Trade in the Soda Portfolio;

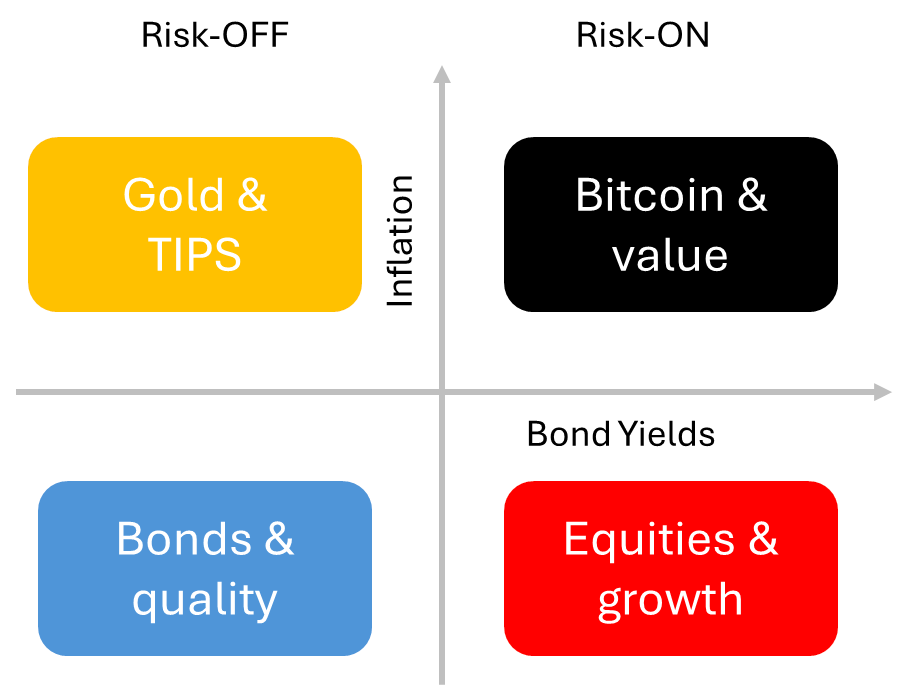

Last Friday, I issued a Flash Note for the first time since April. A few things came together, such as a rally in the US dollar, a drop in bond yields, and a strong move in the yen. These are all associated with Risk-OFF market conditions, and so I reduced some exposure in the Whisky Portfolio, focusing on companies that were starting to feel the pinch.

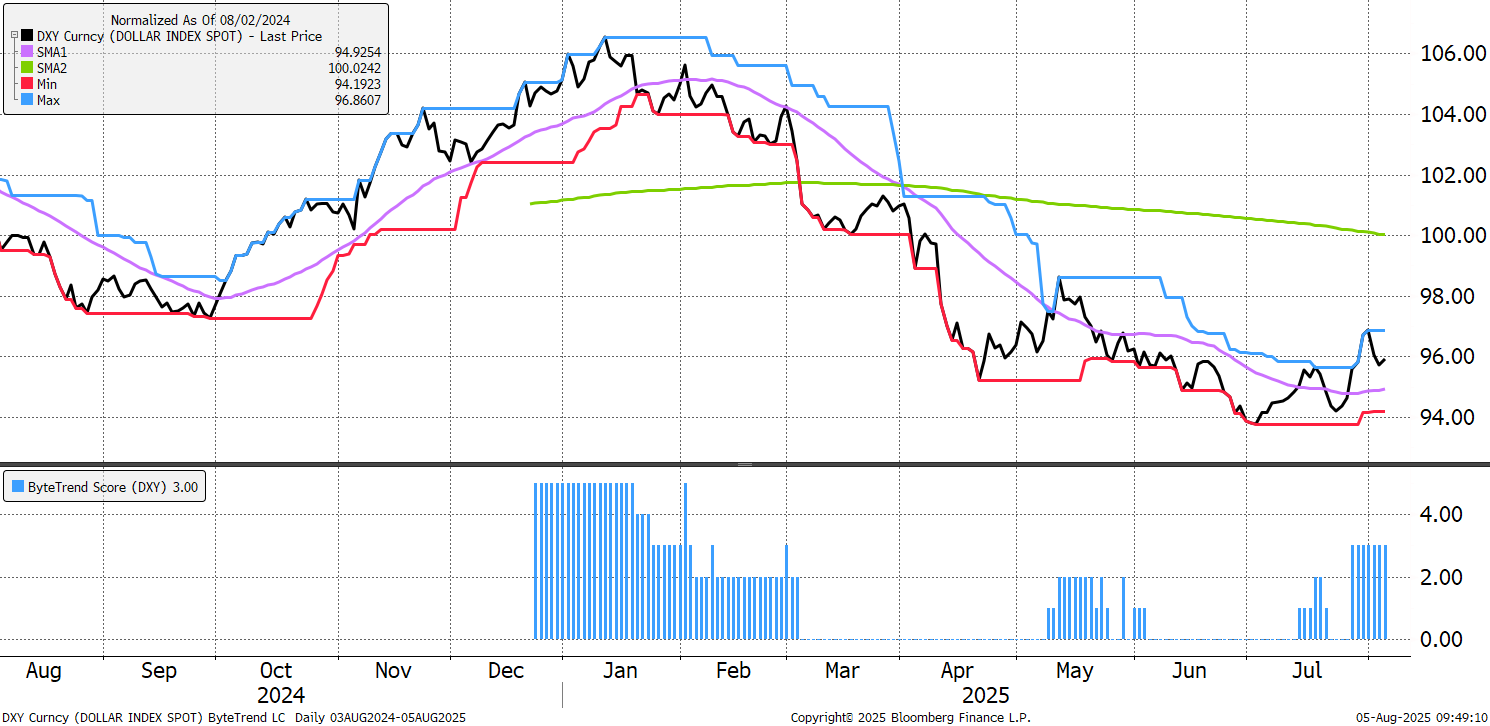

Global markets outside of the US, have been boosted by a weak dollar this year, and so a turn upwards in the dollar, is notable. This may be early days, but the many stock trends build on a weak dollar are unlikely to appreciate seeing a strong dollar. An upward move has begun and has already seen the 30-day moving average turn up. This may fizzle out, but the risk is that it continues, and that would weigh on markets.

US Dollar Index

As my flash note was posted to ByteTree clients on Friday, the US released a weak jobs report, suggesting that employment was slowing. That saw the dollar ease back, as weak employment makes rate cuts ever more likely.

The sharp fall in rates (US 10-year bond yield) took markets by surprise. US core inflation is 2.9%, and the one thing holding it up is wages. A weaker labour market would see wages fall and enable inflation to ease back towards the 2% target. This would allow rate cuts to resume. While rate cuts are sometimes seen positively, that is not the case when the cause is a weaker economy.

US 10-Year Bond Yield

Here in the UK, the 10-year gilt also fell. What is perhaps more noticeable is how the yield has been in a falling trend this year, despite endless media coverage that UK public finances are in a mess and how we are destined for an IMF bailout. This is not what the 10-year gilt yield is telling us, which has been making lower highs this year.

UK 10-Year Gilt Yield

I have no doubt that high government spending is unproductive and reduces growth, as it crowds out the private sector. But the ability for the UK to honour its debts should not be underestimated. For example, the existing government could raise taxes, which would further choke growth, but would please the gilt market. There is also the potential for a future government to slash spending. These are wildly different choices, but would both please gilts, which offer high real yields as inflation has been falling while yields have remained high. The key measure of value in gilts is the real yield, which is historically high. Further falls in inflation would be well received.

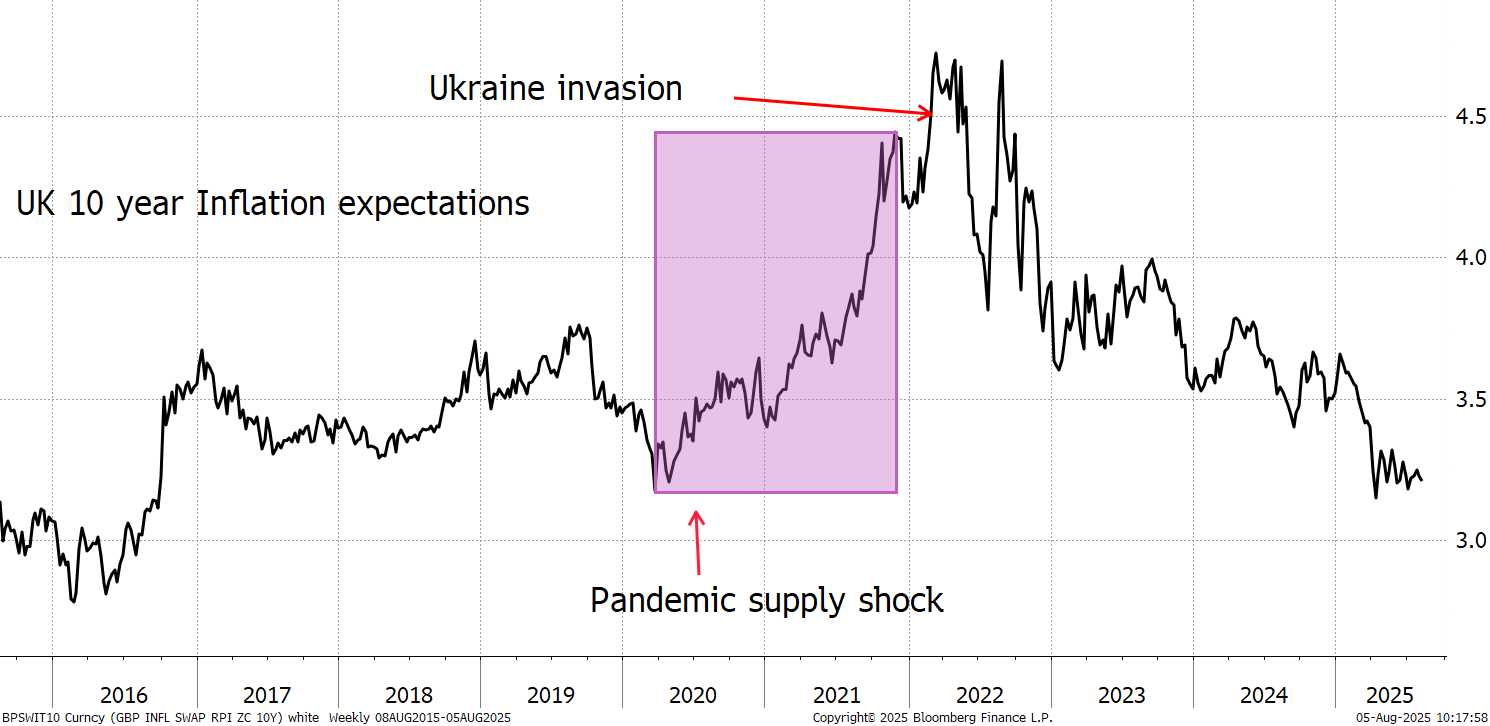

The government lied to us about inflation, when they blamed it on the Russian energy shock. They glazed over the fact that the pandemic supply shock was the elephant in the room, while the Russian impact was a late add-on. Nevertheless, 10-year inflation expectations are back down to 2020 levels while gilt yields are much higher. Recall, this measures RPI, which is approximately 1% higher than CPI.

UK Inflation Expectations

This is important because investors have shunned bonds in favour of stocks. As confidence in bonds returns, large amounts of money could switch back. It is still early days, but my message is that we should fear bonds less than we have and should be prepared to allocate. I shall continue to watch this closely.

The flash note took profits in JET2, Allfunds, and TBC Bank. I like these companies but in order to reduce risk in the Whisky Portfolio, I am changing the mix. This means reducing the value quadrant and increasing quality.

JET2 has diverged from leaders such as Ryanair. Profit growth forecasts have slowed, and although it offers good value and has a rock-solid balance sheet, it wasn’t delivering the growth I had expected. TBC Bank has certainly delivered and made substantial gains, but I felt this was a good opportunity to take profits, as NATO’s relationship with Russia is deteriorating again, and Georgia is a neighbour. Allfunds had a good rally but was showing excessive volatility.

I felt that these were the stocks most at risk should the autumn (the crisis season) disappoint. The Whisky Portfolio now holds 18.3% in cash, which is likely to be reinvested in new opportunities, and hopefully in quality stocks. Alternatively, cash could also be raised further if markets cool.

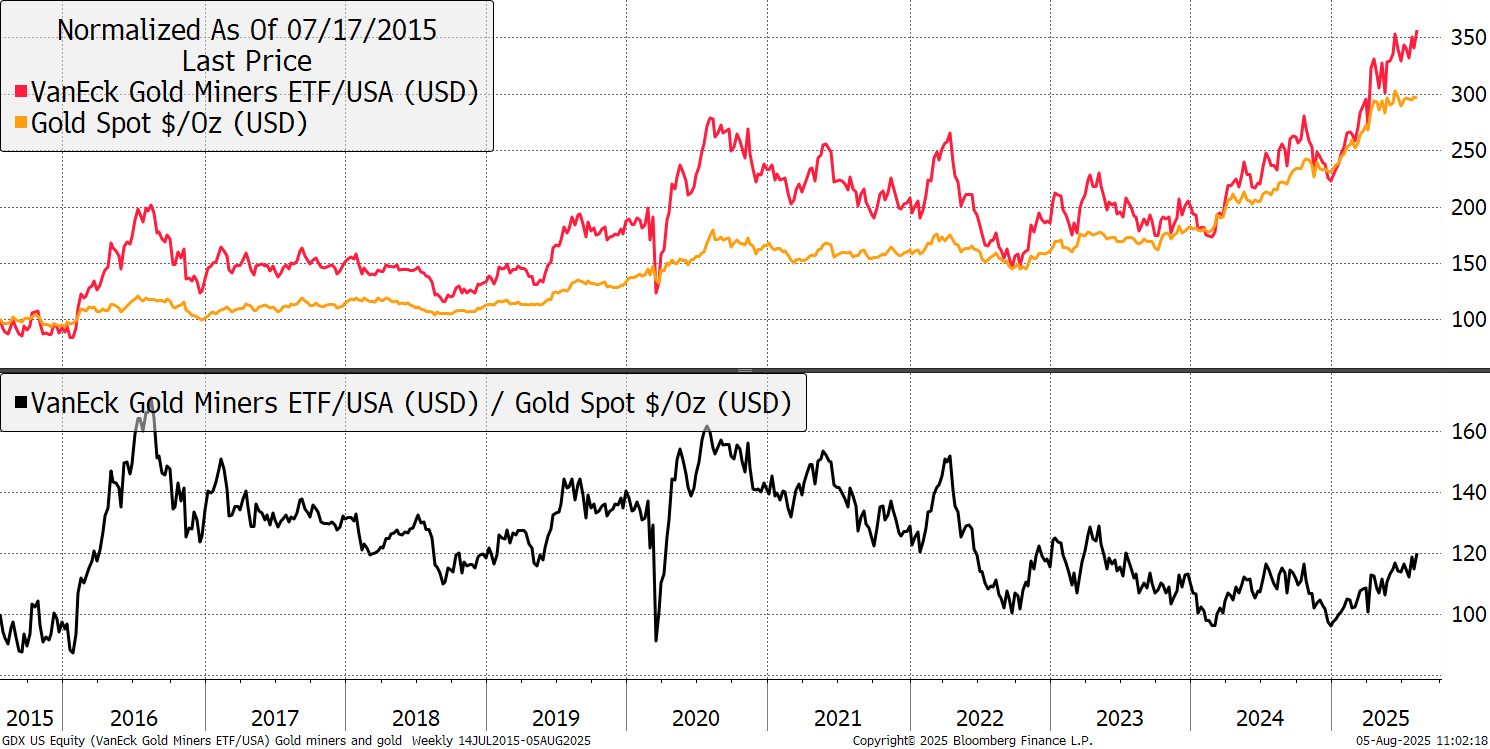

The good news is that lower rates are bullish for gold, and last week saw a new high for the gold miners. It’s finally happening.

Gold and the Miners

Higher rates are not generally good for Bitcoin, but recall that it boomed in a low-rate era. It’s more that falling rates tend to see gold outperform Bitcoin and vice versa. This autumn may prove fruitful as things are warming up.

Bitcoin ETP Ban Is Lifted in the UK

October is generally a seasonally bullish month (known as Uptober) and will be further boosted now that the UK regulator has announced the lifting of the ban on Bitcoin ETPs from 8 October. This will not only allow UK retail investors to buy London-listed Bitcoin ETPs (and BOLD of course, once listed on the London Stock Exchange), but the entire fund universe as well. I don’t think this event should be underestimated, as institutional investors, with their deep pockets, will soon be able to buy Bitcoin.

These are exciting times.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd