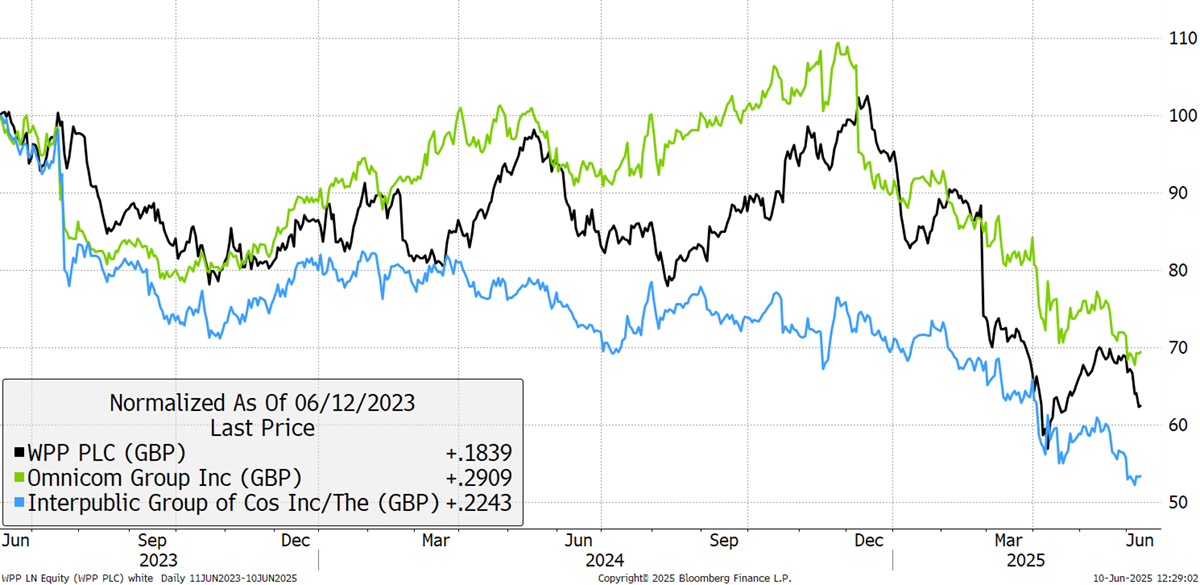

Firstly, I would like to thank Russell Napier for joining us on the webinar last week. He was adamant that it had to sit behind the paywall because AI is plagiarising his business. That’s not just him, as the advertising industry has been negatively impacted as well, which we picked up in the latest update of the Global Trends Investor. The share prices of WPP and US rivals Interpublic and Omnicom are all nosediving together. Then, the FT reported that the CEO, Mark Read, had stood down, despite having invested £300 million in AI in order to be ahead of the game.

Copyright has become a big issue as AI helps itself to everything it sees. Investing in AI is one thing, and no doubt there will be winners, but for me, the most important thing is to acknowledge the carnage and avoid the losers in its wake. Virtual services and intellectual property, previously high-margin business models, have come under pressure.

Advertising Impacted by AI

I want to address some other comments in the webinar. Russell Napier flagged highly indebted countries, and not by referencing government debt, but total debt. Indeed, he gave me a ticking off after sending him last week’s piece, where I showed a chart of USA debt to GDP. He said that’s government debt, not total debt and therefore wrong. That was me told.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd