Bitcoin, Gold and Liquidity

Disclaimer: Your capital is at risk. This is not investment advice.

I had the good fortune to talk to Michael Howell, the MD of CrossBorder Capital, which he founded in 1996. Armed with a PhD in economics, time at ING Barings in the 90s, and Salomon Brothers in the 80s, he has become a leading authority on market liquidity. It is a complex subject that he has been refining for years, as it is an important driver for financial markets.

What Is Liquidity?

We recorded a Zoom call this morning, and I asked him if liquidity could be described as the willingness for markets to provide credit? He broadly agreed but went into more detail. Market liquidity is the speed of transforming an asset into cash, in size, around current prices. Funding liquidity is the speedy access to cash, and funding liquidity drives market liquidity.

These days, measuring liquidity goes way beyond bank credit. The financial system has become highly complex and combines the behaviour of the central banks with the retail banks, the investment banks, the shadow banks, and others.

At $170 trillion, global liquidity is twice the size of world GDP and has driven the business cycle since the 1990s. It measures the capacity of capital rather than the cost of capital, and the key is that liquidity matters most when debt needs to be rolled over.

Last week, I highlighted how the proportion of US public debt that needs refinancing now sits at 28%. In 2019, before the pandemic, it was 20%, and in 2007, before the great financial crisis, it was 12%. The sheer volume of debt that needs annual financing is staggering.

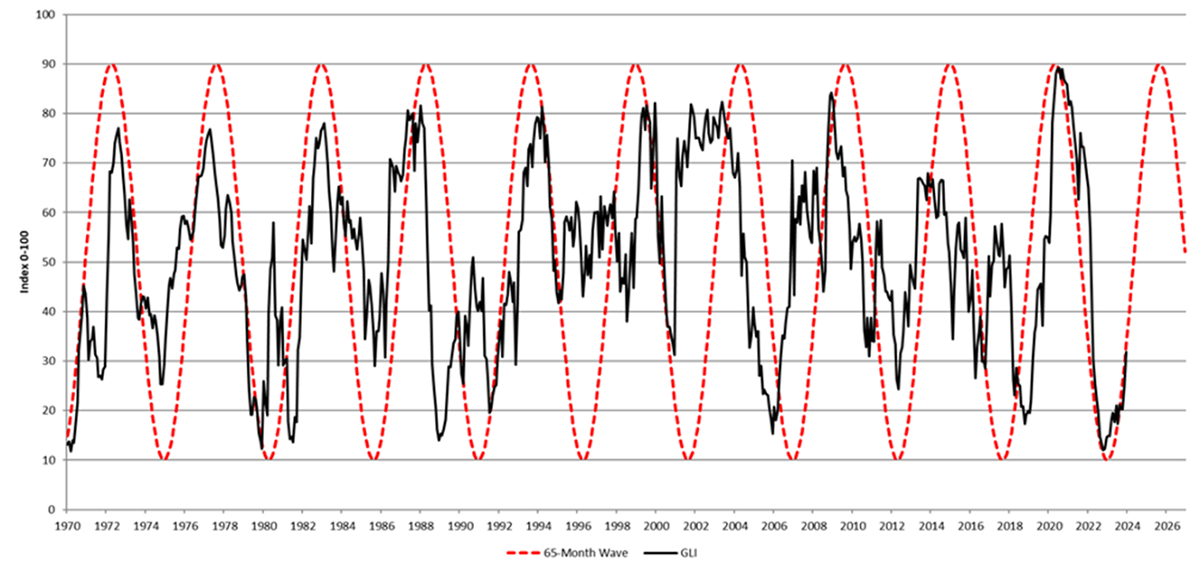

Michael explained how when private sector debt goes wrong, it’s deflationary, but when public debt goes wrong, it’s inflationary. To be clear, he differentiates between monetary inflation, which drives asset prices, and consumer inflation, which defines the cost of goods. A surge in monetary inflation drives tech stocks, bitcoin and gold. It is only when monetary inflation gets out of hand that it devalues the currency and increases the cost of goods. He showed how liquidity moves in five-to-six-year cycles, and this one is just getting started.

Global Liquidity Index (GLI™) Long-Term 5-6 Year Cycles

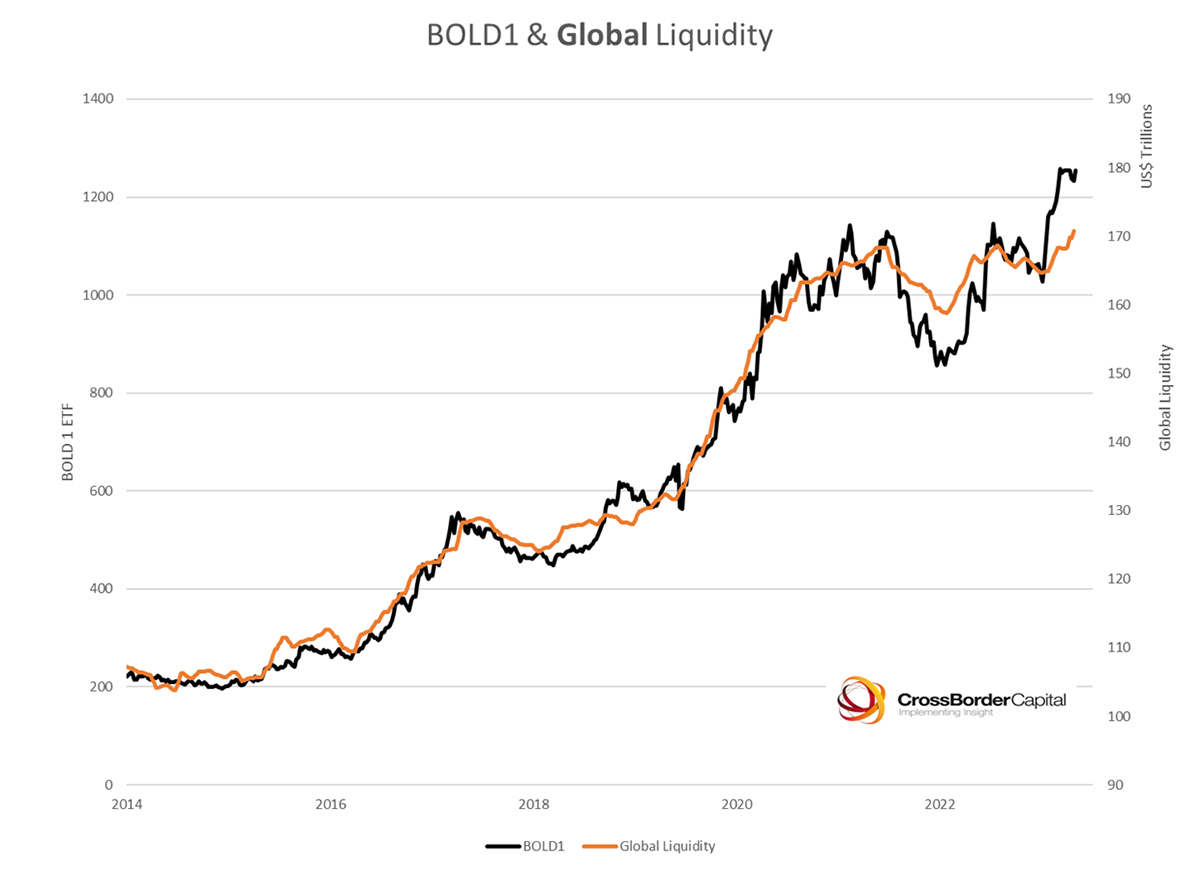

We should buy Chinese stocks, but not until the currency has devalued, but really, we should focus on gold and crypto. That’s how we met. I was keen to see how ByteTree’s BOLD Index (Bitcoin and Gold) would fit with his liquidity measures; it fits like a glove.

Please watch our discussion here.

A Week at ByteTree

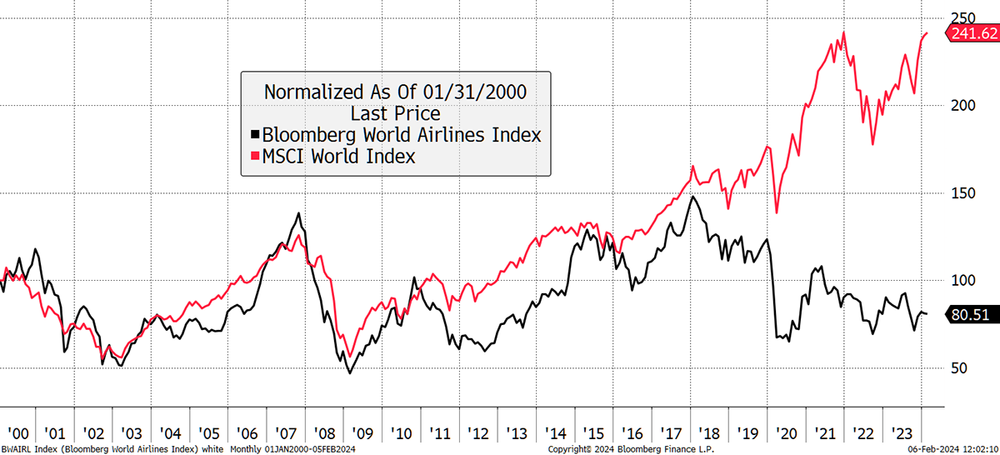

This week I had a look at the airlines. With oil stable and the travel industry booming, it’s a good time, especially when you look at valuations. Generally speaking, and despite their poor track record as an industry, the airlines have generally shadowed the stockmarket until around 2018. Clearly, the pandemic was brutal for the travel industry, but even so, the divergence is alarming, especially when you consider how passenger load factors have fully recovered.

Airlines Have Lagged the Market

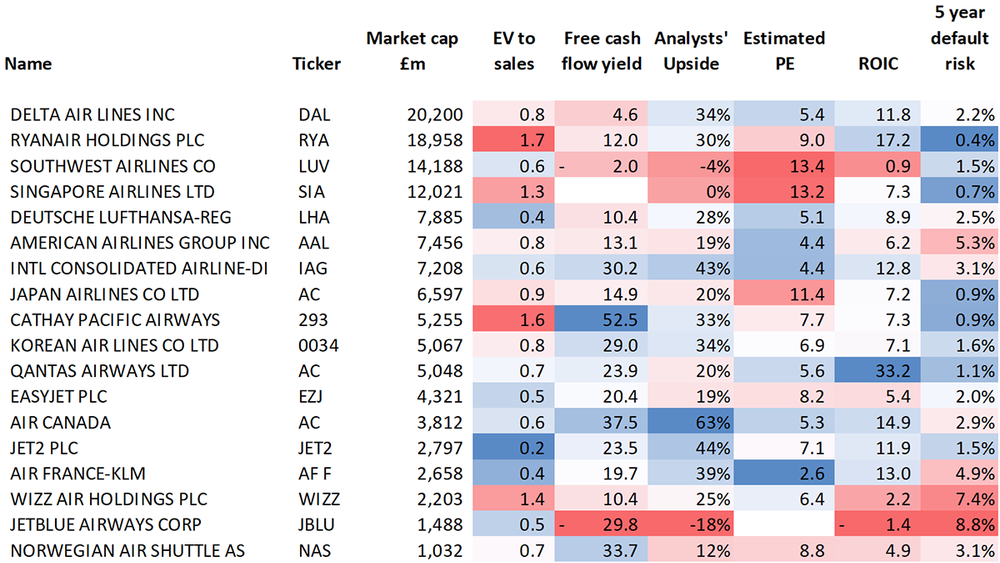

The table shows the major players in the sectors led by Delta (DAL), which has suffered from liquidity shocks on several occasions. Ireland’s Ryanair (RYA) is the star but priced accordingly. Which one did I choose for the Whisky Portfolio?

I’ll give you a clue, and that is the colours can be very helpful. You can read it here.

In crypto, we mentioned stablecoins again, which have grown to $120 billion. However you look at it, and whatever you think about crypto, stablecoins will outwit central bank digital currencies (CBDCs) and become a major source of global liquidity.

Next time, I must ask Michael what he thinks of them.

Have a great weekend,

Charlie Morris

Founder, ByteTree