Printing for Growth

Trade in the Whisky Portfolio;

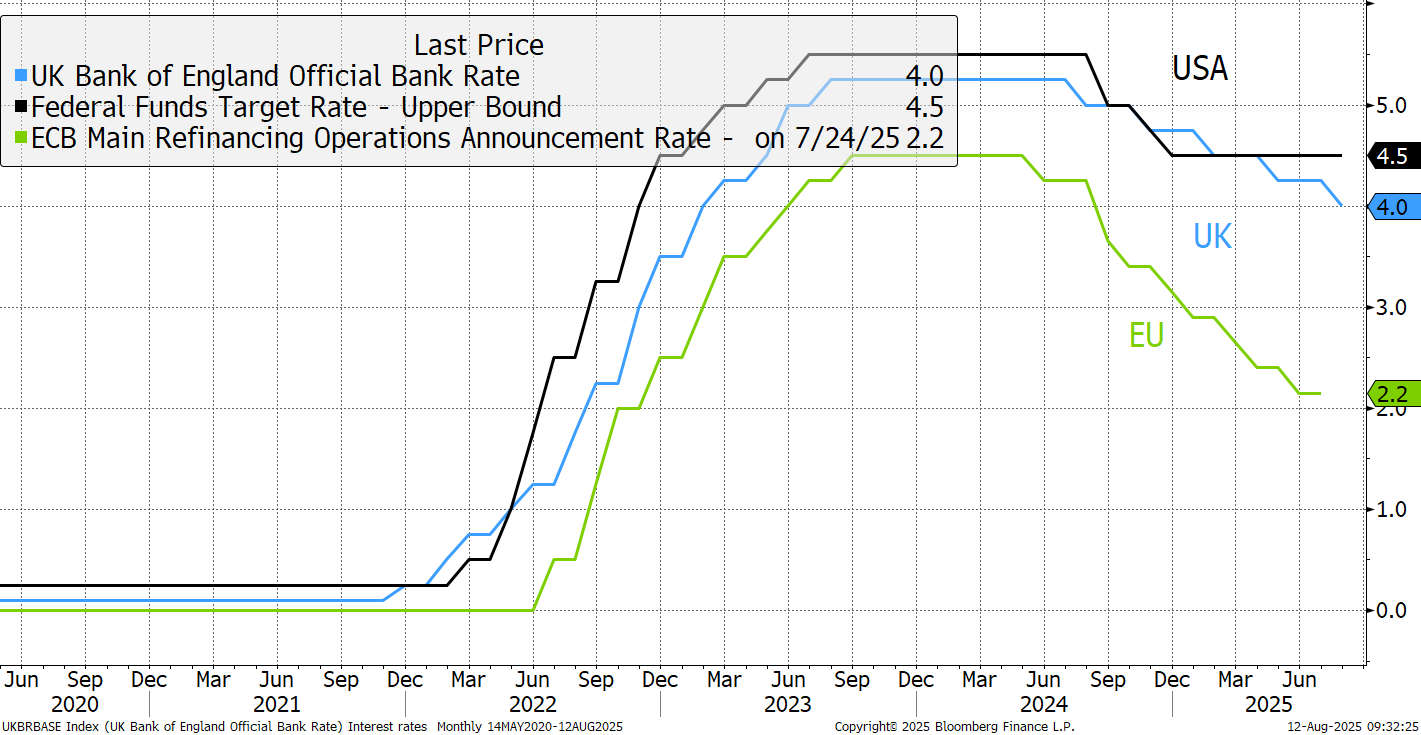

Last Thursday, the Bank of England cut interest rates by 0.25% to 4%. The ECB has already got them down to 2.2%, with the euro still performing well. In the US, the Fed has held them at 4.5% but is expected to cut to 4% in the autumn. The markets like this rosy outlook with easier monetary policy ahead.

Global Interest Rates

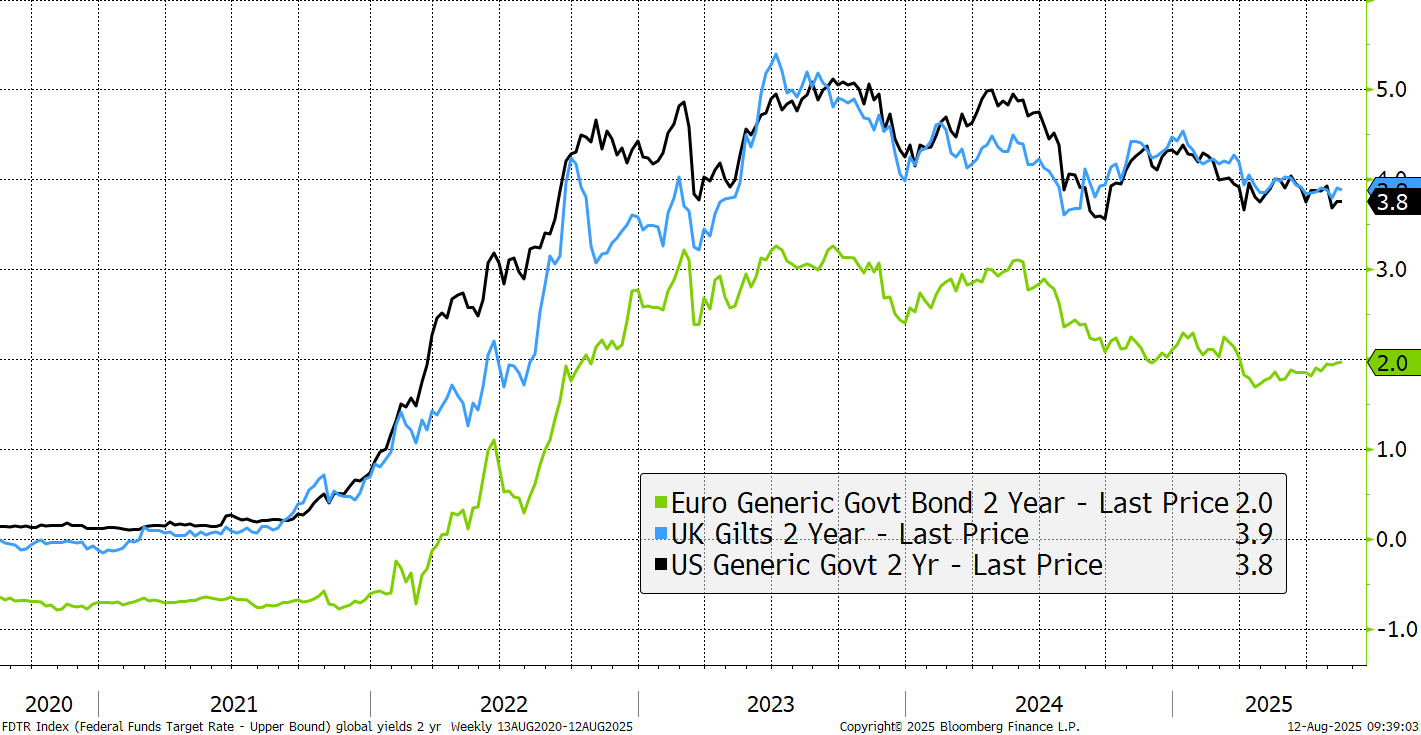

The rate cuts did little to drag down short-term bond yields, which implies that further rate cuts will be slow. This is important because if rate cuts were coming thick and fast, the 2-year yields would be plunging, and they are not.

Global 2-Year Bond Yields

The powers that be would like to see lower rates, but markets seem resistant to the idea. Yet if rates can only fall slowly, the other weapon is the money supply. Whenever there is a sense that things could go wrong, more money has been pumped into the financial system.

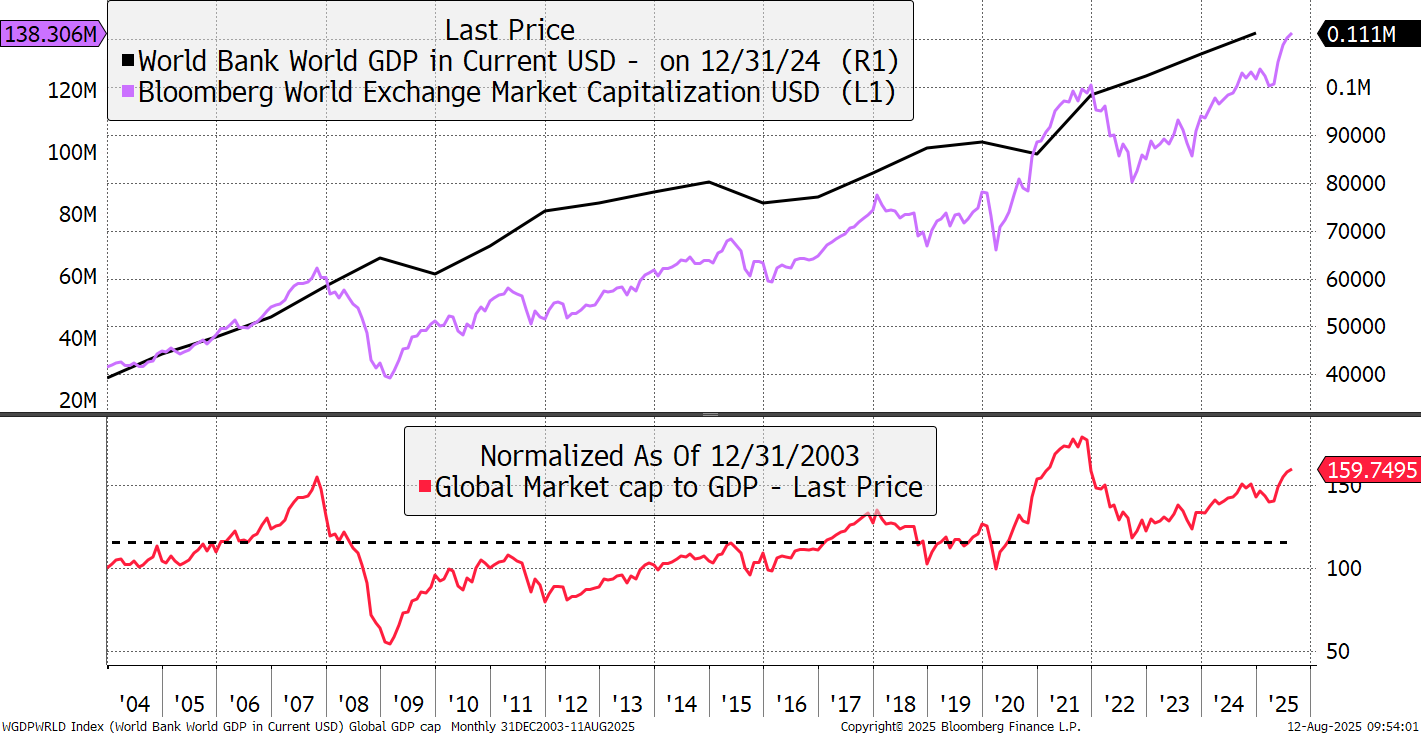

When we look at the value of all global equities relative to global nominal GDP, stockmarkets appear to be red hot, with the ratio above 2007 levels, and not far off the all-time high in 2021. Little wonder old timers like me are on permanent bear market watch.

Global Equity Value versus Global Nominal GDP

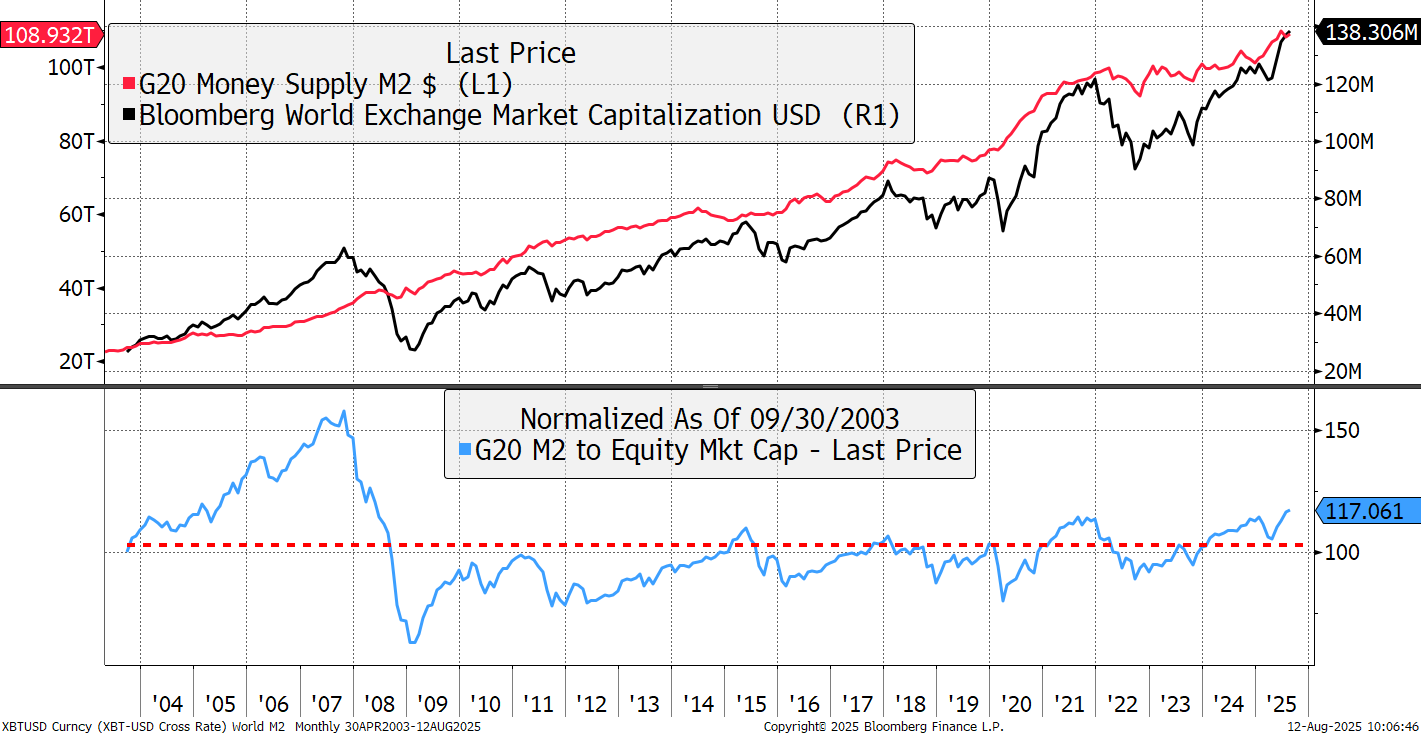

Curiously, when you do the same exercise against the money supply instead of GDP, equities look far less stretched, and only slightly above normal levels. It also suggests that these phenomena are linked, and money supply drives asset prices. The better news here is that we are a long way off the 2007 peak, which was a gargantuan credit bubble, but still, rising into elevated territory.

Global Equity Value versus Global Nominal GDP

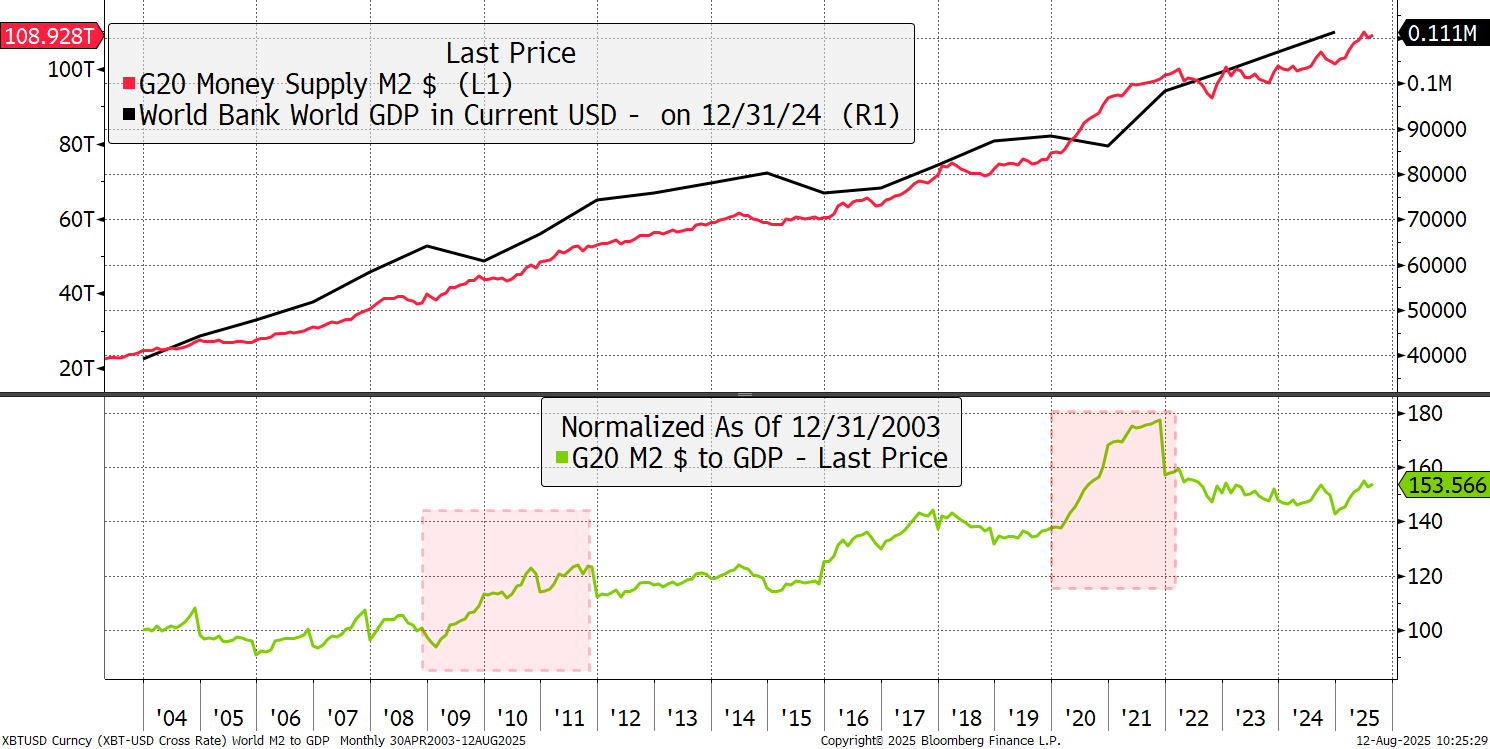

Finally, to compare global nominal GDP growth against the money supply, we can see that there is 53% more money in circulation today compared to the size of the economy than there was 20 years ago. Moreover, whenever we have seen a surge in money (red boxes), inflation has followed. It also seems likely that a new rally has begun (green line) and perhaps bonds yields acknowledge that, with their resistance to fall.

Money Supply versus Global Nominal GDP

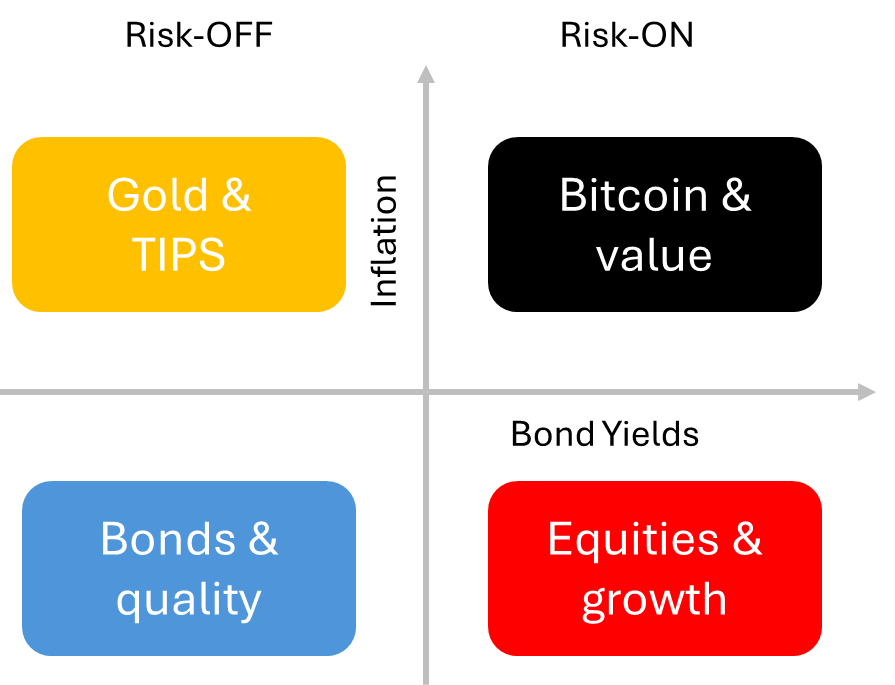

With higher rates, and the potential for inflation to reignite, we go back to the black box in the money map. The banks sit in there, amusingly alongside bitcoin.

Some question whether banks are resilient against inflation, but look no further than Argentina, Venezuela, Turkey, Pakistan, or Zimbabwe. High inflation countries see their stockmarkets shaken with valuations being the first casualty, followed by the number companies listed. Once the impact of inflation has been fully absorbed by the market, the fewer remaining stocks are all related to hard assets such as commodities and industry, soon followed by the banks. The service industries simply disappear.

Remember, it’s not the banks’ money that is being inflated away. The banks receive high interest rates and pay out much less, leaving a healthy margin regardless of the demise of their asset base. That’s why banks sit in the top right box, and had such a struggle in the low rate, low inflation era post 2008.

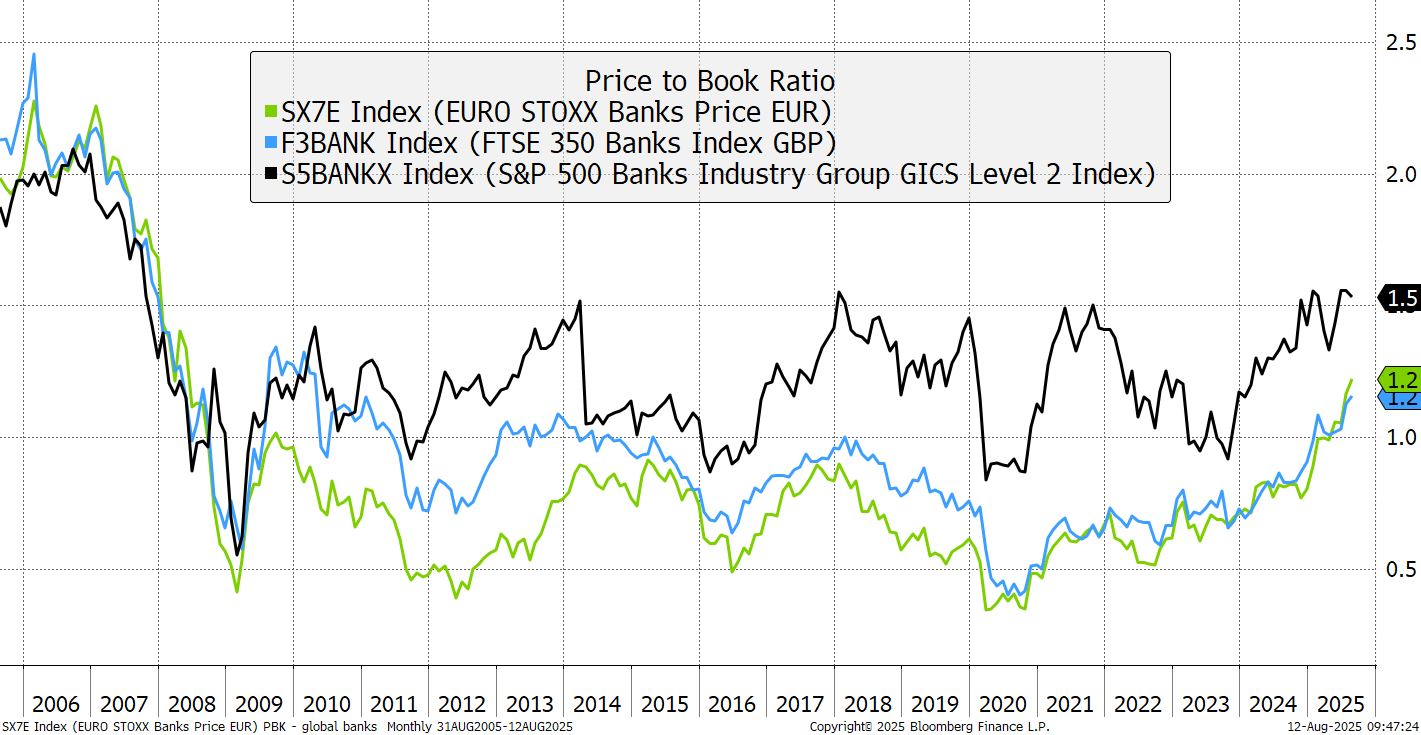

The US banks were much quicker to recover than in the UK or Europe. But today, we see price to book valuations in Europe above 1 and potentially headed back to US levels. Not only that, but the well managed banks are seeing their asset values rise. This means the banks are not just fixed, but once again thriving institutions, having absorbed many years of monetary and regulatory hell.

Global Banks Price to Book Ratio

I try not to regret investment mistakes, but I do wish we had owned more banks in recent years. It’s never too late.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd