U.S. Policymakers Back Crypto for the Long Haul

ByteFolio Issue 170;

After a fortnight of consolidation, Bitcoin dropped to a low of $ 112,000 before stabilising around $ 114,000. It has also lost a star on ByteTrend, now holding a 4-star rating.

BTC in USD

While markets have been steady with minor fluctuations, behind the scenes, the regulatory winds in the US have shifted dramatically in crypto’s favour. The Policymakers are no longer comfortable risking crypto leadership happening offshore. With landmark policy like the GENIUS and CLARITY Acts, and the SEC’s launch of ‘Project Crypto’, the US is actively crafting a friendlier, more constructive regulatory environment.

As stated by the SEC chair, Paul Atkins, “the SEC will not stand idly by and watch innovations develop overseas while our capital markets remain stagnant. To achieve President Trump’s vision of making America the crypto capital of the world, the SEC must holistically consider the potential benefits and risks of moving our markets from an off-chain environment to an on-chain one.”

This new vision is a sharp departure from the enforcement-heavy posture of the past. The SEC now aims to bring crypto asset distributions back onshore, replacing legal ambiguity with clear, functional frameworks. These include clear rules to distinguish between different asset classes such as securities, collectables or digital commodities, making it easier for builders and investors to operate with confidence.

To further enable innovation, the agency is focusing on key pillars: tokenisation of traditional assets, modernisation of custody regulations with support for self-custody, and the launch of “super-apps”, platforms that combine services such as trading, custody, staking and lending, all operating under a single license.

The tokenisation race is already heating up. While the tokenised dollar is well underway, firms are now looking to bring equities on-chain. Coinbase recently announced plans to offer tokenised stocks, joining others like Robinhood, Kraken, and Gemini in what could become a new battleground in financial services.

In another landmark shift, the SEC recently clarified that liquid staking does not involve the offer and sale of securities. This decision comes as a relief for centralised liquid staking service providers. Just over a year ago, in June 2023, the SEC, then under Gary Gensler, charged Coinbase for offering liquid staking to its users, branding it an unregistered securities offering. That stance now appears reversed.

This also removes a major cloud over decentralised protocols like Lido, which now stand on more solid legal ground. For context, Lido’s total value locked currently stands at $32.25bn, making it one of the largest DeFi platforms globally.

The message is clear: regulatory clarity is no longer a far-off ideal, it’s happening now. And not just any clarity, but pro-innovation clarity, designed to empower entrepreneurs, protect investors and make America a launchpad for blockchain’s next era.

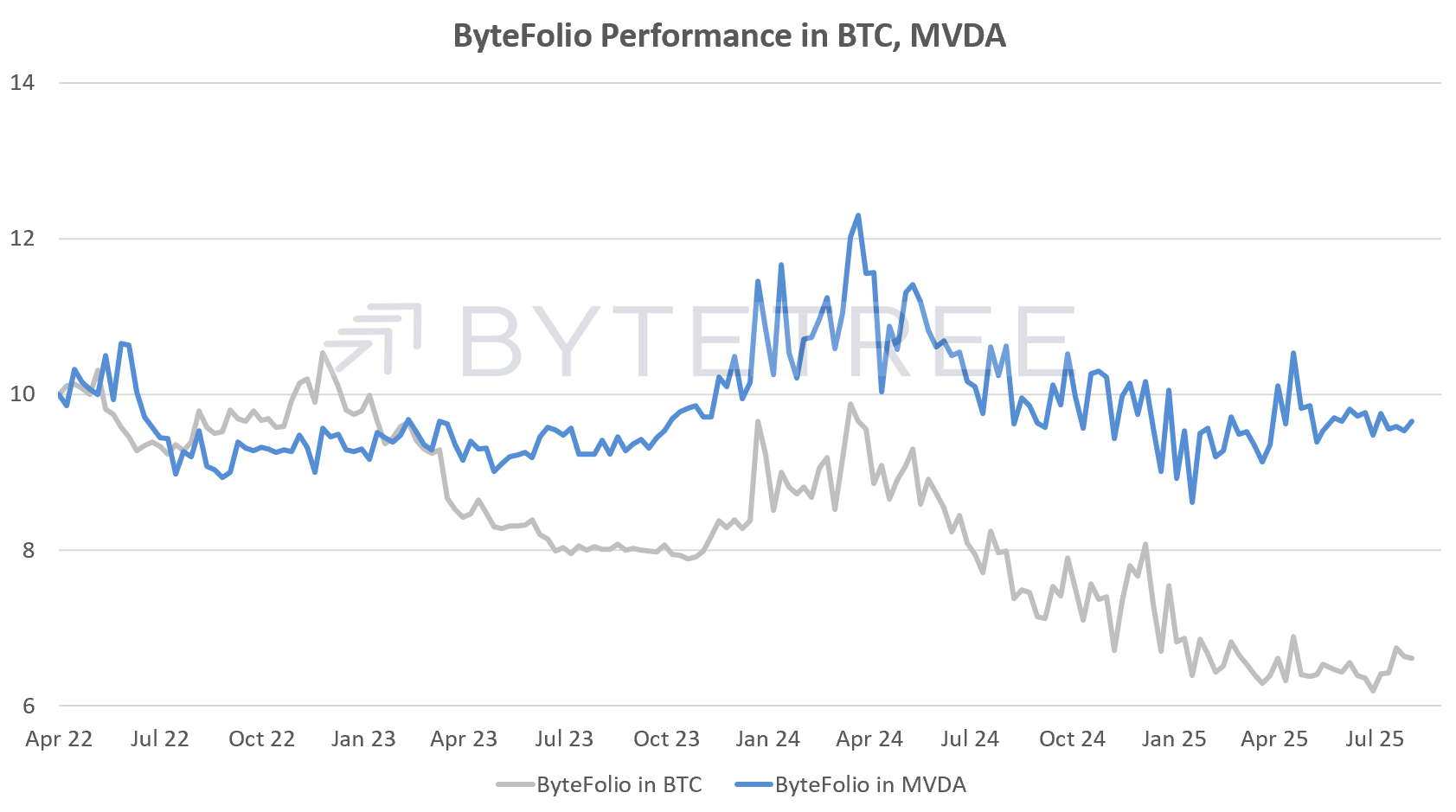

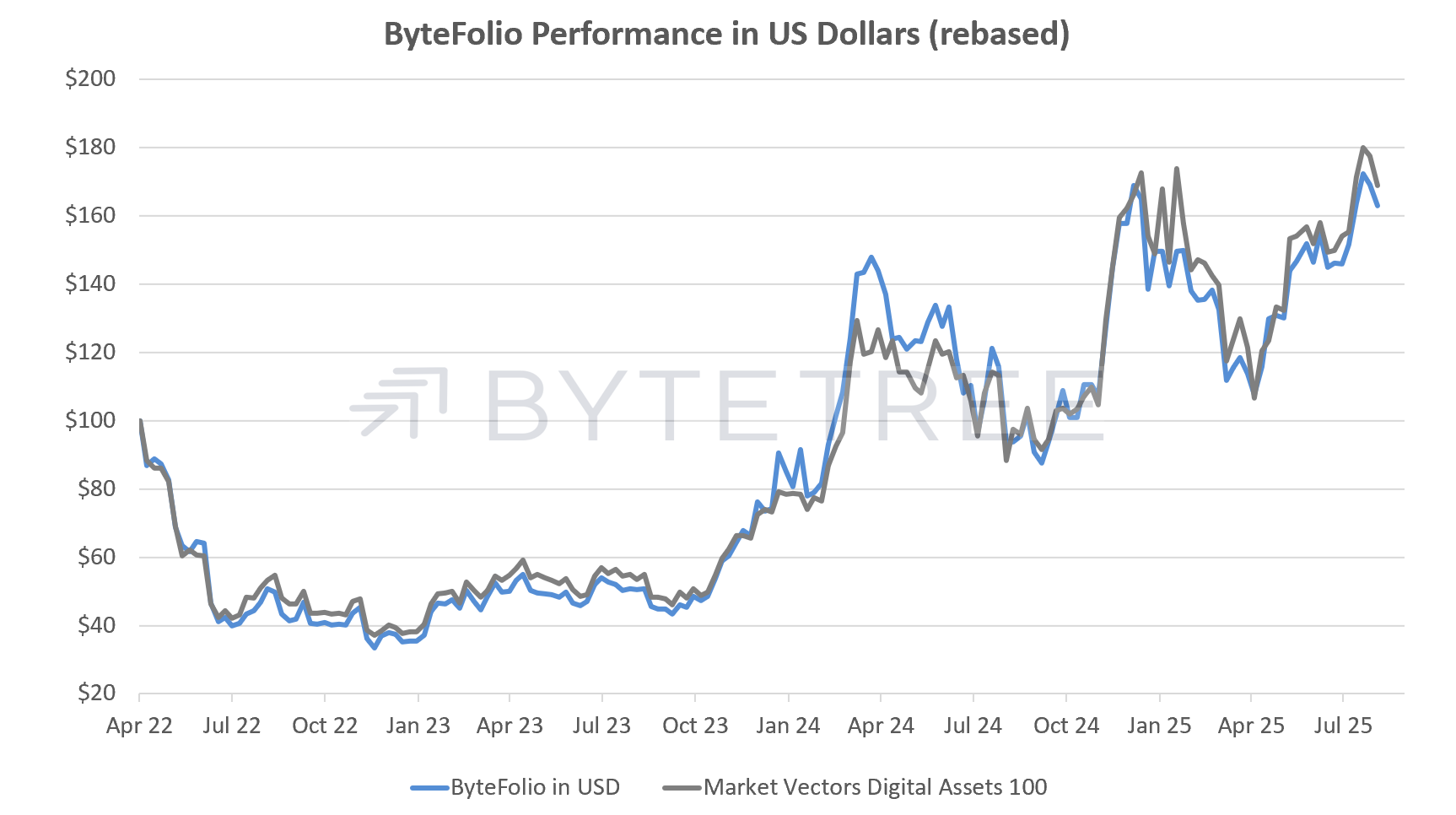

With ByteFolio trading near its all-time highs, the outlook has never been more exciting. I genuinely believe we’re still early. As global adoption expands, not just for Bitcoin, but for DeFi, altcoins, tokenization, and other verticals, the next phase of crypto will be even more transformative.

The groundwork is being laid. The doors are opening. And the best is yet to come.