ByteFolio Issue 164;

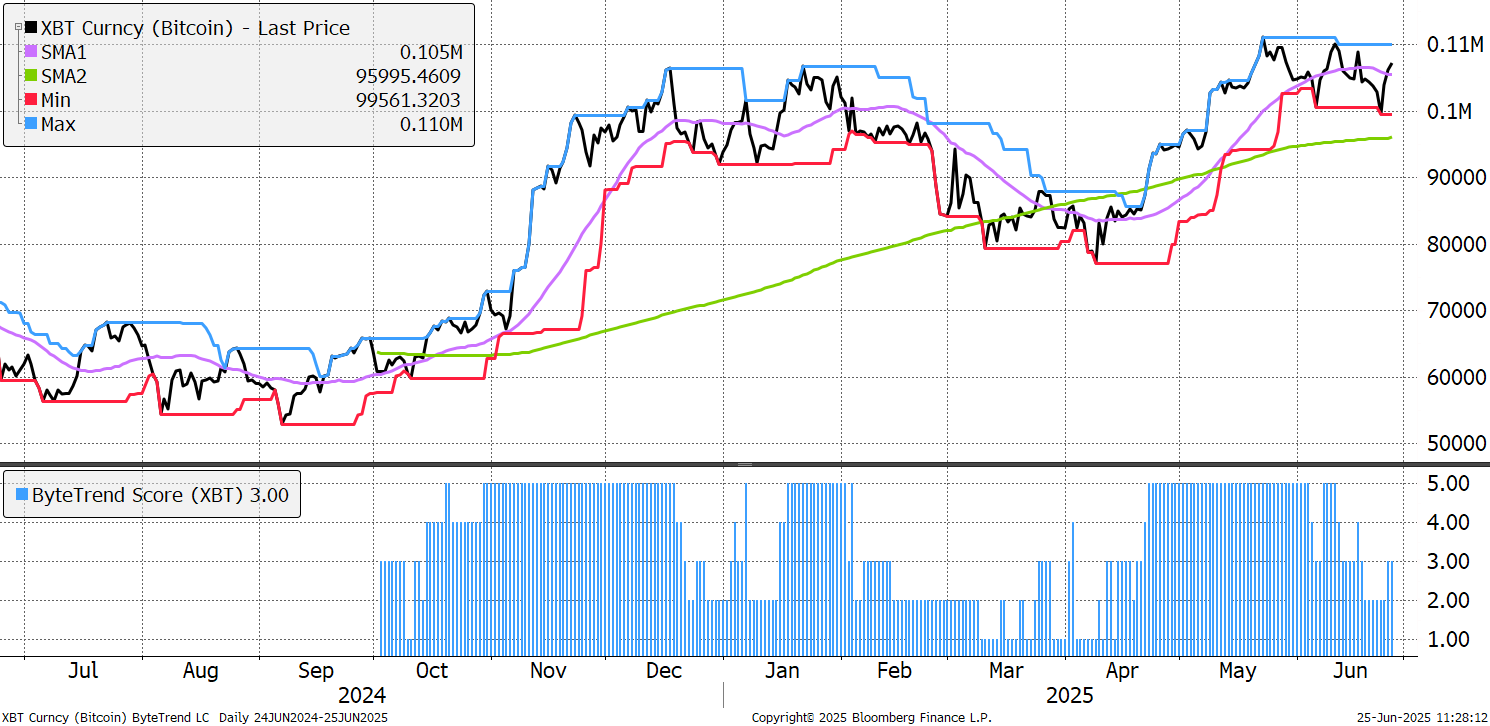

Bitcoin has rallied as peak hostilities seemed to be behind us, which I’ll get to. The price is back above the 30-day moving average taking the ByteTrend Score up to a 3. Unfortunately, it briefly dipped back below $100k but not for long. I can’t wait for that level to become a hard floor for the bitcoin price.

Bitcoin

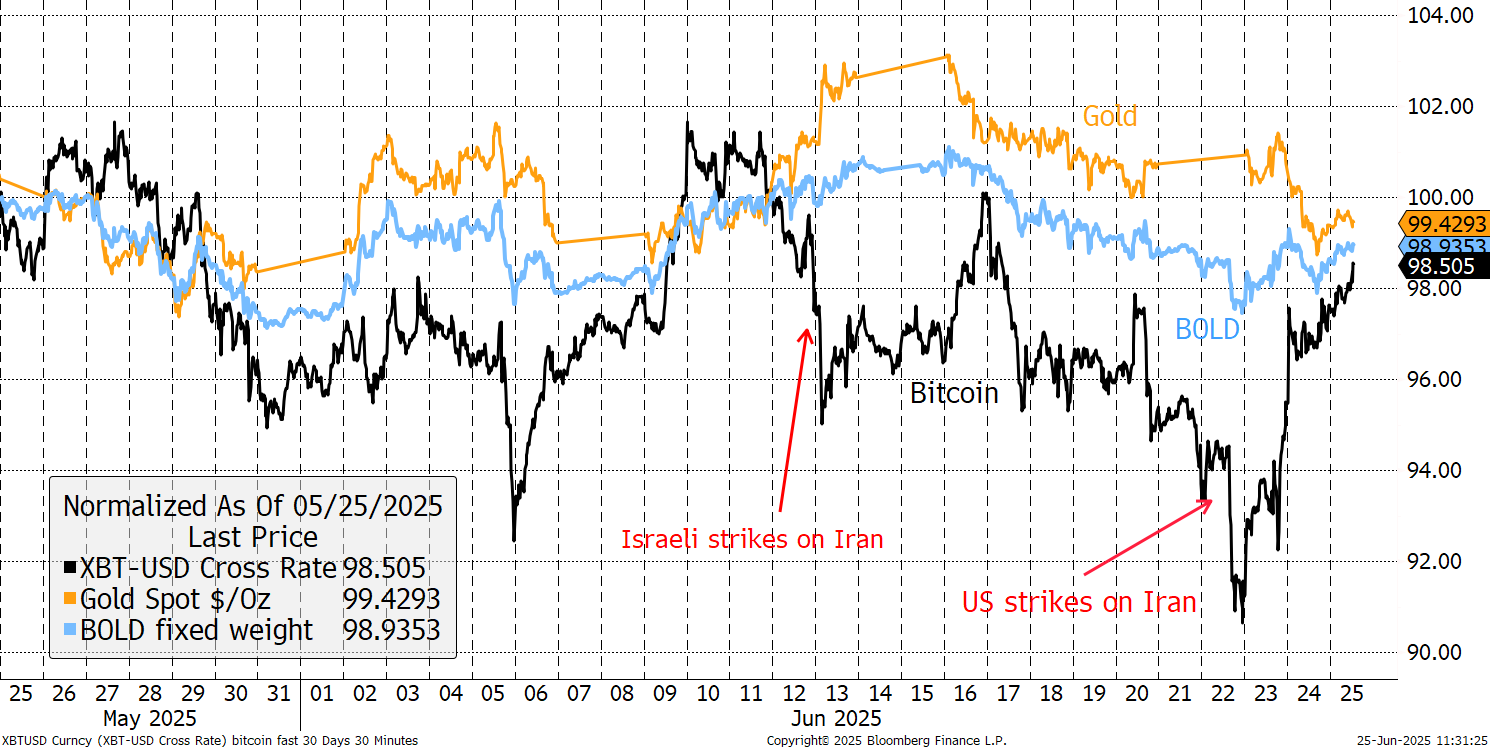

Gold likes war, while Bitcoin prefers peace. That aligns with the risk-ON, risk-OFF nature of the world’s two most liquid alternative assets. Gold peaked ahead of hostilities in the Middle East, while Bitcoin sank. Once it seemed likely that military actions were contained, Bitcoin rallied, and gold dropped back.

Bitcoin, Gold and BOLD

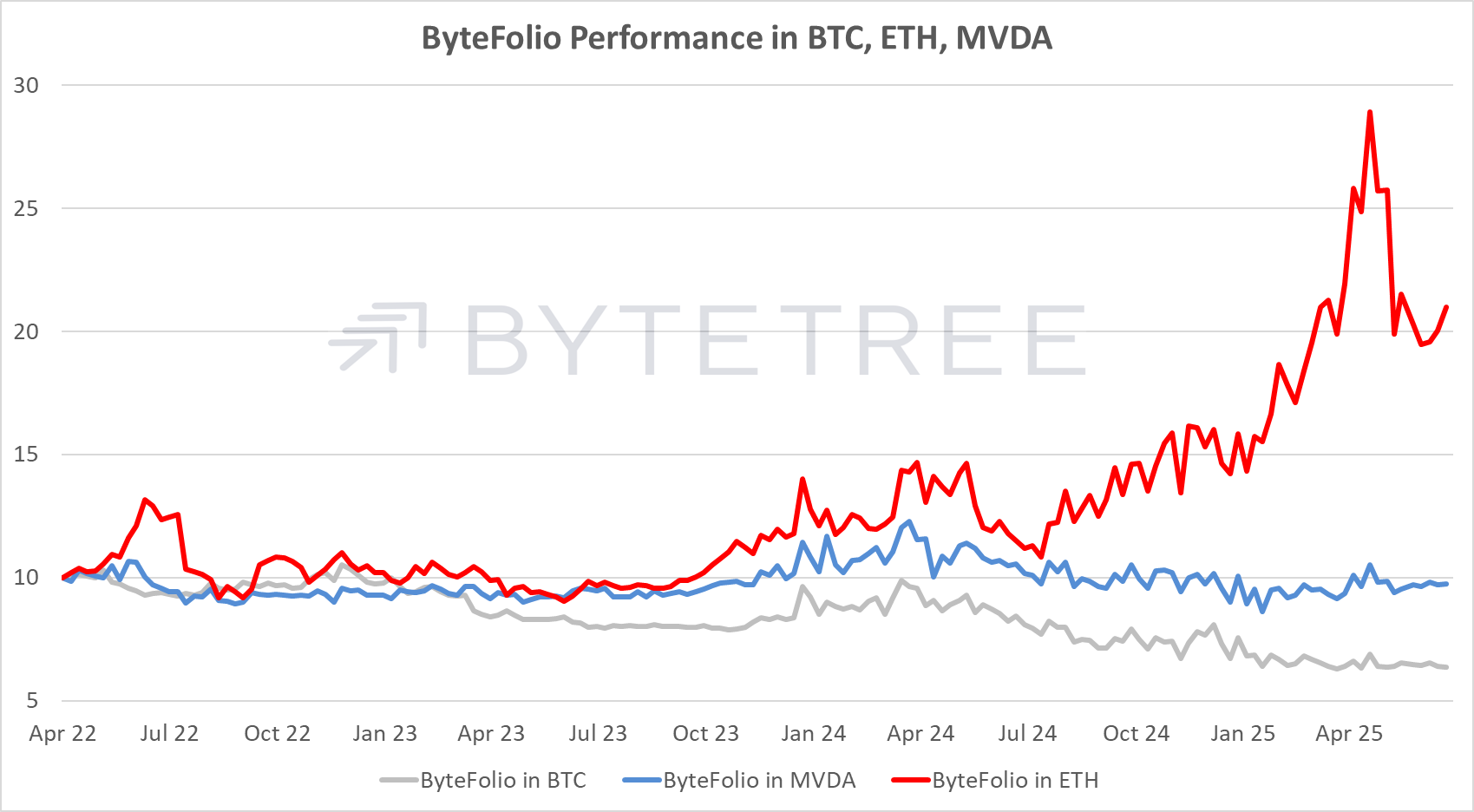

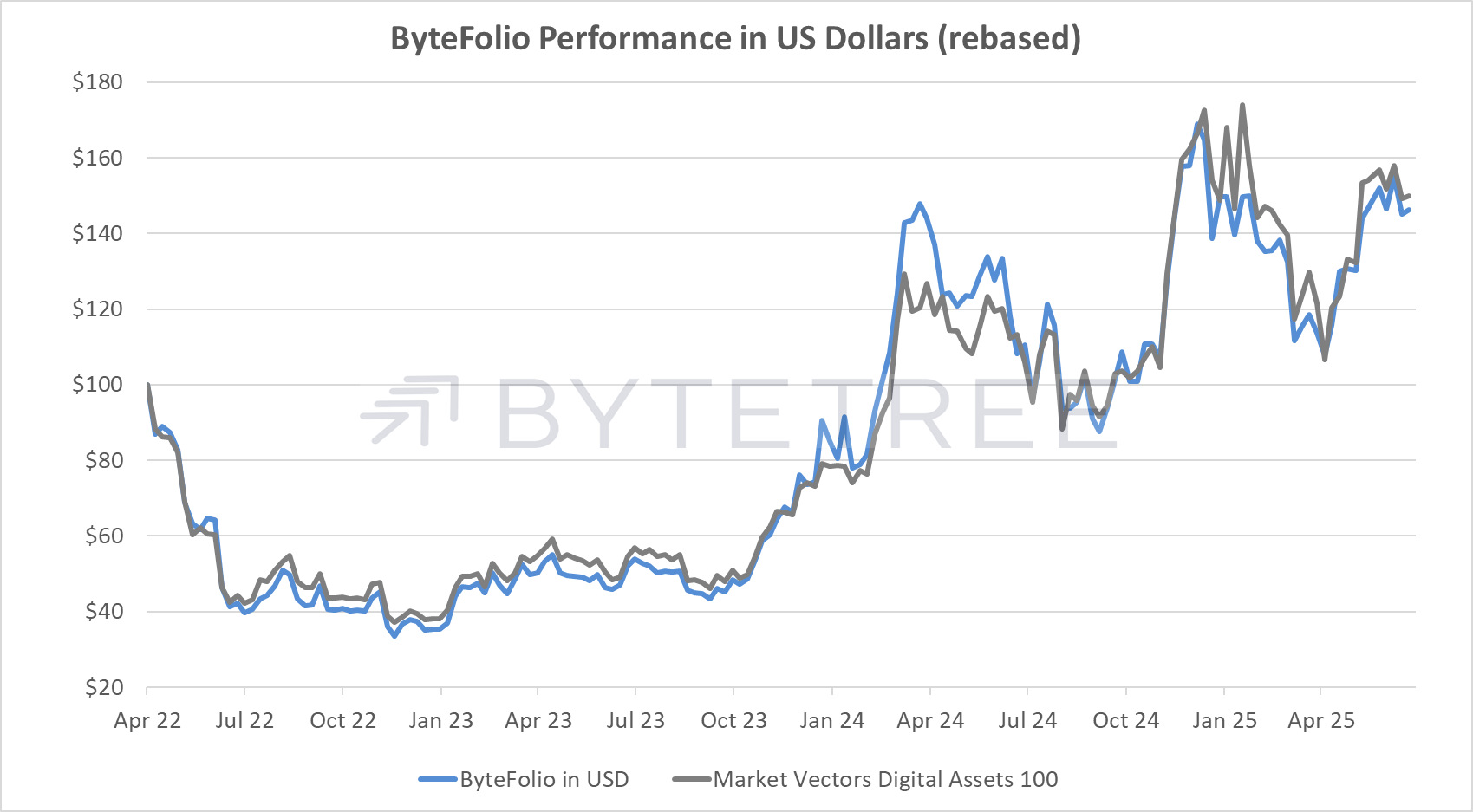

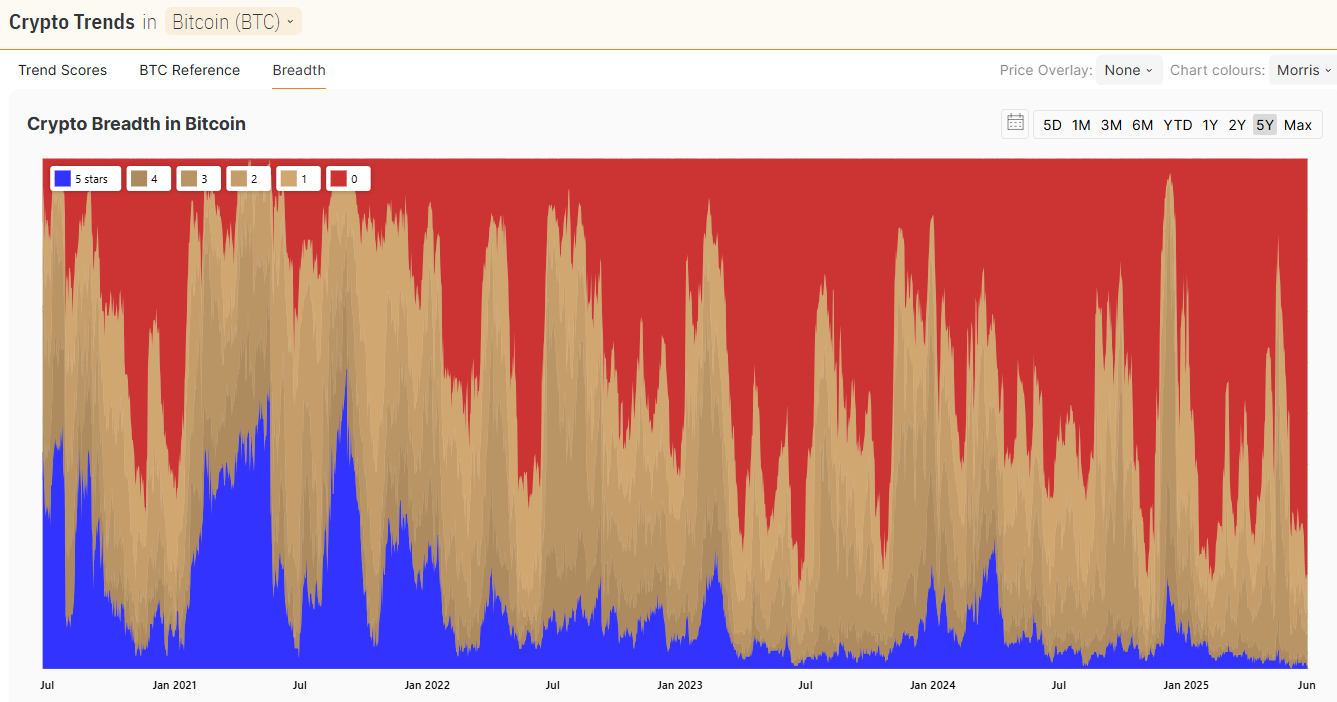

Bitcoin is doing well, and is in good health. It’s the alts that can’t keep up. The blue area shows the percentage of alts outperforming Bitcoin which continues to languish.

Crypto Trends in BTC

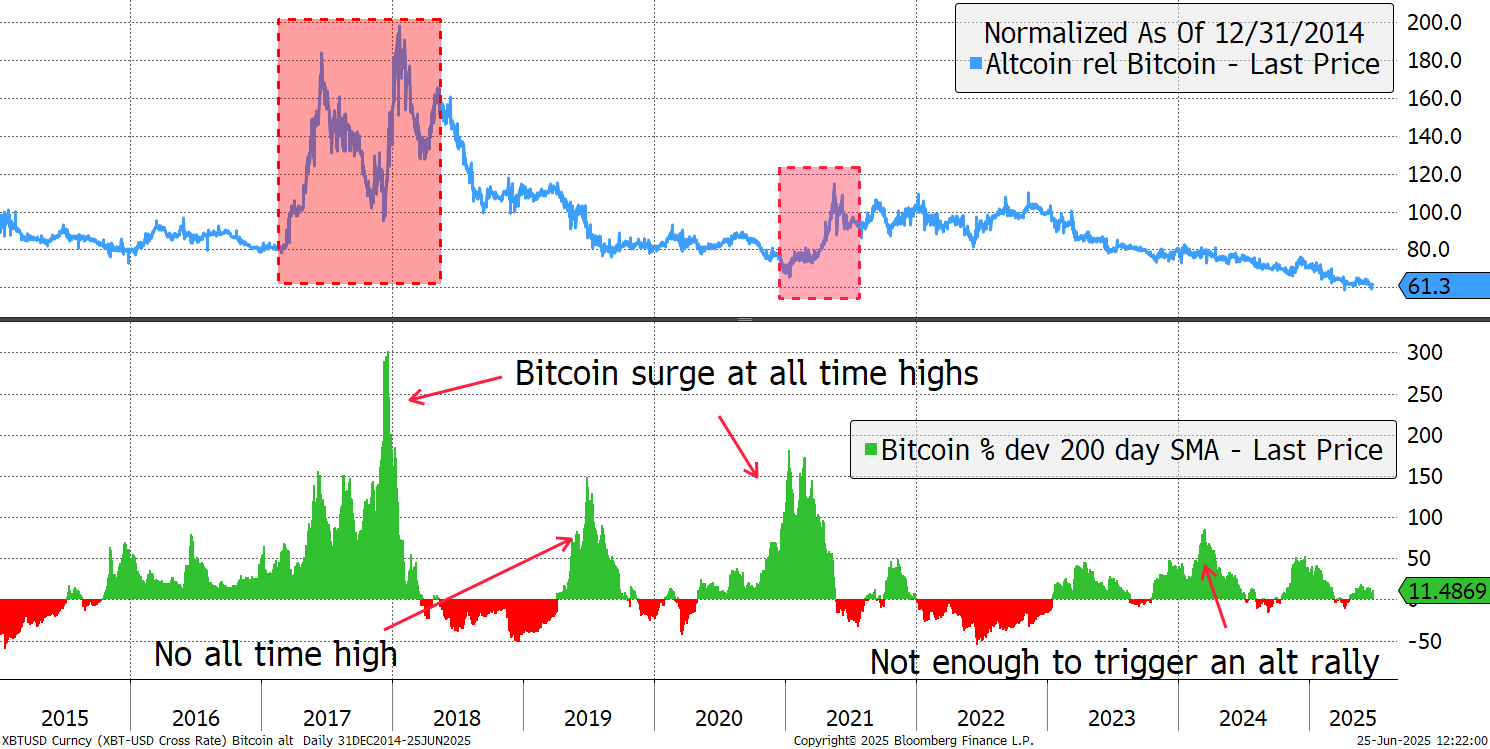

It’s a sorry picture, which gets worse each year, but we know that one day the alt rally will return. There was an alt rally in 2013, when alts surged past Bitcoin, marked by a late move in Litecoin, but I can’t get the data. Since then, there were alt rallies in 2017 and 2021. On both occasions, Bitcoin had already made an all-time high and was massively overbought (shown % deviation from the 200-day moving average on the lower chart). In 2019, Bitcoin was overbought but didn’t make an all-time high until the following year. In 2024, Bitcoin made an all-time high, but the market wasn’t crazy enough to trigger an alt rally.

Altcoin Rallies

Another alt rally will come one of these days, and they’ll be money to be made. In the meantime, having a weak alt market signals that we are no where near a top for Bitcoin.