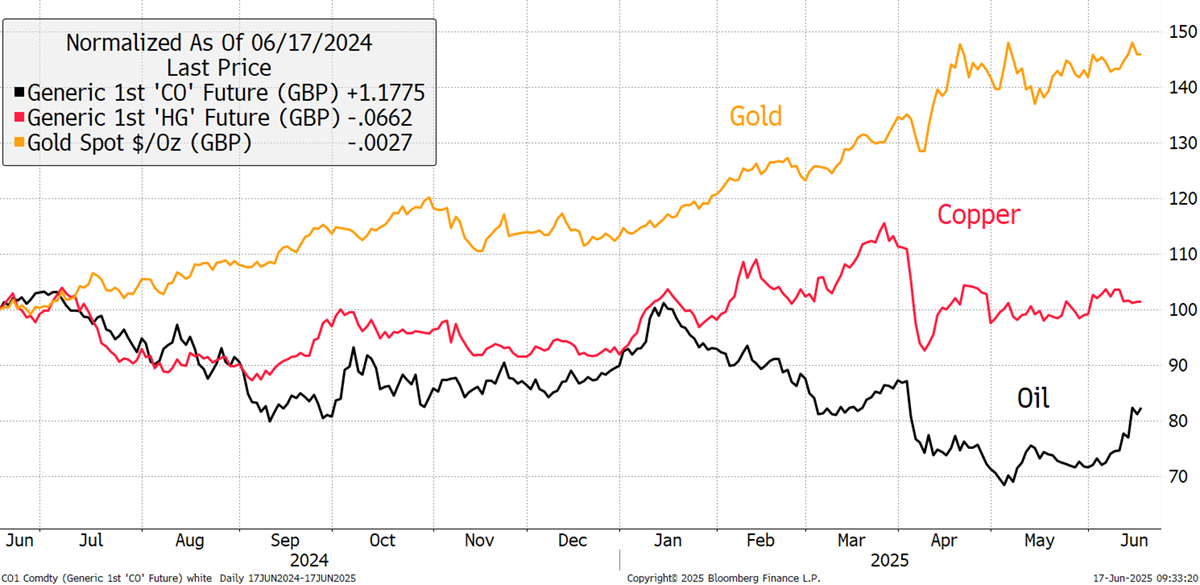

There are renewed tensions in the Middle East between Israel and Iran. Many investors are wondering why financial markets have taken it so calmly. Stockmarkets have barely budged. Gold rose slightly, and the oil price is still what many would describe as cheap. Perhaps it’s complacency, driven by a wave of geopolitical shocks that have always remained contained in the past. The risk is that for the first time in a long time, this war spreads.

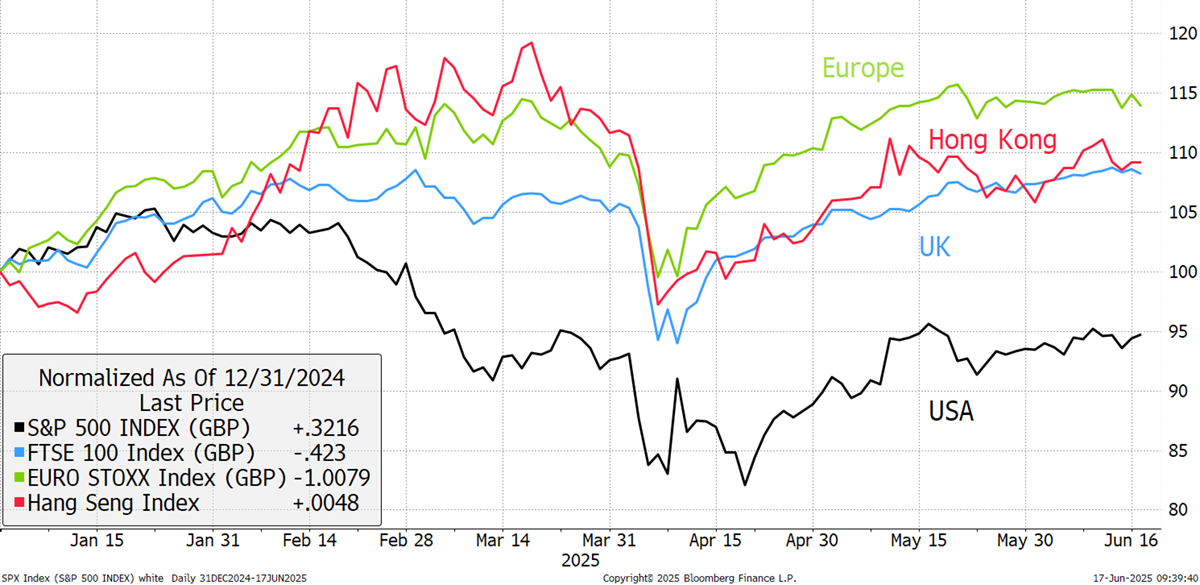

The Whisky and Soda Portfolios are behaving well. They are diversified and seem to be capturing the key themes of the moment. While some US stocks are still breaking records, there are many fewer than they were, and with a weak dollar, asset allocators have been moving back to Europe and Asia.

Europe, Hong Kong, the UK and the USA

Bonds have remained weak, leaving a narrow path for investors to succeed. Even commodities have been lacklustre, with the notable exception of gold. This is surprising in a weak dollar environment, and oil remains cheap despite the heightened geopolitical risks in the Middle East.

Oil, Copper and Gold

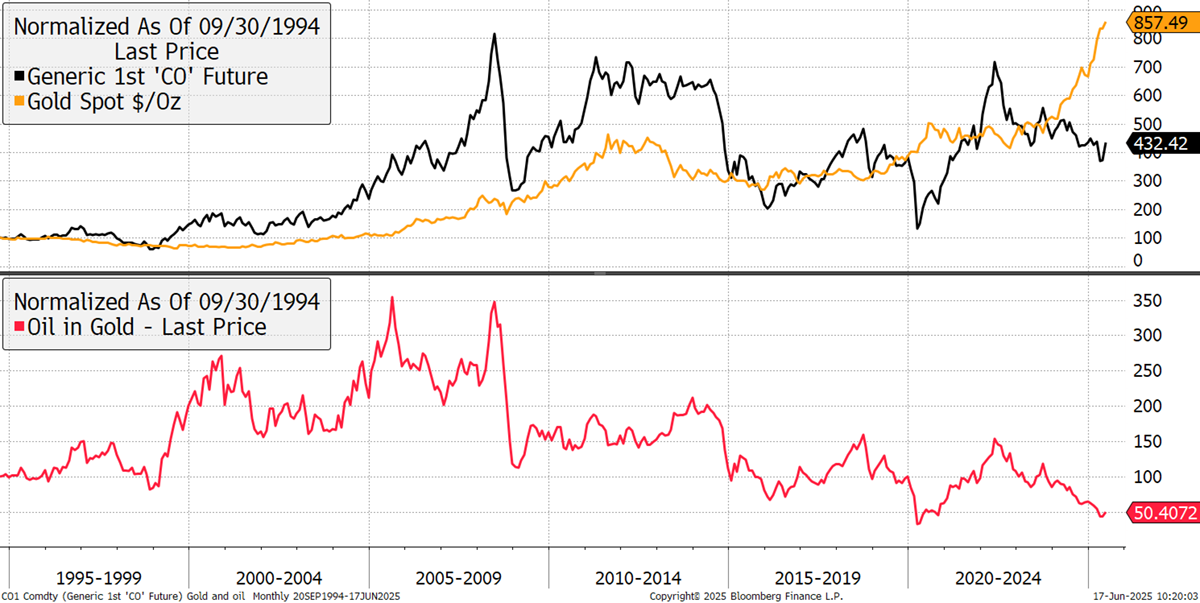

While we are on the subject, the oil vs gold chart is interesting, as it was only recently that gold took over from oil, going back three decades. Oil is currently behind, but history suggests that things can change. Oil is cheap gold, and I am keen to maintain exposure, even if it’s on the light side.

Oil and Gold

I have been poring over the portfolios to see what changes, if any, need to be made. While I have some new ideas that I would like to see included at some point, there is no need to take any action here and now. I like everything we hold, and I am unconvinced any portfolio changes would improve portfolio resilience.

Some of our positions have done very well, but none so much that they need to be reduced. Others have remained soft, but in all cases, they offer compelling value and something different to the rest of the portfolio, thereby providing diversification should things change. The bottom line is that the success of The Multi-Asset Investor Portfolios has been broad-based in 2025.

At the heart of the portfolios is gold. The Financial Times broke a story this week, “Gold overtakes euro as global reserve asset, ECB says”. They highlighted how the central banks now hold more gold (20%) than they do euros (16%). The dollar remains at 46%, but its share is also falling. With the central banks increasingly involved in the gold market, this suggests that holding gold should in no way be considered a peripheral and speculative asset. It has once again become core, just like it always was.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd