ByteFolio Issue 159;

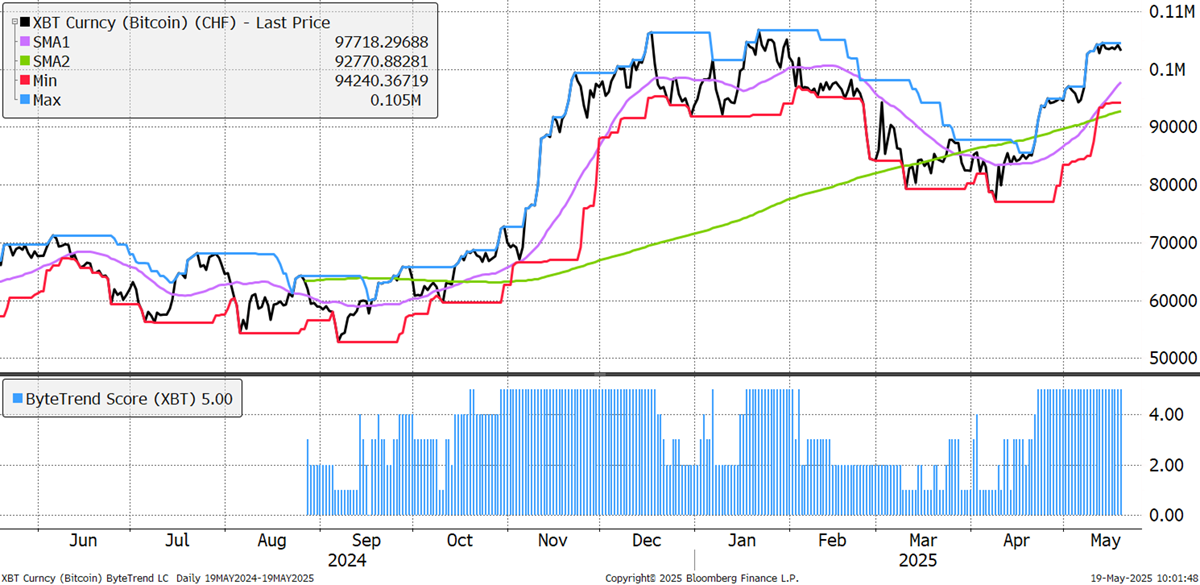

Bitcoin has held a ByteTrend score of 5 for nearly a month. The hope is that it will break above the all-time high set during the Trump rally earlier in the year. It seems more likely to happen than not, at least based on the chart.

Bitcoin Holds a ByteTrend Score of 5

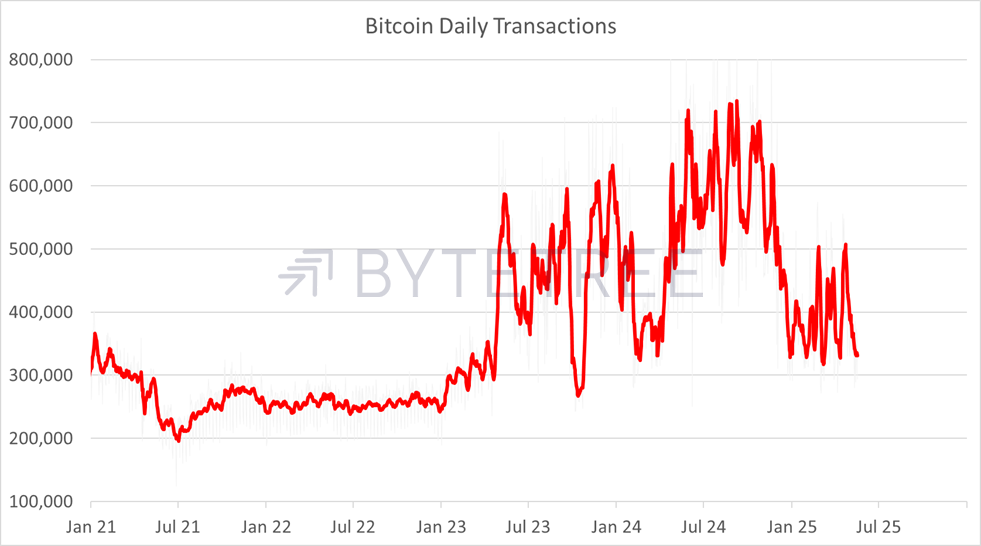

Yet this rally has coincided with sluggish blockchain activity, where the number of transactions remains low. This isn’t a cause for concern, as much of the network activity takes place off-chain. A few years ago, weak transactions would be a cause for concern, but these days, I’m less sure it matters.

Bitcoin Daily Transactions

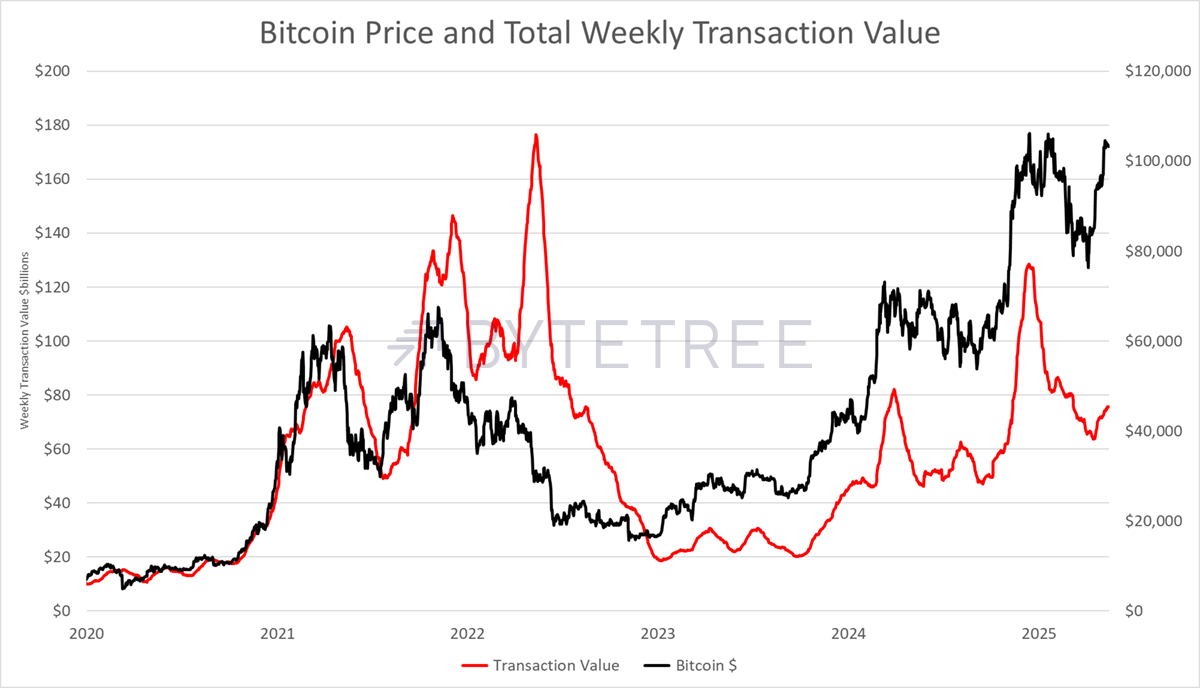

Yet this next chart looks at the network transaction value, which is on the low side. A few months ago, $100k Bitcoin was supported by $120 billion in weekly transaction value. That is now a mere $80 billion. Might this be a cause for concern?

Bitcoin Price and Weekly Transaction Value

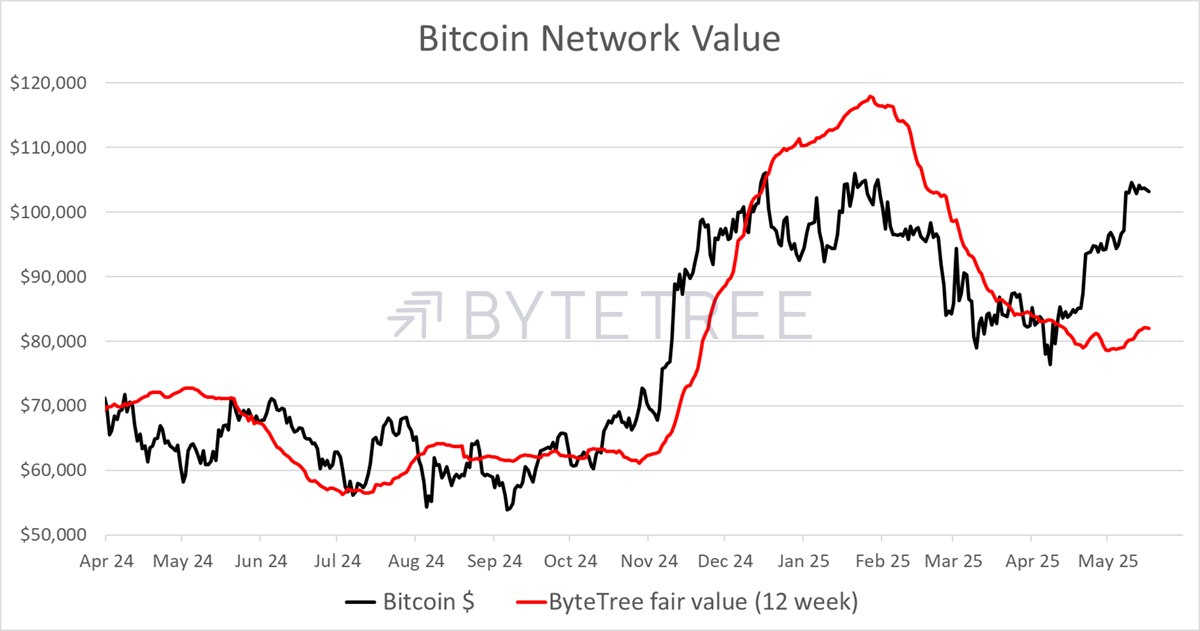

In this chart, I have calibrated the relationship between the Bitcoin price and its fair value, which normally follow each other closely. Unfortunately, not this time. It could mean that Bitcoin is ahead of itself, or equally, it could mean something has changed and the relationship between price and network has moved on. For example, huge volumes now take place in the ETFs and in the futures market, reducing the quantity of on-chain transactions. Off-chain liquidity is huge.

Bitcoin Network Value

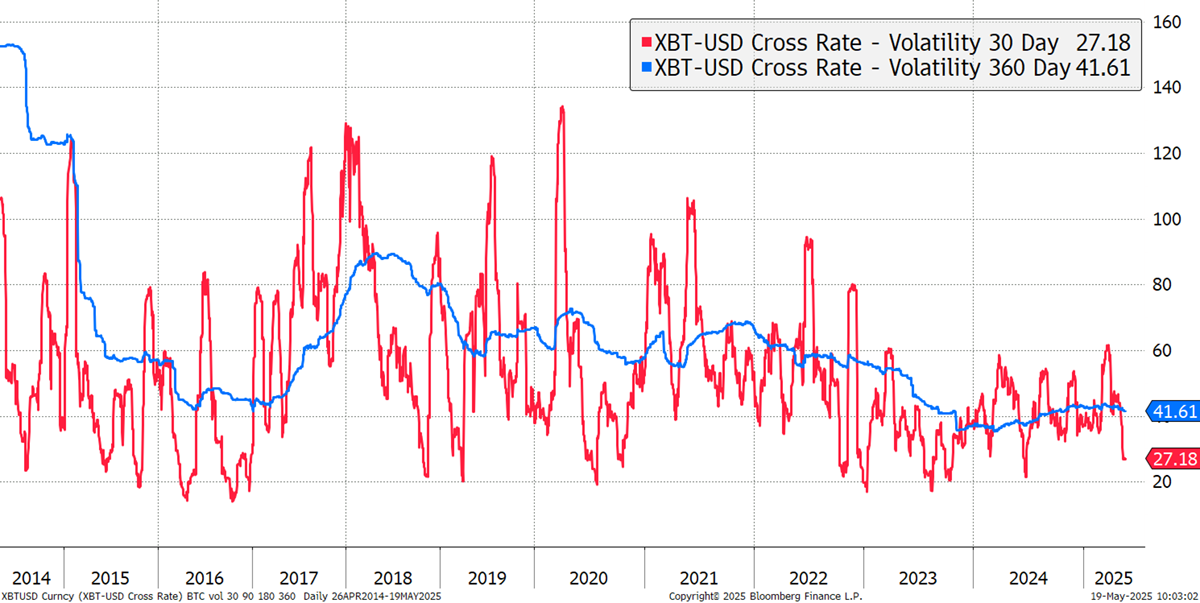

Another significant development is the continued drop in long-term volatility. Bitcoin’s 360-day volatility (blue) is plotted alongside the 30-day volatility (red). The long-term levels are falling again, while short-term volatility is very low. We have generally seen big moves after periods of low volatility, normally upwards because it’s Bitcoin. Although that is not always the case, as we saw a breakdown in November 2018; but the other occasions were bullish.

Bitcoin 30-Day and 360-Day Volatility

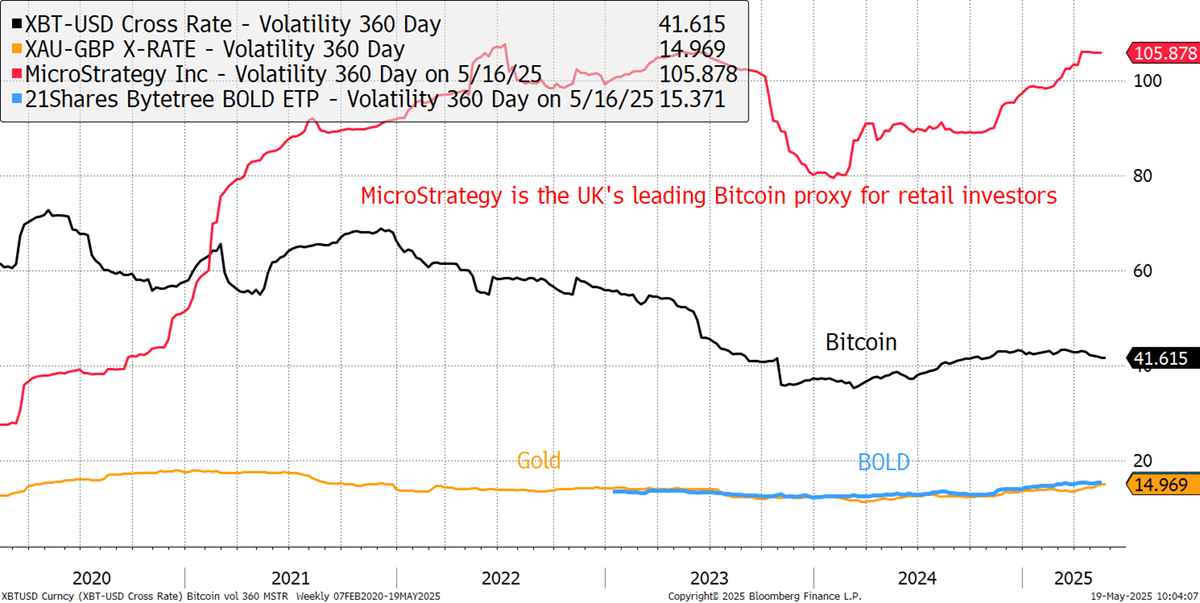

To frame that, notice how gold’s volatility has been rising while Bitcoin’s has fallen. I have added our Bitcoin and gold strategy, BOLD, which is pleasing to the eye. MicroStrategy’s volatility is nearly 2.5x Bitcoin, and that has also drained away some of Bitcoin’s natural network activity. It remains curious why MicroStrategy is so volatile when it doesn’t need to be. I suspect they will converge over time.

MicroStrategy, Bitcoin, Gold and BOLD 360-Day Volatility

A few thoughts on the changing nature of Bitcoin. Lower volatility likely means it is becoming less risky and more liquid. The weakness in on-chain activity may be a cause for concern, but if the liquidity is spread widely, perhaps it’s a good thing.