ByteFolio Issue 168;

Bitcoin retains a ByteTrend Score of 5 but didn’t manage a new high this week, despite a bullish backdrop and a push from the White House as we covered last week. Still, all looks well, and I like these calm bull markets. At least, that is the case for Bitcoin.

Bitcoin Bull Market

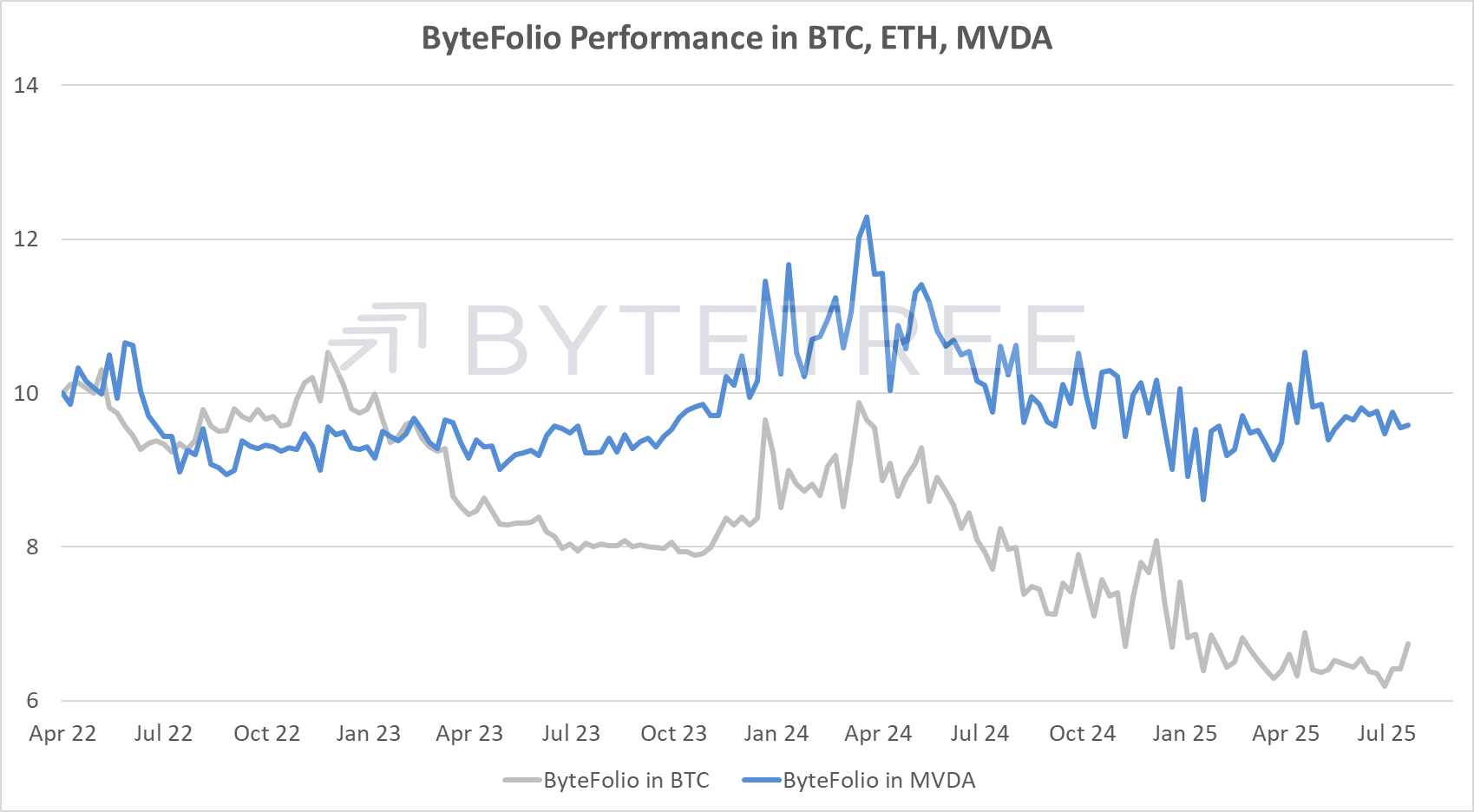

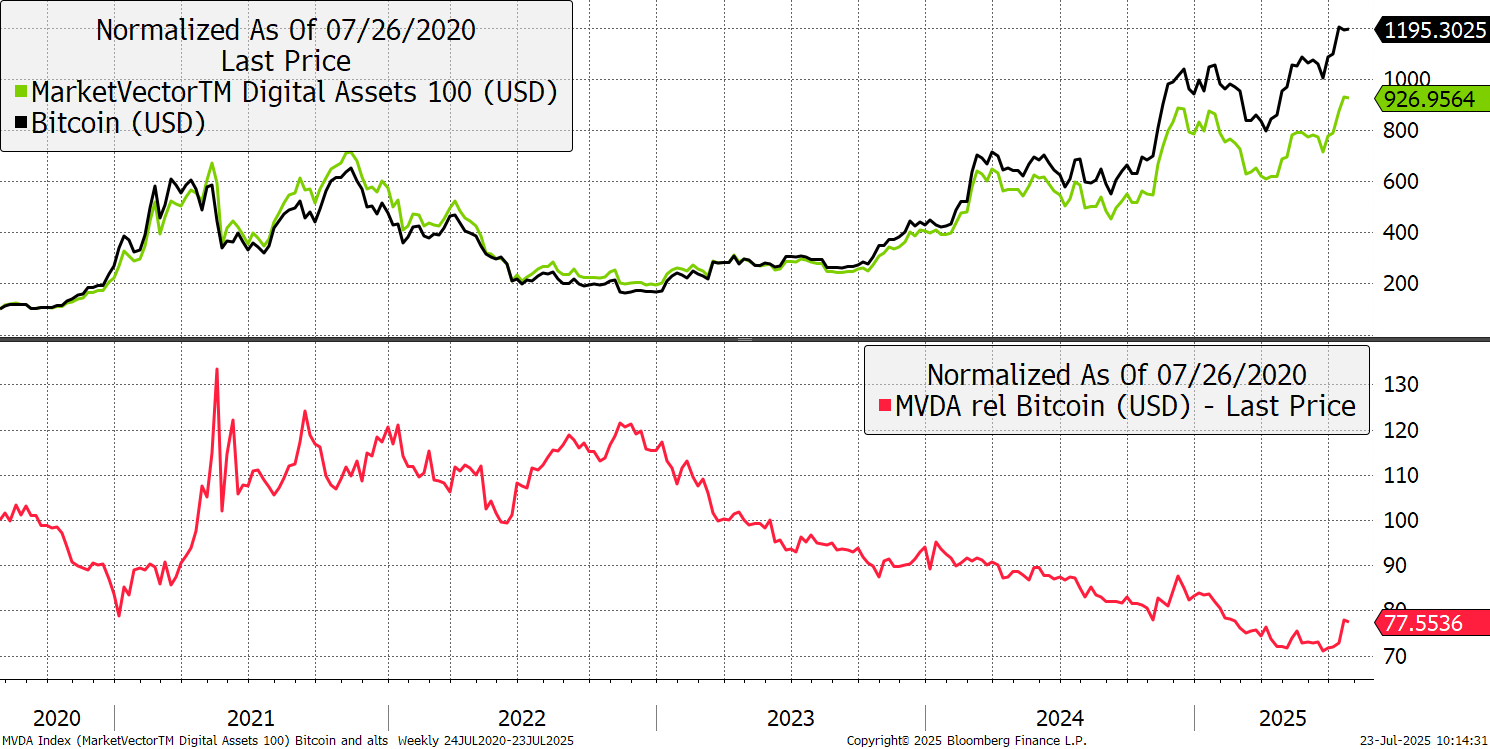

While Bitcoin is calm, the alts are kicking off. Over the last month, the MVDA 100, a diversified index of the top 100 coins and dominated by Bitcoin, has rallied relative to Bitcoin. Yet over five years, it remains 23% behind.

Bitcoin and Alts

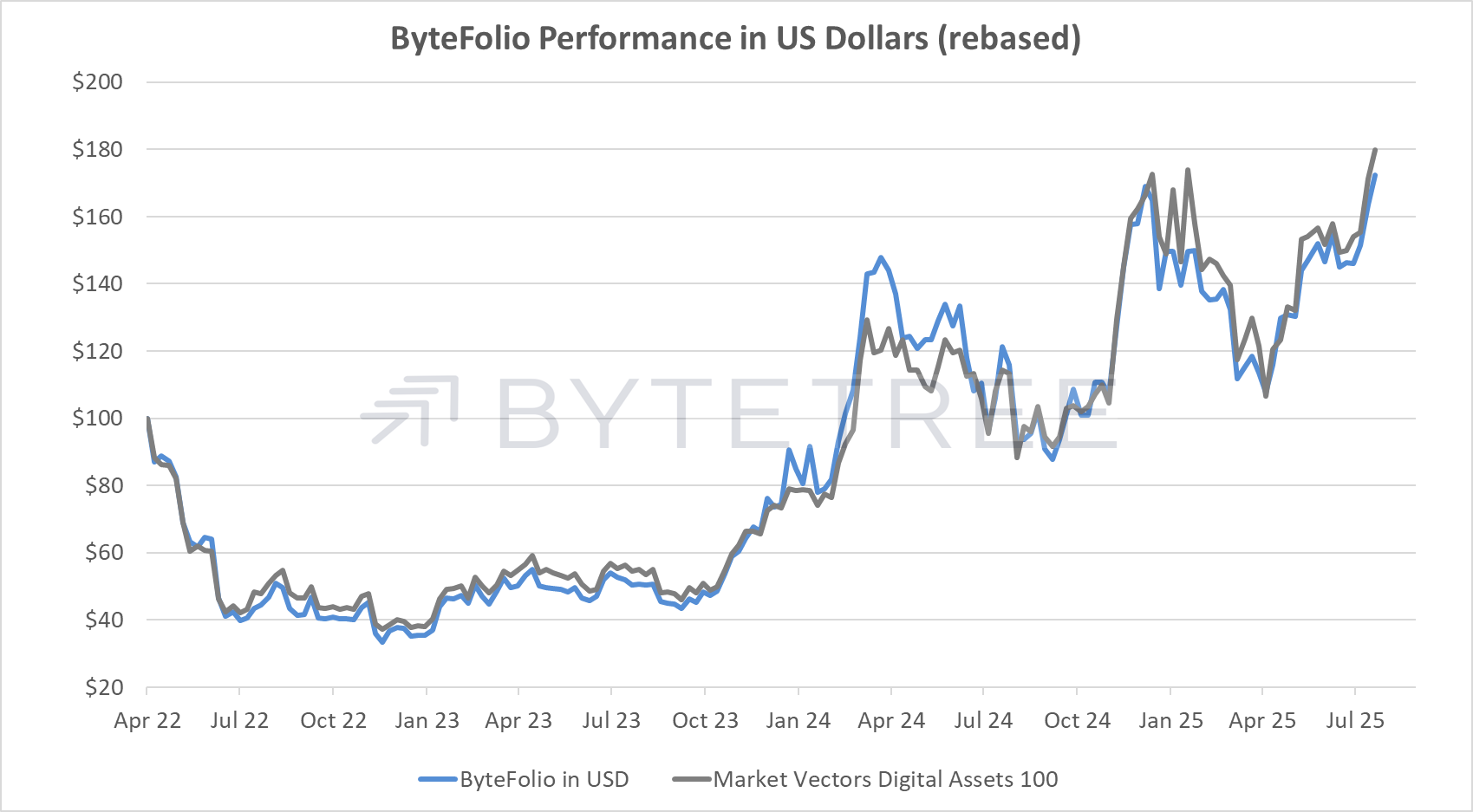

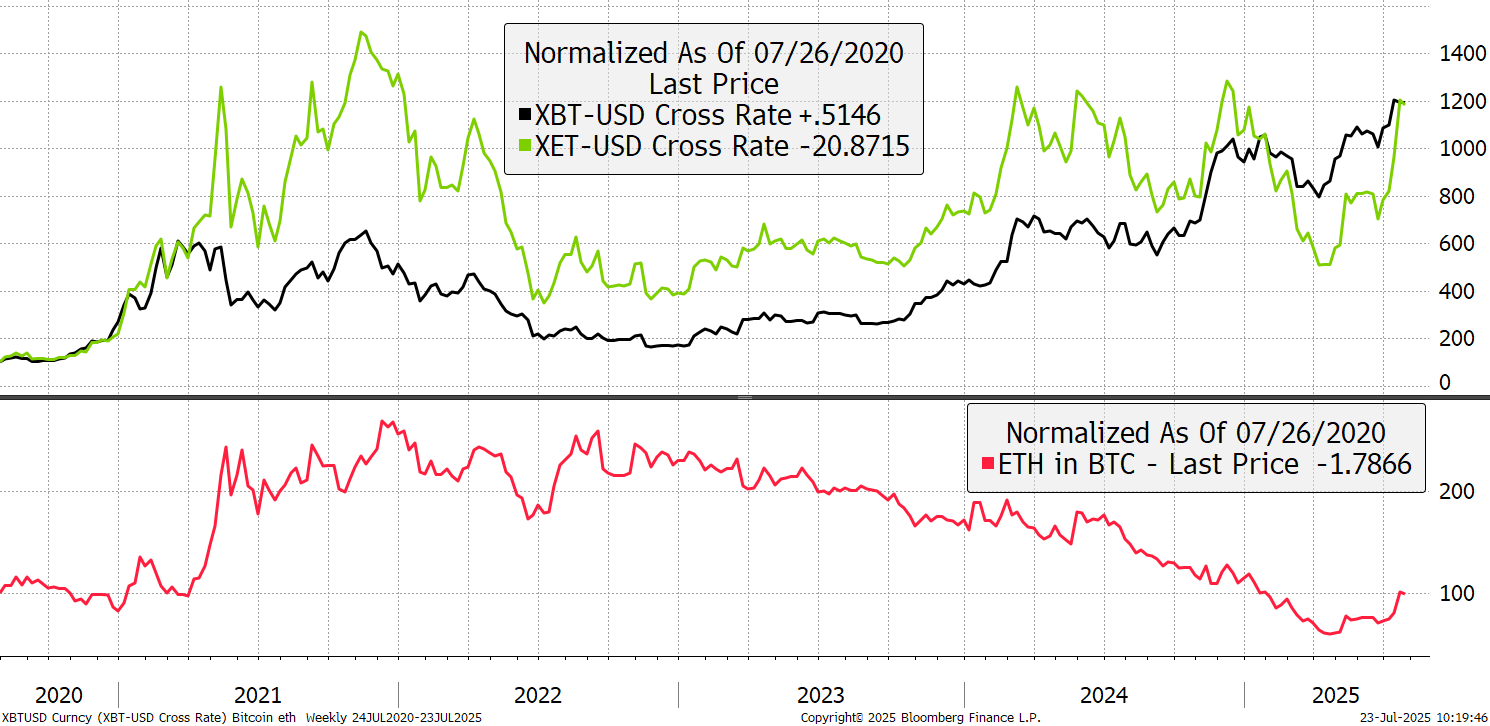

The leading alt is Ethereum (ETH). Over five years they have delivered the same return which is remarkable. That was due to ETH surging into late 2021 after Bitcoin had already peaked. ETH was late to start, and late to finish which reminds us that alt rallies seem to come at the late stages of the cycle.

Bitcoin vs Ethereum

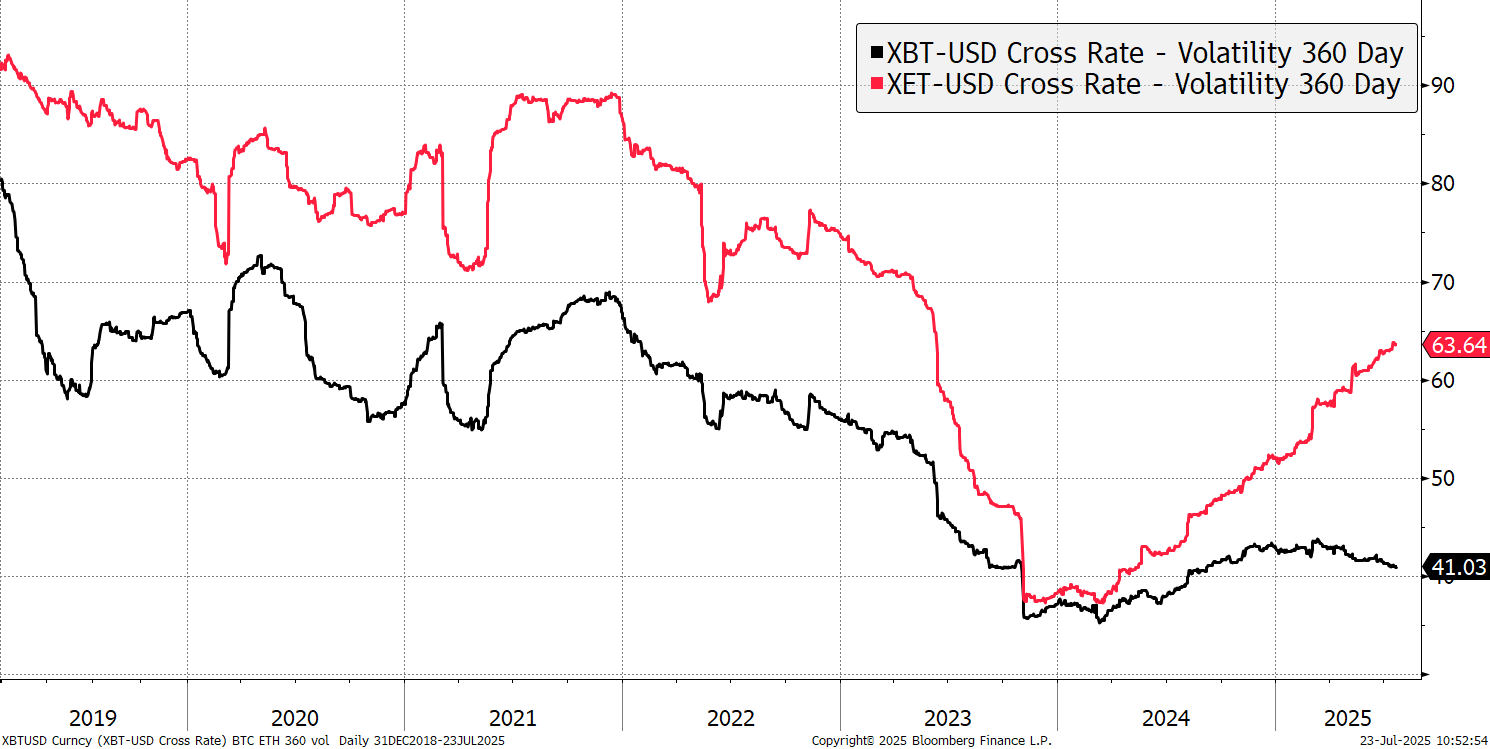

It is also noteworthy that while Bitcoin volatility continues to fall, Ethereum’s is rising again. My simple take would be that ETH should be considered a growth stock and not a store of value. That plays out in the performance data as well, as the 2022 drawdown was even more brutal than it was for Bitcoin.

Bitcoin vs Ethereum

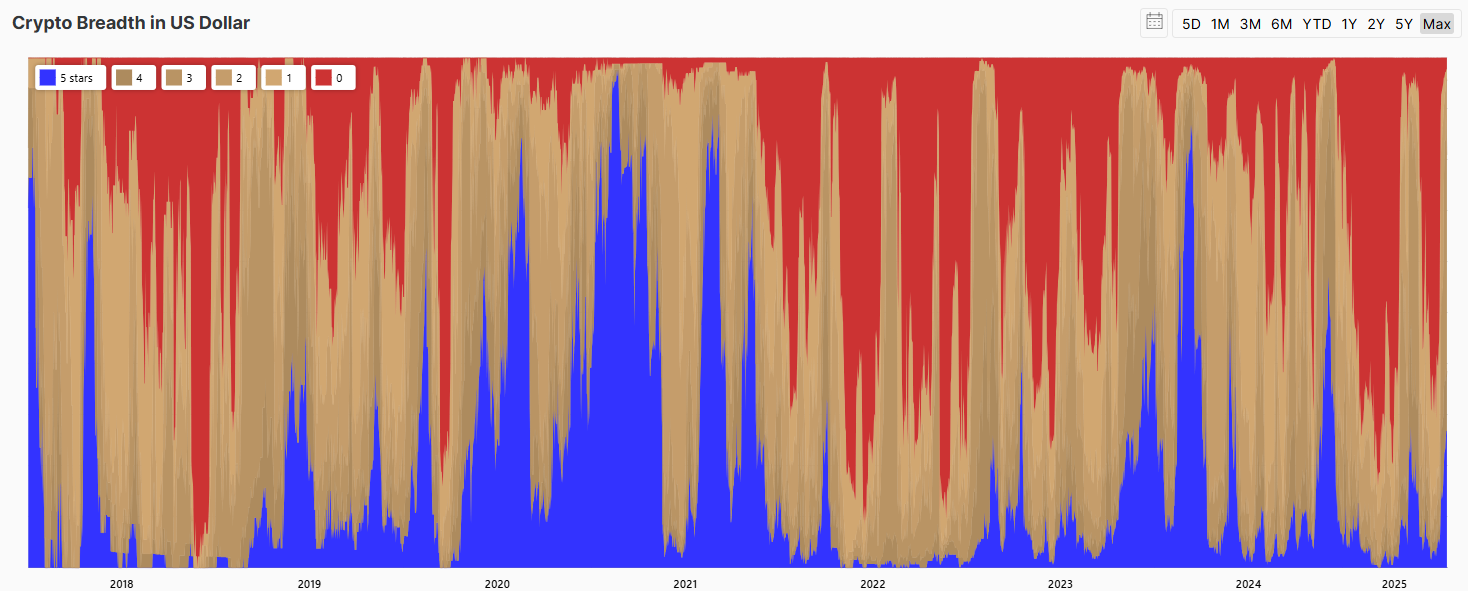

But it’s early alt season, or at least the latest attempt. The strong trends (blue) are rising again, but still on the light side. That said, few alts now have bear trends (red).

Crypto Breadth in US Dollar

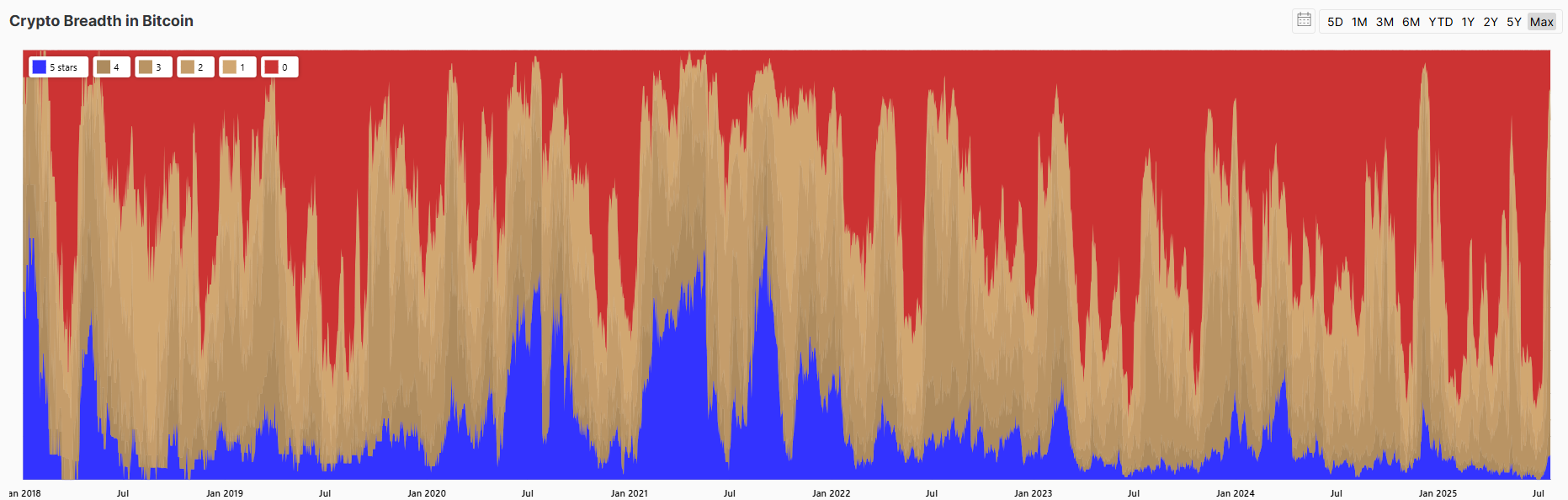

Measuring alts in USD is one thing, but in BTC, it’s another entirely. There are a few market beaters appearing, but they are few and far between. ByteFolio already owns the good ones.

Crypto Breadth in Bitcoin

But alt season is having another go, and that is something we welcome.