ByteFolio Issue 162;

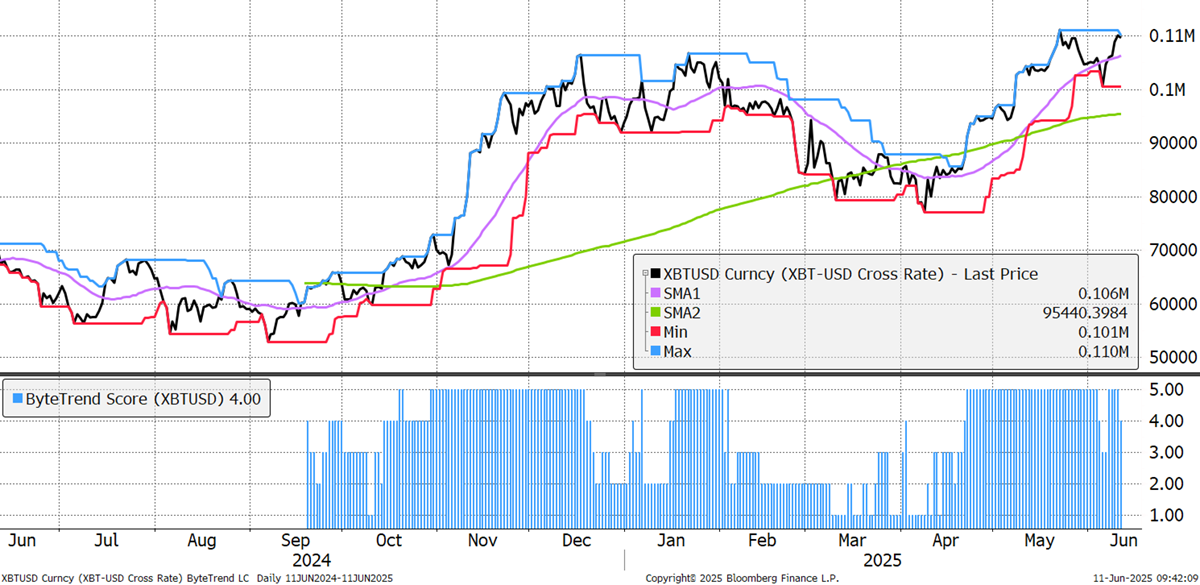

Bitcoin still has a ByteTrend score of 4, as it recently touched the 20-day min line. One more good day, and it will be back to a bullish 5.

Bitcoin

It is noticeable how major Bitcoin breakouts in the past used to have great panache, but these days, it’s a more sombre affair. It means that Bitcoin is maturing, and with that comes lower price volatility. But there is an interesting development. The recent pullback was the first not to cut through the $100k level. This level has become support.

Bitcoin Major Levels

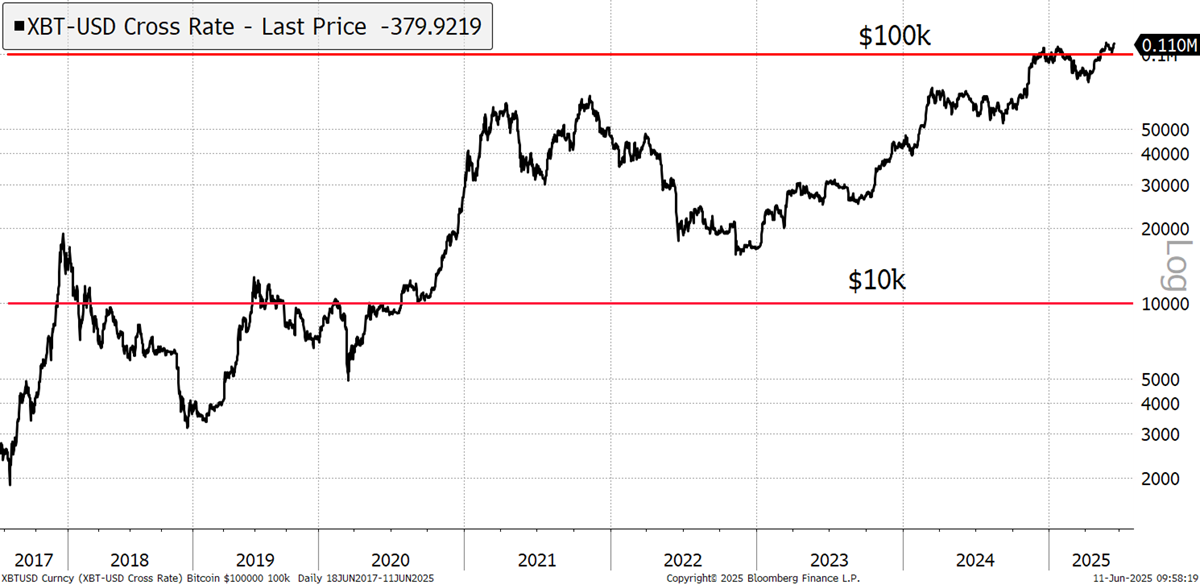

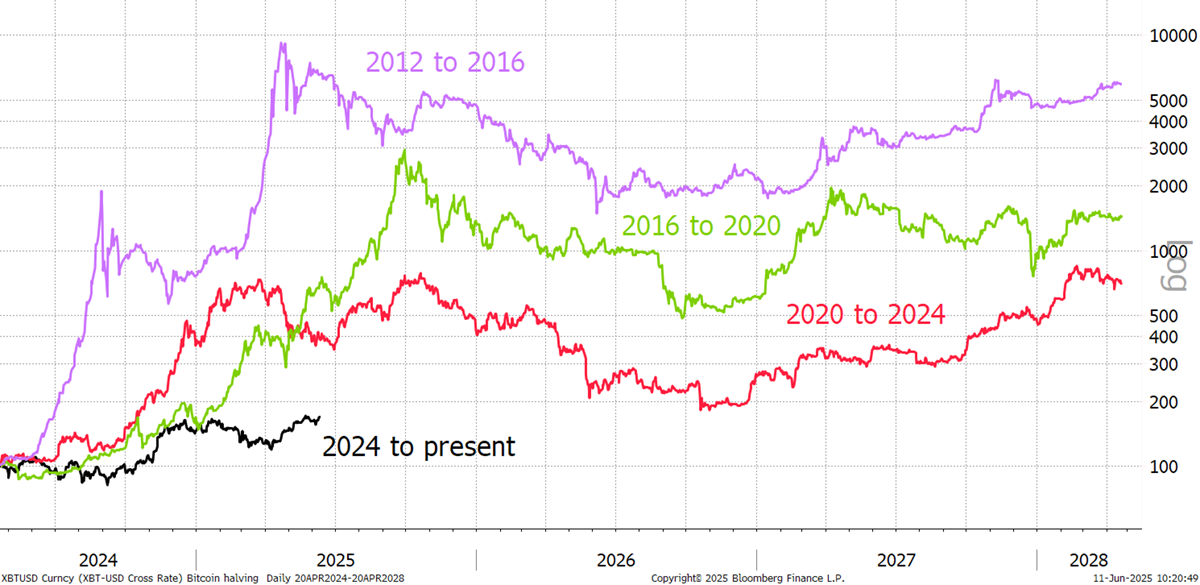

The odds that Bitcoin will never fall below $100k have just shrunk, but old-timers know anything is possible. In past cycles, the halving date to the next cycle low was 15x in 2012/16, 4x in 2016/20, and 2x in 2020/24. This time, we haven’t even made 2x, although the end of the last cycle was unusually strong as the US ETFs came to be.

Bitcoin Cycles since Halving

The US ETFs were a big deal, but the FCA move could be even bigger. Little London may not match the wave of demand that came from the USA, but as the ETF ban is lifted in the UK, other countries will follow. In aggregate, the demand will swamp the US. Stay bullish.