A Healthier World

Trade in Whisky;

We managed to avoid a global crisis in bonds for another week, and thank goodness for that. But we have come a long way, and the good news is that government debt and deficits have finally made front-page news. At the very least, that means the problem has now been flagged, and with a little luck, balanced budgets will make it back onto the political agenda.

Although, deep down, we all know this has to be done, but it isn’t easy, as we can see in France. Prime Minister François Bayrou has lost a confidence vote after just nine months, having failed to agree to essential spending cuts. He succeeded Michel Barnier, who managed just four months. This isn’t a great time to consider a career in politics in high-deficit countries.

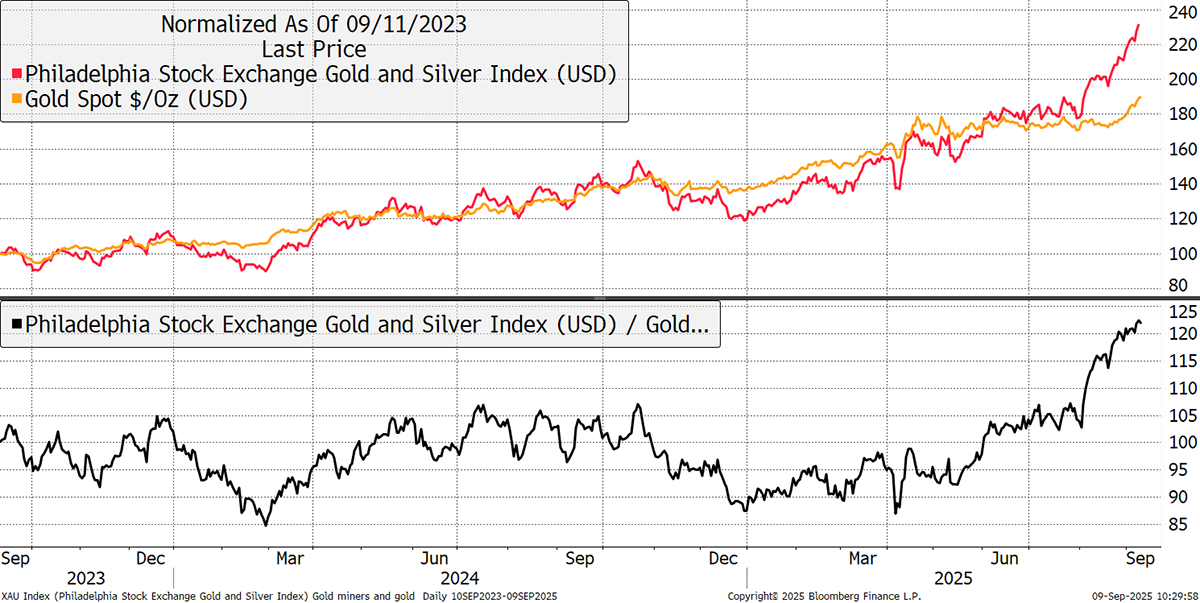

Gold is one of the beneficiaries, and the price is now high enough to see the gold miners accelerate after a few years of patience. The miners are now 25% ahead of the gold price over two years. The outperformance has begun.

Gold and the Miners

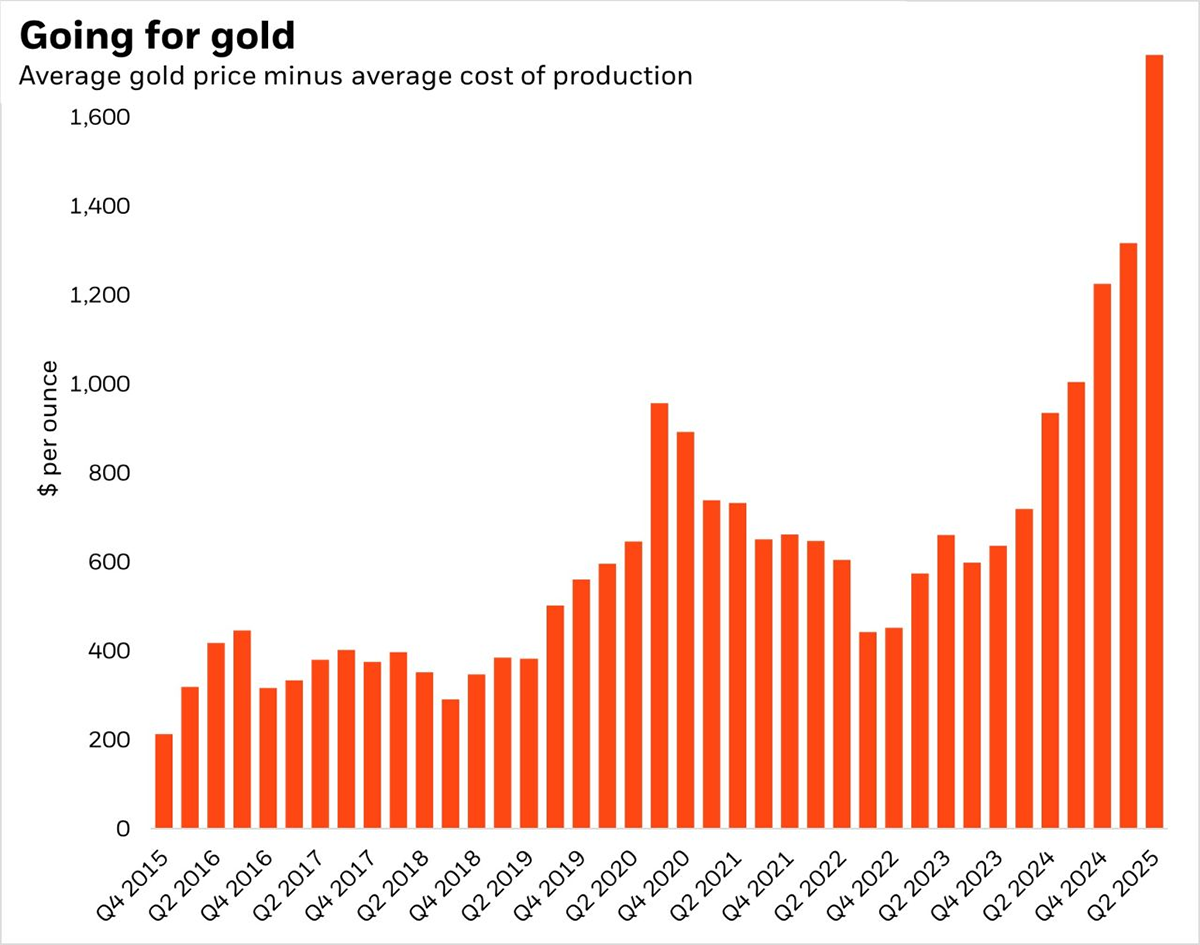

The manager of the BlackRock Gold Fund, Evy Hambro, published this chart showing the average gold price less the average cost of production for the sector. In late 2015, the spread was just $200 per ounce, and today, it is $1,600. Prices above $2,000 have seen profit margins soar, especially given how oil prices have remained so low, which is a miner’s largest cost.

How long can this go on? It’s an important question, which I will address, but the simple answer is that it can last for as long as the deficits. That is, when government debt and spending come under control around the world, the bond market will stabilise and demand for gold will fall. That can’t be close at hand because, while the ruling classes are finally aware of the issue, the electorate isn’t even close. The gold market is strong and not yet overbought. For the time being, we sit tight with gold, silver and the miners, and enjoy the sweet spot while it lasts.

Yet things are happening elsewhere, and I couldn’t help but notice the vitality in biotech stocks. According to the UK Bioindustry Association, Biotechnology is “a broad field that encompasses living organisms or parts of living organisms to make products, improve plants or animals, or develop new processes for various industries.”

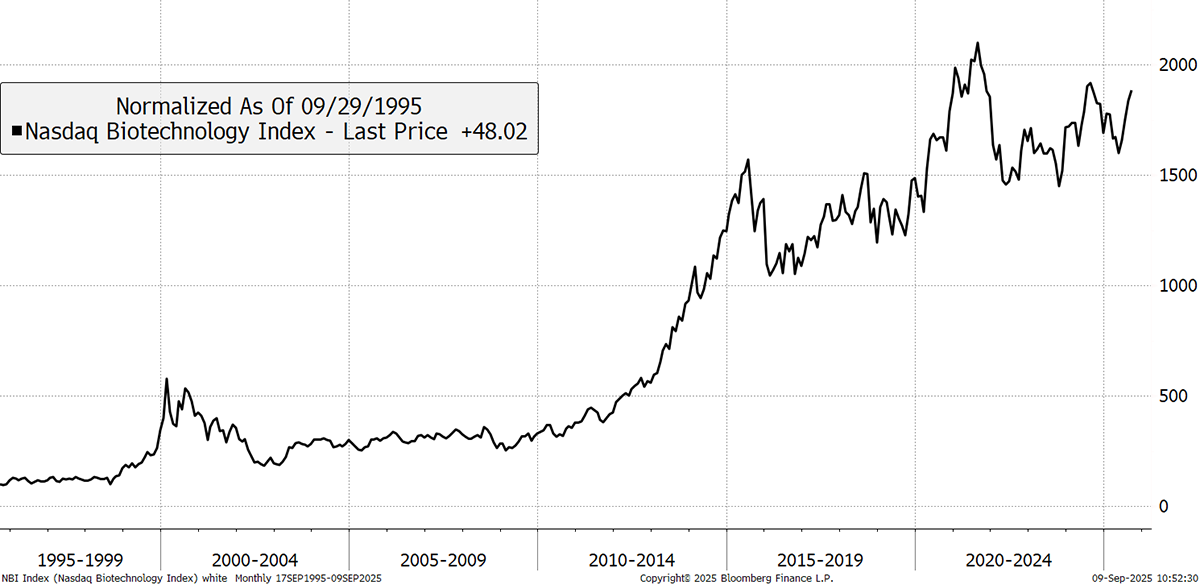

The Nasdaq Biotech Index tells the story well. It surged during the technology bull market in the late 1990s, when the biotech companies didn’t make any money. That changed around 2009, when the money started to roll in. There was a biotech surge into 2015, when incidentally the real economy was troubled (Greece, etc.), and a cooling off since. Today, that means prices are barely higher than a decade ago, in a fast-growing sector, and I smell an opportunity.

Nasdaq Biotech Index since 1995

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd