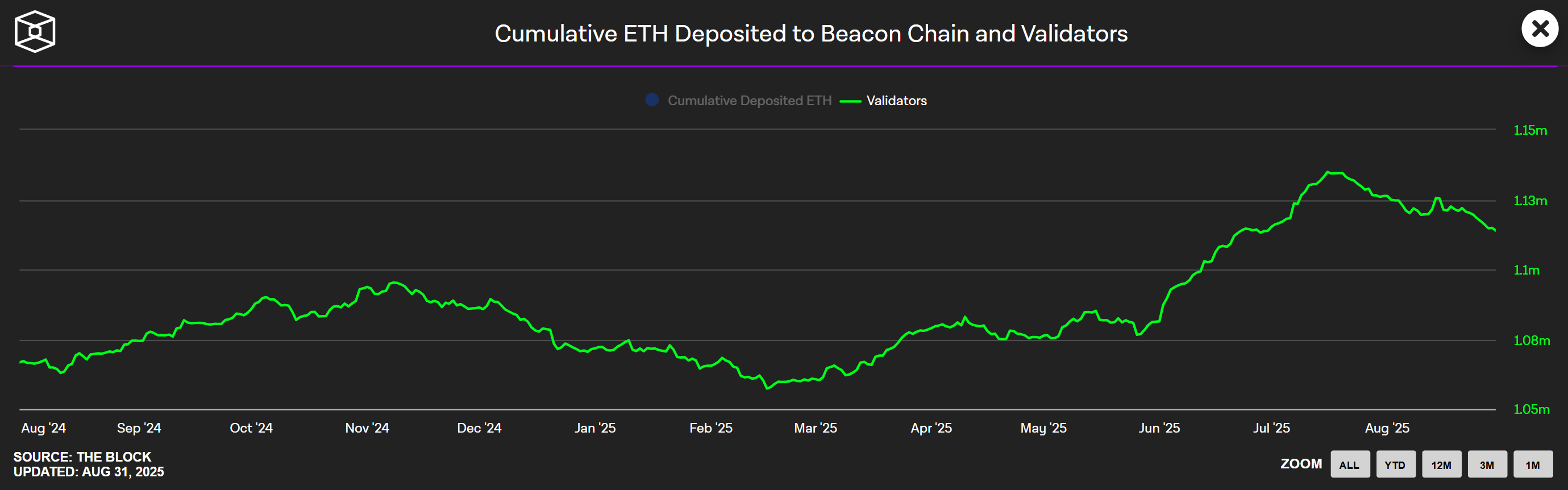

Number of Ethereum Validators

Ethereum, in contrast, is secured by over 1.1 million validators and over 11k Nodes, by far the largest set of any blockchain network. This figure is several magnitudes greater than the combined validator count of all other Layer-1s. For protocols like Aave, this is not just a technical detail, it is the very reason institutional-grade liquidity is possible. Simply put, true decentralisation is a prerequisite for mass adoption, and Aave understand this well.

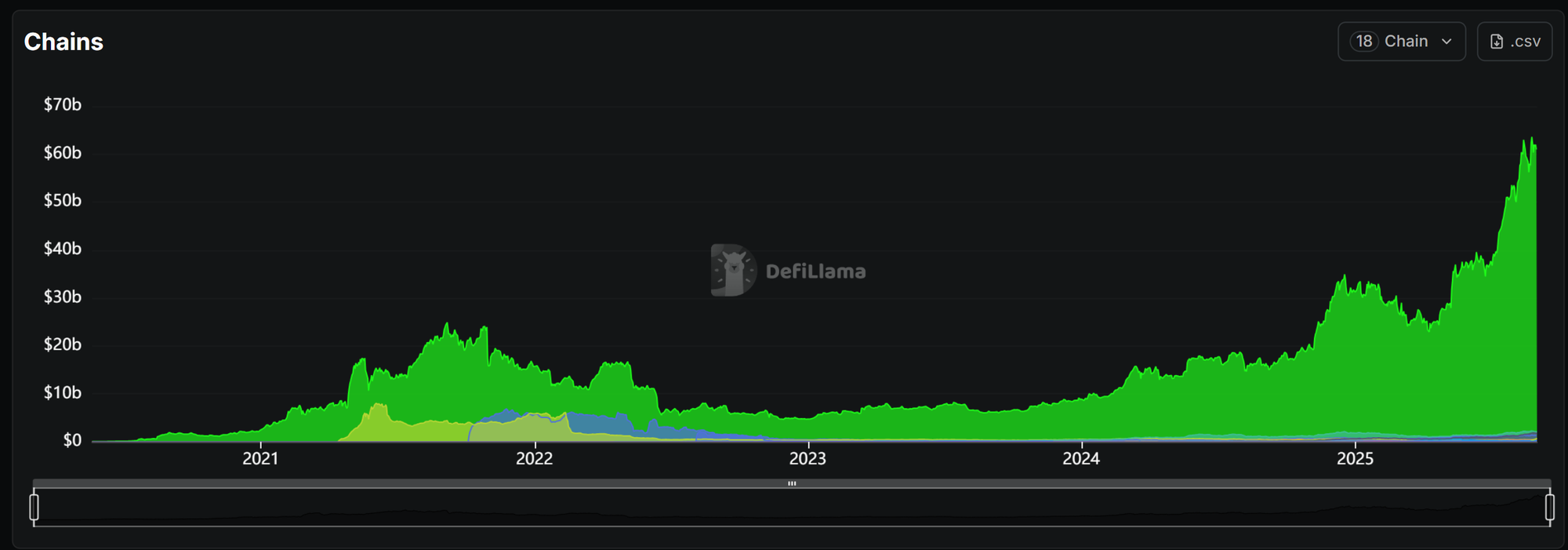

TVL on Aave by Chain

This is evident in Aave’s liquidity distribution. Out of its $68.3bn in TVL, a staggering $60.8bn (almost 90%), highlighted in green above, resides on Ethereum. The next largest pools are on Arbitrum ($2bn) and Base ($1.8bn), both of which are Ethereum Layer-2 networks and thus inherit Ethereum’s security. This is not a coincidence; it is direct evidence that users value decentralisation, and liquidity naturally gravitates toward the most secure environment. Beyond lending, entire DeFi subsectors, from liquid staking and restaking to decentralised stablecoins, thrive on Ethereum for the very same reason.

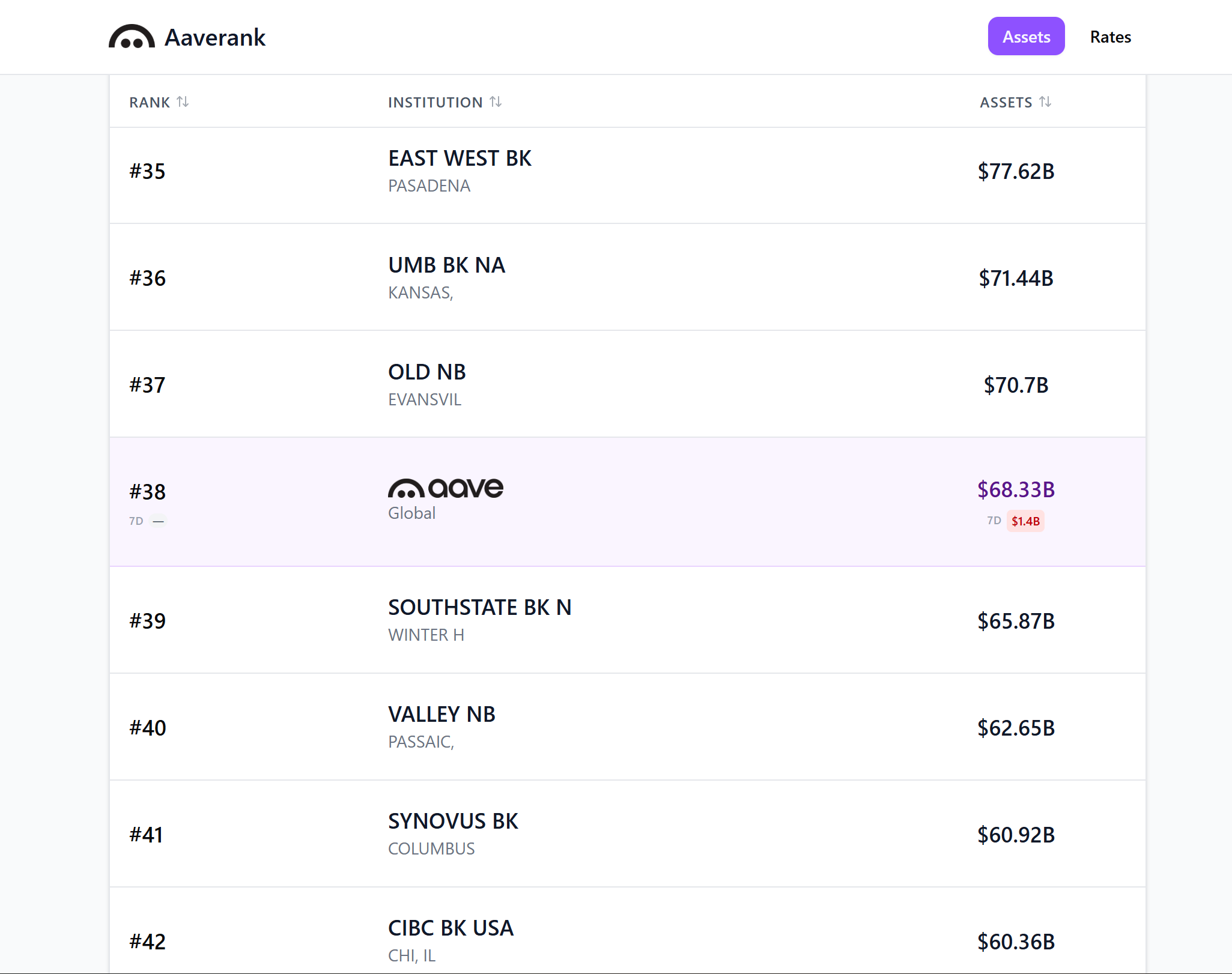

Aave VS US-Chartered Commercial Banks

To put Aave’s scale in perspective, its TVL – the deposits supplied by users to the protocol – sits in the same range as the consolidated assets of mid-sized U.S. commercial banks. While not directly comparable, since TVL represents supplied user funds (deposits) rather than assets owned, the numbers still provide a useful sense of relative scale.

If the protocol were treated like a bank, it would rank as the 38th largest US commercial bank in terms of consolidated assets. That places it ahead of institutions such as SouthState Bank, Barclays and Deutsche Bank. Aave’s TVL already represents over 10% of the consolidated assets of Capital One and Goldman Sachs Bank, 18.4% of State Street and 29.7% of First Citizens Bank.

Even when compared to the largest U.S. banks, the numbers are decent. Against consolidated assets of J.P. Morgan Chase, Bank of America, and Citibank, Aave’s TVL represents 1.8%, 2.5% and 3.7%, respectively. For a decentralised protocol operating entirely on-chain with zero physical branches, these are remarkable figures.

Aave’s growth trajectory shows little sign of slowing down. As DeFi adoption expands and Aave continues to broaden its suite of services, the protocol appears well-positioned to capture an even greater share of global liquidity, challenging not only other DeFi competitors but also traditional banks themselves.

How Does Aave Work?

At its core, Aave is a decentralised liquidity protocol. Instead of relying on traditional financial intermediaries, Aave enables users to supply and borrow assets through liquidity pools secured by smart contracts. This design ensures an open, permissionless marketplace for credit.