Ethereum Steals MicroStrategy’s Thunder

ByteFolio Issue 171;

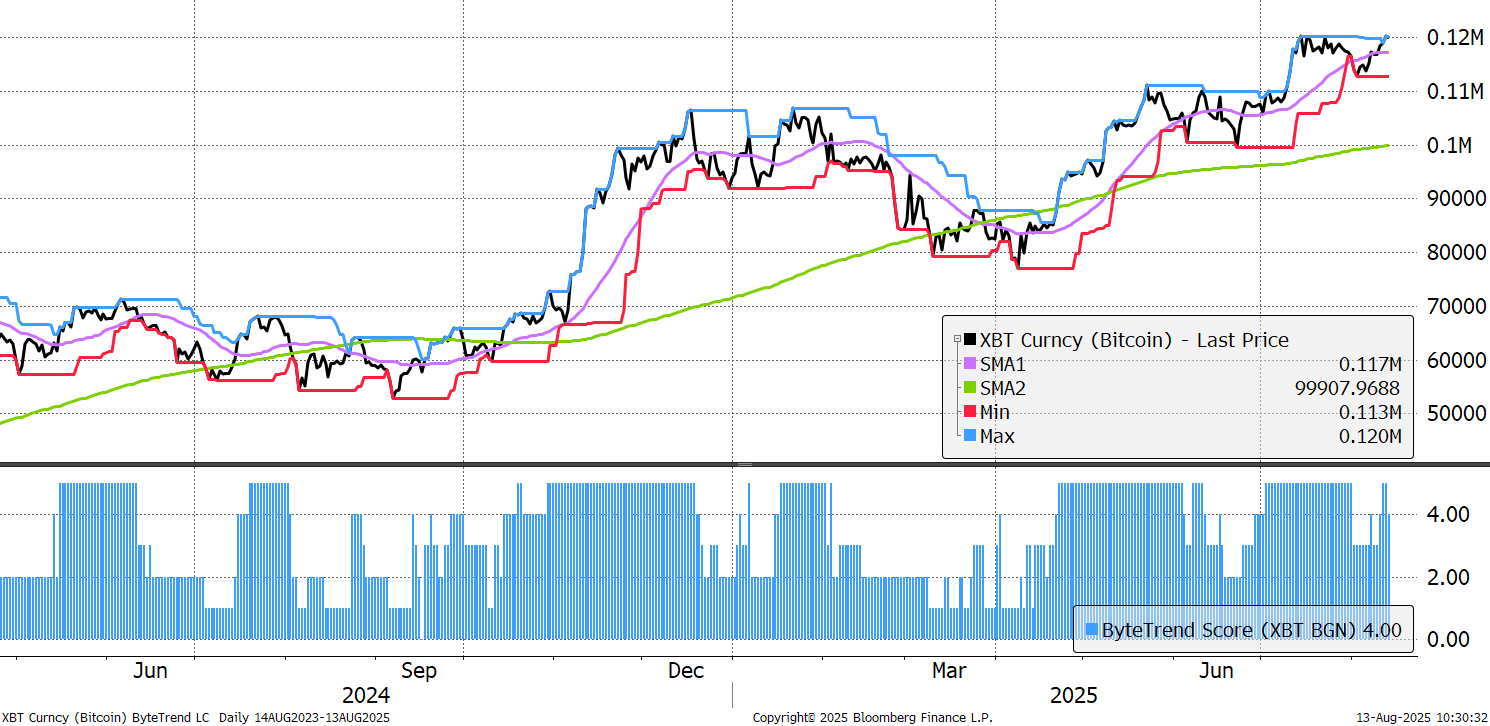

It may be a slow bull market by historic standards, but it’s a bull market, nevertheless. Bitcoin has a ByteTrend score of 5 and is on the verge of a new all-time high. Stay bullish.

Bitcoin Bull Market

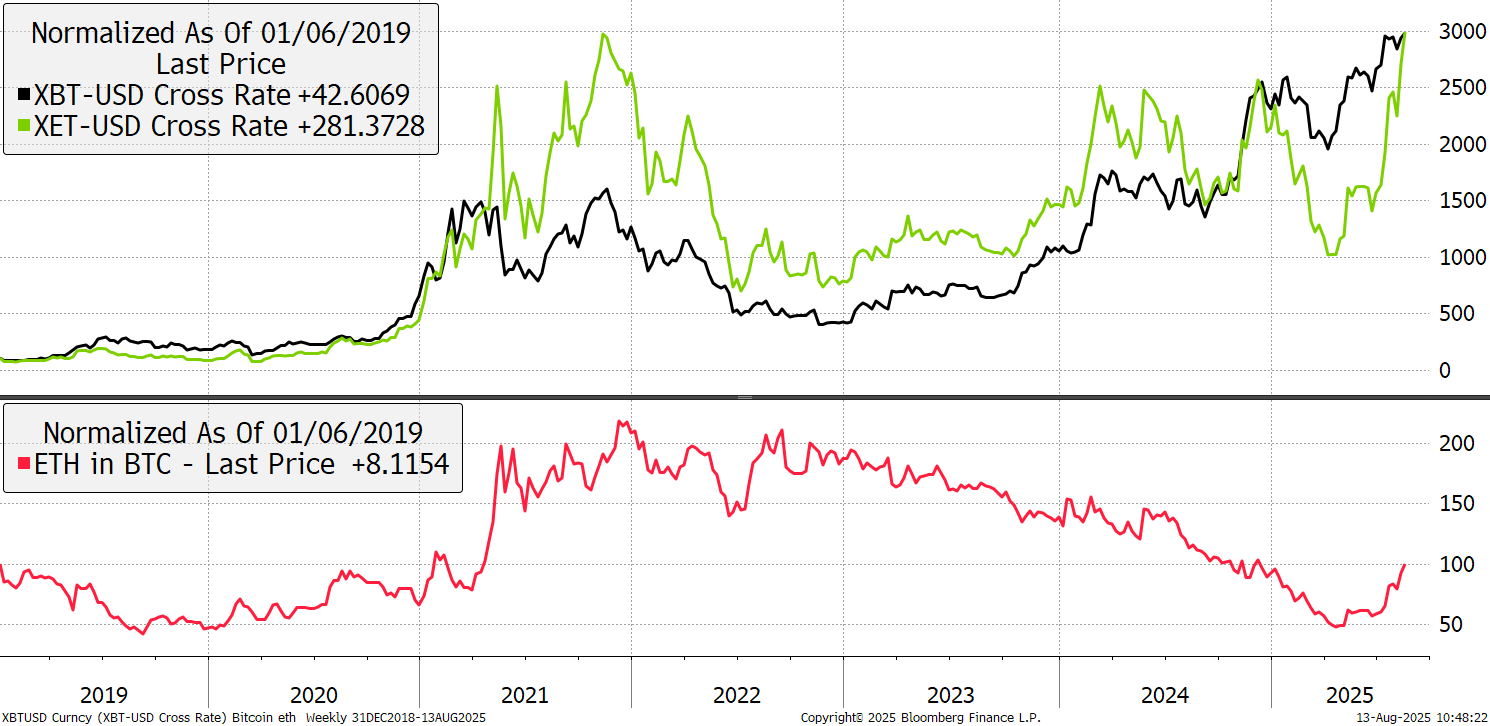

The crypto energy has shifted to Ethereum, which has surged since the April Trump dump. Once again, ETH now has the same 30x return as Bitcoin since the end of the 2018 crypto bear market. Remarkable! Of course, in terms of mkt cap, they are still 4x apart.

Ethereum Catches Up

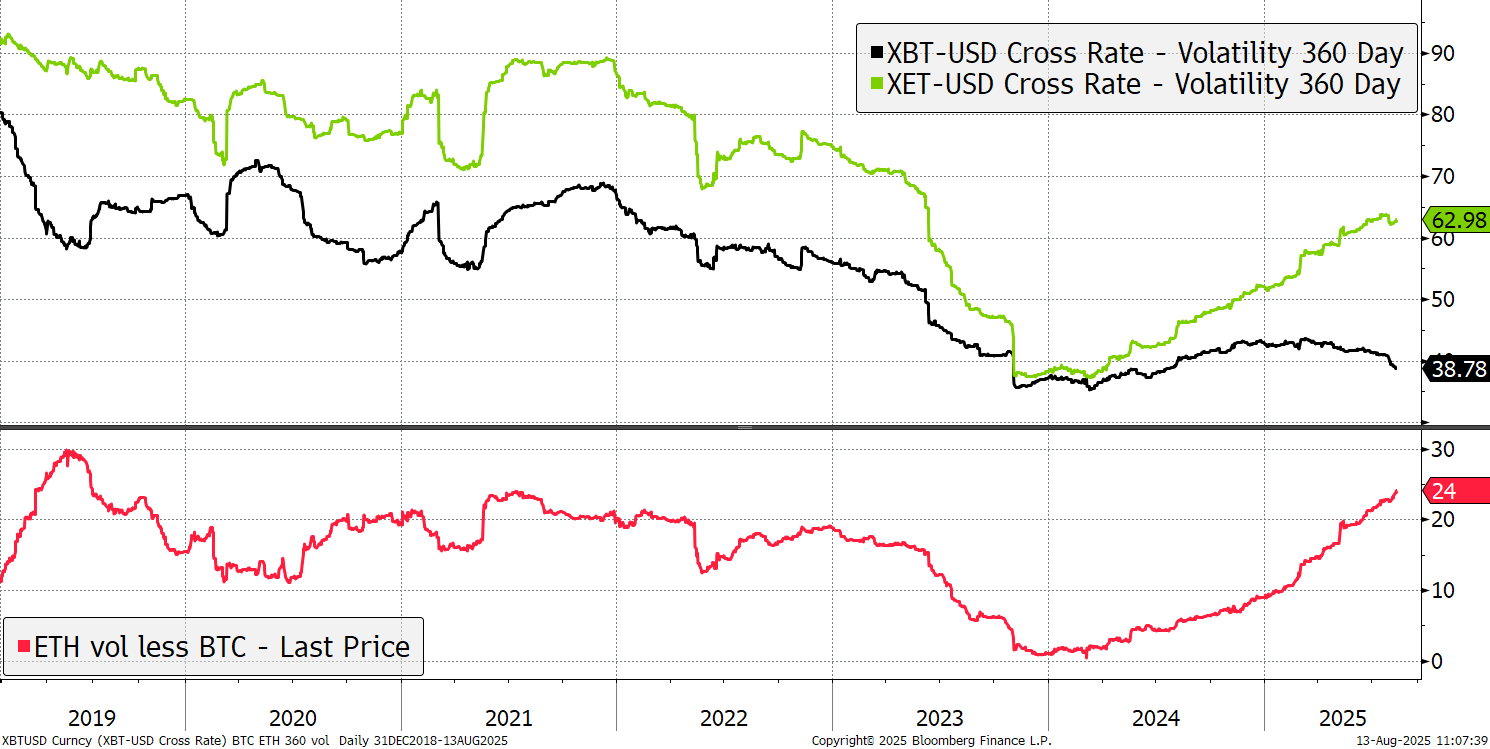

Bitcoin has become a 38% volatility asset, which is similar to Starbucks, BP, or Goldman Sachs. Ethereum, on the other hand, has 62% volatility, a level normally associated with companies going through a rough patch. Novo Nordisk, Twilio, or Block currently have similar levels of volatility to ETH. The fact that an ETH rally sees volatility rise is not a good thing because it highlights how speculative it is. Notice how Bitcoin volatility is still falling.

Bitcoin and Ethereum Volatility

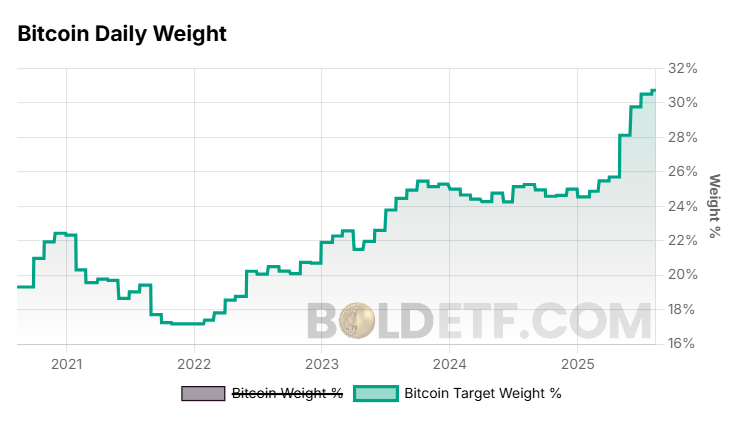

Bitcoin has delivered the same returns as Ethereum with lower volatility, which demonstrates how it is becoming a mainstream asset. Its volatility is still falling, which means liquidity is vast, and institutional adoption keeps on growing. ByteTree’s Bitcoin and Gold Index (BOLD) reflects this. In 2022, Bitcoin made up 19% of BOLD, and now 31%.

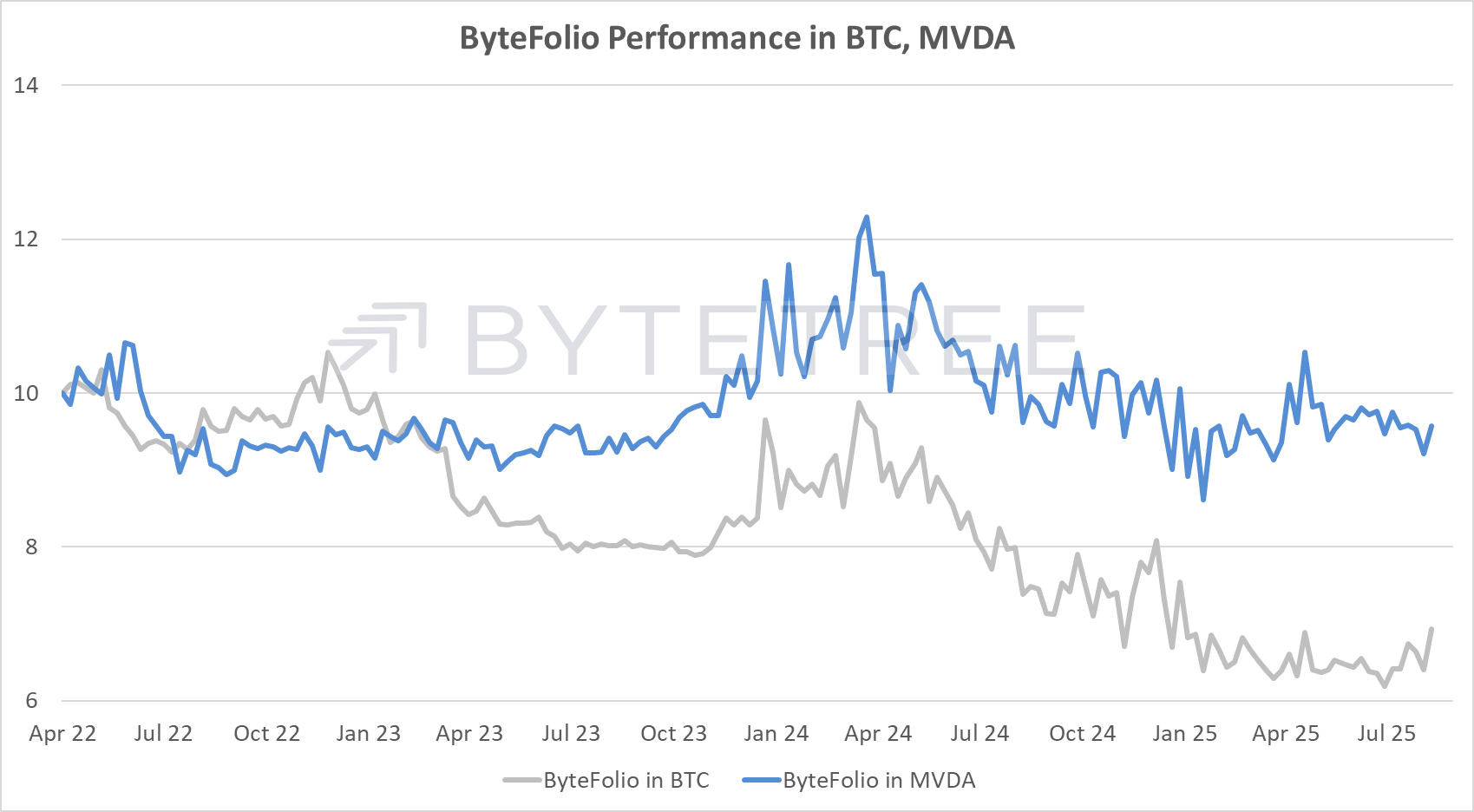

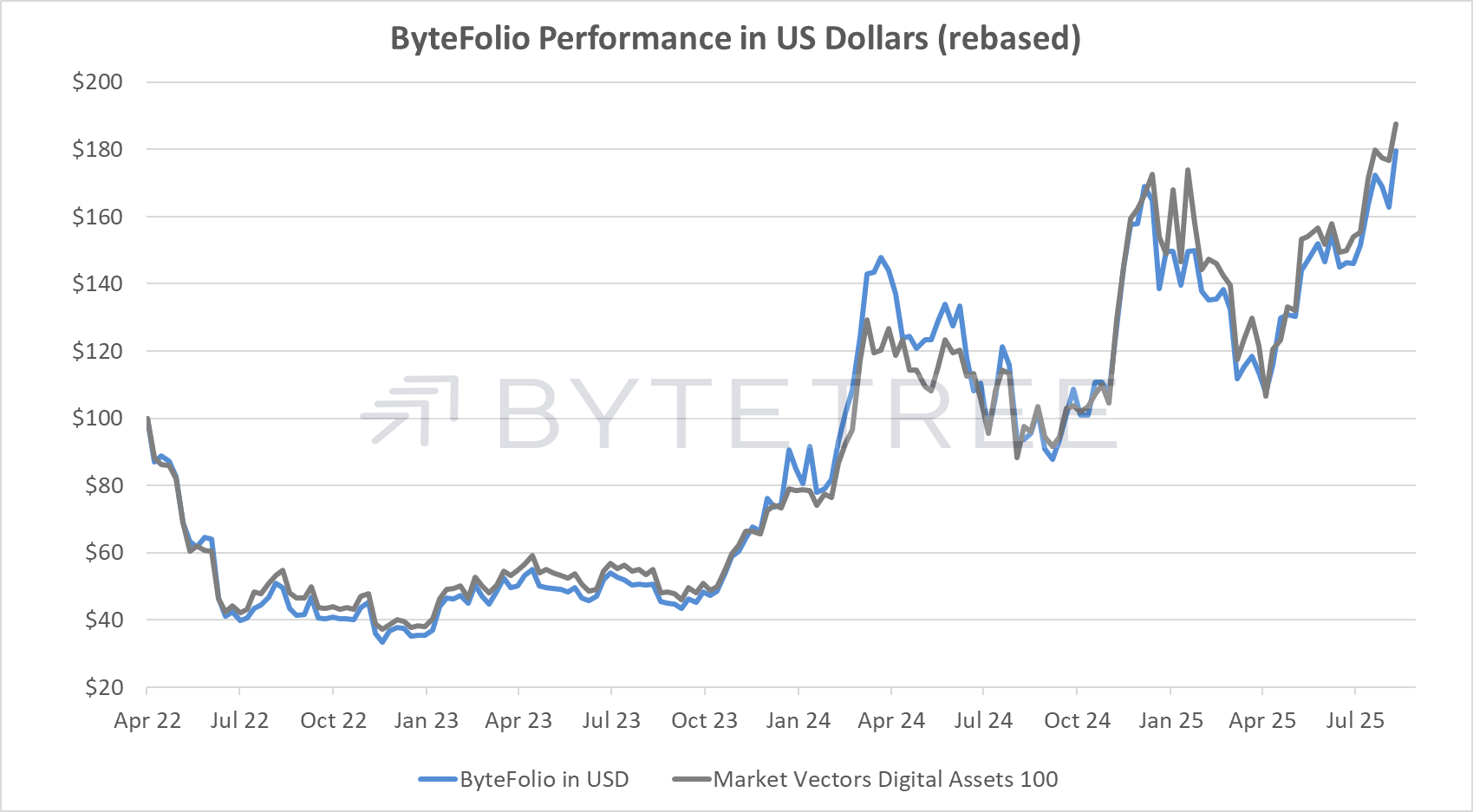

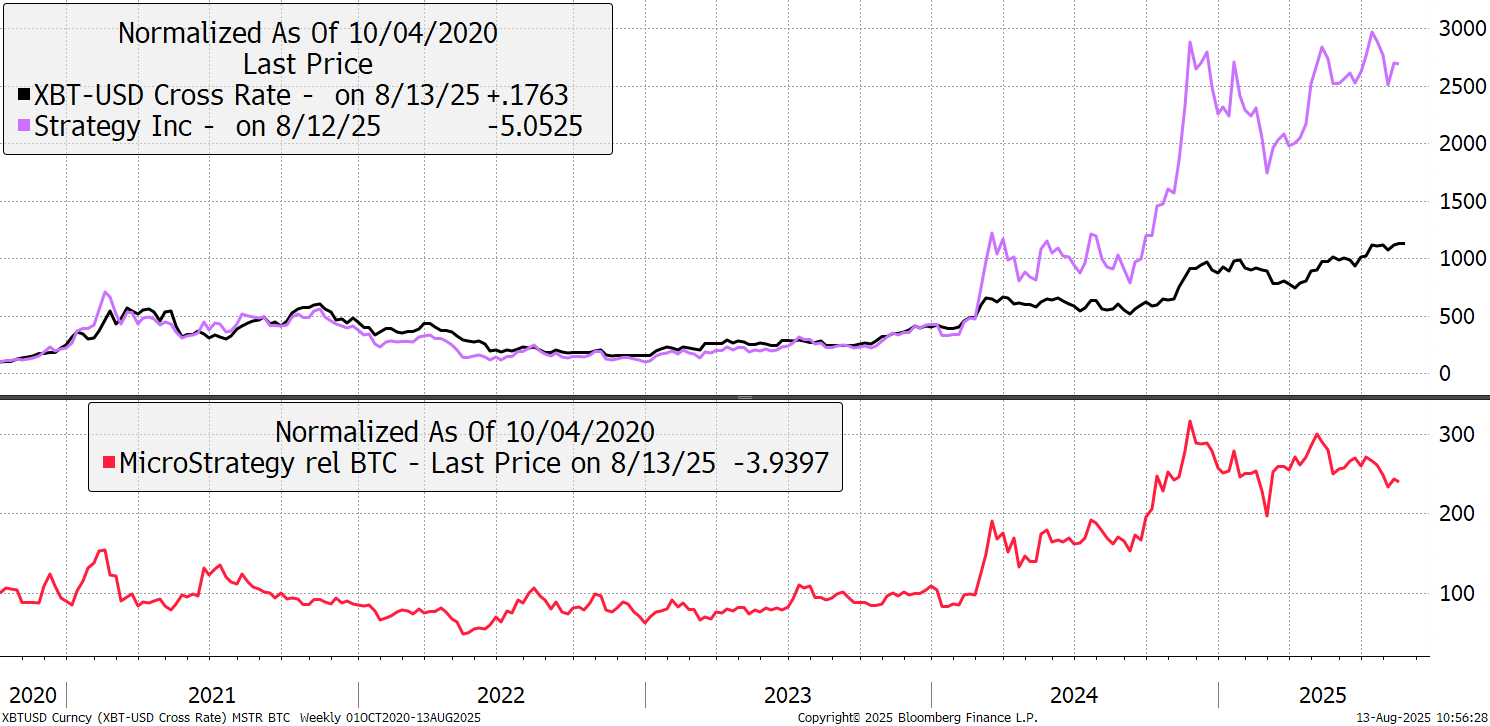

Still, a good thing the ByteFolio bought Ethereum in recent months, because we caught the rally with an 83% gain. Ethereum has not only stolen the limelight from Bitcoin, but also from MicroStrategy (Strategy). As a Bitcoin hoarder, it has had a specular post 2022 bull market yet is starting to lag (red).

Bitcoin and Strategy

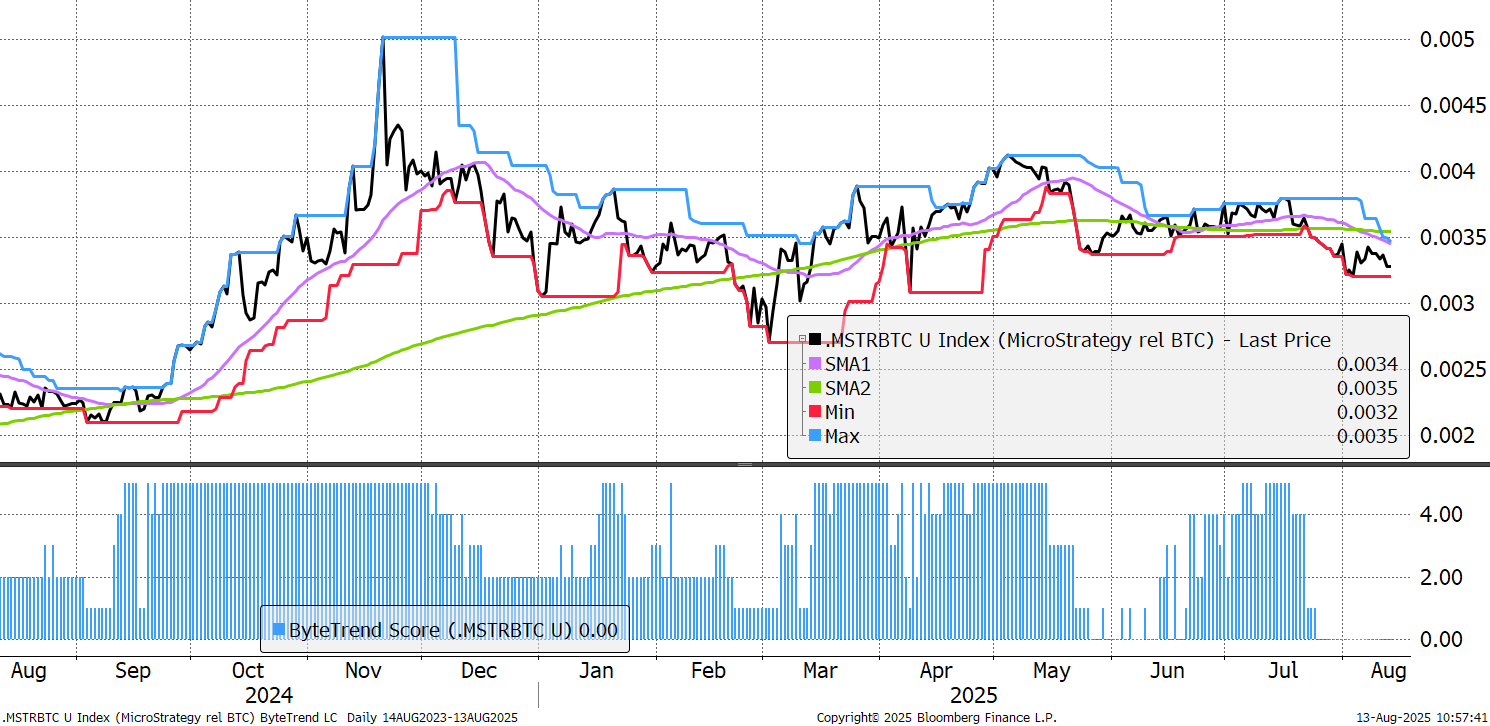

Taking that red line and overlaying ByteTrend, and you get a sense of the premium – or more accurately, the relative performance. The ByteTrend Score is 0, which is not a good sign. Strategy still trades at around twice the value of its Bitcoin held.

Strategy lags Bitcoin

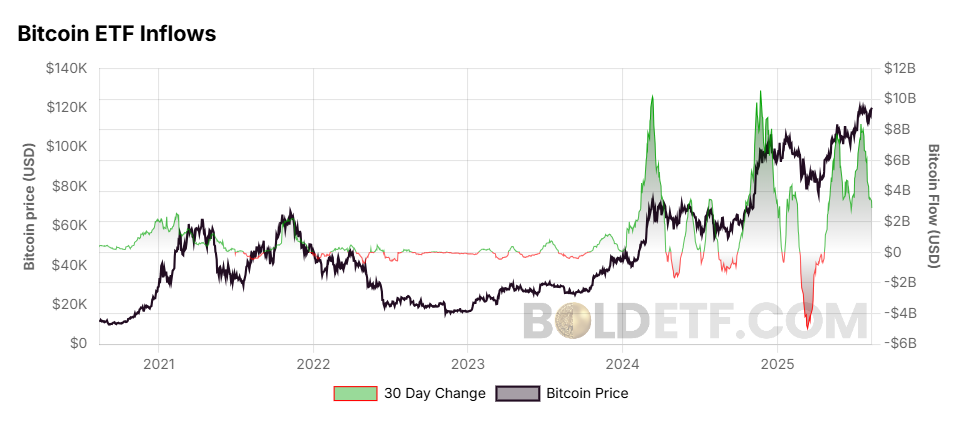

I believe the release of Bitcoin ETPs for retail investors in the UK on 8 October will be a much bigger deal than markets expect. It will impact the global fund scene with any connection with London, and that opens up a large and new source of potential demand. Expect UK and European Bitcoin flows to take off as the institutions arrive on the scene. Global Bitcoin ETP flows have been great, but over the past 30 days, they have been cooling. But never bet against Uptober. This year should be a double whammy.

By the way, Bitcoin ETFs, ETPs, or ETNs are the same thing so far as investors are concerned, as they accurately match the price of the underlying asset and provide liquidity. In the USA, they call them ETFs, but in Europe, ETPs or ETNs. P is for product, and N is for note. Under European law, funds must be diversified with many rules around that, and so in Europe, ETFs generally refer to funds (equities, bonds, etc.).

Single asset products are structured as debt notes rather than funds. This doesn’t mean they are unbacked by assets, they are fully backed, nor does it mean they have debt, they don’t. This is exactly the same structure used for gold “ETFs”, which are, of course, ETPs or ETNs. The US Bitcoin ETFs, which Gary Gensler referred to as ETNs, are in no way superior to European ETPs. All of the well-known gold, silver, Bitcoin and Ethereum products are fully backed by the underlying asset.

The internet has gone wild on this one.