Alt-Season Expectations Rising

ByteFolio Issue 172;

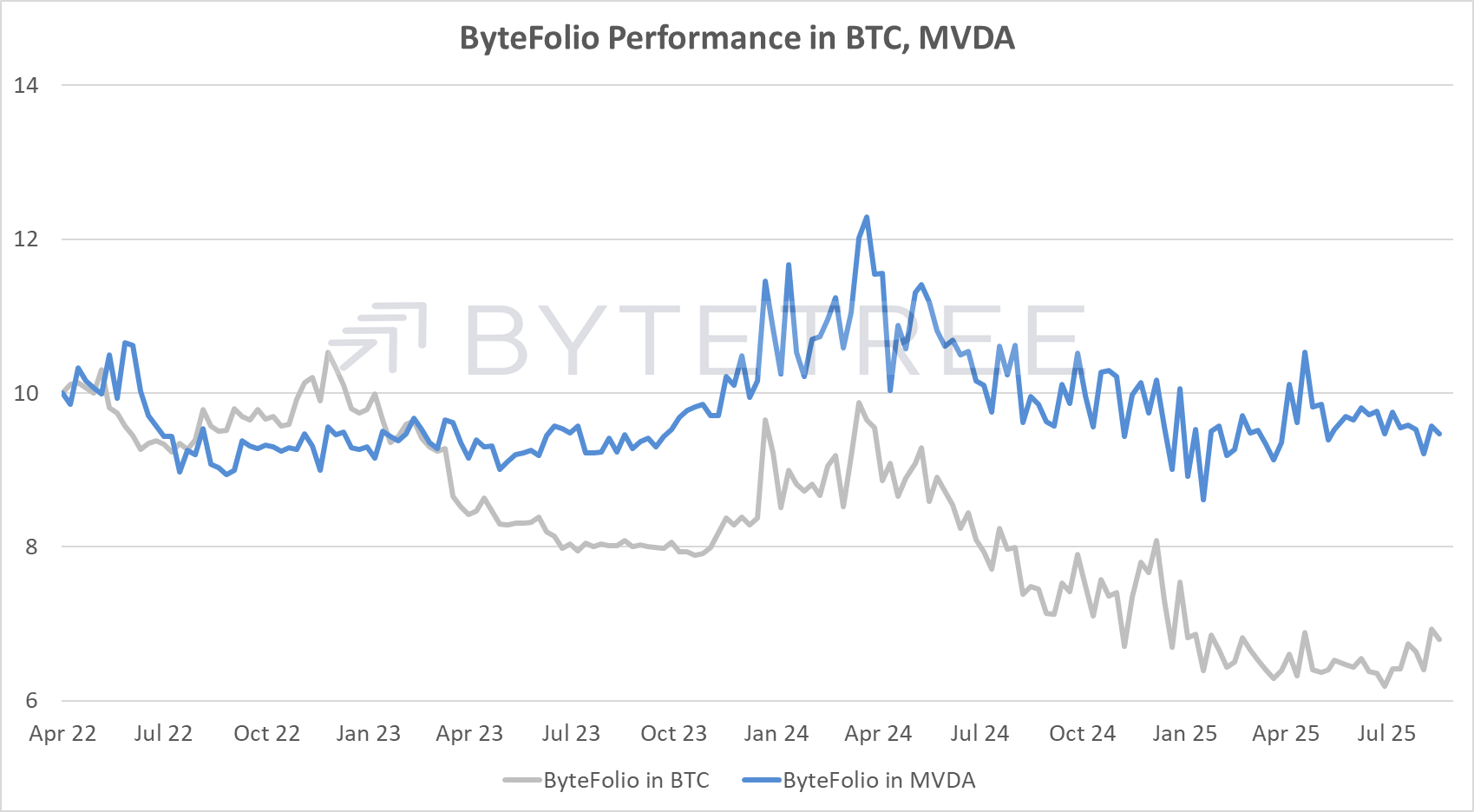

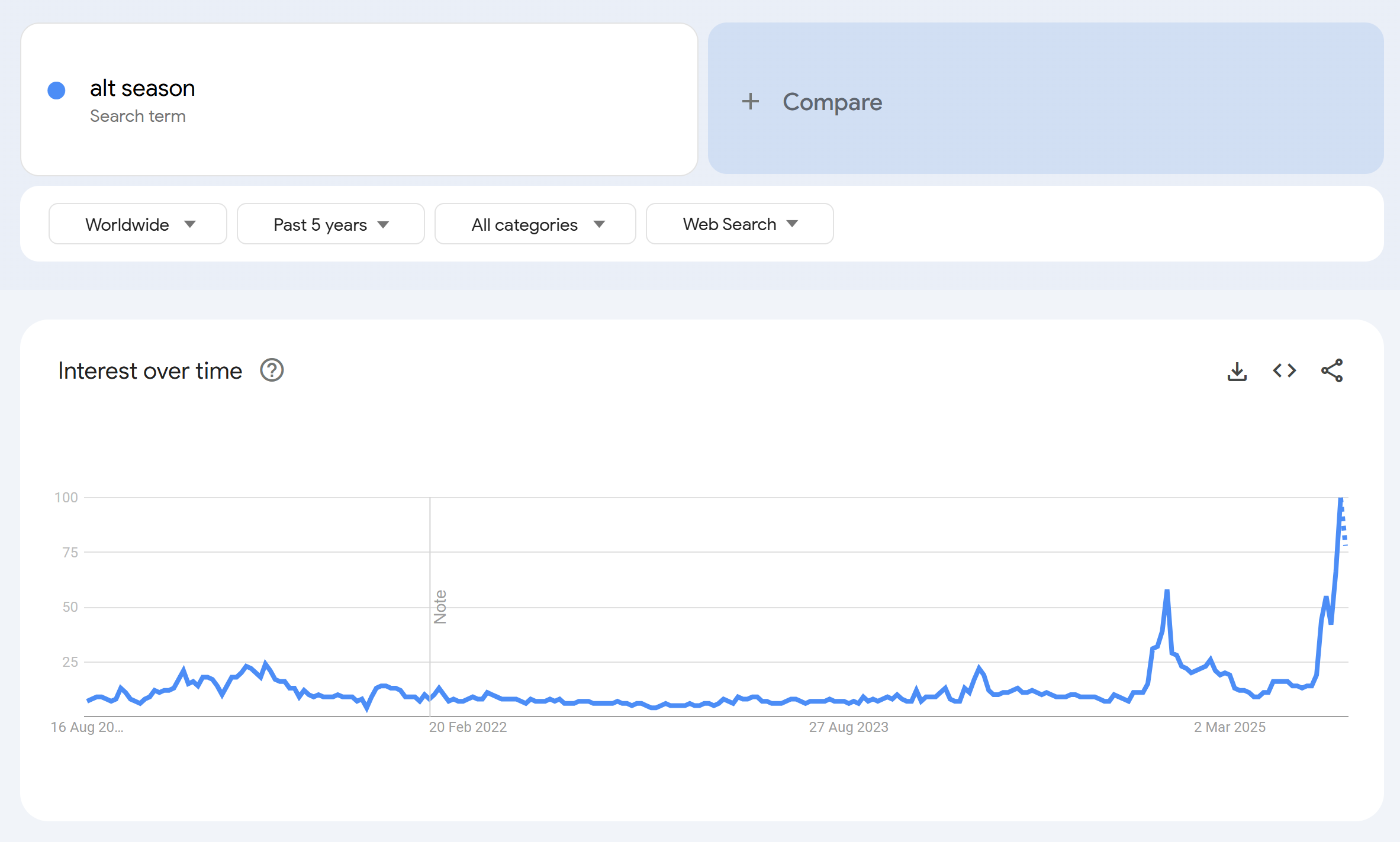

2025 has so far been a strong year for crypto, marked by favourable regulation, increasing institutional adoption, and a steady influx of liquidity. While Bitcoin’s performance has not matched the parabolic rallies of previous cycles, it has nonetheless delivered solid returns. Altcoins, however, tell a different story. With only a handful of exceptions, the broader altcoin market has significantly underperformed Bitcoin.

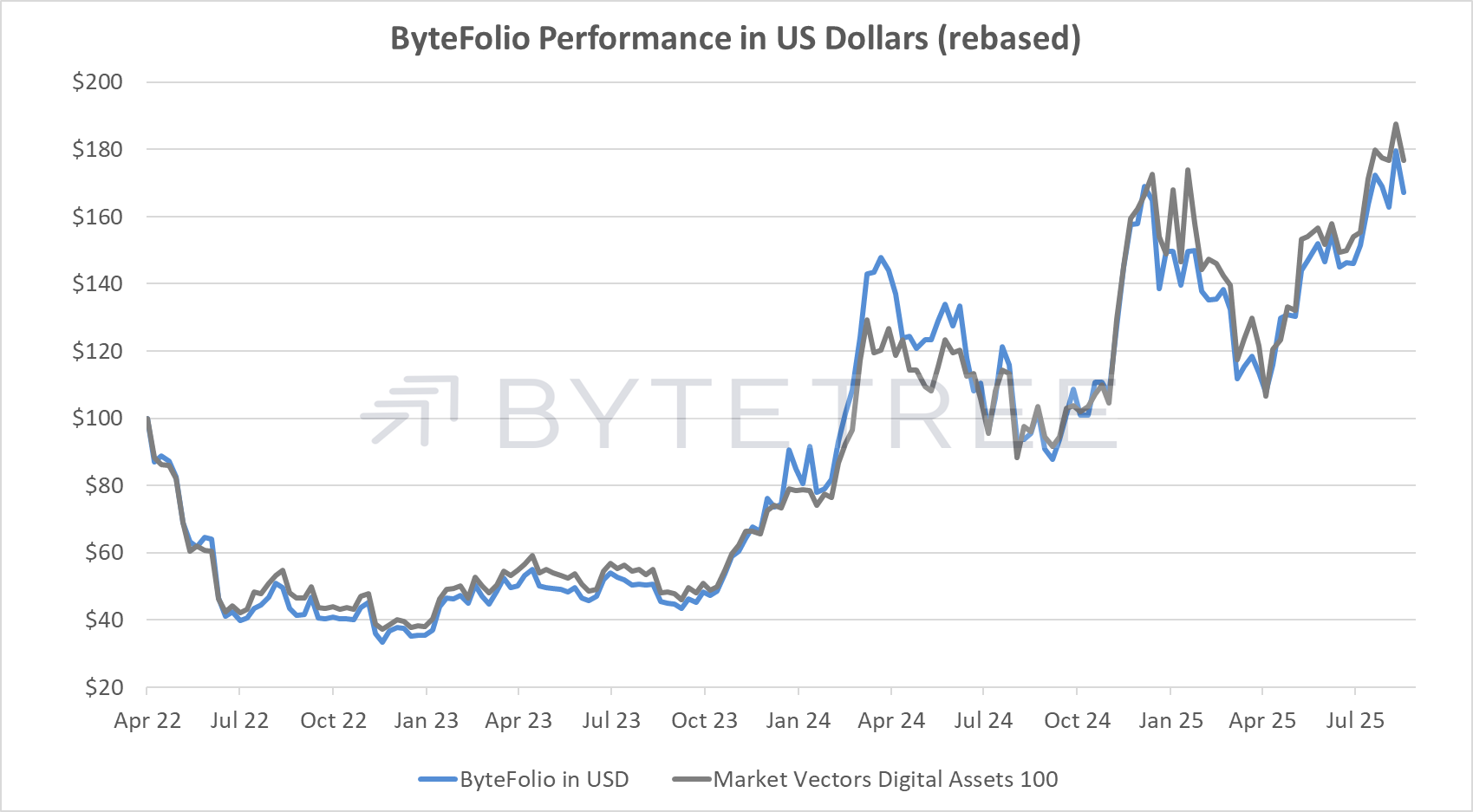

Crypto Breadth in BTC

The breadth chart above highlights this imbalance. Despite a recent improvement, 5-star trend scores against Bitcoin (blue) remain underwhelming compared to early 2023 and 2024 levels. This suggests that, although more tokens are beginning to show relative strength, true market-wide momentum has yet to arrive.

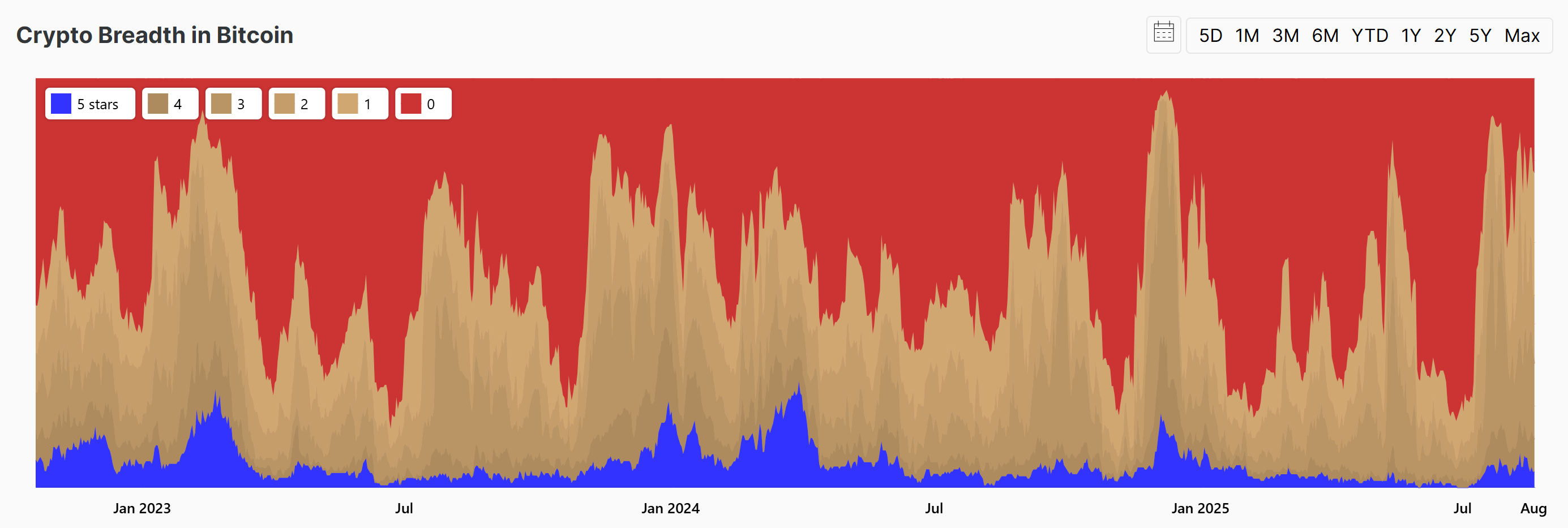

On the sentiment side, the picture is brighter. Google searches for “alt season” have surged to all-time highs.

Google Search Trend for ‘alt season’

Historically, spikes in similar search terms have coincided with phases of broader market exuberance. While searches alone cannot drive price, they indicate a growing appetite among market participants for diversification beyond Bitcoin.

At the heart of any alt season sits Ethereum. As the largest altcoin and foundational layer for DeFi and a wide range of dApps, ETH often acts as the ignition point for altcoin rallies. Following its remarkable 250% rebound from April lows, ETH has not only drawn renewed investor interest but also catalysed significant liquidity inflows across the wider sector.

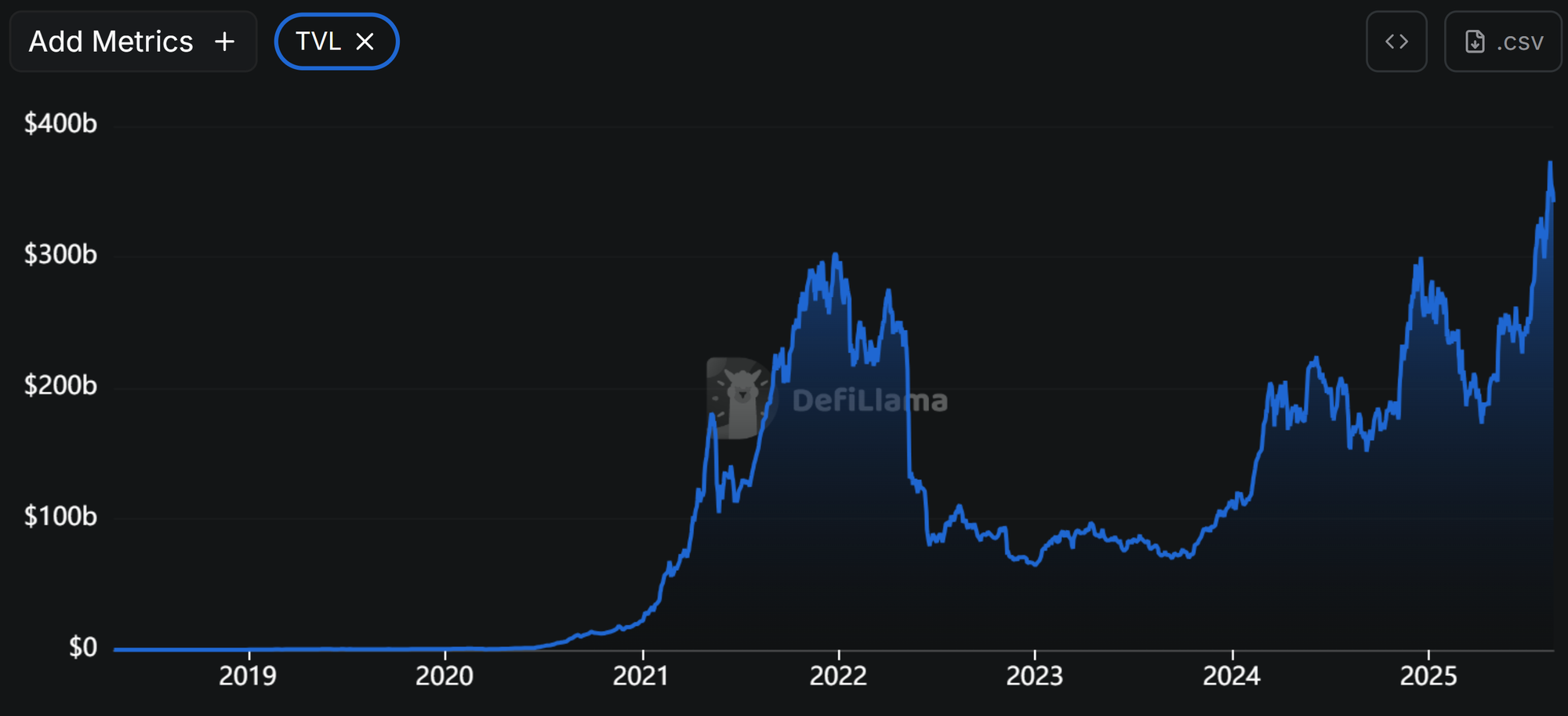

Total DeFi TVL

Total Value Locked (TVL) across DeFi has now surpassed $340bn, piercing through its December 2021 peak of $300bn. Ethereum dominates this growth, with other ecosystems such as Solana, BNB Chain and HyperLiquid also capturing share.

Yet, despite these encouraging developments, a true “alt season” has not fully taken off. Why? The crypto market has matured. Unlike previous cycles, where hype, speculative narratives and celebrity endorsements drove unsustainable gains, today’s market increasingly rewards projects with real-world utility, robust on-chainon-chain activity and sustainable business models. Tokens such as TRX, AAVE and ETH exemplify this shift, showing that price appreciation is now more strongly correlated with adoption and revenues rather than speculation.

This means we must adjust our expectations. The classic idea of an “alt season,” where dozens of tokens rise 5-10x in a matter of months, is unlikely to repeat. Instead, rallies will likely be more selective and grounded in fundamentals. Take Solana as an example: SOL has rallied nearly 12x since October 2023, supported by a genuine explosion in on-chain activity and adoption. However, at its current $110bn fully diluted valuation (FDV), all of this growth, combined with expectations that the blockchain will continue to attract activity, is already priced in. For SOL to continue compounding at a similar pace, network activity must grow at an extraordinary pace, one that may not be realistic. More plausibly, steady and consistent growth in usage should sustain its current valuation and support future upside. And if it doesn’t, the token will reflect the reality.

Holding high-quality tokens with strong ecosystems, clear revenue generation and credible growth paths should form the backbone of any resilient portfolio. Conversely, tokens like XRP, ADA and SUI remain massively overvalued relative to the revenues they generate, making them more a product of hype and FOMO than fundamentals.

Through rigorous research, on-chain evaluation and trend following, we identify projects with strong fundamentals and filter out those driven solely by speculative mania, distinguishing quality from noise.

As crypto continues to evolve, sectors from RWA tokenisation to liquid staking, lending and payments are attracting meaningful liquidity. As these niches mature, capital will increasingly rotate into them, shaping the next wave of crypto growth.

The bottom line: an alt season may be brewing, but it will not look like the wild rallies of the past. Instead, it will be defined by selective, fundamentals-driven growth, rewarding quality projects and penalising those without substance.