Does Government Debt Matter?

Disclaimer: Your capital is at risk. This is not investment advice.

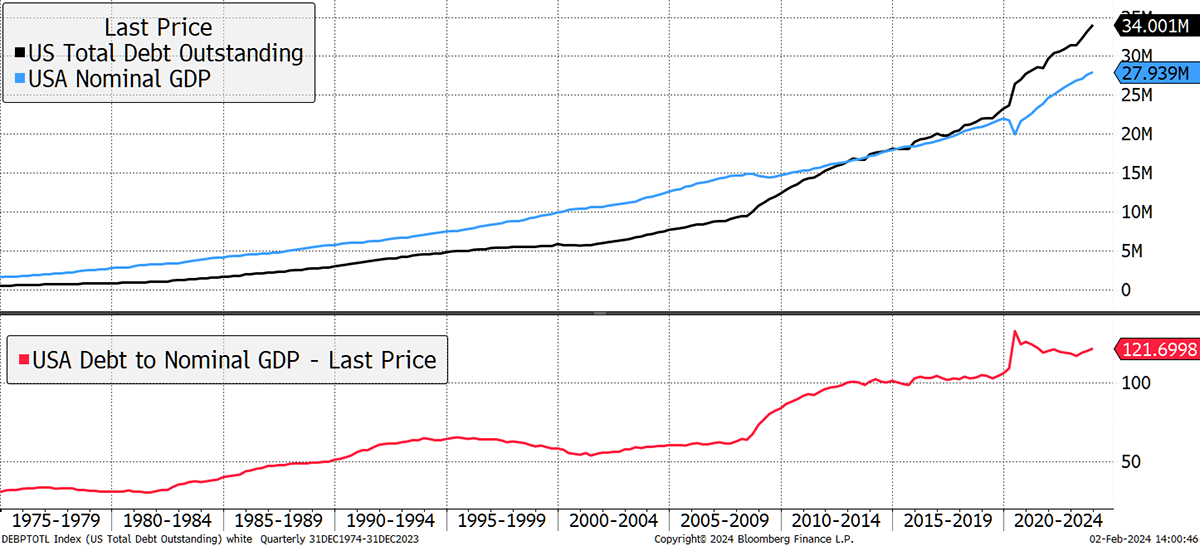

Since the 1970s, the almighty US economy has expanded at a 6% rate in nominal terms. With inflation averaging 3.8%, real growth has been around 2.2%, which isn’t bad for a juggernaut. The trouble is that government debt has been growing at 9%. Fifty years of compounding at 3% add up, and the debt-to-GDP ratio has risen from 35% in the 1970s to 121% today. That’s too high.

More Debt than GDP

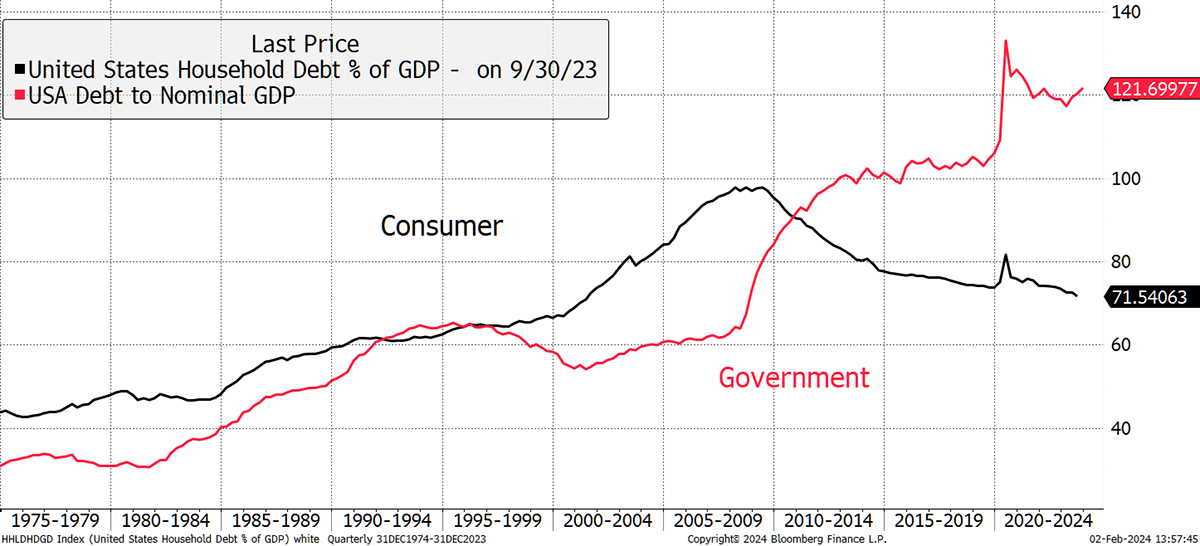

Back in 2008, we had a debt crisis driven by poor lending standards with the help from creative and devious financial engineers. Back then, the consumer was over-indebted at 100% of GDP. Yet they have spent 15 years deleveraging and are now back down to 71% of GDP; a much stronger position. Yet, while the consumer has become more prudent, our governments have become more reckless.

A Prudent Consumer and a Reckless Government

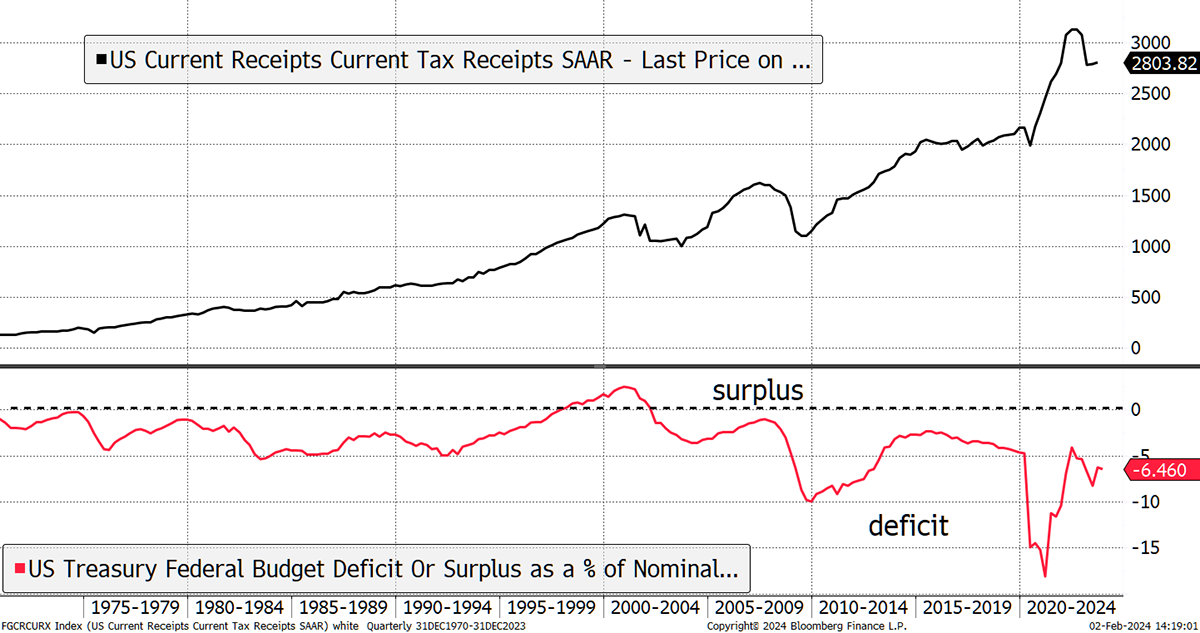

These days, there are few people left in politics who are concerned about spending other people’s money. The political parties try to outdo each other with heroic spending plans that are ultimately unsustainable. Raise taxes, some might say, but they are already at or near all-time highs in most developed countries. Worse still, tax receipts have fallen, which has led to a structural deficit.

In over 50 years, a budget surplus was briefly spotted just once, a bit like the Loch Ness Monster. Yet that moment came courtesy of the dotcom boom. Shame the latest dotcom boom seems to have done so little for public finances.

Structural Deficits

Does debt matter? So far, the answer seems to be no. For if it did, the bond market would have pushed rates up to levels that would have enforced fiscal prudence. But just because they haven’t, doesn’t mean they won’t.

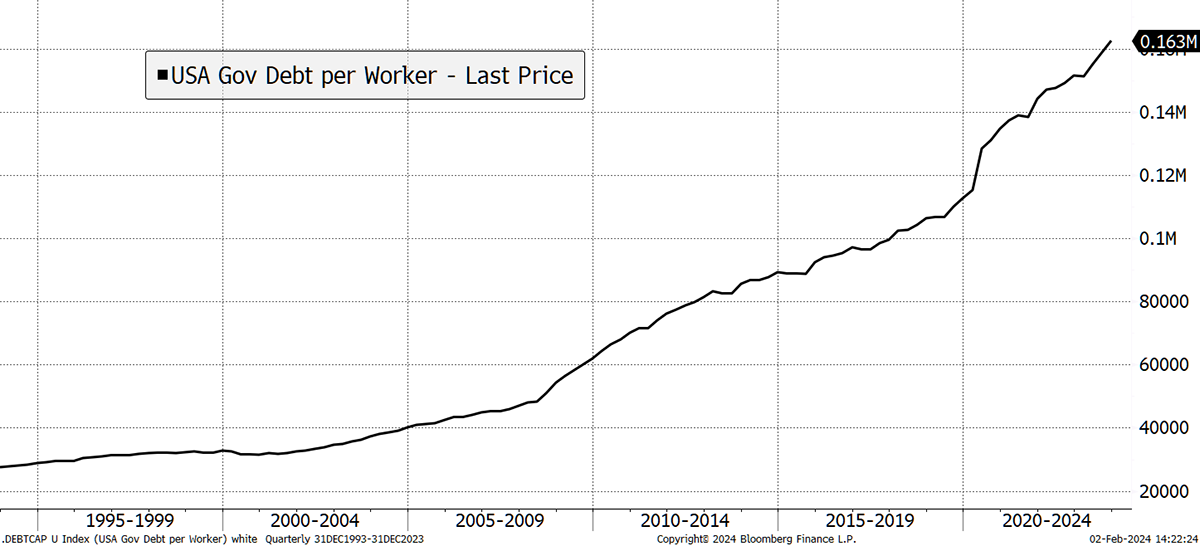

In the USA, there are 209 million people of working age. In 1993, the average worker’s share of the national debt was $25,917. Today, it stands at $163,333. While there are a few very wealthy people who wouldn’t notice paying their share, the majority would struggle.

The Average US Worker’s Share of Government Debt is $163,333

It doesn’t seem that the current path is sustainable, and I am not singling out the USA, as it’s a similar story in Europe. Investors have learnt over the years that when the economy goes into recession, it’s best to own government bonds. But with alarming debt levels, might this be wrong, just like it would be in emerging markets if they behaved in the same way?

Economist and strategist Peter Warburton says the proportion of interest-bearing public debt that needs refinancing this year has been rising, as we have moved from crisis to crisis, and now sits at 28%. In 2019, before the pandemic, it was 20%, and in 2007, before the great financial crisis, it was 12%. The sheer volume of debt that needs annual financing is staggering. How can this not have an impact on bond markets?

I can see how government bonds could have their moment in a recession, but the response would be the same as it always is: to print more money. How many crises do bonds have left before they implode? I’m of the view that one is generous, and two is hopeful. Government finances are in a terrible state and getting worse. It is hard to imagine they deliver the same degree of protection that investors have become used to.

A Week at ByteTree

Which is why Bitcoin and Gold are important choices for investors. For starters, unlike government bonds, they have a limited supply.

The ByteTree BOLD Index (Bitcoin and Gold) was rebalanced on Wednesday at 3 PM, the time of the London gold fix. Few people seem to understand how and why BOLD frequently beats both Bitcoin and Gold and has done so since 16 December 2017. It’s all explained here.

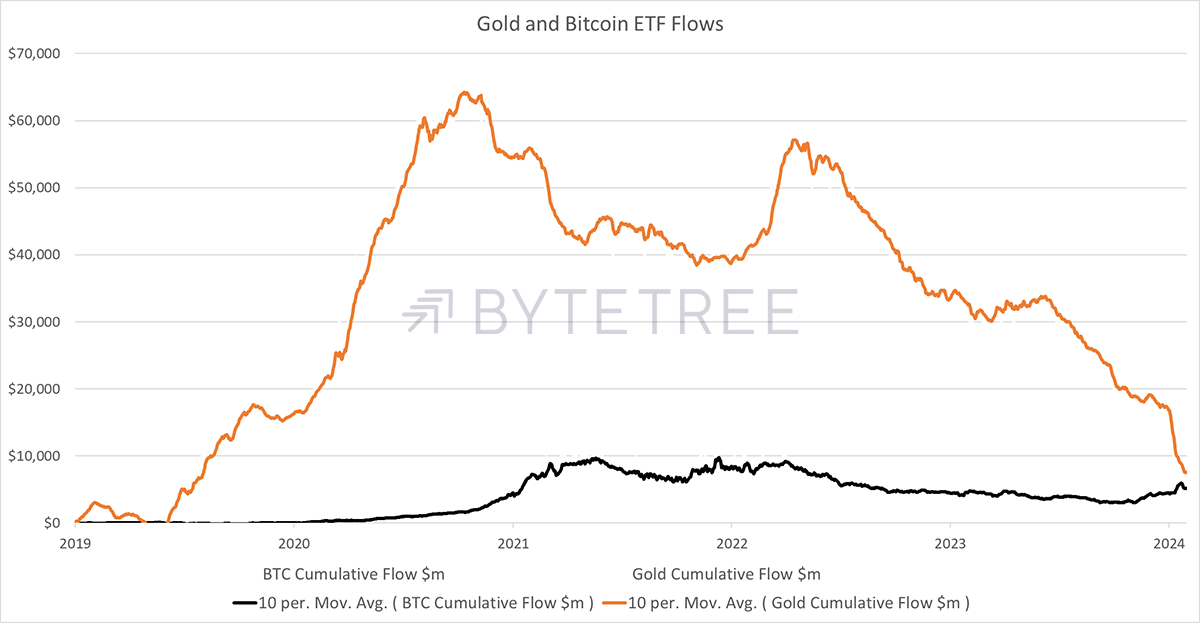

With the hugely successful US Bitcoin ETF launches behind us, I was rooting for gold. It saw huge inflows until the pandemic but has seen $56 billion leave since. Most assets would be beaten to a pulp with outflows that strong, yet gold is trading close to an all-time high. Imagine how well the yellow metal will fare when investors return.

Gold Price Resilient Despite $56 Billion of Outflows

Another area of focus at ByteTree is undervalued, diversified investment portfolios, such as investment trusts and family offices, something ByteTree’s Soda Portfolio has embraced over recent months. I’ve been following these for years, and never before have I seen them buy back their shares so enthusiastically. They are right to do so, and investors will enjoy the fruits.

The Venture Stocks are our best opportunities in mid and small-caps that fly under the radar. Today, I covered a telecoms company., our 16th idea since September. The UK stockmarket is on sale and giving away value. Best to take it when offered.

Robin and Rashpal published their monthly Adaptive Asset Allocation Report on Wednesday. There’s always a gem, and Robin didn’t disappoint:

“We are in an election year in both the USA and the UK. We think the prime up trend will probably last until the final moment in the election process. After the election, whoever wins, we will get the correction phase.”

I love the disparaging “whoever wins” because it clearly doesn’t matter. They’ll do nothing about the debt, and the recession will come when it wants to.

And finally, in crypto, we looked at stablecoins, Helium and TRON. Helium is an interesting project with real-world use cases, and this week, we highlighted their new partnership with a high-profile company in Mexico. TRON has a checkered past but continues to impress with its stablecoin market cap of $51 bn, closing in on market leader Ethereum’s $69 bn. It is also worth noting that TRON currently holds a bullish 5-star trend in USD on ByteTrend.io.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()