Trade in Soda;

The stockmarket indices and their funds are great financial innovations, but, as I have said many times, they cause major distortions in markets. When an allocation such as the S&P 500 becomes too popular, it feeds on itself or, as George Soros would call it, reflexivity. That is a market that does well attracts investors, reducing the cost of capital, which in turn improves corporate performance, attracting more investors… Repeat in a cycle of reflexivity.

The opposite scenario would be forgotten markets, through no fault of their own. Some markets are forgotten for good reason, such as a dodgy regime, punitive taxes, or an underdeveloped economy. Yet there can be other reasons, such as those experienced by Australia and Canada. Both are modern, dynamic, well-governed economies with well-functioning markets, yet global investors are structurally underweight these markets and always have been.

In the case of Canada, it neighbours the USA, where investors buy the S&P 500 en masse, which has no exposure to Canada. Admittedly, many Canadian stocks have secondary listings in the USA, but that doesn’t lead to index inclusion in the S&P 500. To the south, Mexico will be included in Latin American indices, which is a major component of emerging markets. Most investors will simply buy the S&P 500 and ignore Canada but will probably own Mexico through Latam.

Australia is another forgotten market. When investors select Asia, they often overlook Australasia, which includes Australia and New Zealand. To capture Australia, they might choose to allocate across a Pacific Index, which is popular with institutional investors. But the mainstream view would be to choose between India, Southeast Asia, and Japan, leaving out Australia entirely.

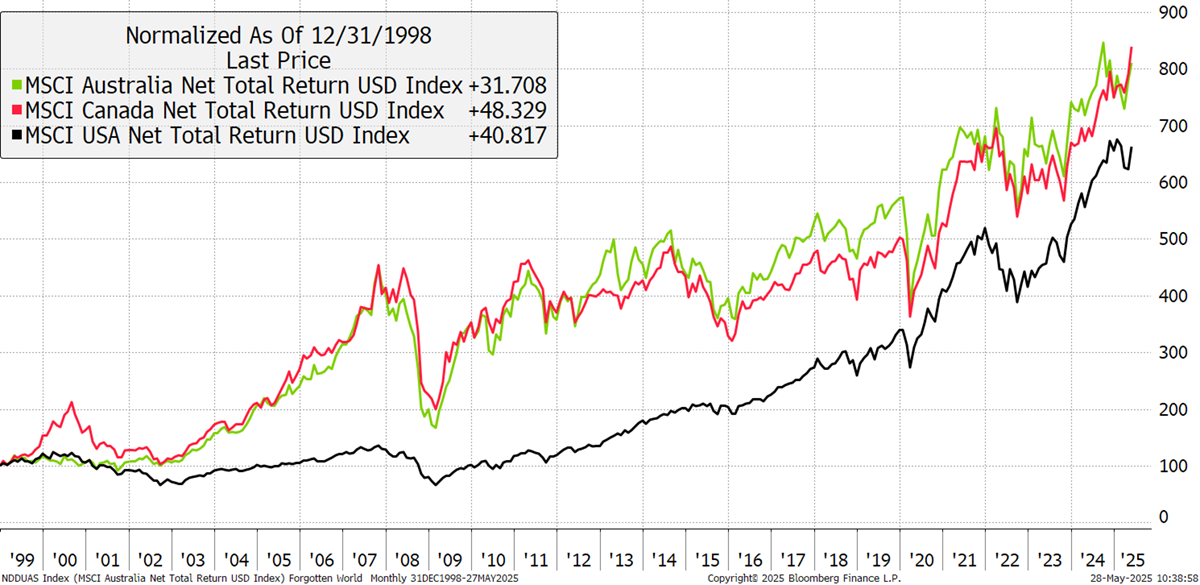

The curious thing is that these forgotten markets have done very well over the years. Canada and Australia are ahead of the US since 1999.

Australia, Canada and USA Total Return since 1999

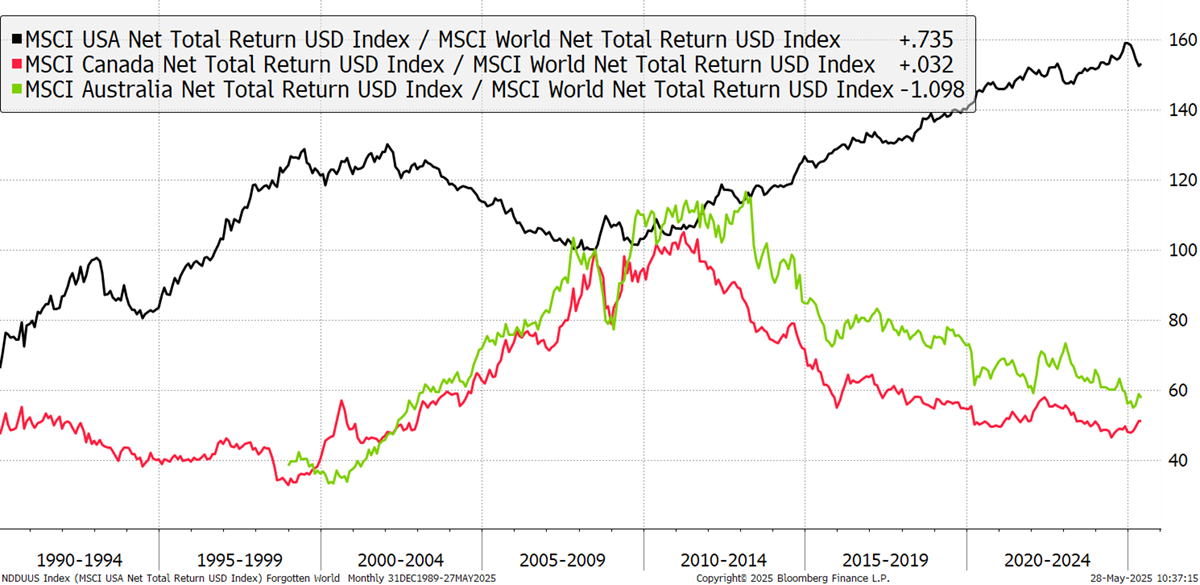

Starting a decade earlier and shifting to relative charts (relative to the world index), it is noticeable how similar Canada and Australia have been. They both took off in the 2000s, peaked around 2010, and have tailed off since, in a mirror image of the US market. It stands to reason that if the US stalls, our forgotten markets will be better placed.

Australia, Canada and USA Relative to the World Total Return since 1990

If an asset allocator in 2004, 2005 or 2006 wondered why their portfolio was lagging the world, they’d soon realise that a large US position was causing problems. On further investigation, they’d see that the forgotten markets, Europe, and the emerging markets were much stronger. As the years go by, capital leaves the US and heads towards the rest of the world, in a reflexive loop, which feeds on itself until it runs out of steam. The result was a decade of outperformance.

There is also the commodity sector, where both Canada and Australia are major players. They also have strong banks, which seemed to miss the credit crisis in 2008. Some say it was more luck than judgment, but that’s where they are.

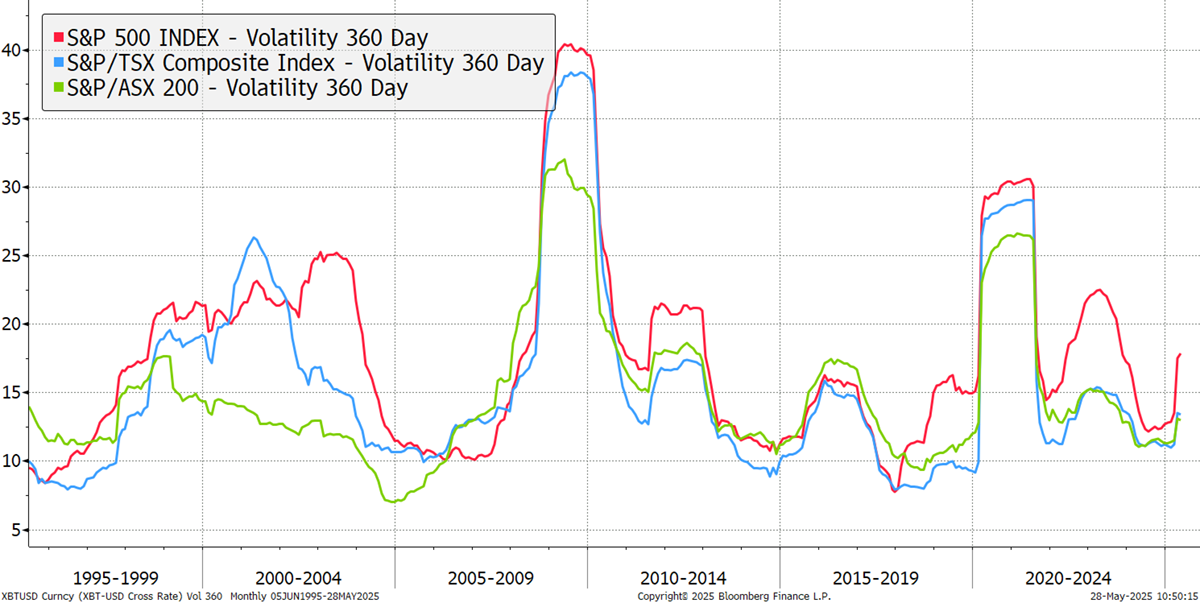

I think one of the missed points of forgotten markets, so named due to structural underinvestment, is how they consistently demonstrate lower volatility. The S&P 500 (red) has spent most of the time with higher volatility than both Australia (green) and Canada (red). That comes despite the S&P TSX Canadian Composite Index having 217 stocks and the S&P ASX Australian Composite Index having 200 stocks. The US market has more than twice the number of stocks and has much higher liquidity, yet is more volatile.

USA, Canada, and Australia 360-day Volatility – since 1995

King Charles III just visited Canada, giving a speech to their parliament in both French and English. The King mentioned strength and freedom but never mentioned President Trump by name. It has pushed Canada to the limelight, and then yesterday, it popped up in ByteTree’s Global Trend Investor (GTI-200) titled “Oh Canada!”. It was notable how many major Canadian stocks featured, especially the banks.

I recall this from the pre-2008 era, wondering how similar the Canadian and Australian stockmarkets were back then. It is remarkable to see how this relationship has held. I would have added South Africa as another forgotten market, as few allocate to Africa at all. South African economic performance has been better than many think, but in recent years, there has been a political divergence. What’s more, all three countries have a vibrant gold mining sector, which comes as a bonus. The point is that all three are structurally underinvested by global funds because they are economic prisoners of geography for different reasons.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd