Investors Flock to Gold

UK Gilts Drift;

The 30-year gilt yield is up again and looks poised to move higher.

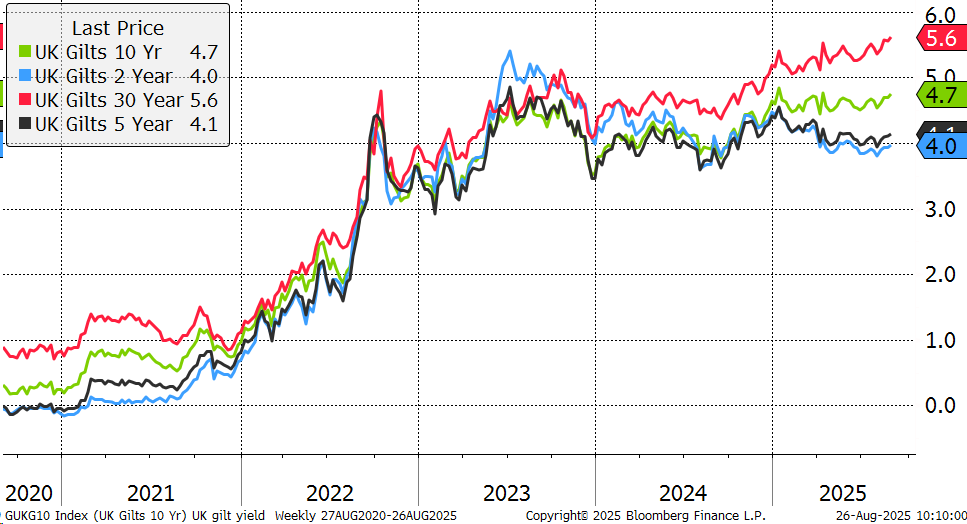

This should be the safe asset for investors seeking certainty. But as yields rise, prices fall, and it is hard to know where this ends. The shorter dated 2- and 5-year yields are heavily influenced by the interest rates set by the Bank of England. The normal reason for rising yields is higher growth or compensation for future inflation. It’s unlikely to be growth.

See how The Multi Asset Investor can help you.

UK Gilt Yields

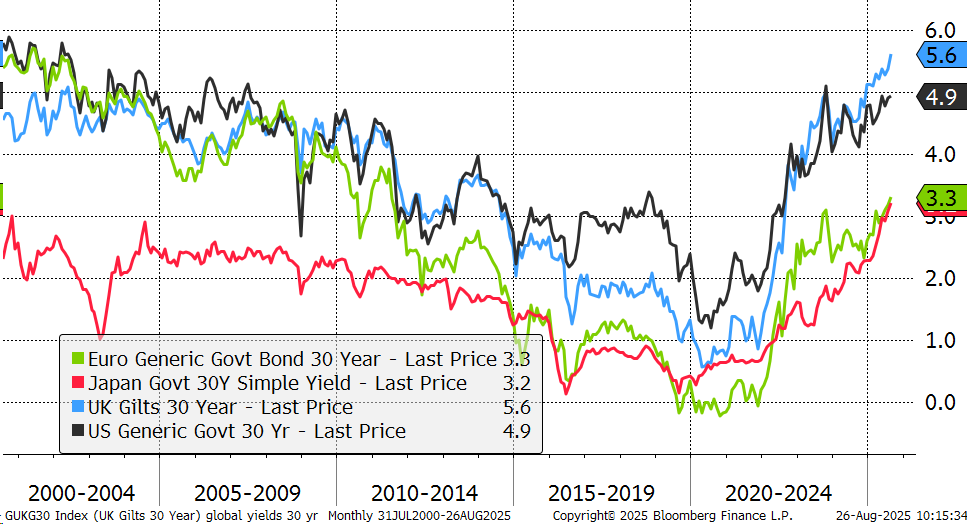

Rising 30-year bond yields is a global trend, but the UK leads the way. The curious thing is that longer-term inflation barometers remain muted, and so we have to instead believe the issue relates to issuance. The short-dated bonds are anchored to interest rates, but the long bonds are not. Given the scale of government issuance, we have to assume it is related to that. If there are more sellers than buyers, prices fall. There is too much government debt to be absorbed by investors and so prices fall, while yields rise.

Global Government 30 Year Yield

Yields are rising to find the point where they attract investors, and eventually, they will. The bad news is that governments will have to fund their deficits with shorter-dated bonds, as long-term rates are too high. That is the equivalent of funding your house, not with a 25-year mortgage, but with short-term loans. It’s risky, and time is not on your side.

The good news, if I can call it that, is that stockmarkets would be more heavily impacted if short-term funding rates were rising, rather than long-term rates, as the impact on funding would be more immediate. That isn’t happening yet, but we can’t run large deficits indefinitely without something breaking. Luckily, we seem to have the antidote.

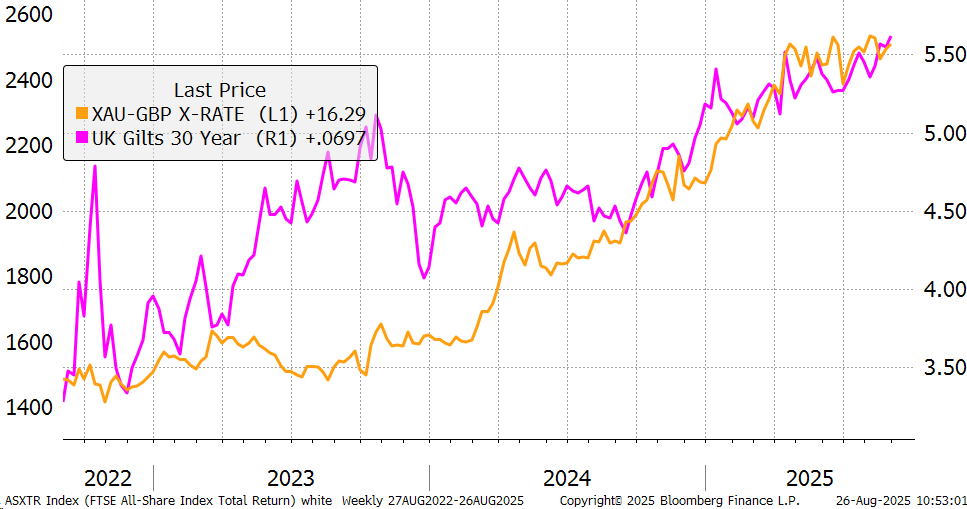

Gold has traditionally benefitted from easy money, the combination of bond yields below inflation. Something has changed as gold now seems to be enjoying these higher yields. We’ve had 20 years of positive correlation between gold and bond prices (low yields, strong gold), and recently the correlation has turned negative. Unlike bonds, where supply is unlimited, gold is a scarce asset.

Gold and the 30 Year Gilt Yield

I believe that if the bond market continues to sour from here, gold will continue to provide protection to our portfolios.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd