With so many changes in the high office, we should ask what the impact on markets will be. Today’s politicians want to spend more money, but they all fear the bond market, which forces them to come across as fiscally responsible. This restricts their room for manoeuvre because their hands are tied. They are willing to run deficits to keep the economy sufficiently propped up, but none of them live on planet austerity. The result is these political eruptions are not as meaningful for markets as one might think.

As discussed last week, higher interest rates are taking their toll on the consumer, who is bruised. A weaker consumer should be deflationary and good for the bond market. But, in a two-way pull, the persistent deficits weigh on the bond market, keeping yields elevated. Austerity would see the deficits shrink, and bonds soar, but likely crush the economy. Bigger deficits would boost the economy, and perhaps inflation too, but with debt to GDP at these high levels, this plan couldn’t be sustained for very long.

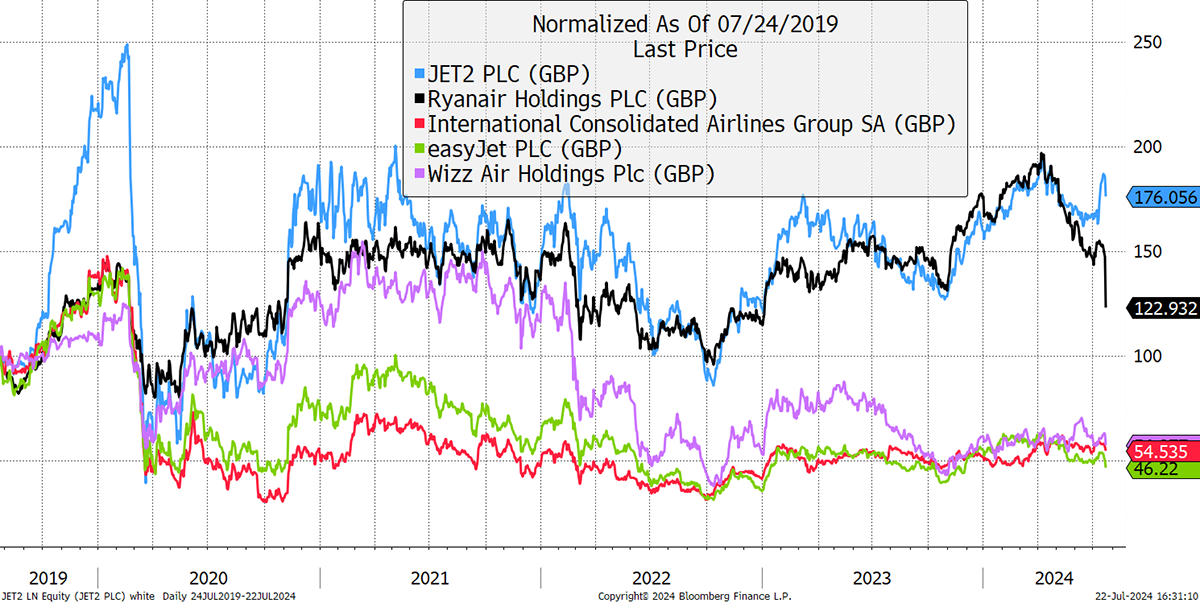

Last week, I showed the weakness in consumer stocks from Burberry (BRBY) to Nike (NKE). This week, I wanted to mention Ryanair (RYA) who reported Q1 results yesterday. Revenue was down 6% while traffic grew 10%, meaning lower fares. The shares are now down 38% since the all-time high in April. I show RYA against its competitors.

UK-Based Airlines – Past Five Years

You’ll notice two groups of airlines, the upper gang and the lower gang, which seem to trade in sync. Wizz Air (WIZZ) dropped from the upper to the lower in 2022, leaving the two better-managed, higher-margin, and stronger-balance-sheet airlines in place. Comparing JET2 (JET2) with RYA, there’s a similar ethos behind the scenes in that they are both highly efficient companies. Yet, in their investor presentation, RYA didn’t acknowledge JET2 even though it has higher sales than WIZZ and is catching up with EasyJet (EZJ).

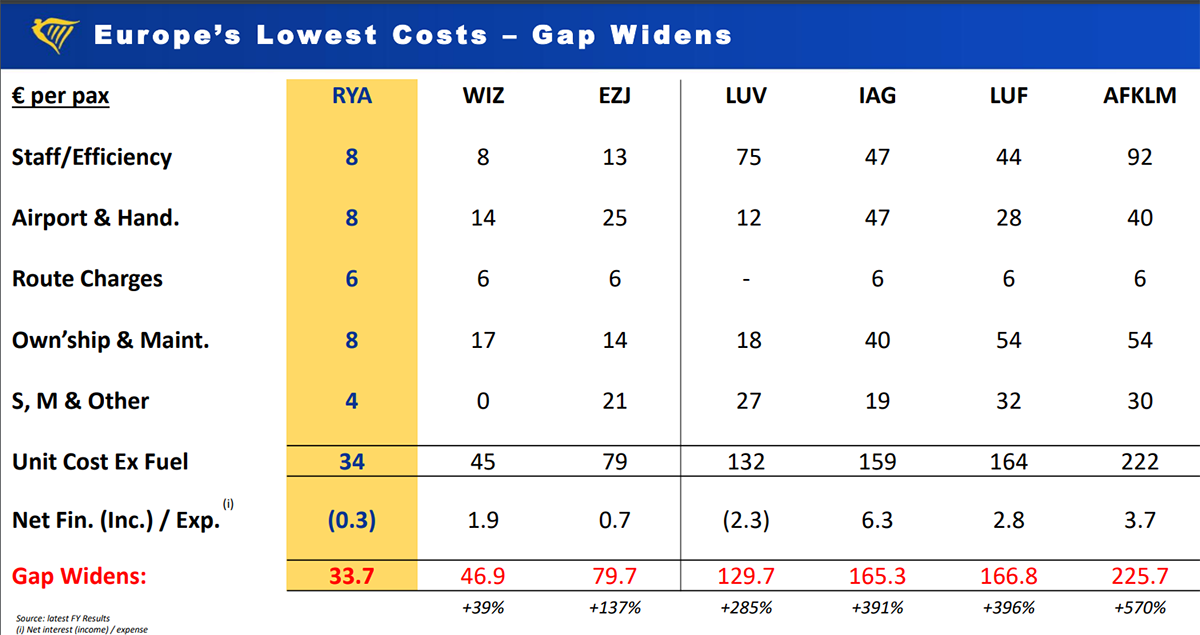

RYA highlight their efficiencies with these cost-per-passenger metrics. Southwest (LUV) is America’s EasyJet and, I believe, created the no-frills airline industry. It is remarkable how much more efficient RYA is compared to WIZZ and EZJ. Better still, compare it to the flag carriers BA (IAG), Lufthansa (LHA) and Ari France-KLM (AF). As the table shows, the gap widens.

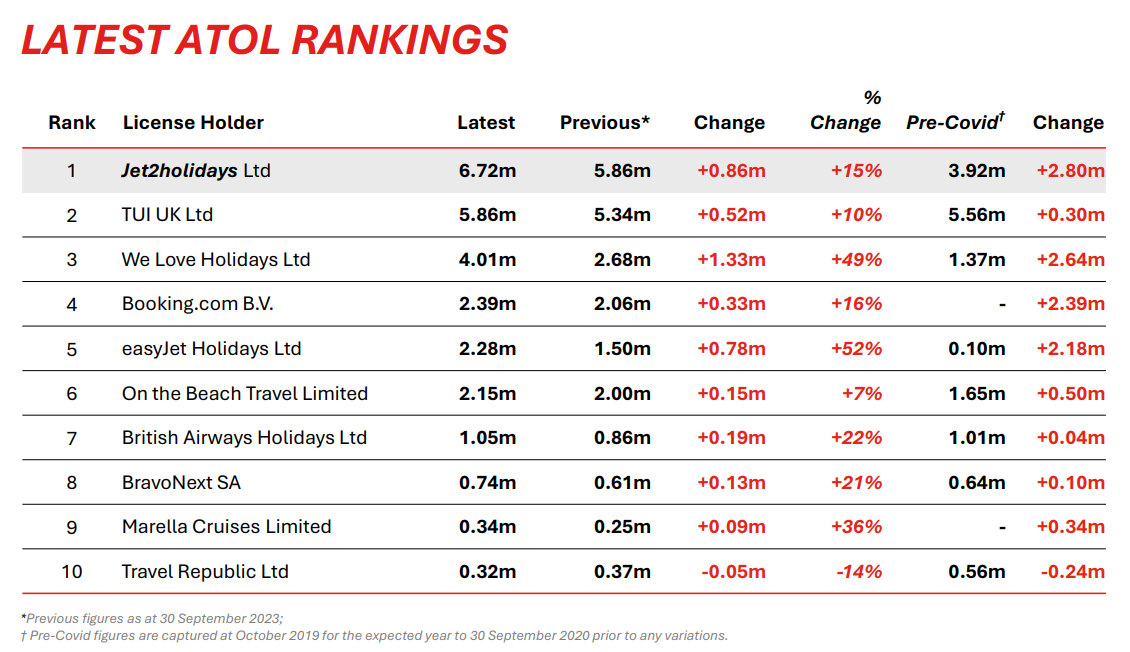

Although not shown, RYA and JET2 both have highly efficient business models. Yet there are some big differences too. Most of JET2’s routes leave UK regional airports, with a presence at Stanstead to cover London. They claim that 56 million people live within a 90-minute drive of Jet2’s 12 on-sale UK bases, which makes it a convenient choice for holidaymakers. JET2 has now taken the number one position in UK holidays.

For RYA, flight-only ticket sales are their core business, whereas for JET2, it made up less than one-third, and prices were 14% ahead of last year. All around, it seems to be a smooth operator, but the best bit is the valuation, where JET2 truly stands out.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd