Token Takeaway: HYPE;

Hyperliquid is a high-performance Layer-1 (L1) blockchain laser-focused on revolutionising transparent, on-chain crypto trading. In just over six months, its native token, HYPE, has rapidly climbed the ranks to become the 11th largest by market cap.

However, such a meteoric ascent hasn't come without scrutiny, as concerns have been raised around protocol centralisation and potential market manipulation. This Token Takeaway will explore Hyperliquid’s addressable market, assess its core fundamentals, unpack key risks, and examine the role HYPE plays in the broader ecosystem.

Introduction

Introduced in late 2022 by Jeffrey Yan and the pseudonymous iliensinc, Hyperliquid set out to build a fully on-chain perpetuals exchange that could deliver the speed, depth, and user experience of centralised platforms like Binance, while maintaining the transparency and composability of DeFi. Perpetuals (perps), also known as perpetual futures contracts, are derivatives that allow traders to speculate on asset prices without expiry dates. These products dominate crypto trading volumes, with most of that activity taking place on centralised exchanges (CEXs). Until recently.

Yan, a Harvard graduate, brings a strong pedigree in quantitative trading. He previously worked at Hudson River Trading, one of the world’s most sophisticated high-frequency trading firms. In 2020, he entered the crypto space by founding Chameleon Trading, a proprietary trading firm that quickly rose to become one of the largest crypto market makers globally. His co-founder, iliensinc, a fellow Harvard classmate and alum, was a key contributor at Chameleon. Together, they combined institutional-grade trading expertise with a deep understanding of blockchain architecture to build something new.

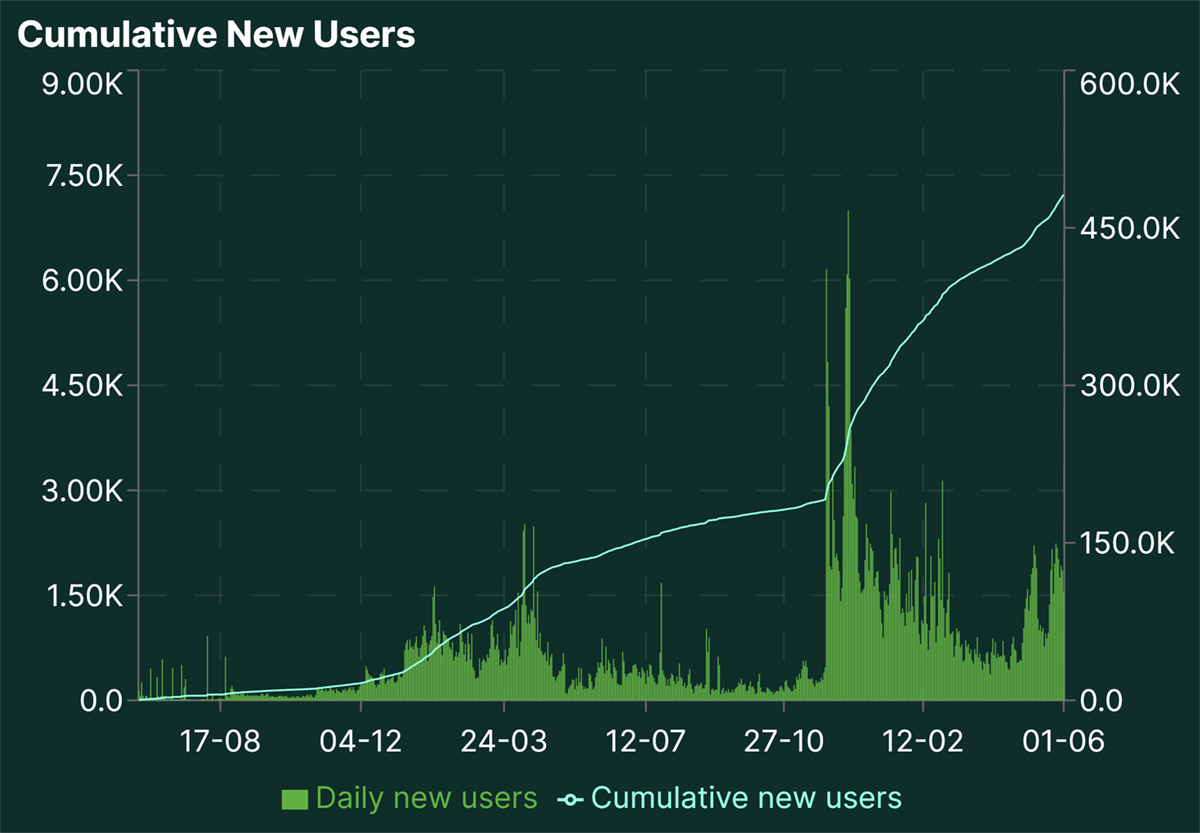

Since November 2024, Hyperliquid has witnessed exponential growth, coinciding with the launch of the HYPE token. As of mid-2025, it boasts nearly 500,000 unique users and has facilitated over $1.5tn in cumulative trading volume, a staggering figure for a protocol that is not even three years old.

Hyperliquid User Growth

With its cutting-edge tech stack, innovative order book design, gas-less leveraged trading features and consistently high trading throughput, Hyperliquid has become a dominant force among decentralised trading protocols.

But before diving into the intricacies of Hyperliquid, let’s explore the broader addressable market it operates in and why this segment is ripe for disruption.

Hyperliquid’s Addressable Market

Hyperliquid is not just participating in the evolution of crypto derivatives trading; it’s actively redefining it. The question is no longer if it will matter, but how much it can grow from here.

To understand the magnitude of the opportunity, consider the traditional financial system. The notional value of the global derivatives market is estimated to exceed one quadrillion dollars, a staggering figure when compared to the world’s GDP of around $106tn. While the net derivatives exposure is significantly lower due to offsetting positions and leverage, the sheer scale underscores the demand for derivative instruments in capital markets.

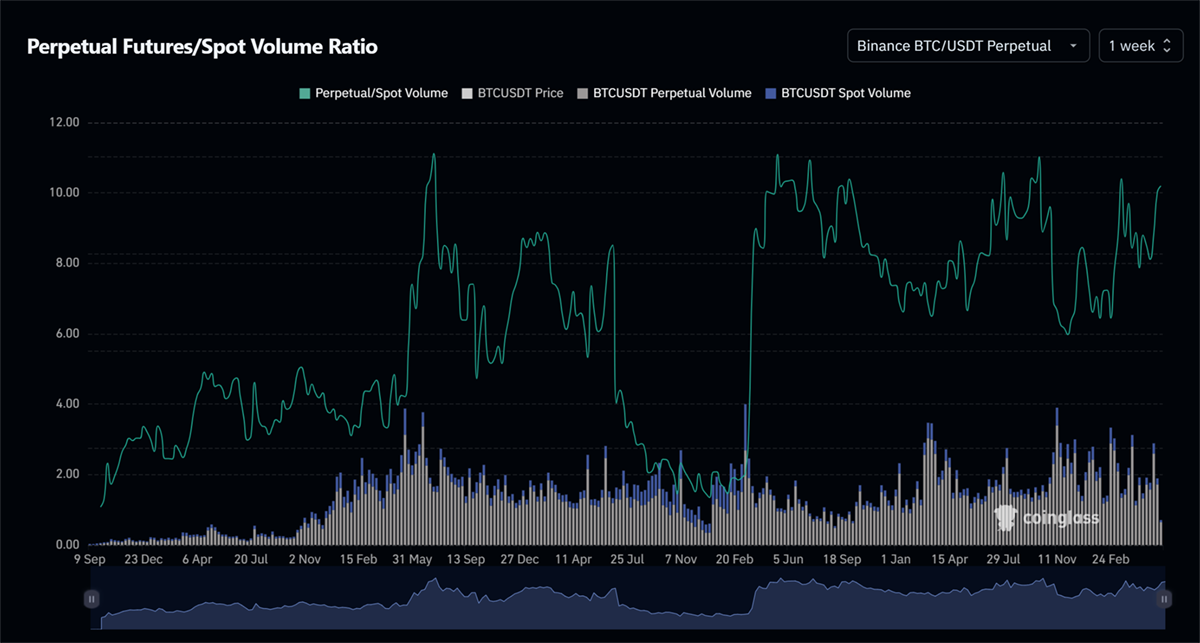

A similar pattern exists in crypto, where perpetual futures dominate spot trading volumes. Nowhere is this more evident than with Bitcoin, the most traded crypto asset. On Binance, for example, Bitcoin’s perpetual futures trading volume regularly exceeds 10x the spot volume. This is not a temporary distortion; it’s a structural trend that has only grown stronger over time, with the perpetual-to-spot volume ratio highlighting the shift.

BTC Perpetual Futures vs Spot Volumes

Since Q4 2019, when the ratio hovered around 1, the dominance of perpetuals has exploded. The dip in late 2022, triggered by the collapse of FTX, a major centralised perpetuals exchange, was short-lived. By early 2023, volumes had rebounded sharply, suggesting that the downturn was driven more by panic and loss of confidence than by any structural decline in demand. The appetite for leveraged trading never truly disappeared; it simply shifted to safer, more transparent alternatives.

Hyperliquid Capitalised on the Demand

Hyperliquid launched right as the FTX collapse sent shockwaves through the crypto market. In hindsight, the timing was impeccable. Co-founder Jeffrey Yan sought to build a platform that could offer the performance and user experience of FTX while avoiding its pitfalls through radical transparency and on-chain execution.

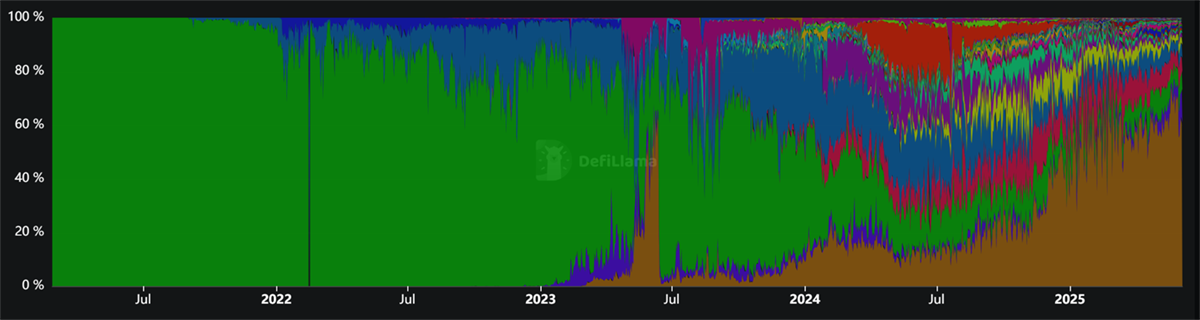

That vision resonated, and Hyperliquid began capturing market share in 2023, growing into a market leader in the decentralised perpetuals space. At its peak, the protocol held over 72% of the total DEX perp market share, as highlighted below in brown.

Perp Market Share by Chains

As of June 5, 2025, it still commands a dominant 61%, far ahead of BNB Smart Chain (12.6% in purple) and Ethereum (6.83% in green).

This dominance is even more pronounced when examining recent volume data.

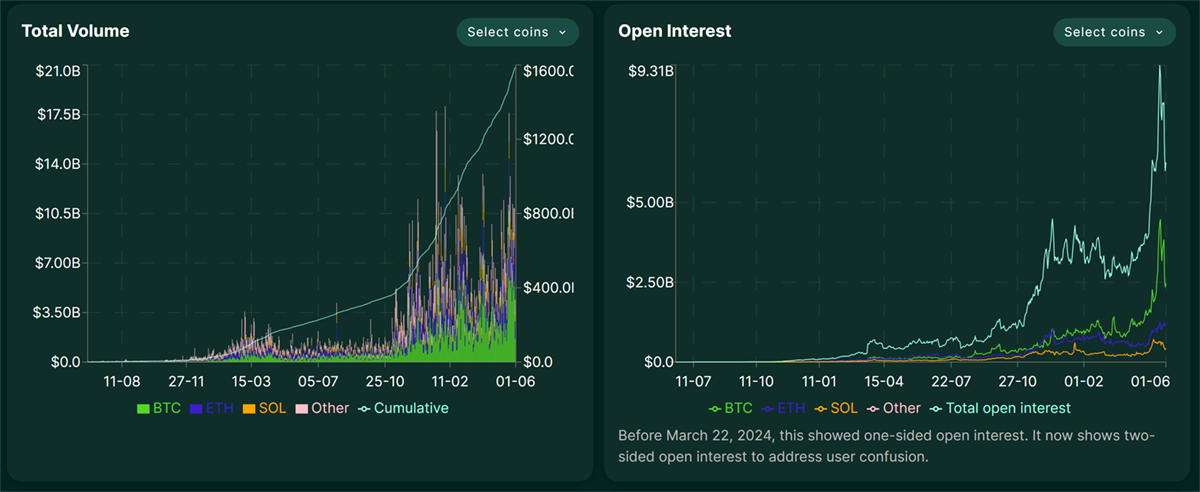

Top 10 Chains by 30-day Perp Volumes

In the last 30 days, Hyperliquid processed more than $250bn in trading volume, compared to $28.4 bn on Ethereum, $27.9 bn on Solana, and $19.6 bn on BNB Smart Chain. In short, Hyperliquid isn't just competing, it's dominating.

As the crypto bull market reignited in late 2024, driven by broader macro tailwinds and rising institutional interest, liquidity began flooding back into digital assets. It also marked a significant resurgence in speculative and leveraged trading activity, the kind of demand Hyperliquid is specifically built to capture.

Total Volume and Open Interest on Hyperliquid

As shown above, the cumulative volume has grown significantly during that period and surpassed $1.5tn. However, due to the current market pullback, Open Interest (OI), a metric that reflects the total value of outstanding derivative contracts, currently stands at $6.2 bn, down from over $9 bn a few weeks ago.

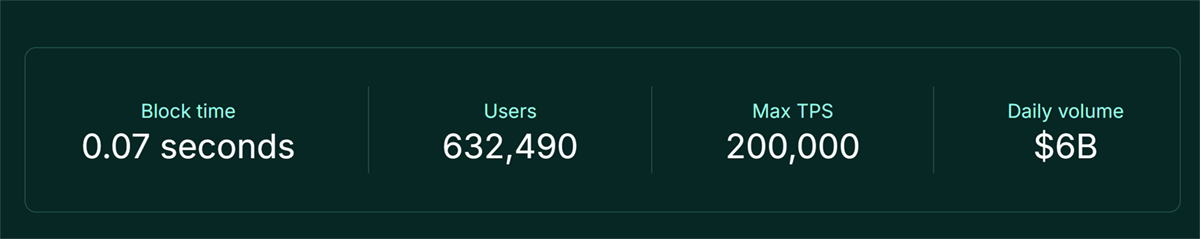

Hyperliquid’s technological backbone plays a crucial role in its success. The protocol boasts block times as low as 0.07 seconds and a throughput capacity of up to 200k transactions per second (TPS).

Hyperliquid’s Key Stats

In comparison, dYdX, Hyperliquid’s largest direct competitor, has a 1-second block time and facilitates 1500 TPS. These stats are essential for mass adoption and serving quantitative and high-frequency trading (HFT) use cases, and Hyperliquid is miles ahead.

Additionally, dYdX utilises an off-chain order book or matching engine while only settling trades on-chain. On the other hand, Hyperliquid executes the entire trading process on-chain. This includes order submission, matching, execution, and settlement, all within a fully transparent smart contract environment.

This design isn’t just a technical choice; it’s a critical safeguard against front-running, a form of market manipulation where an entity uses prior knowledge of a user’s trade to execute a trade ahead of them for unfair profit. As all order flow on Hyperliquid is publicly verifiable, there is no privileged access to order data, and the protocol does not rely on any off-chain intermediaries that could exploit insider information.

By contrast, centralised exchanges (CEXs) and some hybrid DEXs have been vulnerable to such practices. One of the most prominent examples was the FTX-Alameda scandal, where Alameda Research, FTX’s sister trading firm, was accused of front-running FTX token listings by holding a significant amount of tokens prior to their listing on the exchange. In a transparent system like Hyperliquid, that kind of behaviour is structurally impossible, not because of good intentions, but because the protocol enforces equal access.

However, Hyperliquid is not perfect either and has been accused of market manipulation because of its centralised validator (governance) structure. But more on that later.

Hyperliquid Architecture

Hyperliquid’s technical architecture is purpose-built for high performance. It is composed of three tightly integrated core components: HyperBFT, HyperCore, and HyperEVM, each playing a distinct role.