ByteFolio Issue 163;

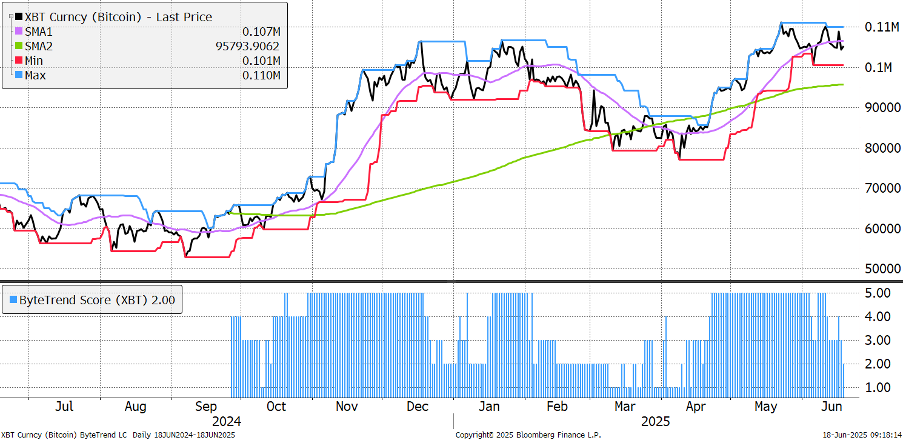

Bitcoin has eased back from attempting an all-time high, but the war in the Middle East gives just cause for that. The price had dipped below the 30-day moving average, and the last touch of the max/min lines was a (red) low in early June. That takes the ByteTrend Score to a 2. Note the 200-day moving average is rolling over because the price has not made much progress for six months. That is surprising given the regulatory tailwinds from the US administration.

Bitcoin

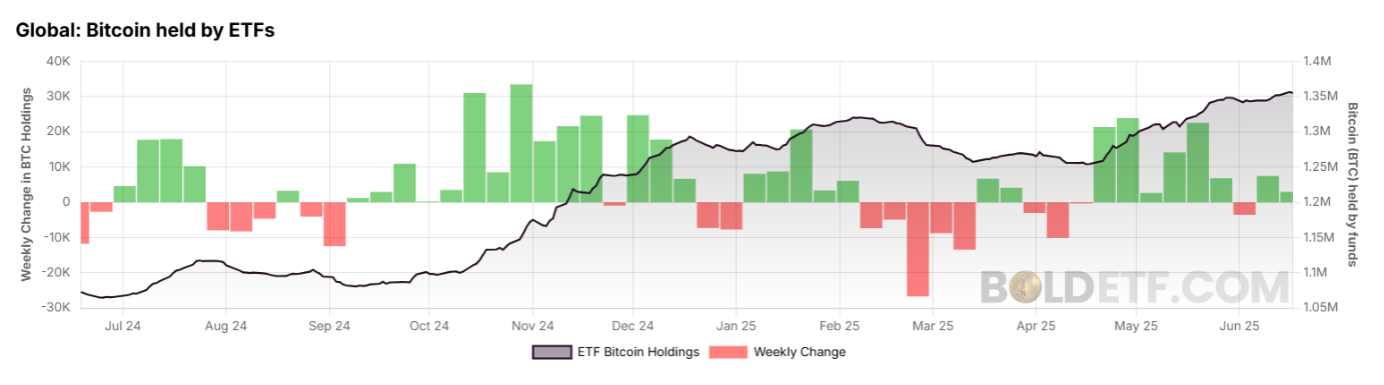

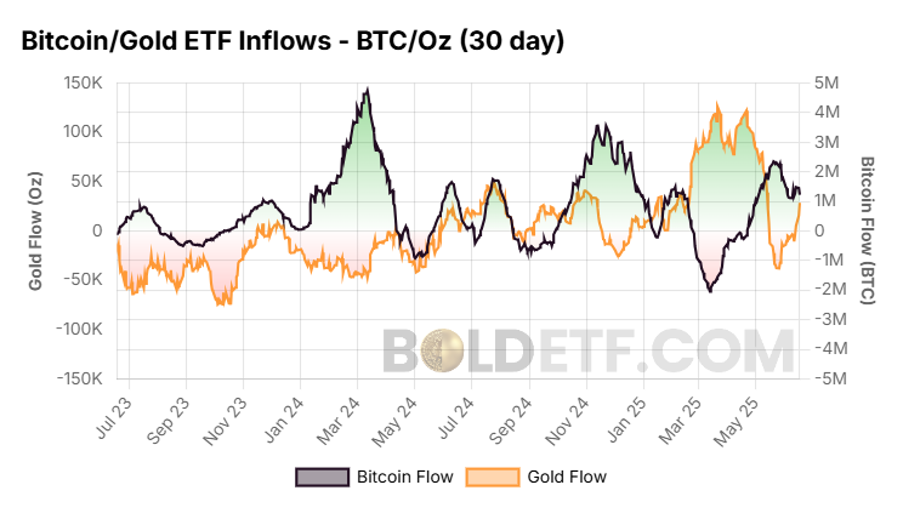

Yet flows into the Bitcoin ETFs remain positive and are even stronger from the treasury companies, which ought to be supportive. It implies there is heavy selling pressure from traditional Bitcoin holders.

This chart flips from time to time, but the flows into gold are back in charge. War does that, so no great surprise. Bitcoin is likely to pick up when the geopolitical news improves.

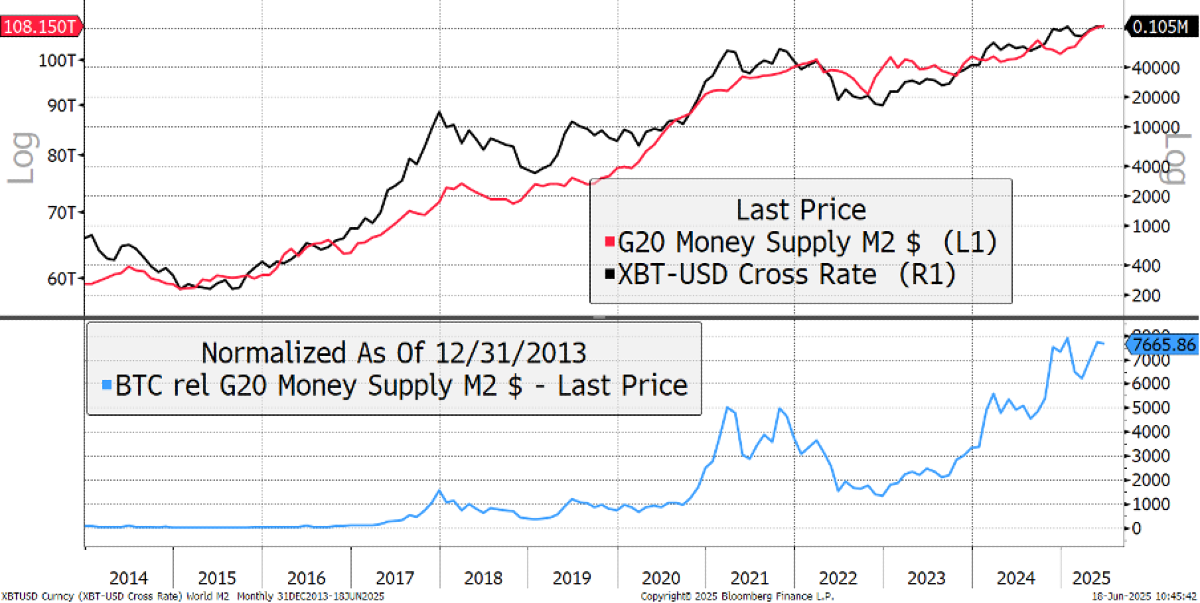

A positive force driving both bitcoin and gold is the world money supply, which keeps on growing at a trend rate of 7.2% p.a.. Bitcoin has latched onto this and followed the money supply higher at a faster rate of 45% since 2013, 25% since 2017, and 10% since 2021. Bitcoin is clearly maturing, but is still growing 10% faster than the money supply, which is an impressive feat.

Bitcoin and the Money Supply

If you believe they will keep on printing money, then stay long Bitcoin.