43 Days to Go

ByteFolio Issue 173;

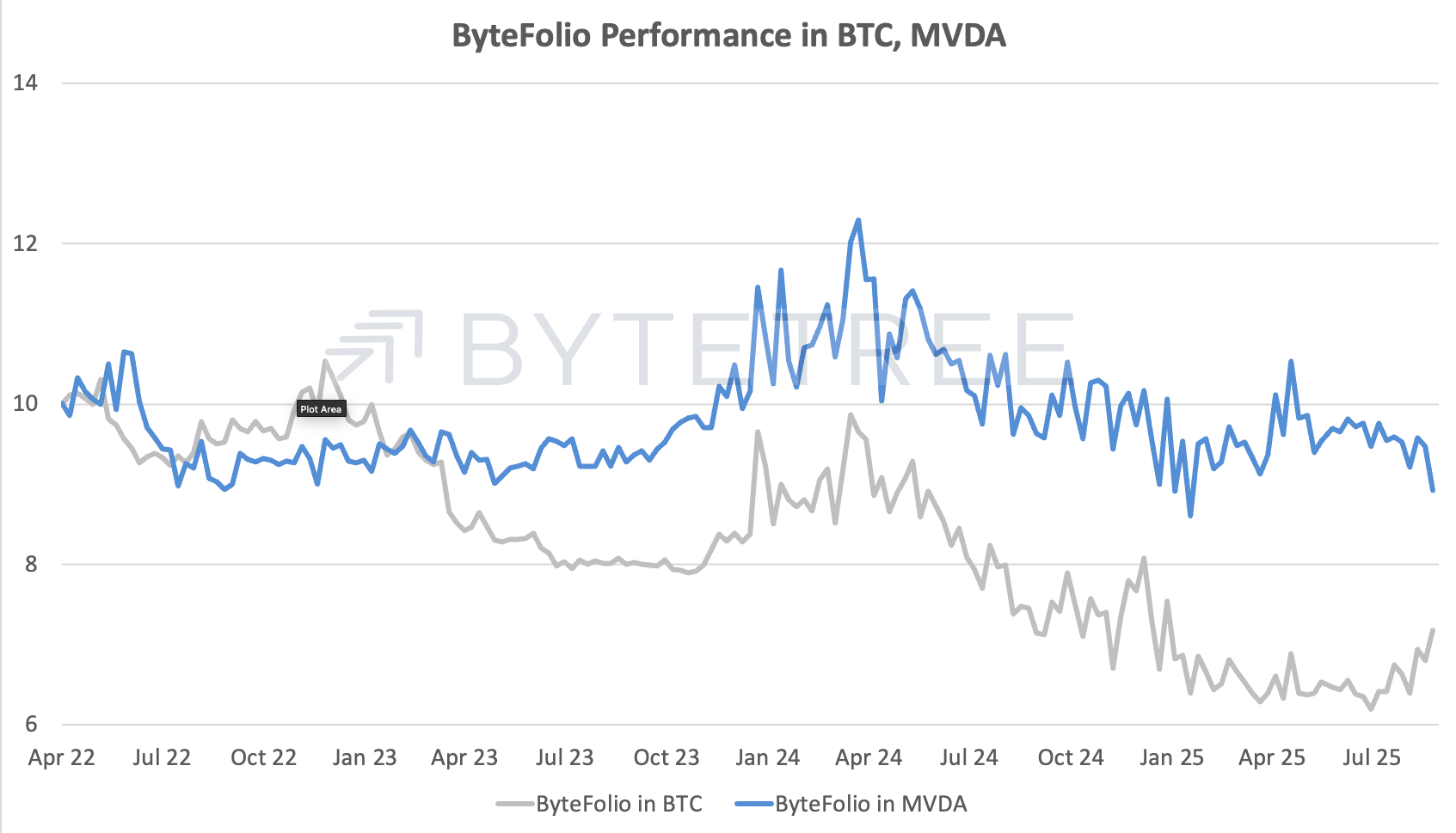

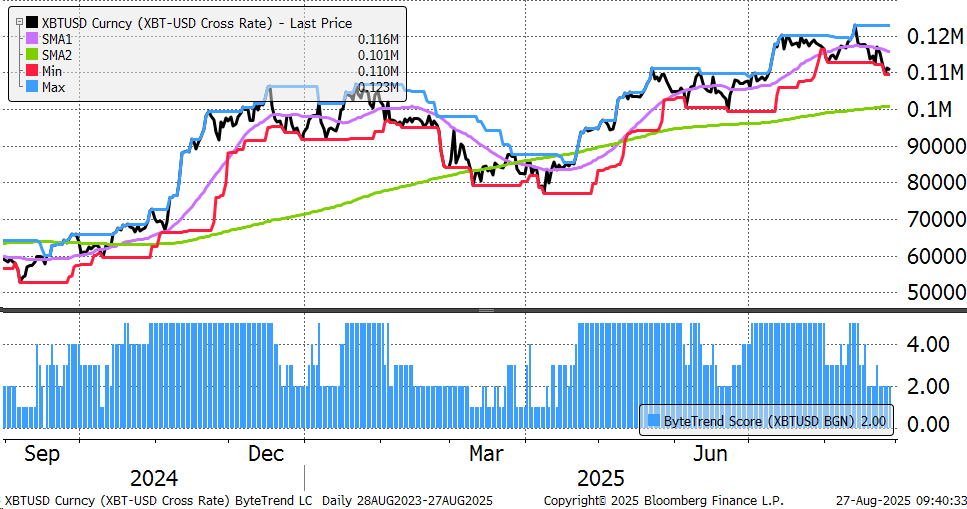

Bitcoin drops to a ByteTrend Score of 2 in USD. That means the price has touched the 20-day low (red), has turned below the 30-day moving average (pink), and that same moving average is pointing down. This has stalled the rally, but at least there is plenty of support at the $100k level. A retest is possible, but a break would be disappointing.

Get access to our professional research for deeper insights into this exciting new market.

Bitcoin Bull Market

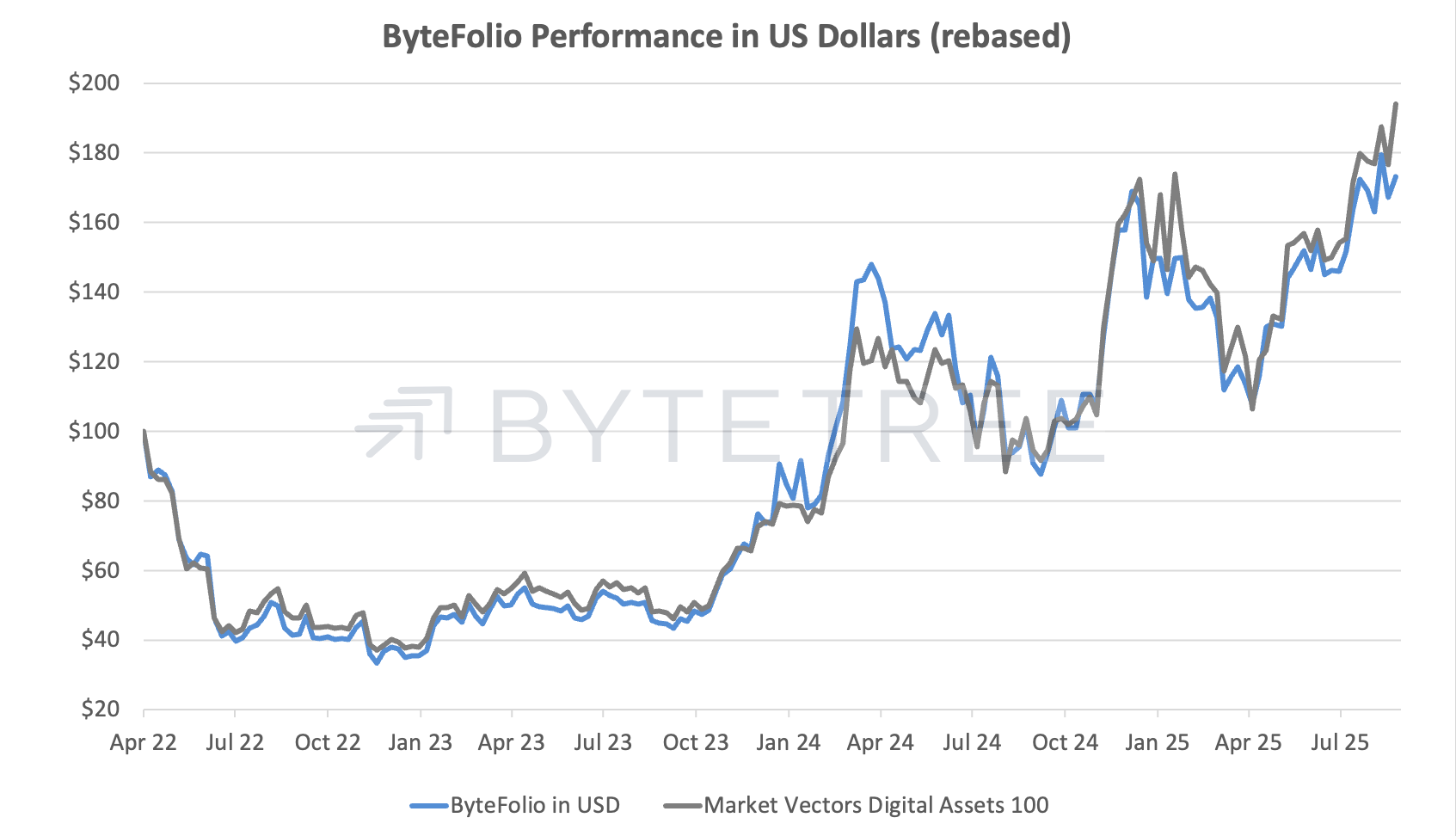

It has certainly been a slow post-halving cycle compared to the past, but it is notable how the last cycle (red) performed very well in the run-up to April 2024, with an 8x gain. Maybe this cycle, if there still is such a thing, came early. But you can’t ignore the fact that $2 trillion + assets behave differently than when they were minnows.

Bitcoin Cycles

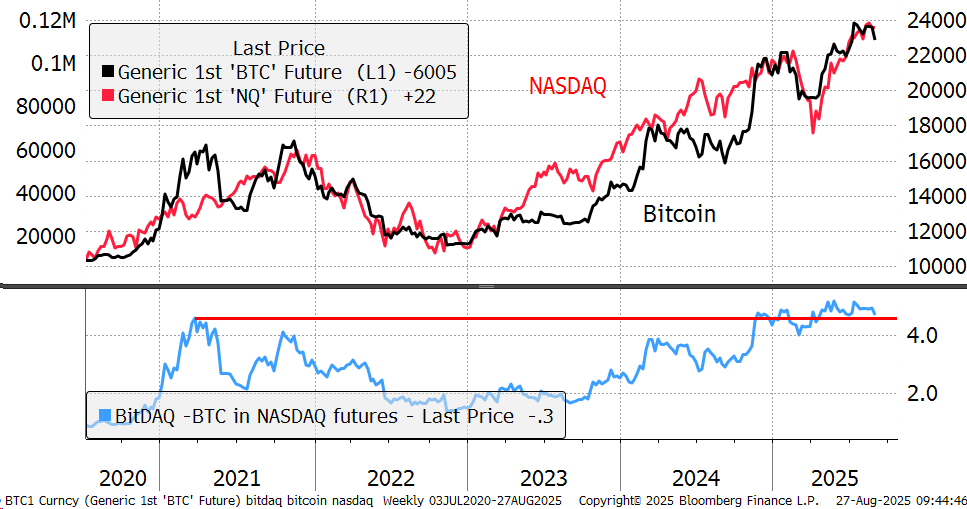

The other key test is Bitcoin versus NASDAQ. The correlation remains high, and Bitcoin in NASDAQ has held the high ground for a year. Bitcoin is still a NASDAQ beater, which is no mean feat. NVIDIA releases earnings today, and so something is bound to happen. Should big tech disappoint, Bitcoin is well-placed to pick up the baton.

Bitcoin in NASDAQ

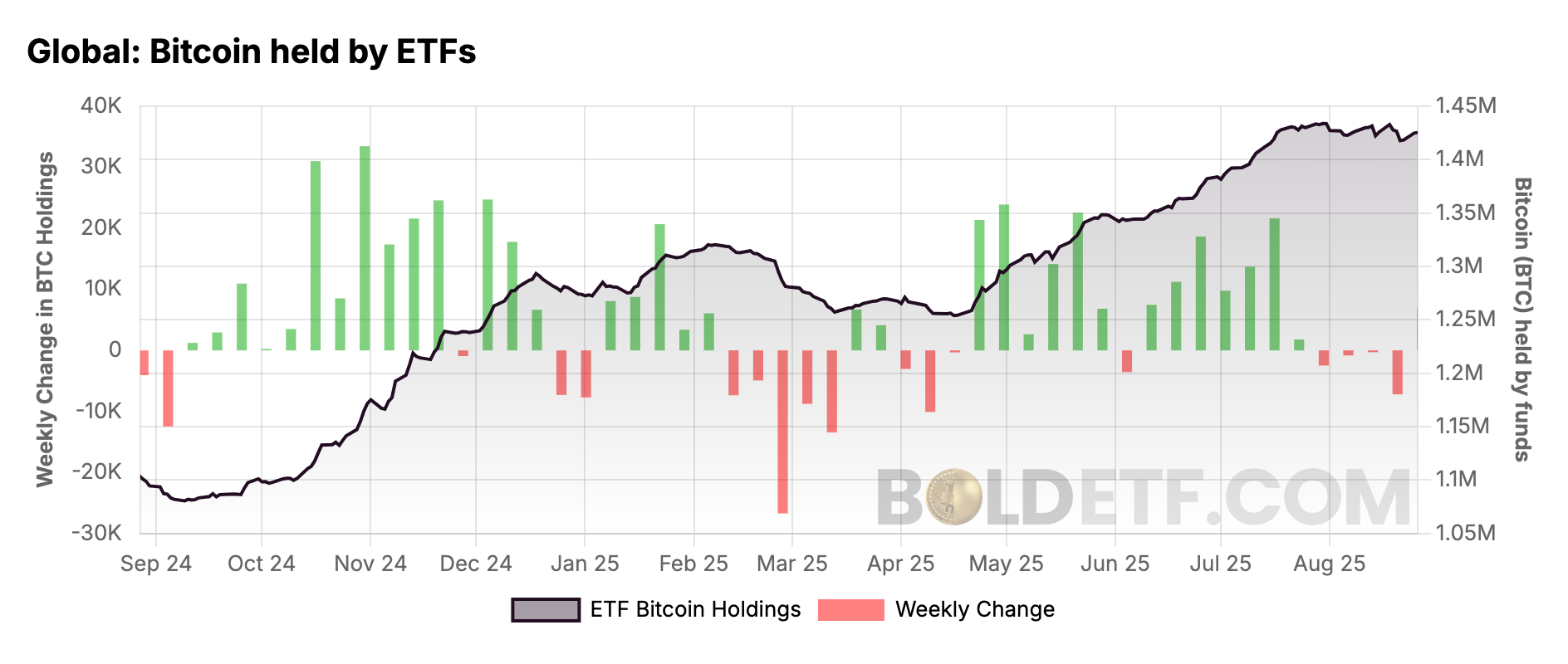

But the flows into the ETFs and the treasury companies have slowed. The ETFs have been net sellers, but only slightly, and this needs to turn for Bitcoin to regain its momentum. The good news is that the UK ETF market will fly on 8 October, just 43 days away. The UK is a major financial centre, and clarification on Bitcoin ETF status will be felt around the world.

Besides, never bet against “Uptober”. October is a month that has been kind, following a traditionally weak September. Things are on track.