Trade in the Whisky Portfolio;

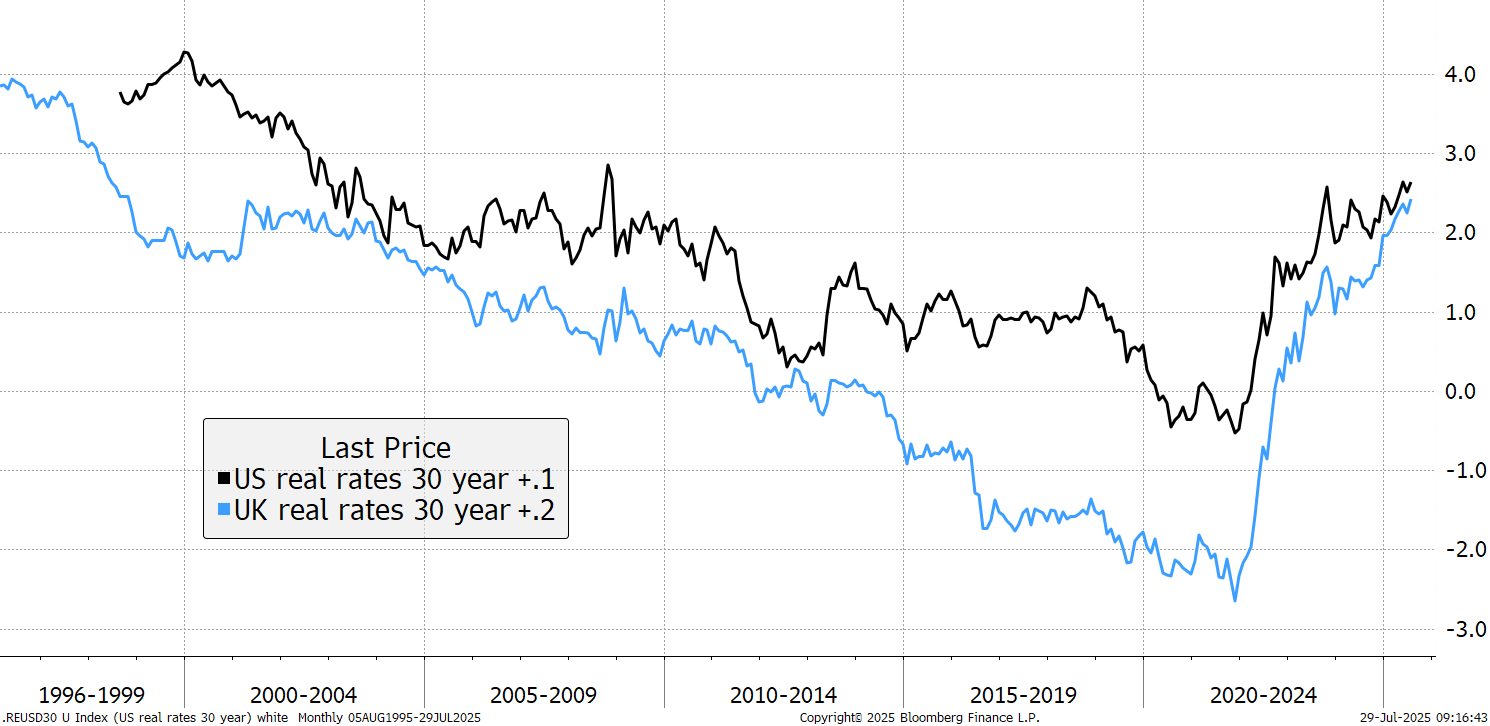

At 2.5%, the 30-year real yield on government bonds in both UK gilts and US treasuries is hard to ignore. Data goes back to 1996 in the UK, and 1998 in the US. Prior to that, there was no significant market for index-linked bonds, and the data was not recorded. In any event, to receive 2.5% plus inflation, for the next 30 years, guaranteed by major governments, is a good deal. Over the 30-year period, that would more than double your money in real terms.

While that’s not enough for people like us, it should appeal to major institutional investors. Yet for some reason, it’s not yet high enough to get the crowds excited.

US and UK 30-Year Real Yields

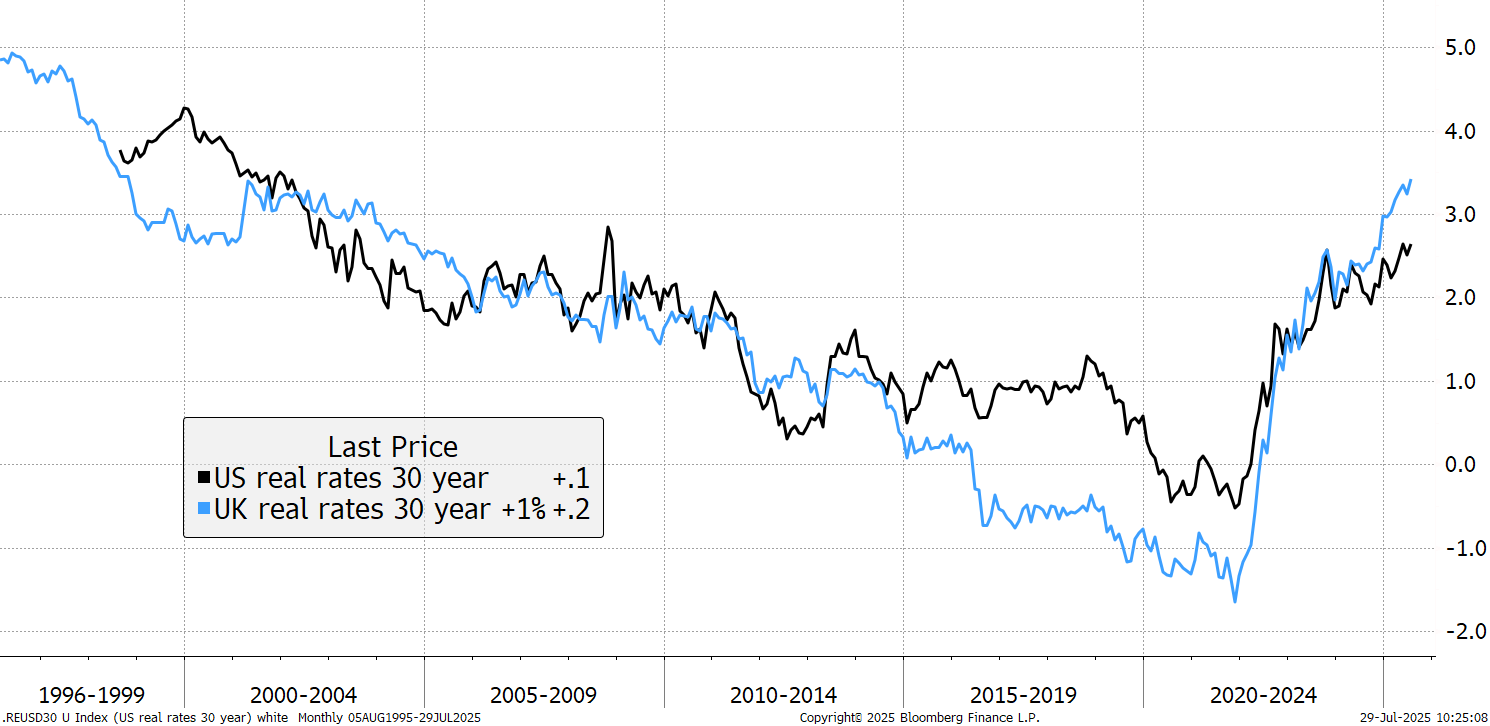

There’s one more thing to mention about UK inflation. These days it is reported as consumer price inflation (CPI), whereas historically, it was retail price inflation (RPI). Index-linked gilts pay RPI. The differences are that CPI excludes things like mortgage interest, includes spending by foreign visitors, and is a more modern methodology, which is widely used in other countries. Since 1996, RPI has been 1% higher than CPI, which is significant.

To compare US Treasury Inflation-Linked Securities (TIPS) against UK inflation linked gilts (linkers) it makes sense to add another 1% to linkers as RPI overstates CPI by 1%. Regardless, investors get paid for it and so linkers now look 1% more attractive than TIPS. A 3.5% real yield is even more interesting than 2.5%, nearly tripling the value in real terms over 30 years.

TIPS vs Linkers – 30-Year Real Yield

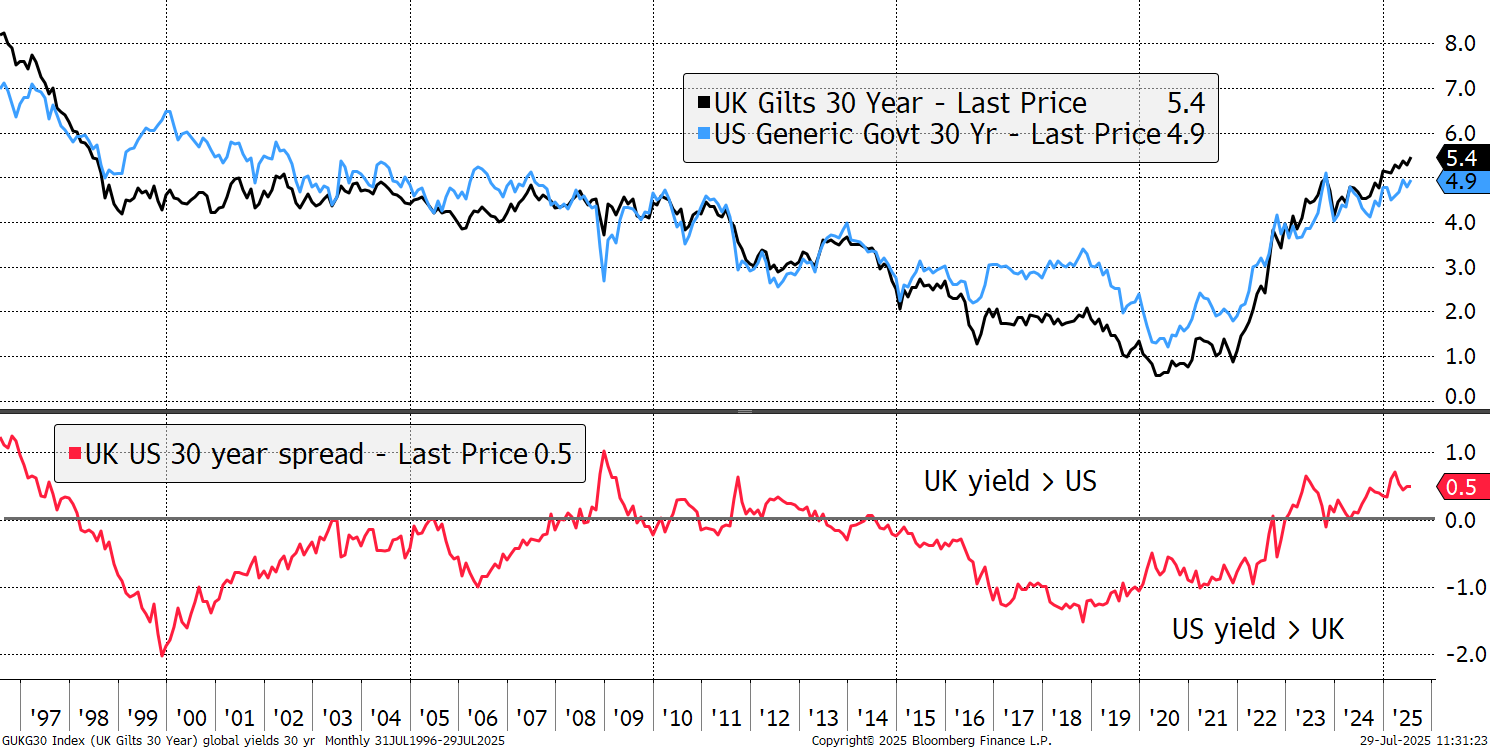

This chart makes sense as TIPS and linkers are about the same much of the time, whereas the earlier chart shows linkers persistently offering lower returns. If that were true, the UK could borrow at a lower real rate than the US. It would be nice, but seems most unlikely.

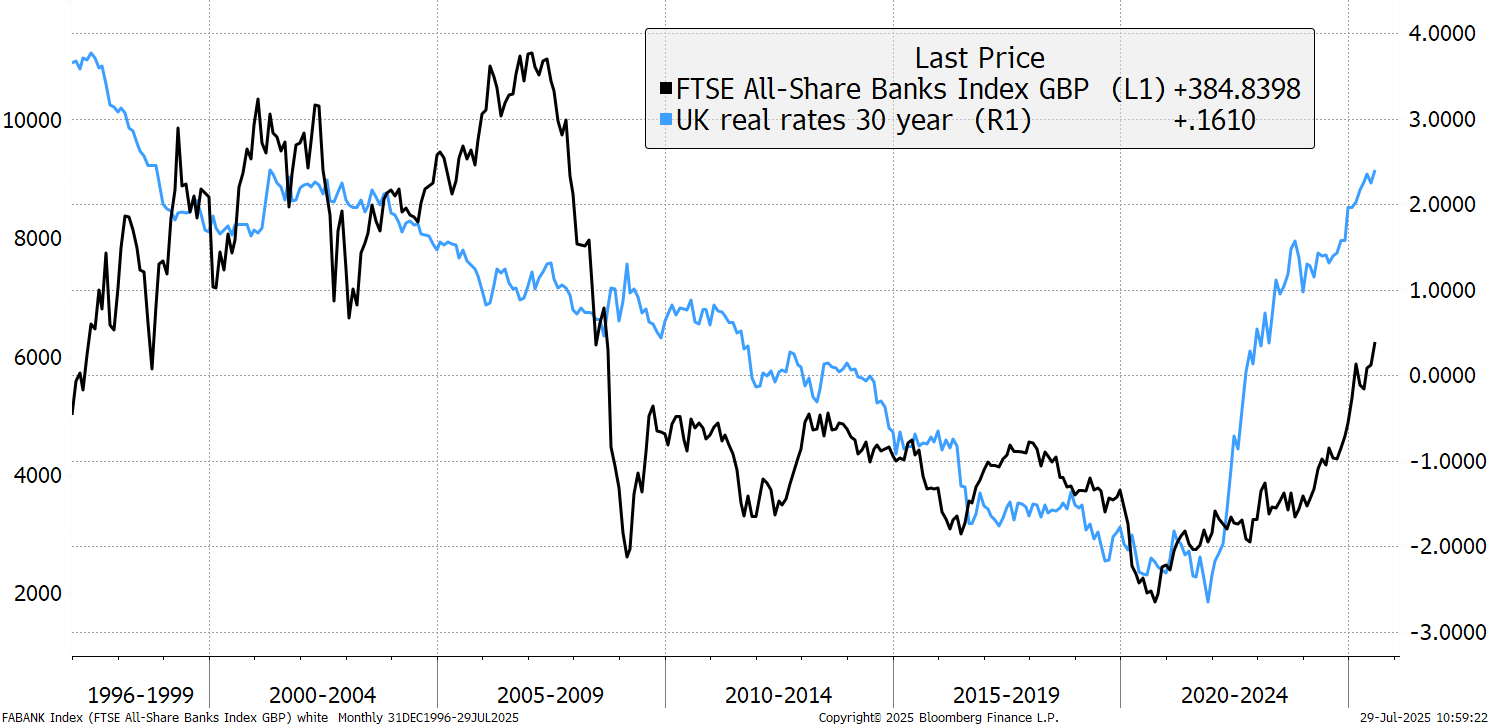

The main point is that the rise in real yields is a sign or normalisation in the economy. Although distorted by the 2008 financial crisis, bank shares fell alongside real (and nominal) interest rates. Now they are recovering, banks shares are doing much better too. That is largely down to the banks receiving much higher rates of interest and not paying it out to customers.

Banks and Real Yields

If real yields are normally high, and attractive, then they can’t be that bad. But it’s perhaps abnormal that government borrowing is so high at the same time. It may have made sense to go on a spending spree in a zero-rate environment, but it doesn’t anymore now the government has to pay high real yields to borrow. The restoration of the real yield back to these levels is another way of saying that the credit crisis is finally over, as the banks are back on track. The banks got us into it, and now they have gotten us out of it.

Few investors are chasing the long linkers, despite attractive pricing. Yet that was also true a generation ago in 1999, at the top of the US stockmarket, real yields were paying 4%; even more than today. In the end, and among other factors, that was enough to entice investors away. Equities peaked, and a two-decade bond bull market began.

There are so many reasons not to buy bonds, the main one being they aren’t currently going up. But even more investors are convinced the bond market is on the precipice and will sooner or later blow up, meaning much higher borrowing costs for all. I am starting to question that if this is so obvious, why it hasn't already happened? That it hasn’t yet blown up could mean that it won’t.

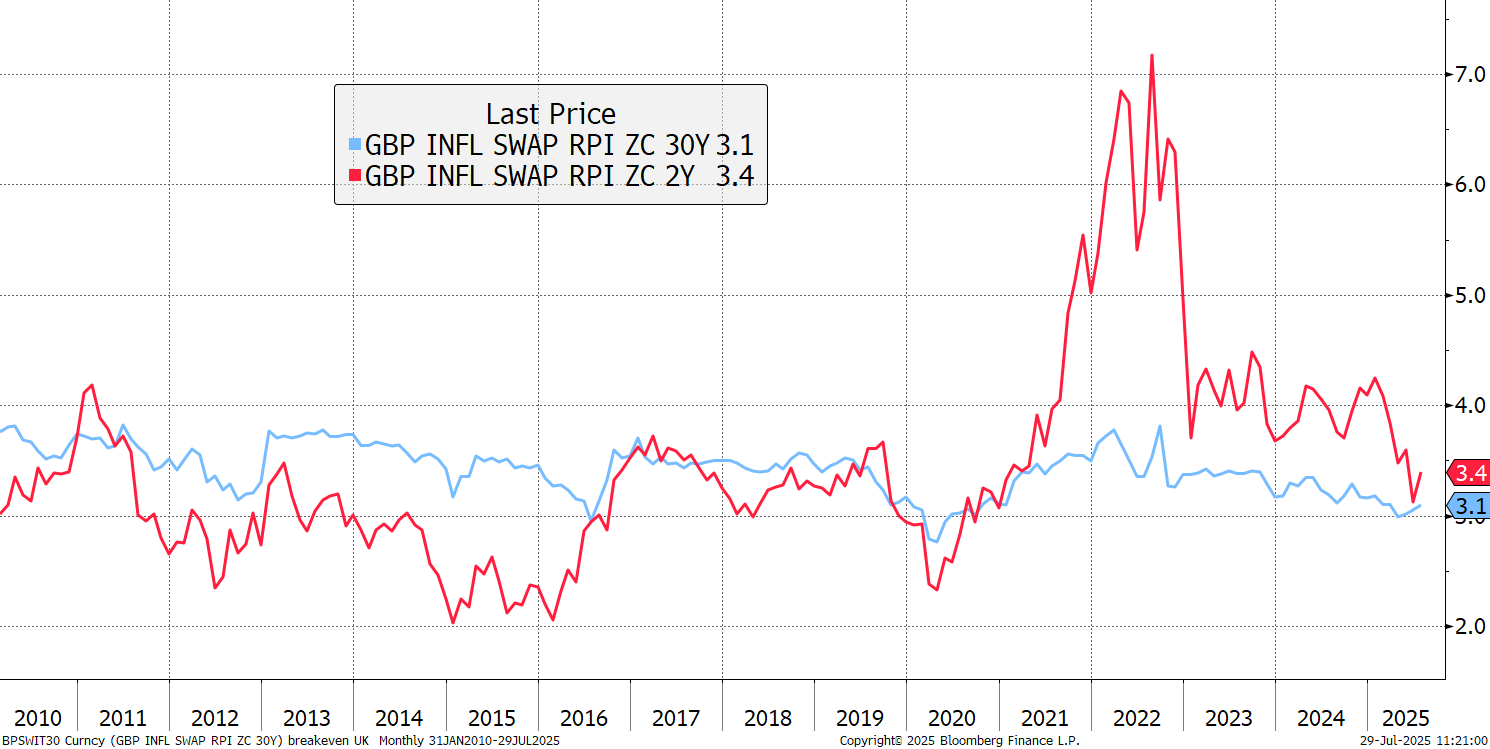

The UK government has too much debt, and a deficit that never seems to close. I agree that if we continue like this, the country will end up broke. But we also have to wonder why inflation expectations are still coming down. These measure RPI, and so we can knock off another 1% to estimate CPI. That implies 2.1% over 2 years and 2.4% over 30 years, which are not far from the official targets.

UK Inflation Forecasts

While I subscribe to the view that governments will keep on printing money to keep the ball rolling, I am sure they don’t want the bond market to blow up. In the US, Musk’s DOGE initiative made some early progress, but seems to have fizzled out. Yet it has made the point that spending can be cut if required. More recently, Trump’s tariffs are set to surge, but that won’t help the UK. Regardless, UK and US nominal yields are roughly the same. You might think that if the US has a solution to its debt problem and has left the UK behind, then yields would diverge, but they haven’t.

UK and US 30-Year Bond Yields

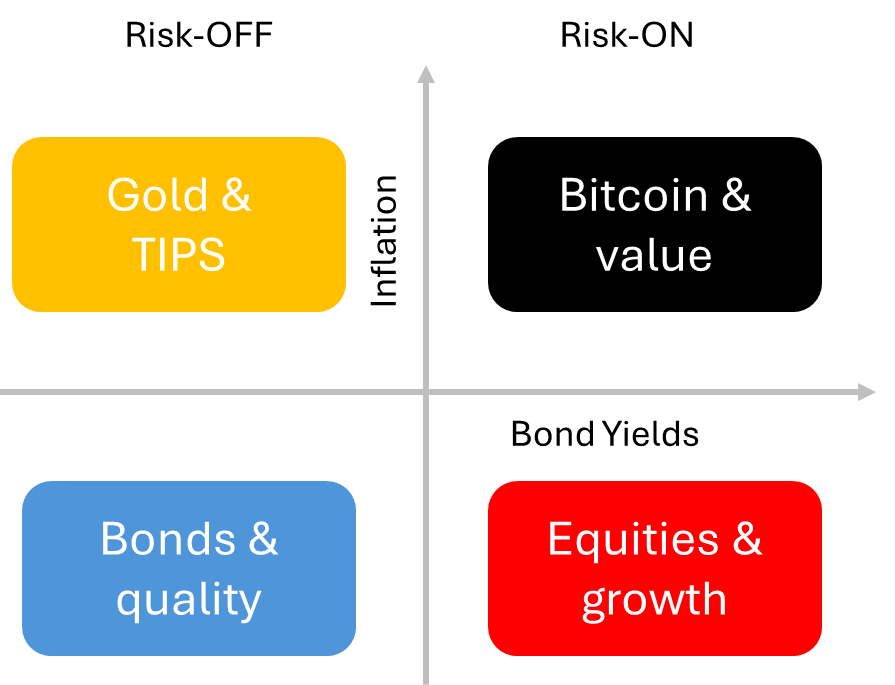

The conclusion is that we should give the bond market the benefit of the doubt. It may well be true that there is more room for governments to print money while maintaining low inflation. This will not be true forever, and tariffs may boost inflation in the short term, rather like an increase in VAT, but probably not in the long term. There is too much competition in the world for that. The natural force on consumer prices is down.

We need to differentiate between consumer inflation and monetary inflation. We successfully made this transition for gold three years ago, but I think this doctrine needs to spread further. After all, they shut down the world economy, locked us up, caused shortages and bottlenecks in the supply chain, and inflation really did turn out to be transitory. The central bankers were too slow, and it went on for longer they said it would, largely due to the energy shock from the war in Ukraine, but inflation is broadly contained. If inflation remains under control, or even falls, this means it is time to revisit quality.

The ByteTree Money Map

Quality

Quality stocks are not just better for when things go wrong, but if the price paid is fair, they should beat the market over the long-term. The problem is that so many investors have figured this out over the years that quality is generally overpriced. If you are following our work in The Global Trends investor, you’ll have seen how many richly valued US quality stocks got themselves into trouble. Fortunately, this happened to UK quality much earlier, and opportunities are opening.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd