The Opportunity in Airlines

Trade in Whisky;

In this issue, I am going to look at the airline sector, where we are witnessing a post-pandemic travel boom that shows no signs of abating. Furthermore, the price of oil has stabilised, which is one of the most important factors for their profitability.

Against that, we are all familiar with the fact that the sector has a lousy investment record. The likes of Warren Buffett frequently make jokes about investing in airlines as they have historically delivered poor returns on capital. It is true that they don’t take economic downturns well because they have high fixed costs, and an oil shock can be devastating. It’s all the more surprising that Buffett bought the airlines ahead of the pandemic before nursing losses.

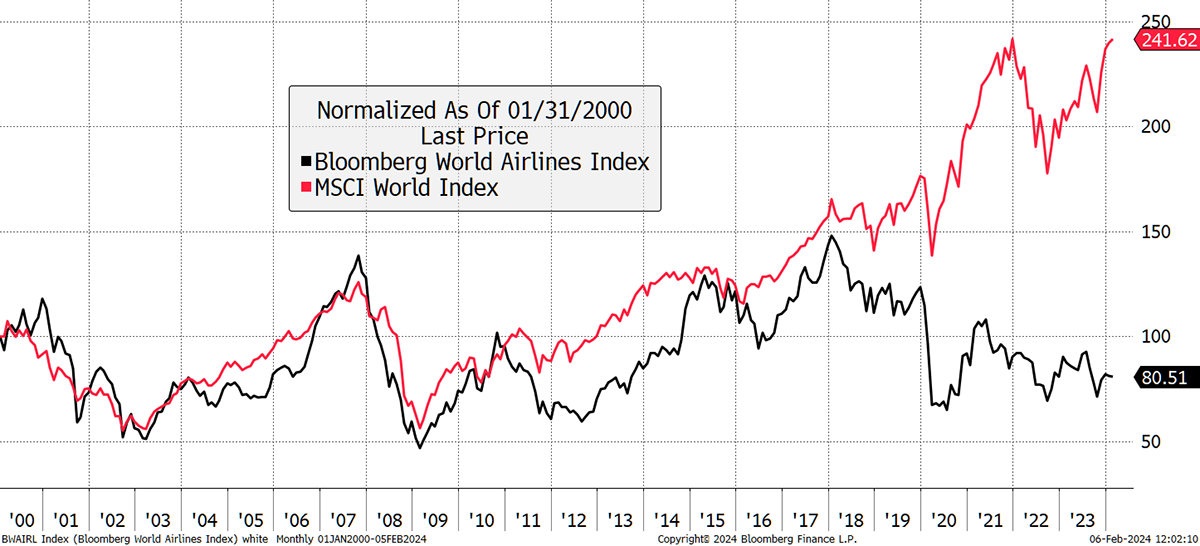

Looking at the 21st-century record of the airlines index, until 2018, it was pretty similar to the overall market, and that includes the 9/11 tragedy. Then there was the credit crisis with an oil shock, then the pandemic with another oil shock. Then, higher interest rates, which increased the cost of financing. Somehow, these airlines are still around to tell the tale.

Airlines versus the World

Remarkably, their profits have already returned to pre-pandemic levels and are growing. The difference between this cycle and previous cycles is that the cost of flying has risen while the passenger load factors have fully recovered. That means the planes are full while charging more. So long as they can avoid a price war, this sector remains highly cash-generative.

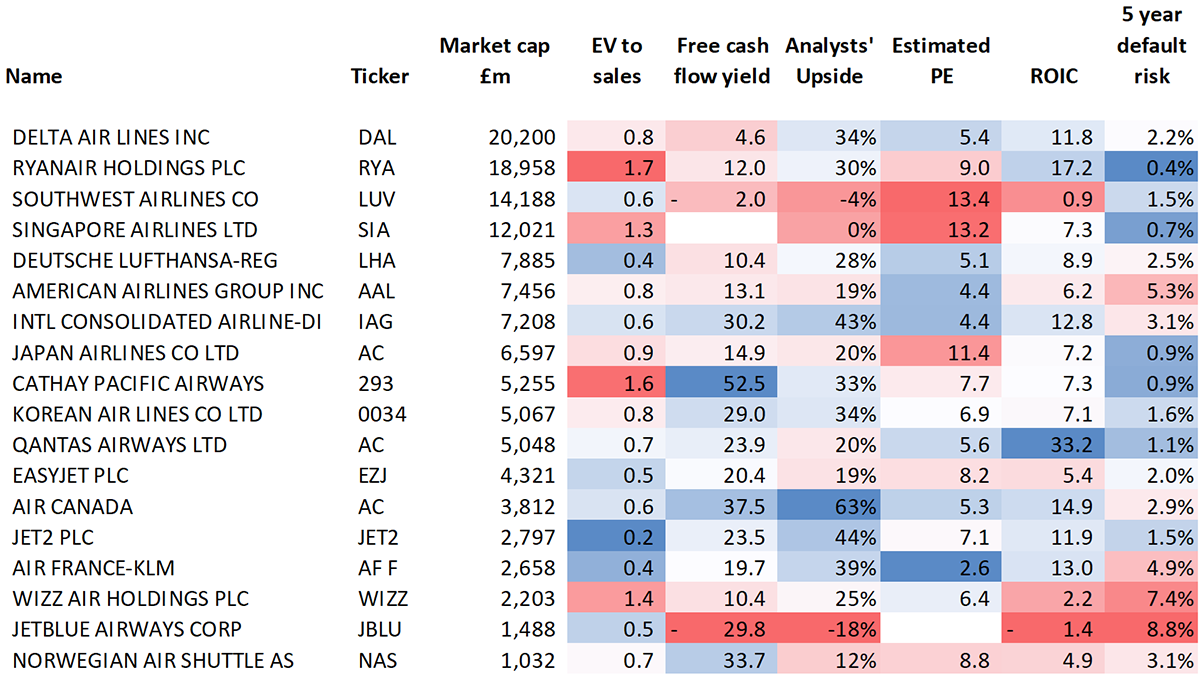

The table shows the key financial metrics for the major airlines, sorted by market value. Delta (DAL) makes the top of the list, but undeservedly and only thanks to past bailouts. Ryanair (RYA) is truly impressive, having grown to become the second most valuable airline on the back of organic growth. Furthermore, it has high returns and a strong balance sheet and has become the operating model for airlines to follow.

Global Airline Industry Financial Metrics

If I were to select an airline to hold for a decade, Ryanair would be a good choice because it is not just well managed, but it is also fully valued. The analysts may see a 30% upside on the share price, but it already trades at 1.7x enterprise value (EV = market cap + debt – cash), which is the highest in the industry. They have no net debt, i.e. more cash than debt, which makes their balance sheet the strongest of them all, as shown by the negligible default risk.

But the best company isn’t always the best investment because valuation matters. I want to choose an airline with a strong balance sheet, plenty of upside, good returns, growth, and a low valuation. Moreover, I want to be able to understand why the mispricing exists. I have chosen…

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd