ByteFolio Issue 165;

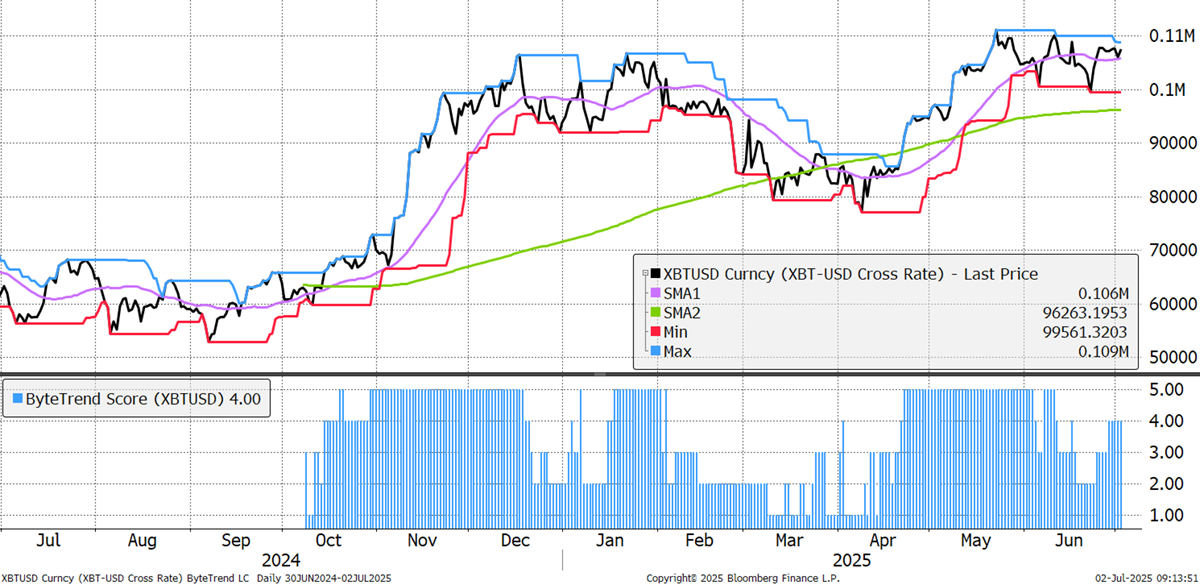

Bitcoin ByteTrend Score is 4 as it trades back above the 30-day moving average, which is now upward sloping. One touch of the blue 20-day max line would make it a 5.

Bitcoin

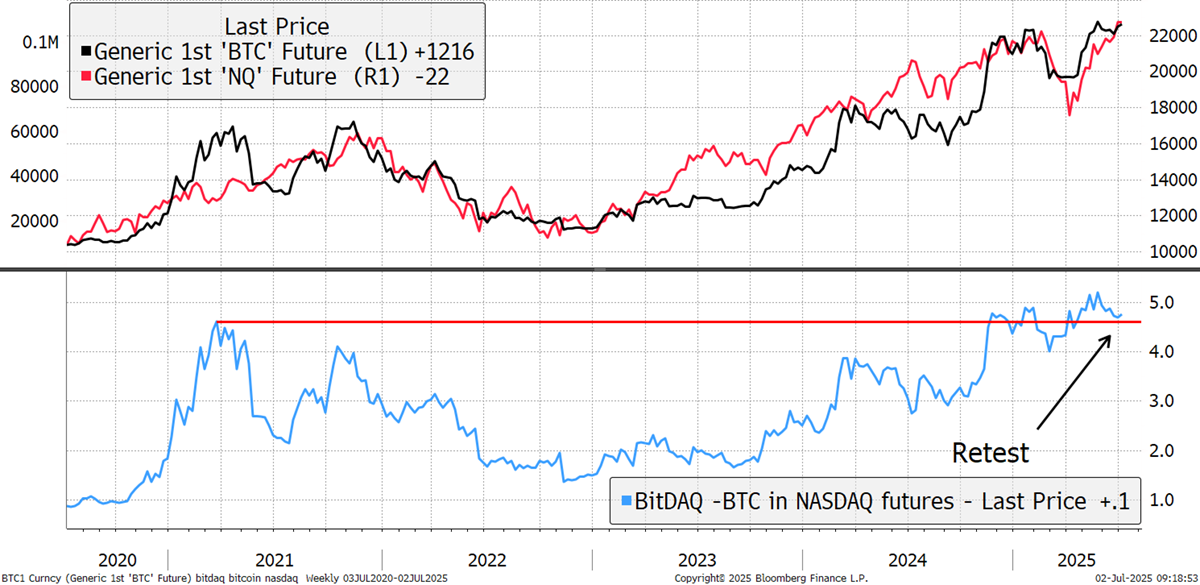

The bottom line is that the chart looks good. One problem is that the great Bitcoin breakout versus the Nasdaq has cooled. But you could read that as buy the dip, which looks like support. Of course, Bitcoin has done 5x better as shown in the blue chart.

BitDAQ: Bitcoin in Nasdaq

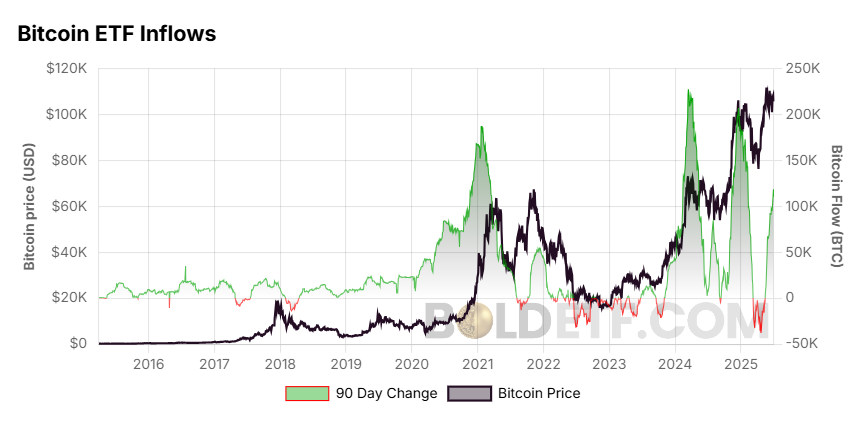

Big tech has long been a rival to Bitcoin for asset allocators, and the chart above also looks good. I would also highlight that investors are buying Bitcoin, and the past 90 days of inflows are the fourth-highest on record. Flows from Europe will also open up later this year as the FCA reverses the ban on Bitcoin ETFs. London will lead, and the world outside the US will follow. Wealth management will buy Bitcoin for the first time. It is going to be big.

Bitcoin ETF Inflows

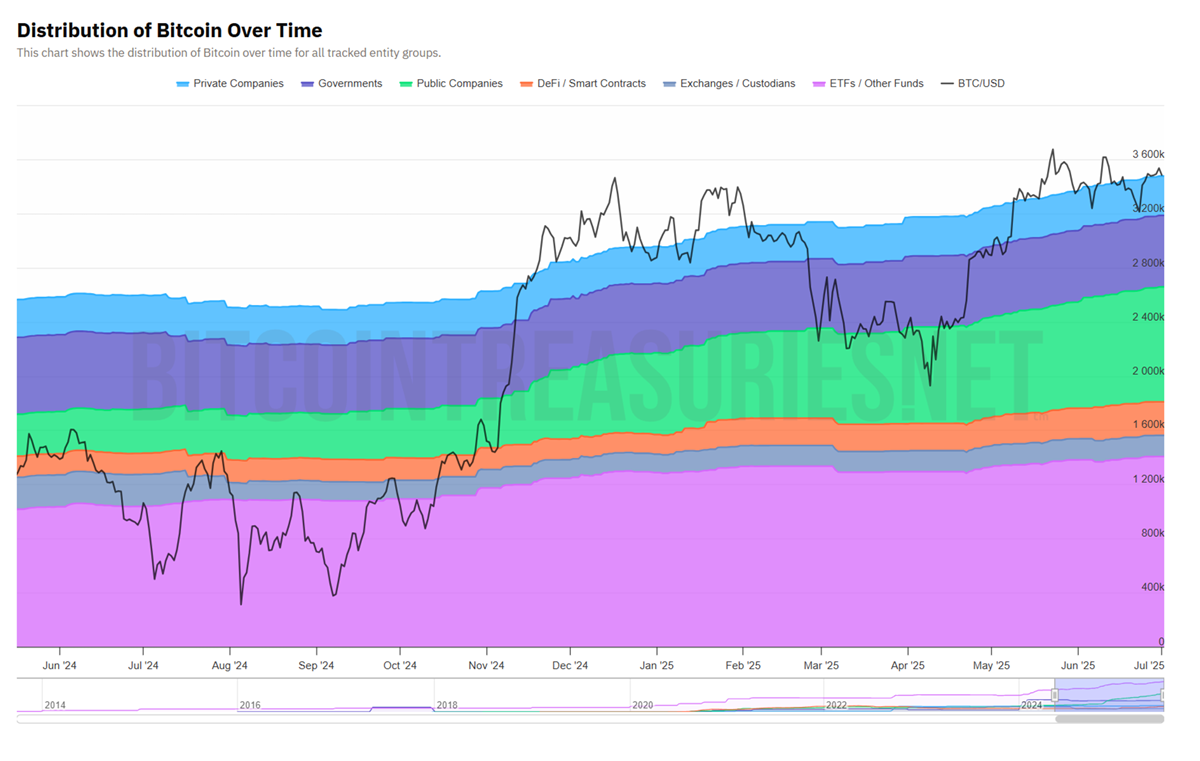

One other source of demand comes from treasury companies, where there’s a major hype cycle. Currently, the ETFs are banned in the UK, Ireland, India, Thailand, Japan, and Singapore, and shadow-banned (discouraged) almost everywhere else. When that happens, the case for treasury companies, fuelled by a premium valuation (so-called mNAV), will disappear. Still, they seem to have accumulated 849k Bitcoin, which is catching up with the 1.4 million Bitcoin held by ETFs.

Who Owns Bitcoin?

When you hear that Bitcoin is all institutional these days, I disagree. The total held by government, institutions, companies and ETFs is 3.5 million when the total supply is 19.9 million. It’s still small and there is plenty of room to grow, especially with the dollar making new lows. Long may it continue.

Dollar Index