ByteFolio Issue 161;

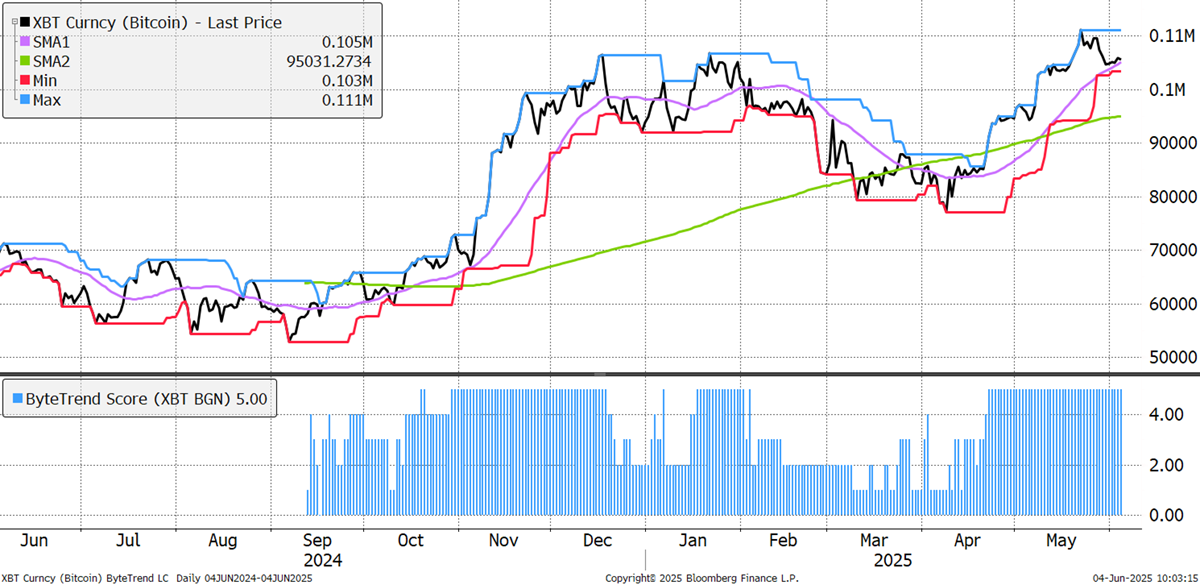

Bitcoin still has a ByteTrend score of 5, but only just as it hovers around the 30-day moving average. So far, it’s Bitcoin's least impressive all-time high, but still, it’s a dangerous time to be short.

Bitcoin 5-star ByteTrend Score

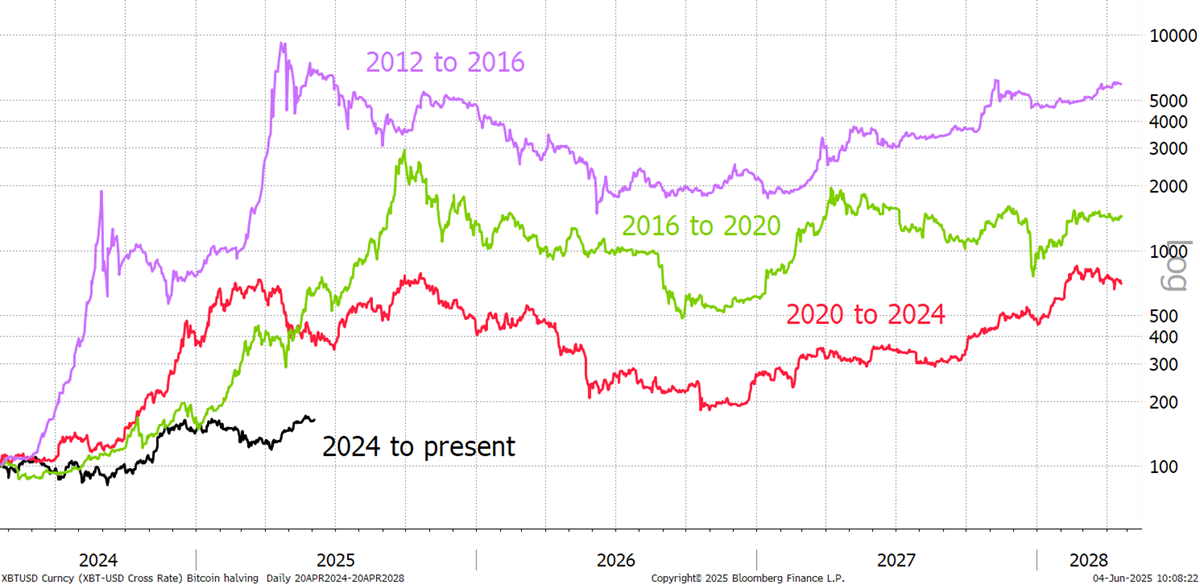

I’m not expecting 100x, as we saw post-2012, or 30x, as we saw after 2016, or even 8x, as seen after 2020, but I am expecting more than 2x. So far, this cycle has been disappointing, but it is not over.

Bitcoin Halving Cycles

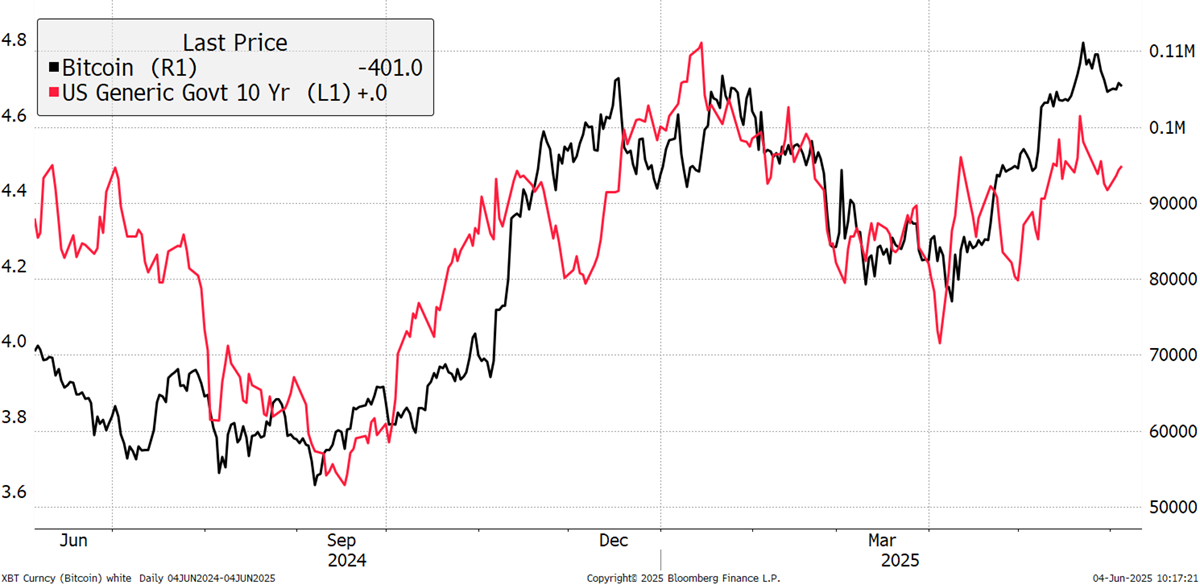

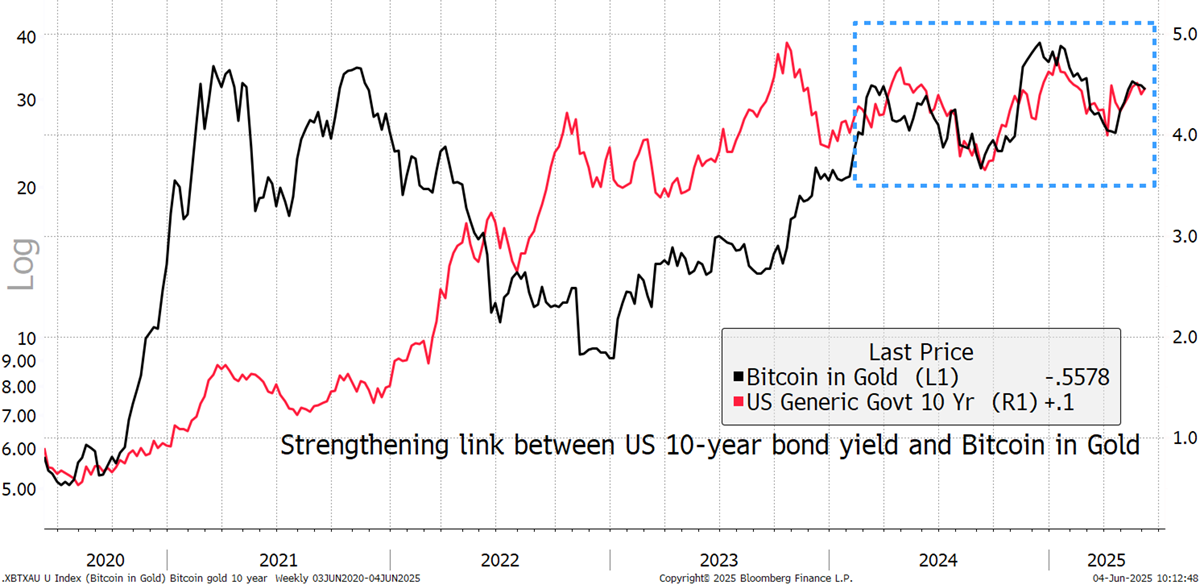

One important consideration is the bond yield. Government bond markets are in crisis. Debt levels are too high, and governments are being squeezed by the cost of servicing their debt. This has pushed bond yields higher as the market has struggled to cope with the vast levels of new debt issuance.

What I find most interesting for Bitcoin and gold watchers is how the 10-year yield is driving the price of Bitcoin vs gold. This has always been true to an extent, as rising yields generally reflect growth, and falling yields a slowdown. Gold is risk-OFF and prefers falling yields. Bitcoin is risk-ON and prefers rising yields. The relationship has tightened considerably.

The Impact of Bond Yields on Bitcoin and Gold

This short-term pullback in the 10-year treasury yield helps to explain why Bitcoin’s breakout was lacklustre. But if you believe that Trump likes borrowing and spending money, then this yield moves higher, and Bitcoin moves with it.

Bitcoin and the 10-Year